U.S. Bar Soap Market Size & Outlook, 2022-2030

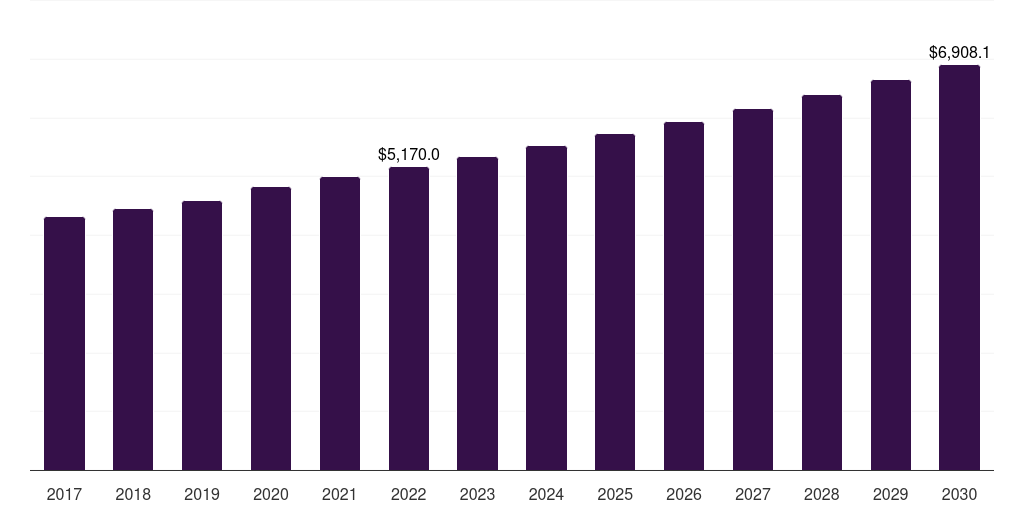

U.S. bar soap market, 2017-2030 (US$M)

Related Markets

U.S. bar soap market highlights

- The U.S. bar soap market generated a revenue of USD 5,170.0 million in 2022 and is expected to reach USD 6,908.1 million by 2030.

- The U.S. market is expected to grow at a CAGR of 3.7% from 2023 to 2030.

- In terms of segment, synthetic was the largest revenue generating type in 2022.

- Organic is the most lucrative type segment registering the fastest growth during the forecast period.

Bar soap market data book summary

| Market revenue in 2022 | USD 5,170.0 million |

| Market revenue in 2030 | USD 6,908.1 million |

| Growth rate | 3.7% (CAGR from 2022 to 2030) |

| Largest segment | Synthetic |

| Fastest growing segment | Organic |

| Historical data | 2017 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Organic, Synthetic |

| Key market players worldwide | Unilever PLC, Natura &Co Holding SA ADR, Johnson & Johnson, Colgate-Palmolive Co, Lush Retail Environments, Ethique, Chagrin Valley Soap & Salve, Galderma, Dr. Bronner's |

Other key industry trends

- In terms of revenue, U.S. accounted for 17.1% of the global bar soap market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. bar soap market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 1,222.1 million by 2030.

Synthetic was the largest segment with a revenue share of 90.69% in 2022. Horizon Databook has segmented the U.S. bar soap market based on organic, synthetic covering the revenue growth of each sub-segment from 2017 to 2030.

Despite the rise of liquid soaps and body washes in recent years, bar soap continues to hold a significant share of the personal care market in the U.S. For decades, bar soap has been a household staple in the U.S., with its solid, compact form and ease of handling and storage. This is especially true for older generations who appreciate its familiar and comfortable nature.

As environmental awareness grows, consumers are becoming increasingly conscious of the impact their choices have on the planet. Bar soaps have garnered favor among environmentally conscious individuals due to their minimal plastic packaging and potential for zero waste, making them a more sustainable choice over liquid soaps.

Bar soap manufacturers in the U.S. have adapted to changing consumer needs and are offering specialized formulations to cater to various skin types and concerns. Some bar soaps are designed specifically for sensitive skin, while others contain natural ingredients or have hypoallergenic properties.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Bar Soap Market Scope

Bar Soap Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. bar soap market size, by type, 2017-2030 (US$M)

U.S. Bar Soap Market Outlook Share, 2022 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more