- Home

- »

- Organic Chemicals

- »

-

Chloromethane Market Size & Share, Industry Report, 2027GVR Report cover

![Chloromethane Market Size, Share & Trends Report]()

Chloromethane Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Chloroform, Methylene Chloride, Methyl Chloride), By Application, By End Use (Pharma, Personal Care Products), And Segment Forecasts

- Report ID: GVR-4-68038-559-5

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global chloromethane market size was estimated at USD 4.58 billion in 2019 and is expected to register a compound annual growth rate (CAGR) of 4.9% from 2020 to 2027. Rising demand for silicone elastomers across various end-use industries, such as construction and automotive, is anticipated to drive the market growth over the forecast period. Chloromethanes are colorless, water-soluble, highly flammable organic compounds with a faint sweet smell. They are prepared by the reaction of hydrogen chloride and methanol and can also be produced alternatively by the chlorination of methane. The chlorination process yields other compounds, such as methylene chloride and chloroform.

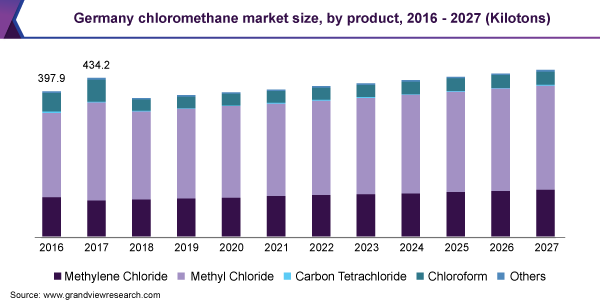

Germany is one of the leading producers and exporters of chloromethane with the presence of major manufacturing companies including AkzoNobel and Nouryon. The demand for chloromethane in Germany is majorly driven by its rising utilization in the pharmaceutical applications as an intermediate in drug manufacturing and as a local anesthetic in medications. However, product consumption in Germany and other European countries is expected to face hindrances from the European Union (EU) as it has classified chloromethane as an ozone-depleting substance, which is expected to hurt market demand for methyl chloride and carbon tetrachloride.

The global market for chloromethane is anticipated to grow at a moderate pace, owing to the stringent regulations imposed by the major governing bodies such as REACH and U.S. EPA. However, the market is driven by the increasing demand for silicon polymers in the electronic and automotive industry. Rising affordability and growing sales of passenger vehicles are also anticipated to drive the demand for silicone polymers. According to OICA, the production of passenger cars grew from 67.8 million units in 2014 to 70.5 million units in 2018. The demand for silicon polymers in the automotive industry is attributed to the regulations on the weight of the vehicle. Lightweight vehicles are fuel-efficient and thus reduce carbon emissions. Automotive production is growing significantly in Asia, thus driving the demand for silicone polymers in the region.

The global cold chain industry is growing considerably. The growth can be attributed to rising international trade of fresh food products, technological leaps in refrigerated transport & storage, government support for infrastructure linked to cold chain industry and rise in demand for perishable foods from the consumers. Methyl chloride is used in the production of hydro-fluoro olefins that are being used as a replacement for hydrofluorocarbons. With the rise in the adoption of hydrofluorocarbon alternatives, the demand for chloromethanes is expected to increase rapidly. On the other hand, high toxicity levels and environmental issues associated with the utilization of chloromethane may hinder market growth. The EU has banned its usage in consumer goods. Chloromethane exposure from old refrigerators and air conditioners have also been harmful and thus its substitutes, such as chlorofluorocarbons, hydrofluorocarbons, and natural refrigerants, are expected to gain preference over the forecast period.

Product Insights

Methylene chloride or dichloromethane led the market accounting for 65.8% of the share in 2019. Methylene chloride is majorly used as an industrial solvent and as a chemical intermediate in the production of polyurethane foams, adhesives, and aerosols.

On the other hand, it is a highly toxic substance and hence its usage has been banned in all paint removers for consumer use by the U.S. EPA. However, the demand from the pharmaceutical, transport, and food & beverage industries will support the segment growth.

Carbon tetrachloride segment is expected to register a CAGR of 3.4% from 2020 to 2027. Carbon tetrachloride is used in a wide range of applications, such as precursor to refrigerants, cleaning agents and fire extinguishers. However, its major application is in the refrigerant industry. The rising global temperature coupled with an increasing disposable income in the emerging economies is expected to boost the demand for refrigerants. Key application areas for refrigerants manufactured from chloromethane are air conditioners, chillers, and mobile air conditioning systems.

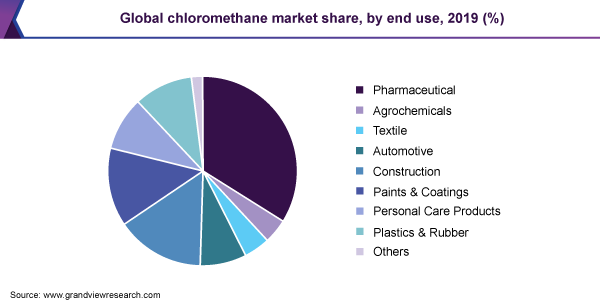

End-use Insights

Pharmaceutical segment dominated the market with a revenue share of 34.7% in 2019. The pharmaceutical industry is anticipated to grow from USD 1.2 trillion in 2018 to over 1.5 trillion in 2023, according to Pharma World Magazine. This growth is anticipated to benefit the associated industries. Chloromethane is used as an intermediate in the production of medicinal drugs. Methylene chloride is mainly used as re-crystallization and an effective reaction solvent in the extraction of numerous pharmaceutical compounds and the synthesis of antibiotics and vitamins.

The construction segment is projected to account for the second largest market share owing to rising demand for silicone polymers in building products. These polymers are used to add performance and processing aids for various applications, such as pre-fabricated concrete, paver stones, ready-mix concrete, dry mix mortars (self-leveling underlayment, stucco/render, grouts), and construction materials. Growing building & construction industry in the emerging economies due to rapid urbanization and rising redevelopment and renovation activities.

Application Insights

Silicone polymers accounted for a revenue share of 6.1% of the global chloromethane market and is expected to witness a CAGR of 5.4% from 2020 to 2027. These polymers are largely used in electronic applications, such as keyboards, mobile components, and copier rollers. Another major application of silicone is in the production of consumer goods, especially personal care and kitchenware products. Rapidly expanding electronics and personal care industry is thus one of the major drivers for silicone polymers.

Globally, methyl-based silicones are gaining high preference owing to their solubility in organic solvents, high water repellence, and flexibility. These properties make them suitable in the electronics and automotive industry. Rising demand for lightweight substitutes for metal and glass is further anticipated to propel market growth over the forecast period.

Chloromethanes are widely used as a chemical intermediate in the production of a wide variety of chlorine derivatives. Methylene chloride is used as an intermediate in the production of polycarbonate, phenolic, and others, whereas methyl chloride is utilized in the manufacture of agrochemicals, such as disodium methanearsonate, paraquat, and monosodium methanearsonate. Methylene chloride is projected to drive the market for chloromethane as a chemical intermediate due to the high demand for polycarbonate and phenolic resins across the globe.

Regional Insights

Asia Pacific is expected to register the fastest CAGR of 5.3% from 2020 to 2027. It also estimated to be the largest regional market over the coming years. The abundant feedstock availability and a significant number of shale gas reserves in China are anticipated to propel the manufacturing of the product in the region. These factors have also given rise to chemical production in the region at a tremendous rate. Moreover, major players are shifting their focus to high opportunity markets, such as China and India, due to the easy availability of raw materials and skilled labor at cheaper costs.

One of the major end-use markets of chloromethane in Asia Pacific is the pharmaceutical industry. The discovery of new viruses, such as the recent corona threat across the region has resulted in a lot of pharmaceutical companies investing in R&D activities to develop new drugs. Such activities are expected to propel the demand for laboratory chemicals and drug additives like chloromethane.

The demand for chloromethane in Europe is anticipated to grow moderately due to the stringent regulations in the region. The regional market in Europe is anticipated to be led by countries, such as Belgium, Poland, and the Czech Republic, due to the increase in construction activities and chemical intermediate manufacturing. Germany and U.K. are the mature markets in the region with Germany being one of the major exporters and U.K. being one of the largest importers.

Key Companies & Market Share Insights

The market is highly competitive. Multinational companies are integrated through the value chain with the production of methanol, chloromethane and its derivatives, such as methyl chloride and methylene chloride. The competitive factors that have a deep impact on the market growth include regulatory approvals, product portfolio, pricing, geographical presence, and manufacturing technology. Some of the prominent players in the chloromethane market include:

-

Asahi Glass Co. Ltd.

-

Tokuyama Corp.

-

AGC Chemicals Ltd.

-

Gujarat Alkalies and Chemicals Ltd.

-

Occidental Chemical Corp.

-

AkzoNobel N.V.

-

Shin-Etsu Chemical Co. Ltd.

-

Solvay S.A.

-

INEOS Group

Chloromethane Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.7 billion

Revenue forecast in 2027

USD 6.7 billion

Growth Rate

CAGR of 4.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; South Europe; CIS; East Europe; China; India; Japan; South Korea; Brazil; Argentina; Egypt

Key companies profiled

Asahi Glass Co. Ltd.; Tokuyama Corp.; AGC Chemicals Ltd.; Gujarat Alkalies and Chemicals Ltd.; Occidental Chemical Corp.; AkzoNobel N.V.; Shin-Etsu Chemical Co. Ltd.; Solvay S.A.; INEOS Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global chloromethane market report on the basis of product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Methylene Chloride

-

Methyl Chloride

-

Carbon Tetrachloride

-

Chloroform

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Refrigerant

-

Industrial Solvent

-

Silicone Polymers

-

Laboratory Chemicals

-

Chemical Intermediates

-

Methylating & Chlorinating Agent

-

Propellant & Blowing Agent

-

Catalyst Carrier

-

Herbicide

-

Local Anesthetic

-

Adhesives and Sealants

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Pharmaceutical

-

Agrochemicals

-

Textile

-

Automotive

-

Construction

-

Paints & Coatings

-

Personal Care Products

-

Plastics & Rubber

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

CIS

-

East Europe

-

South Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Egypt

-

Middle East

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global chloromethane market size was estimated at USD 4.58 billion in 2019 and is expected to reach USD 4.80 billion in 2020.

b. The global chloromethane market is expected to grow at a compound annual growth rate of 4.9% from 2020 to 2027 to reach USD 6.74 billion by 2027.

b. Asia Pacific dominated the chloromethane market with a share of 70.7% in 2019. This is attributable to high chemical production in the region due to the abundant feedstock availability and a significant number of shale gas reserves in China.

b. Some key players operating in the chloromethane market include AkzoNobel N.V., Dow Chemical Company, Asahi Glass Co. Ltd., Tokuyama Corporation, Gujarat Alkalies & Chemicals Ltd., Solvay S.A., INEOS, Shin-Etsu Chemical Co. Ltd., and Solvay.

b. Key factors that are driving the market growth include growing demand for silicone elastomers across various end-use industries such as construction and automotive.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.