Brazil Bar Soap Market Size & Outlook, 2022-2030

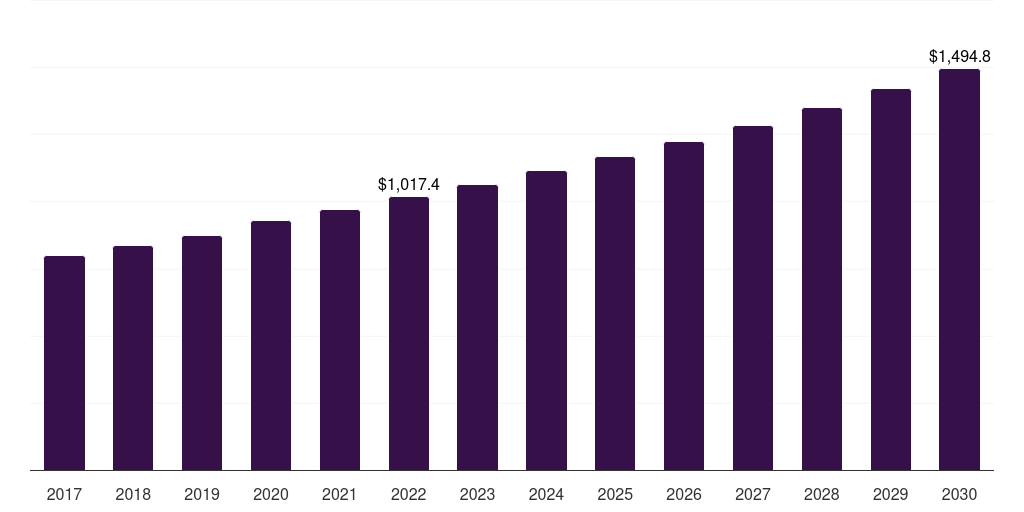

Brazil bar soap market, 2017-2030 (US$M)

Related Markets

Brazil bar soap market highlights

- The Brazil bar soap market generated a revenue of USD 1,017.4 million in 2022 and is expected to reach USD 1,494.8 million by 2030.

- The Brazil market is expected to grow at a CAGR of 4.9% from 2023 to 2030.

- In terms of segment, synthetic was the largest revenue generating type in 2022.

- Organic is the most lucrative type segment registering the fastest growth during the forecast period.

Bar soap market data book summary

| Market revenue in 2022 | USD 1,017.4 million |

| Market revenue in 2030 | USD 1,494.8 million |

| Growth rate | 4.9% (CAGR from 2022 to 2030) |

| Largest segment | Synthetic |

| Fastest growing segment | Organic |

| Historical data | 2017 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Organic, Synthetic |

| Key market players worldwide | Unilever PLC, Natura &Co Holding SA ADR, Johnson & Johnson, Colgate-Palmolive Co, Lush Retail Environments, Ethique, Chagrin Valley Soap & Salve, Galderma, Dr. Bronner's |

Other key industry trends

- In terms of revenue, Brazil accounted for 3.4% of the global bar soap market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Latin America, Brazil bar soap market is projected to lead the regional market in terms of revenue in 2030.

- Brazil is the fastest growing regional market in Latin America and is projected to reach USD 1,494.8 million by 2030.

Synthetic was the largest segment with a revenue share of 92.95% in 2022. Horizon Databook has segmented the Brazil bar soap market based on organic, synthetic covering the revenue growth of each sub-segment from 2017 to 2030.

Based on data from the Brazilian Cosmetic, Toiletries, and Perfumery Industry Association (ABIHPEC), soap manufacturing in Brazil is witnessing a rise in the global market. Soaps accounted for 19% of the sector's total exports in 2022, reaching approximately USD 148 million. Notably, 83% (USD 122.5 million) of these exports were shipped to countries like Chile, Argentina, Peru, Paraguay, Venezuela, Colombia, Mexico, and Uruguay, with bar soaps making up 67% of the shipments.

Dana Cosmetics is a prominent personal care brand in Brazil that sells deodorant and soaps. In April 2023, Dana Cosmetics’ Herbissimo brand collaborated with Perfetti Van Melle’s Mentos brand to release bar soaps along with liquid soaps, liquid talcum, shampoo, and conditioner.

The soaps are formulated with EspuMentos technology that gives color and creaminess to the bath foam. The vegetable glycerin and natural ingredients in the soap leave the skin fragrant and clean.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Bar Soap Market Scope

Bar Soap Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Brazil bar soap market size, by type, 2017-2030 (US$M)

Brazil Bar Soap Market Outlook Share, 2022 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more