South Africa Bar Soap Market Size & Outlook, 2022-2030

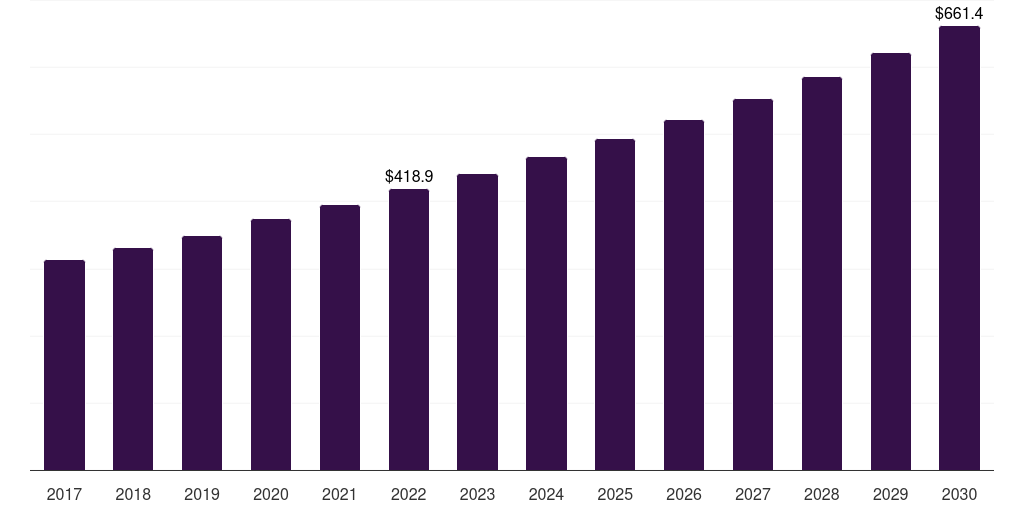

South Africa bar soap market, 2017-2030 (US$M)

Related Markets

South Africa bar soap market highlights

- The South Africa bar soap market generated a revenue of USD 418.9 million in 2022 and is expected to reach USD 661.4 million by 2030.

- The South Africa market is expected to grow at a CAGR of 5.9% from 2023 to 2030.

- In terms of segment, synthetic was the largest revenue generating type in 2022.

- Organic is the most lucrative type segment registering the fastest growth during the forecast period.

Bar soap market data book summary

| Market revenue in 2022 | USD 418.9 million |

| Market revenue in 2030 | USD 661.4 million |

| Growth rate | 5.9% (CAGR from 2022 to 2030) |

| Largest segment | Synthetic |

| Fastest growing segment | Organic |

| Historical data | 2017 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Organic, Synthetic |

| Key market players worldwide | Unilever PLC, Natura &Co Holding SA ADR, Johnson & Johnson, Colgate-Palmolive Co, Lush Retail Environments, Ethique, Chagrin Valley Soap & Salve, Galderma, Dr. Bronner's |

Other key industry trends

- In terms of revenue, South Africa accounted for 1.4% of the global bar soap market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Middle East & Africa, South Africa bar soap market is projected to lead the regional market in terms of revenue in 2030.

- South Africa is the fastest growing regional market in Middle East & Africa and is projected to reach USD 661.4 million by 2030.

Synthetic was the largest segment with a revenue share of 92.84% in 2022. Horizon Databook has segmented the South Africa bar soap market based on organic, synthetic covering the revenue growth of each sub-segment from 2017 to 2030.

Social campaigns conducted by big corporations in South Africa have been increasing the demand for bar soaps by promoting hygiene awareness, emphasizing the importance of regular handwashing, and addressing public health concerns. These campaigns leverage the companies' marketing reach and resources to educate and engage the public, resulting in a heightened demand for soap products, including bar soaps.

In July 2023 for instance, Reckitt Benckiser Group Plc’s Dettol partnered with the Nelson Mandela Foundation to spread awareness about hand hygiene in Orange Farm, located in the south of Johannesburg, South Africa. Children were educated about the importance of effective hand hygiene as the cornerstone of infection control and learnt how to wash their hands properly with soap and water.

A similar program was held in Hamman kraal, South Africa in July 2023, to spread awareness about hygiene in wake of the cholera outbreak in the area. This partnership is part of the recently launched Hygiene Quest Schools Programmed of Reckitt Benckiser Group Plc, which aims to reach about one million students annually with a focus on Early Childhood Development Centers and Special Needs Schools.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Bar Soap Market Scope

Bar Soap Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

South Africa bar soap market size, by type, 2017-2030 (US$M)

South Africa Bar Soap Market Outlook Share, 2022 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more