Middle East & Africa Bar Soap Market Size & Outlook

Related Markets

MEA bar soap market highlights

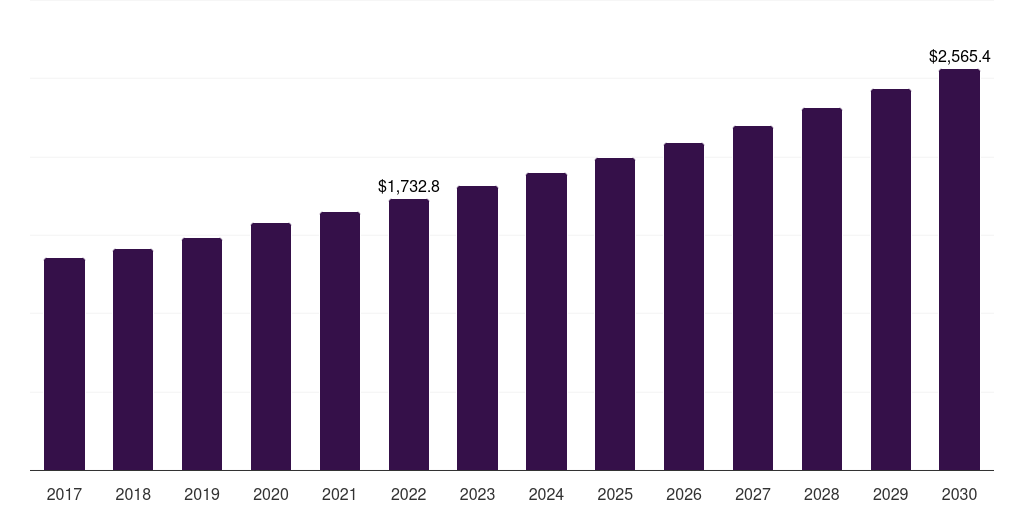

- The MEA bar soap market generated a revenue of USD 1,732.8 million in 2022.

- The market is expected to grow at a CAGR of 5% from 2023 to 2030.

- In terms of segment, synthetic was the largest revenue generating type in 2022.

- Organic is the most lucrative type segment registering the fastest growth during the forecast period.

- Country-wise, South Africa is expected to register the highest CAGR from 2023 to 2030.

MEA data book summary

| Market revenue in 2022 | USD 1,732.8 million |

| Market revenue in 2030 | USD 2,565.4 million |

| Growth rate | 5% (CAGR from 2022 to 2030) |

| Largest segment | Synthetic |

| Fastest growing segment | Organic |

| Historical data covered | 2017 - 2021 |

| Base year for estimation | 2022 |

| Forecast period covered | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Organic, Synthetic |

| Key market players worldwide | Unilever PLC, Natura &Co Holding SA ADR, Johnson & Johnson, Colgate-Palmolive Co, Lush Retail Environments, Ethique, Chagrin Valley Soap & Salve, Galderma, Dr. Bronner's |

Other key industry trends

- In terms of revenue, MEA region accounted for 5.7% of the global bar soap market in 2022.

- Globally, Asia Pacific is projected to lead the regional market in terms of revenue in 2030.

- Asia Pacific is the fastest growing regional market and is projected to reach USD 18,427.6 million by 2030.

Synthetic was the largest segment with a revenue share of 92.18% in 2022. Horizon Databook has segmented the Middle East & Africa bar soap market based on organic, synthetic covering the revenue growth of each sub-segment from 2017 to 2030.

Bar soaps are favored in the Middle East and Africa due to their cost-effectiveness and wide availability. They serve as a practical choice for personal hygiene needs, with a more affordable price point compared to liquid soaps. Regional companies have been coming to the forefront by capitalizing on local market insights, meeting cultural preferences, and offering competitive pricing, allowing them to gain prominence and compete with global brands effectively.

Arma Soap and Detergents, for instance, an Egyptian FMCG company, displayed its products during the fourth iteration of EGY BEAUTY EXPO 2023 as part of its plan to increase exports and seek new markets. The corporation aims to grow its export share from 10% to 25% by 2025 to stimulate the Egyptian economy and draw in foreign currency.

Companies offering natural ingredient-based soaps are emerging in the African bar soap market due to the growing consumer demand for sustainable, eco-friendly, and locally-sourced products, reflecting a shift toward more conscious choices in personal care.

Key Regions: U.S. , UK , Japan , Brazil , South Africa

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Bar Soap Market Scope

Bar Soap Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Dr. Bronner's | View profile | 11-50 | Escondido, California, United States, North America | https://www.drbronner.com |

| Galderma | View profile | 10001+ | Lausanne, Vaud, Switzerland, Europe | http://www.galderma.com |

| Chagrin Valley Soap & Salve | View profile | 1-10 | Cleveland, Ohio, United States, North America | https://www.chagrinvalleysoapandsalve.com |

| Ethique | View profile | 1-10 | Christchurch, Canterbury, New Zealand, Oceania | https://ethique.com |

| Lush Retail Environments | View profile | 11-50 | San Diego, California, United States, North America | https://lushretail.com |

| Natura &Co Holding SA ADR | View profile | 19955 | Avenida Alexandre Colares, No. 1188, Sala A17-Bloco A, Parque Anhanguera, Sao Paulo, SP, Brazil, 05106-000 | https://ri.naturaeco.com |

| Colgate-Palmolive Co | View profile | 34000 | 300 Park Avenue, New York, NY, United States, 10022 | https://www.colgatepalmolive.com |

| Unilever PLC | View profile | 128377 | 100 Victoria Embankment, London, United Kingdom, EC4Y 0DY | https://www.unilever.com |

| Johnson & Johnson | View profile | 134400 | One Johnson and Johnson Plaza, New Brunswick, NJ, United States, 08933 | https://www.jnj.com |

MEA bar soap market size, by country, 2017-2030 (US$M)

Middle East & Africa Bar Soap Market Outlook Share, 2022 & 2030 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more