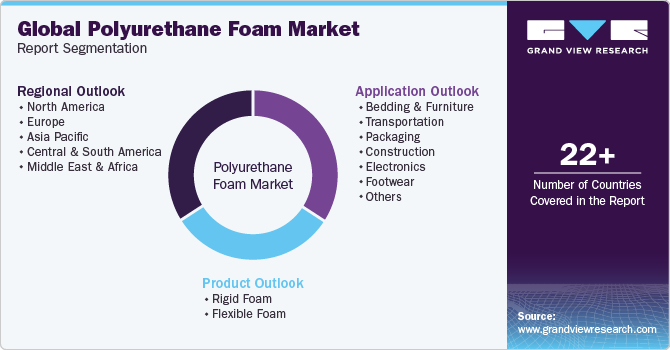

Polyurethane Foam Market Size, Share & Trends Analysis Report By Product (Rigid Foam, Flexible Foam), By Application (Bedding & Furniture, Transportation, Packaging, Construction, Electronics, Footwear), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-807-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Polyurethane Foam Market Size & Trends

The global polyurethane foam market size was estimated at USD 43.70 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030. Factors such as increasing demand from various industries, including automotive, construction, and furniture. Polyurethane (PU) foam's demand is driven by its versatility and excellent insulation properties, thus making it an ideal material for ensuring the comfort, safety, and energy efficiency of using products. In addition, the market is driven by consumer preference for eco-friendly and sustainable materials, as PU foam can be manufactured using bio-based materials, reducing the environmental impact. Moreover, advancements in technology and manufacturing processes have made PU foam more cost-effective, further fueling its adoption across multiple sectors. As these driving factors continue to shape the industry landscape, the global PU foam market is projected to experience steady growth over the forecast period.

Market growth of polyurethane (PU) foam has been closely linked to several key trends in recent times. The burgeoning automotive industry has significantly increased its usage of PU foam for various applications, such as seat cushions, headrests, and interior trims, as automakers seek to improve vehicle comfort and fuel efficiency. Moreover, the construction sector's continuous expansion has driven demand for PU foam insulation in buildings to reduce energy consumption and meet sustainability requirements. In addition, the furniture industry has embraced PU foam due to its lightweight nature and excellent cushioning properties, which enhance comfort and durability of sofas, mattresses, and other upholstered products. Growing awareness about environmental concerns has propelled manufacturers to develop bio-based PU foam, tapping into eco-friendly niche markets. These driving factors, combined with ongoing technological advancements and increasing adoption across various industries, promise a positive outlook for the global market in the foreseeable future.

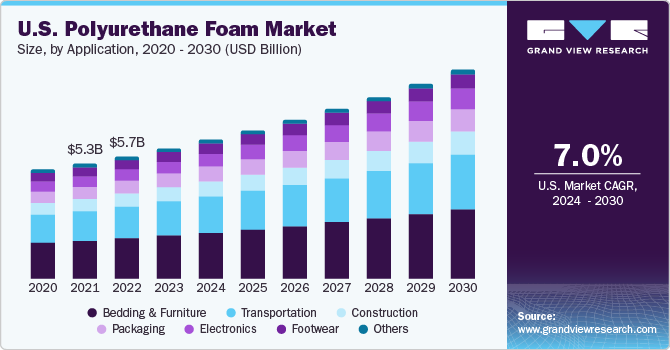

The U.S. plays a significant role in global market, exhibiting its strong presence and influence. With a robust manufacturing sector and a technologically advanced market, the U.S. has emerged as one of the leading consumers and producers of PU foam products worldwide. Country's construction, automotive, and furniture industries have been major drivers of PU foam demand, fueling its widespread adoption across various applications.

PU foam has a widespread application in the construction sector as a thermal and acoustic insulation for buildings. The U.S. is experiencing a significant rise in demand for PU foam as energy efficiency has become a major concern. The automotive industry extensively utilizes PU foam for seat cushions, headrests, armrests, and interior panels due to its lightweight, durability, and comfort. Moreover, the furniture industry relies on PU foam for manufacturing comfortable mattresses, cushions, and upholstery materials, catering to a growing demand for aesthetically pleasing and durable home and office furniture.

The U.S. has a strong presence of PU foam manufacturers, suppliers, and distributors, which further drives market growth. Several prominent American companies are engaged in the production of PU foam and its related products, leveraging advanced technologies and innovative manufacturing processes. This allows the U.S. to cater to both domestic and international demand, exporting PU foam to various countries globally. The country's involvement in the global market is expected to remain robust due to its industrial prowess, technological advancements, and continuous growth of key end-use industries.

Market Dynamics

The high demand for polyurethane foams for building insulation can be attributed to the unique features of these foams that align with sustainability concerns of building walls and other construction parts. PU foams have a high insulation value. As such, they allow the use of thin insulation layers and maximize usable interior spaces of buildings. The versatile properties of these foams enable their seamless usage in residential buildings, commercial establishments, and industrial structures. In addition, durability of polyurethane foams ensures their long-lasting performance, reducing requirement for their frequent replacements and minimizing waste generation at the time of construction work.

Volatility in raw material prices necessitates the requirement for effective supply chain management and implementation of risk mitigation strategies by manufacturers of polyurethane foams. This may involve maintaining strong relationships with raw material suppliers, diversifying their supply base, exploring alternative raw material sources, and engaging in hedging or forward contracting practices to mitigate the impact of volatility in raw material prices.

Application Insights

Bedding & Furniture segment dominated the market with a revenue share of more than 31.0% in 2023. PU foam, known for its softness, comfort, and versatility, is extensively used for bedding and furniture products. Its exceptional cushioning properties make it ideal for mattresses, pillows, cushions, and upholstered furniture, elevating the overall comfort and quality of sleep or seating experience. In bedding applications, PU foam is widely used for mattresses and pillows. It offers pressure relief by conforming to the body's contours, ensuring optimal support, and promoting sleep. PU foam evenly distributes body weight and alleviates pressure points, which ensures comfort and a proper spinal alignment. Moreover, PU foam bedding products are durable, resilient, and are guaranteed to retain their shape, providing long-lasting comfort.

In furniture, PU foam finds extensive applications in upholstered seating, including sofas, chairs, and recliners. Foam's soft and pliable nature allows it to mold according to the body's shape, offering superior comfort and ensuring a better sitting experience. Its high resilience ensures that foam retains its shape even with prolonged use, providing sustained support and preserving aesthetic appeal of furniture.

Demand for PU foam-based bedding and furniture products is driven by various factors, including the growing emphasis of consumers on comfort, rising disposable income, and evolving lifestyle preferences. Manufacturers in the global market continuously develop innovative foam designs to meet specific consumer needs and preferences. With increasing preference for comfortable and high-quality bedding and furniture worldwide, consumption of PU foam in the bedding and furniture segment is expected to witness significant growth over the forecast period.

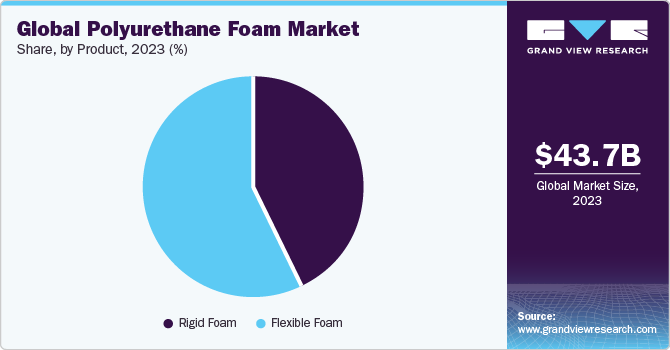

Product Insights

Flexible Foam segment dominated the global market with a revenue share of more than 58.7% in 2023. Flexible foam has emerged as a dominating product segment in the global PU foam market for several compelling reasons such as, its versatility making it an ideal choice for a wide range of applications. Flexible PU foam can be found in various industries, including automotive, furniture, bedding, packaging, and construction. Its ability to conform to different shapes and provide superior cushioning and comfort has made it a popular material in mattresses, seat cushions, and upholstery, among others. This wide range of applications has driven demand for flexible foam and contributed to its dominant position in the market.

Demand for flexible PU foam is driven by consumer preferences and lifestyle changes. With an increasing focus on comfort and convenience, products made with flexible foam have become sought after. For instance, the rising trend of online shopping has boosted demand for flexible foam packaging to protect delicate and valuable items during transportation. In addition, the growing automotive industry has driven a need for comfortable and durable seat cushions, further fueling demand for flexible PU foam in this sector.

Moreover, development of advanced manufacturing techniques and formulations has improved the performance and quality of flexible PU foam. Manufacturers have been able to customize foam's properties, such as density, firmness, and elasticity, to suit specific applications, meeting the diverse needs of various industries. These advancements, coupled with the material's cost-effectiveness and eco-friendly options, have solidified flexible foam's position as the dominating product segment in the global market.

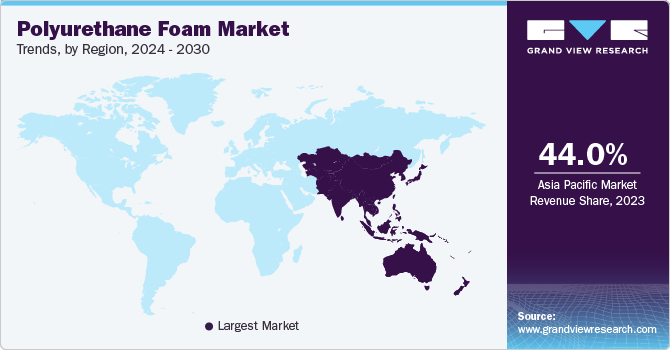

Regional Insights

Asia Pacific dominated the market in 2023 with a revenue share of more than 44.0%. China led the market in 2023, in terms of both volume and revenue. The region's rapid economic growth and industrialization have led to a surge in construction and automotive activities. PU foam finds extensive use in these sectors for insulation, cushioning, and acoustic purposes. As a result, increasing demand for infrastructure development and automobile manufacturing has driven the consumption of PU foam in Asia Pacific, making it the largest market for this versatile material.

Asia Pacific's large population and rising urbanization have fueled the demand for furniture and bedding, where PU foam is extensively utilized. The region's growing middle-class population, with increasing disposable income, has led to a higher demand for comfortable and modern furniture, further propelling the use of PU foam in furniture industry. In addition, the thriving e-commerce industry in the region has boosted the need for protective packaging, where PU foam’s lightweight, cushioning, and shock-absorbing properties are highly advantageous.

Moreover, the presence of a well-established manufacturing sector in countries like China, India, South Korea, and Japan has facilitated production of PU foam at a competitive cost. The advancements in PU foam manufacturing technologies and formulations have allowed manufacturers in region to offer a diverse range of products with varying properties to meet specific customer needs. These factors, coupled with the region’s increasing focus on energy-efficient construction and sustainable materials, have made Asia Pacific, a dominating region segment in the global market.

Key Companies & Market Share Insights

The market has been characterized by the presence of key players along with a few medium and small regional players. Major players are continuously working on developing polymers for production of polyurethane (PU) foam owing to rising demand for bedding & furniture.

This is a highly competitive market due to the presence of major industries across globe as these companies are comparatively concentrated and fiercely competitive along with acquisitions, mergers, and collaborations. For Instance, in June 2023, Sheela Foam, one of renowned manufacturers of foam-based products, planned to acquire Kurlon Enterprise with a capital investment of USD 395.51 million. This strategic move represents a significant step forward for Sheela Foam as it expands its market presence and product portfolio. By acquiring Kurlon Enterprise, Sheela Foam gains access to a strong brand, an extensive distribution network, and a diverse customer base. This acquisition not only reinforces Sheela Foam's position as a dominant player in the industry but also opens new avenues for growth and innovation. With this bold investment, Sheela Foam is well-poised to offer a comprehensive range of high-quality foam and bedding solutions, further cementing its reputation as a trusted name in the market.

Key Polyurethane Foam Companies:

- Huntsman Corporation

- The Dow Chemical Company

- BASF SE

- Sekisui Chemical Co., Ltd.

- Trelleborg AG

- Future Foam, Inc

- Elliott Co. of Indianapolis, Inc.

- Recticel S.A.

- Foamcraft, Inc.

- UFP Technologies, Inc.

- Rogers Corporation

- Wanhua Chemical Group Co., Ltd.

- Saint-Gobain S.A.

Polyurethane Foam Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 46.94 billion |

|

Revenue forecast in 2030 |

USD 73.57 billion |

|

Growth Rate |

CAGR of 7.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; Netherlands; Poland; China; India; Japan; South Korea; Australia; Thailand; Indonesia; Brazil; Argentina; UAE; Saudi Arabia |

|

Key companies profiled |

Huntsman Corporation; The Dow Chemical Company; BASF SE; Sekisui Chemical Co., Ltd.; Trelleborg AG; Future Foam, Inc.; Elliott Co. of Indianapolis, Inc.; Recticel S.A.; Foamcraft, Inc.; UFP Technologies, Inc.; Rogers Corporation; Wanhua Chemical Group Co., Ltd.; Saint-Gobain S.A. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polyurethane Foam Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane foam market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Rigid Foam

-

Flexible Foam

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Bedding & Furniture

-

Transportation

-

Packaging

-

Construction

-

Electronics

-

Footwear

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyurethane foam market size was estimated at USD 43.70 billion in 2023 and is expected to reach USD 46.94 billion in 2024.

b. The global polyurethane foam market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 73.57 billion by 2030.

b. Flexible segment dominated the polyurethane foam market with a share of 58.74% in 2023. This is attributable to their wide application in industries such as furniture, transportation, bedding, packaging, textiles, and others.

b. Some key players operating in the polyurethane foam market include Huntsman Corporation, The Dow Chemical Company, BASF SE, Sekisui Chemical Co., Ltd., Trelleborg AG, Future Foam, Inc., Elliott Co. of Indianapolis, Inc., Recticel S.A., Foamcraft, Inc., UFP Technologies, Inc., Rogers Corporation, Wanhua Chemical Group Co., Ltd., Saint-Gobain S.A..

b. Key factors that are driving the market growth include increasing demand from bedding & furniture industry owing to rising urban population in emerging economies of Asia Pacific.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."