- Home

- »

- Petrochemicals

- »

-

Methanol Market Size And Share, Industry Report, 2030GVR Report cover

![Methanol Market Size, Share & Trends Report]()

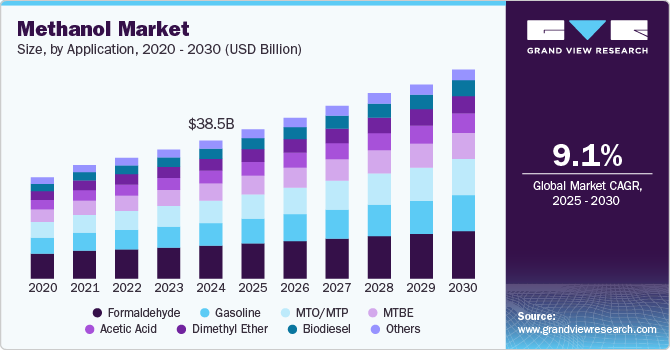

Methanol Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Formaldehyde, Gasoline, Acetic Acid, Dimethyl Ether, MTO/MTP, Biodiesel), By Region(North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-016-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Methanol Market Summary

The global methanol market size was estimated at USD 38.50 billion in 2024 and is anticipated to reach USD 64.14 billion in 2030, growing at a CAGR of 9.1% from 2025 to 2030. The increase in methanol consumption to produce dimethyl ether and methyl tert-butyl ether (MTBE), which serve as alternatives to gasoline, is a significant factor contributing to this trend.

Key Market Trends & Insights

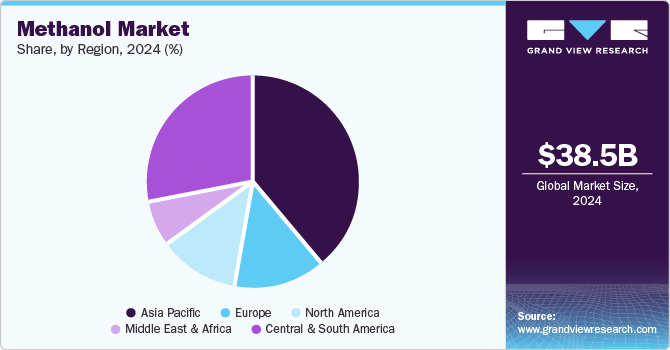

- Asia Pacific dominated the market in 2024 by accounting for the largest share of 51.2%.

- Methanol market in China is witnessing demand due to the start of a new methanol to olefin (MTO) plant in the country in 2022.

- By application, the formaldehyde segment dominated the market with a market share of 23.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.50 Billion

- 2030 Projected Market Size: USD 64.14 Billion

- CAGR (2025-2030): 9.1%

- Asia Pacific: Largest market in 2024

Additionally, high spending on construction activities worldwide, particularly in developing residential and commercial sectors, is expected to drive market growth further. This product plays a crucial role in the production of biodiesel. It is created by reacting to fatty acids or vegetable oil with methanol through a process known as transesterification, which occurs in the presence of a catalyst, such as sulfuric acid. Biodiesel is recognized as a clean-burning fuel and serves as a renewable alternative to petroleum diesel.

Methanol manufacturers have shifted to alternative feedstocks, such as biomass and coal. This change is driven by fluctuations in natural gas prices, concerns about energy security, and efforts to reduce the environmental impacts of conventional methanol production. Processes for converting coal to methanol and biomass to methanol have gained attention as viable alternatives, especially in regions rich in coal reserves or biomass resources. Furthermore, the development of renewable methanol production methods, including carbon capture and utilization (CCU) and the electrolysis of carbon dioxide, is part of a growing trend toward more sustainable methanol production.

The product's manufacturing process usually entails converting carbon-based feedstocks like natural gas, coal, or biomass into methanol through various chemical reactions. The most prevalent method for industrial methanol production involves synthesizing methanol from synthesis gas (syngas), which is a mixture of hydrogen (H2) and carbon monoxide (CO).

Drivers, Opportunities & Restraints

Methanol is one of the major components in the production of biodiesel, which is manufactured by chemically reacting vegetable oil or fatty acid with methanol. This chemical reaction is termed transesterification and is performed in the presence of a catalyst such as sulfuric acid. Biodiesel is considered to be a clean burning fuel and a renewable substitute for petroleum diesel. North America and Europe are the prominent markets for the production and consumption of biodiesel. According to the U.S. Energy Information Administration, between January 2022 and January 2023, the U.S. production capacity for producing renewable diesel and other biofuels increased by 1.25 billion gallons per year, a 71% increase from 2022.

Methanol is toxic and poses risks to human health and the environment, if not handled properly. Additionally, its combustion produces carbon dioxide emissions, contributing to climate change. Furthermore, there are concerns about the sustainability of methanol production, especially when derived from fossil fuels, such as natural gas or coal, which are currently the most common sources of methanol. This raises questions about methanol production's environmental impact and carbon footprint.

As regulations on sulfur emissions tighten across the world, methanol emerges as a viable alternative fuel for ships. Its low sulfur content and clean burning characteristics make it attractive for reducing air pollution in coastal areas. Companies such as Maersk and Carnival Corporation are making efforts for methanol-powered vessels. Moreover, Mitsui O.S.K. Lines (MOL), for the first time in 2023, in collaboration with Methanex Corporation, completed its net-zero voyage fueled by bio-methanol.

Application Insights

The formaldehyde segment dominated the market with a market share of 23.5% in 2024, during the forecast period. Formaldehyde is typically produced through a vapor oxidation reaction involving methanol and oxygen. In addition to this vapor phase oxidation process, formaldehyde can be generated using a metal oxide catalyst. Methanol can be made from various feedstocks, including coal, biomass, and natural gas. Methanol production involves synthesizing hydrogen and carbon monoxide, which are then reacted through a catalytic process.

Methanol-to-olefin (MTO) catalysts have significantly improved in producing olefins from methanol or coal feedstocks, offering an alternative to the traditional naphtha cracking process. The primary driver for the increased global demand for MTO has been the higher olefin yields. Furthermore, light olefin recovery technology is gaining traction worldwide, as it effectively recovers light olefins, specifically propylene and ethylene produced in MTO reactors.

Regional Insights

Asia Pacific is the spearhead of methanol market growth, with China being the major producer and consumer of methanol on a global scale, followed by other Asian countries, such as Japan and South Korea. Increasing demand for acetic acid, formaldehyde, and DME is driving the methanol market across Asia Pacific.

Methanol market in China is witnessing demand due to the start of a new methanol to olefin (MTO) plant in the country in 2022. Conversely, weaknesses in China’s downstream olefins industry are expected to slow down the consumption pattern of methanol to a certain extent soon. When in full operation, the MTO facility of Nanjing Chengzi Clean Energy is expected to require around 1.8 million Tons of feedstock methanol annually

North America Methanol Market Trends

Despite the decline in methanol prices across North America, the demand is rising, as recorded in 2022. A strong product supply drives significant demand for methanol in the region to cater to the rising demand for MTBE, acetic acid, and formaldehyde. However, the recession between 2008 and 2010 led to reduced construction activities in the region, eventually reducing the demand for MTBE and formaldehyde.

Europe Methanol Market Trends

The demand for methanol in Europe remains robust despite challenges such as the potential shutdown of major methanol plants in Egypt and Germany's inadequate supply. Europe's growing renewable methanol market is driven by the increasing demand for clean energy and government support for renewable fuels. Key players in this market include CRI Green Chemicals, Enerkem, and BioMCN.

Latin America Methanol Market Trends

In the Latin American market, Brazil is observed to be the key contributor to methanol consumption, accounting for around 42.7% of the overall region’s demand. Brazil is also recognized as one of the key exporters of methanol, supported by the presence of key multinationals, such as Group Peixoto de Castro and more.

Middle East & Africa Methanol Market Trends

The Middle East & Africa accounts for a comparatively lower consumption of methanol, which is majorly driven by the production of methanol by Sasol. Sasol is the only methanol manufacturer in the country, located at Sasolberg and has an annual production capacity of 140,000 tons. In addition, the growing demand for methanol in various industries, such as chemical, transportation, and construction, is driving the market.

Key Methanol Company Insights

Some of the key players operating in the market include BASF SE and Methanex Corporation.

-

BASF SE is a chemical manufacturer and supplier with presence across Europe, North America, Asia Pacific, South America, Africa, and the Middle East. The company manufactures a wide range of products such as solvents, amines, resins, glues, petrochemicals, thermoplastics, foams, and polymers. It comprises eleven operating divisions grouped into six segments, namely chemicals, materials, industrial solutions, surface technologies, nutrition and care, and agricultural solutions.

-

Methanex Corporation is a prominent participant in the methanol industry, with production facilities in countries such as New Zealand, Egypt, Canada, Chile, the U.S., and Trinidad. Its global supply chain is extensive, and it has well-equipped storage facilities. The company’s methanol serves various end-use industries including plastics, chemicals, paints & coatings, and pharmaceuticals.

Key Methanol Companies:

The following are the leading companies in the methanol market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Mitsui & Co. Ltd.

- Celanese Corporation

- Petroliam Nasional Berhad (PETRONAS)

- SABIC

- Methanex Corporation

- Mitsubishi Gas Chemical Co., Inc.

- QAFAC (Qatar Fuel Additives Company Limited)

- Qualcomm Technologies, Inc.

- Zagros Petrochemical Company

Recent Developments

-

In March 2024, BASF SE announced a partnership with Envision Energy, a significant provider of green technology, to enhance the conversion of green CO2 and hydrogen into e-methanol through advanced and dynamic process design. BASF will support this through its advanced SYNSPIRE technology, which Envision Energy will combine with its cutting-edge energy management system to convert green CO2 and hydrogen into e-methanol efficiently.

-

In January 2024, Fairway Methanol, a joint venture between Celanese and Mitsui & Co. Corporation, has commenced methanol production by utilizing carbon dioxide from plants surrounding its facility. The venture is expected to capture 180 thousand metric tons of CO2 and produce 130 thousand metric tons of low-carbon methanol annually, leading its annual production capacity to 1.63 million metric tons. This methanol production is one of Mitsui's carbon capture and utilization projects, which considers CO2 a resource that can be reused as a raw material, thus realizing carbon recycling and reducing CO2 emissions into the atmosphere.

Methanol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.55 billion

Revenue forecast in 2030

USD 64.14 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Million Tons, Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Germany; China; India; Japan.

Key companies profiled

BASF SE; Mitsui & Co. Ltd.; Celanese Corporation; Petroliam Nasional Berhad (PETRONAS); SABIC; Methanex Corporation; Mitsubishi Gas Chemical Co., Inc.; QAFAC (Qatar Fuel Additives Company Limited); and Zagros Petrochemical Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Methanol Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global methanol market report based on application and region.

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion; 2018 - 2030)

-

Formaldehyde

-

Gasoline

-

Acetic Acid

-

MTBE

-

Dimethyl Ether

-

MTO/MTP

-

Biodiesel

-

Other Applications

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global methanol market size was valued at USD 38.50 billion in 2024 and is expected to reach USD 41.55 billion in 2025.

b. The global methanol market is projected to grow at a compound annual growth rate (CAGR) of 9.1% from 2025 to 2030 to reach USD 64.14 billion by 2030.

b. Asia Pacific dominated the market in 2024 by accounting for the largest share of 51.2% of the global methanol market in terms of revenue in the same year. Increasing demand for acetic acid, formaldehyde, and DME are considered the key drivers of the industry across the Asia Pacific.

b. Some prominent players in the global methanol market include: BASF SE; Zagros Petrochemical Company; Mitsui & Co. Ltd.; Celanese Corporation; Petrolian Nasional Berhad (PETRONAS); SABIC

b. Key factors that are driving the market growth include growing demand for biodiesel and rising popularity of MTO process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.