- Home

- »

- Plastics, Polymers & Resins

- »

-

Polycarbonate Market Size & Share, Industry Report, 2033GVR Report cover

![Polycarbonate Market Size, Share & Trends Report]()

Polycarbonate Market (2026 - 2033) Size, Share & Trends Analysis Report By Grade (General Purpose, Medical, Food, Flame Retardant, PC Alloyed), By Application (Transportation, Construction, Packaging, Optical Media, Medical Devices, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-269-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycarbonate Market Summary

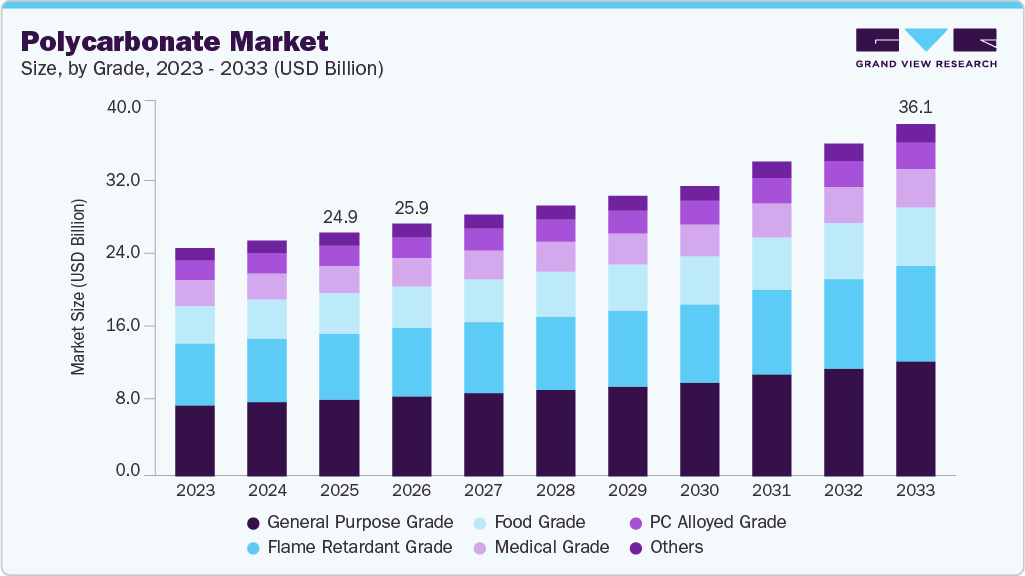

The global polycarbonate market size was estimated at USD 24.99 billion in 2025 and is projected to reach USD 36.06 billion by 2033, growing at a CAGR of 4.9% from 2026 to 2033. The rising use of polycarbonate in electrical and electronics applications is driving the market.

Key Market Trends & Insights

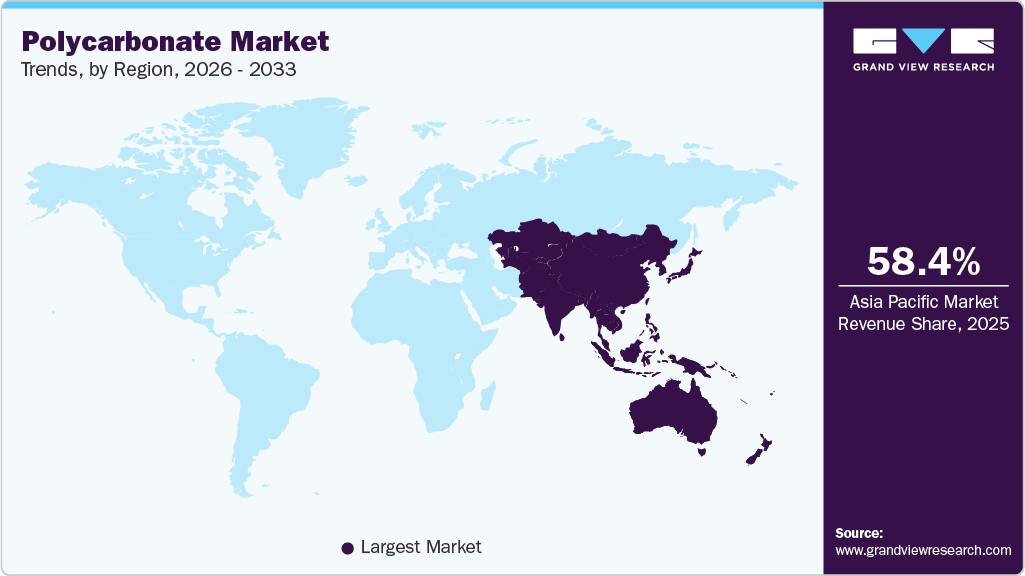

- Asia Pacific dominated the global polycarbonate industry with the largest revenue share of 58.42% in 2025.

- The polycarbonate industry in Taiwan is expected to grow at a substantial CAGR of 7.0% from 2026 to 2033.

- By grade, the general purpose grade segment is expected to grow at a considerable CAGR of 5.3% from 2026 to 2033 in terms of revenue.

- By application, the transportation segment is expected to grow at a considerable CAGR of 5.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 24.99 Billion

- 2033 Projected Market Size: USD 36.06 Billion

- CAGR (2026 - 2033): 4.9%

- Asia Pacific: Largest market in 2025

Its high heat resistance, electrical insulation, and dimensional stability support the growing demand for consumer electronics, data centers, and smart infrastructure equipment.

The market is experiencing a strong shift toward sustainability and performance-driven applications. Manufacturers are increasingly investing in eco-friendly production processes, recycled materials, and advanced material technologies to meet rising regulatory and customer expectations on environmental impact. This trend is reflected in the growing development of bio-based polycarbonates and chemical recycling methods that aim to maintain performance while reducing carbon footprint and waste. Sustainable solutions are becoming a core part of product strategies.

Drivers, Opportunities & Restraints

Demand for lightweight, high-performance materials across the automotive, electronics, and construction sectors remains a key market driver. Polycarbonate’s combination of impact resistance, thermal stability, and design flexibility makes it a preferred choice for vehicle components, electronic housings, and architectural panels. In the automotive industry, polycarbonate supports weight-reduction goals, directly contributing to improved fuel efficiency and increased electric vehicle range. This broad industrial adoption is expanding overall market consumption.

Expanding use of polycarbonate in secure identity applications and specialty segments represents a high-value opportunity. Governments and financial institutions are increasing the issuance of durable polycarbonate identity cards and payment cards that leverage the material’s tamper resistance and longevity. Parallel growth in medical, optical, and flame-retardant specialty grades offers higher margins compared to commodity resins. Innovations in recycling and bio-based feedstocks also open pathways to sustainable product portfolios and new market entries.

Volatility in raw material prices and sustainability pressures constrain market growth. Polycarbonate production depends heavily on petrochemical feedstocks such as bisphenol-A, exposing manufacturers to crude oil price swings and supply chain disruptions that squeeze margins and complicate pricing. Concurrently, stringent environmental regulations and challenges in recycling infrastructure place cost and compliance burdens on producers. These factors can slow investment and limit expansion in certain end-use applications.

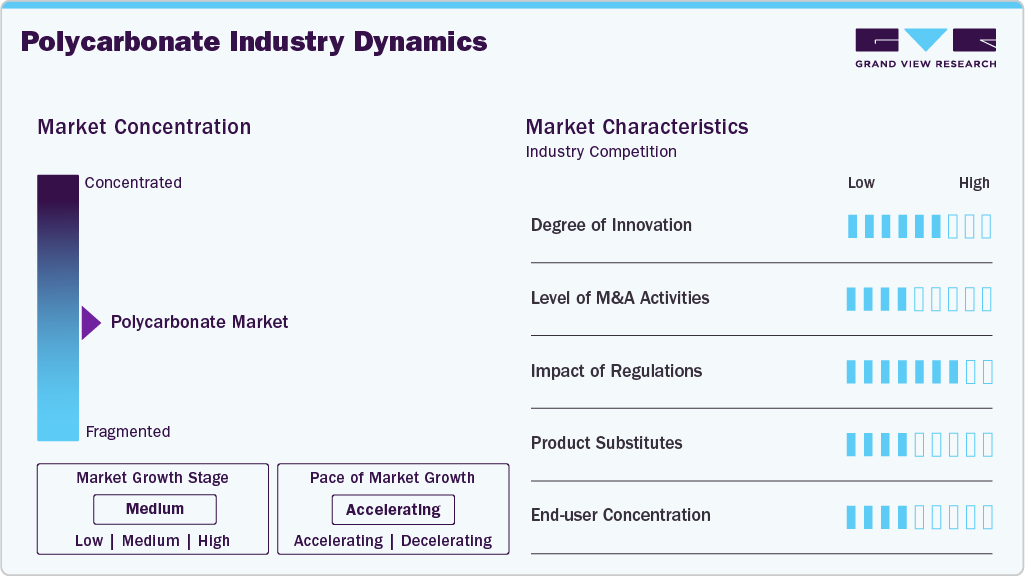

Market Concentration & Characteristics

The market growth stage is moderate, and growth is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as Covestro, SABIC, Lotte Chem, Teijin Industries, Mitsubishi Engineering Plastics Corp., Trinseo, Idemitsu Kosan Co., Ltd., Lone Star Chemical, Chi Mei Corporation, Entec Polymers, RTP Company, LG Chem, and others play a significant role in shaping the market dynamics. These leading players often drive innovation in the market, introducing new products, technologies, and product types to meet the industry's evolving demands.

Innovation in the market is concentrated on circularity and targeted performance upgrades. Chemical recycling and bio-based feedstocks are moving from pilot to early commercial stages, creating lower-carbon PC grades and new supply chains. Concurrently, suppliers are launching advanced surface coatings to address scratch and UV vulnerability for glazing and display applications. Material blends for higher heat and flame performance are enabling broader use in EVs and telecom hardware. Collaboration with OEMs is accelerating the development of application-specific grades, also driving the demand for the market.

The main substitutes are glass, acrylic (PMMA), PET, and engineering resins such as ABS. Glass competes on scratch resistance and thermal stability but adds weight and cost. Acrylic offers clarity and a lower price, though it falls short in impact resistance and temperature performance. PET and oriented polymers challenge PC in packaging due to established recycling streams. Advances in scratch-resistant glass coatings and specialty acrylics increase competitive pressure. Strategic responses include hard coatings, engineered blends, and service-level offerings to protect share.

Grade Insights

General-purpose grade dominated the market across all grade segments in terms of revenue, accounting for a 31.60% market share in 2025, and is forecasted to grow at a 5.3% CAGR from 2026 to 2033. General-purpose polycarbonate demand is supported by steady growth in construction, glazing, and sheet markets that value clarity and impact resistance. Manufacturers are shifting capacity toward extrusion and coextrusion sheet lines to meet demand for architectural panels and greenhouses. Market pricing pressure is easing as supply expansions from major producers align with steady end-use consumption. Producers emphasize consistent melt flow and optical properties to retain share against PET and acrylic substitutes. This structural demand underpins volume growth in commodity PC grades.

The food-grade segment is anticipated to grow at a substantial CAGR of 5.1% through the forecast period. Regulatory action against bisphenol A is reshaping demand for food-contact polycarbonate and prompting rapid formulation shifts. The EU ban on BPA in food contact materials, introduced on December 19, 2024, has accelerated industry adoption of BPA-free alternatives and barrier laminates. Producers now prioritize certified non-BPA chemistries and compliance documentation to retain food packaging contracts. This regulatory pressure is increasing the development of specialty copolymers and substitution strategies that preserve performance while meeting new safety criteria.

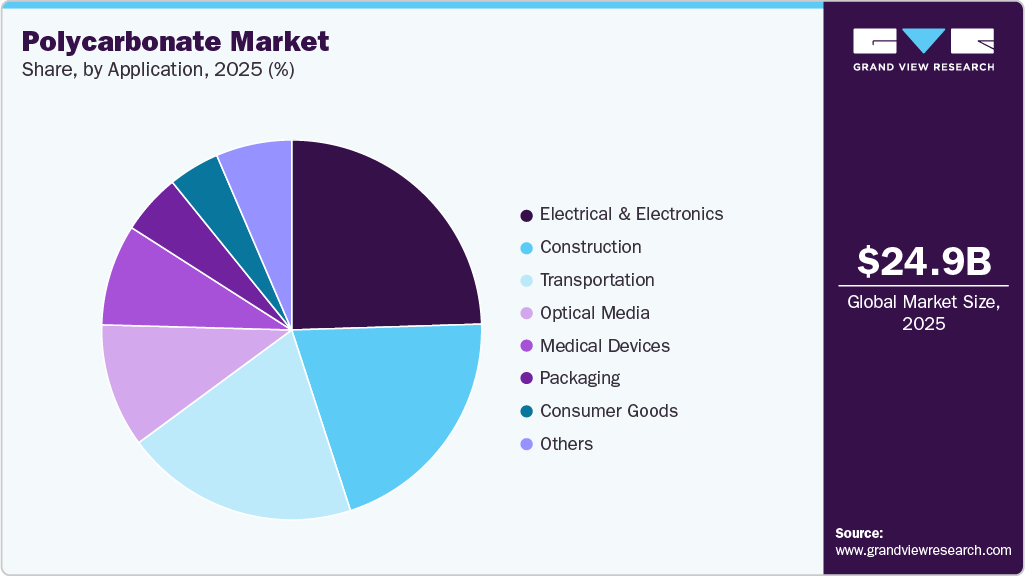

Application Insights

Electrical & electronics dominated the market across the application segmentation in terms of revenue, accounting for a 24.51% market share in 2025, and is forecast to grow at a 5.2% CAGR from 2026 to 2033. Polycarbonate is gaining market share as consumer electronics and telecom equipment demand higher thermal stability and dimensional precision. Demand is rising for PC blends in smartphone frames, LED display housings, and 5G radio enclosures, where flame-retardant and dielectric properties are critical. Data center infrastructure also drives demand for robust polymer housings and cable components. Suppliers offer tailored flame-retardant and high-heat grades to meet UL and IEC standards. These application-specific grades command premium pricing compared to commodity resins.

The transportation segment is expected to expand at a robust 5.8% CAGR over the forecast period in the automotive polycarbonate glazing market. Automotive lightweighting and advanced glazing requirements are expanding the use of polycarbonate in vehicle exteriors and interior components. Polycarbonate glazing and headlamp modules reduce mass while preserving optical clarity and impact resistance. Electric vehicle programs further increase adoption because weight savings translate directly into extended driving range. Investment in surface-hard coatings and chemical treatments improves scratch resistance and service life, enabling greater OEM acceptance.

Regional Insights

The Asia Pacific polycarbonate market held the largest share, accounting for 58.42% of the revenue in 2025, and is expected to grow at the fastest CAGR of 5.6% over the forecast period. Asia Pacific’s market is primarily driven by rapid industrialization and the expansion of mass manufacturing. China, Japan, South Korea, and India together account for the majority of regional consumption, driven by strong electronics and automotive clusters that require advanced, lightweight materials. Urban infrastructure growth further fuels demand for polycarbonate roofing, glazing, and construction panels, propelling the polycarbonate sheet market. Government incentives supporting EV production and smart city initiatives are reinforcing regional uptake and investment in high-performance polycarbonate grades.

China Polycarbonate Market Trends

The polycarbonate market in China stands as the single largest contributor to the global market, driven by its dominant electronics and automotive manufacturing base. Government mandates on new energy vehicles and localized supply chain development reduce import dependence and boost domestic resin production capacity. Rapid urbanization and infrastructure investment also stimulate construction uses such as glazing and roofing. Local expansions by integrated producers increase the availability of specialty grades, supporting both internal demand and export competitiveness.

North America Polycarbonate Market Trends

The polycarbonate market in North America is driven by the robust electronics and automotive sectors, which seek lightweight, durable materials to meet performance and regulatory targets. Specialized materials are adopted in high-growth segments such as EV charging infrastructure and semiconductor fabrication modules. Medical device manufacturing also supports steady consumption, driven by stringent safety requirements for transparent and sterilizable components. Investments in sustainable construction materials and premium engineering plastics further sustain regional market expansion.

The U.S. polycarbonate market is propelled by accelerating electric vehicle programs and the build-out of advanced semiconductor and electronics manufacturing facilities. Automotive OEMs increasingly specify polycarbonate for glazing, lighting, and interior components to achieve weight and efficiency targets. Expansion of large data centers and 5G network equipment drives demand for high-performance grades with superior thermal and electrical properties. The medical equipment segment also underpins growth through demand for durable, sterilizable components.

Europe Polycarbonate Market Trends

The polycarbonate market in Europe is shaped by stringent environmental and regulatory standards that elevate the adoption of recyclable and non-phosgene production processes. Sustainability directives and circular economy policies encourage the use of eco-friendly grades in construction, automotive, and electrical applications. Germany, France, and Italy anchor regional demand through premium automotive manufacturing and industrial automation. Regulatory compliance and advanced polymer innovation support resilient material demand across diverse end-use industries.

Key Polycarbonate Company Insights

The polycarbonate industry is highly competitive, with several key players dominating the landscape. Major companies include Covestro, SABIC, Lotte Chem, Teijin Industries, Mitsubishi Engineering Plastics Corp., Trinseo, Idemitsu Kosan Co., Ltd., Lone Star Chemical, Chi Mei Corporation, Entec Polymers, RTP Company, and LG Chem. The polycarbonate industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polycarbonate Companies:

The following key companies have been profiled for this study on the polycarbonate market.

- Covestro

- SABIC

- Lotte Chem

- Teijin Industries

- Mitsubishi Engineering Plastics Corp.

- Trinseo

- Idemitsu Kosan Co. Ltd.

- Lone Star Chemical

- Chi Mei Corporation

- Entec Polymers

- RTP Company

- LG Chem

Recent Developments

-

In March 2025, Deepak Advanced Materials inaugurated a new polycarbonate compounding plant in Gujarat, India, to supply customized PC granules for local automotive, electronics, and construction markets and to reduce import dependence through localized value-added processing.

-

In January 2025, Covestro announced a major capacity expansion for tailor-made polycarbonates at its Herbon, Ohio site, committing capital to new production lines to serve North American automotive, electronics, and specialty film demand and to shorten lead times for custom grades.

-

In November 2024, Trinseo agreed to sell its polycarbonate technology license and the Stade, Germany, polycarbonate assets to Deepak Chem Tech Limited, marking a strategic divestment that supports downstream consolidation and enables Deepak to fast-track entry into European PC production.

Polycarbonate Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25.86 billion

Revenue forecast in 2033

USD 36.06 billion

Growth rate

CAGR of 4.9% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Taiwan; Singapore; Australia; Brazil; Argentina; Colombia; Saudi Arabia; UAE; Turkey; South Africa

Key companies profiled

Covestro; SABIC; Lotte Chem; Teijin Industries; Mitsubishi Engineering Plastics Corp.; Trinseo; Idemitsu Kosan Co., Ltd.; Lone Star Chemical; Chi Mei Corporation; Entec Polymers; RTP Company; LG Chem

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polycarbonate Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends across sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the polycarbonate market report based on type, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

General Purpose Grade

-

Flame Retardant Grade

-

PC Alloyed Grade

-

Medical Grade

-

Food Grade

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Transportation

-

Electrical & Electronics

-

Construction

-

Packaging

-

Consumer Goods

-

Optical Media

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polycarbonate market size was estimated at USD 24.99 billion in 2025 and is expected to reach USD 25.86 billion in 2026.

b. The global polycarbonate market is expected to grow at a compound annual growth rate of 4.9% from 2026 to 2033 to reach USD 36.06 billion by 2033.

b. General purpose grade dominated the market across all grade segments in terms of revenue, accounting for a 31.60% market share in 2025, and is forecasted to grow at a 5.3% CAGR from 2026 to 2033.

b. Some key players operating in the polycarbonate market include Covestro, SABIC, Lotte Chem, Teijin Industries, Mitsubishi Engineering Plastics Corp., Trinseo, Idemitsu Kosan Co., Ltd., Lone Star Chemical, Chi Mei Corporation, Entec Polymers, RTP Company, and LG Chem.

b. The rising use of polycarbonate in electrical and electronics applications is driving the polycarbonate market. Its high heat resistance, electrical insulation, and dimensional stability support the growing demand for consumer electronics, data centers, and smart infrastructure equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.