- Home

- »

- Advanced Interior Materials

- »

-

3D Printing Filament Market Size, Industry Report, 2027GVR Report cover

![3D Printing Filament Market Size, Share & Trends Report]()

3D Printing Filament Market (2020 - 2027) Size, Share & Trends Analysis Report By Type (Plastics, Metal, Ceramics), By Plastic Type (Polylactic Acid, ABS), By Application (Industrial, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-304-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing Filament Market Summary

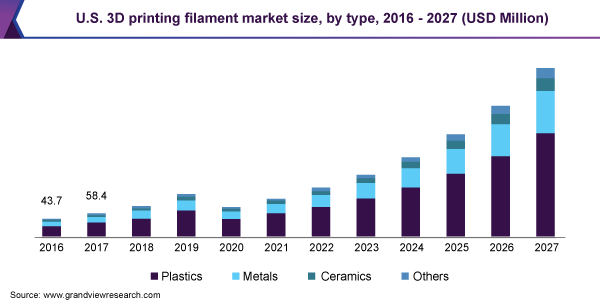

The global 3D printing filament market size was estimated at USD 471.3 million in 2019 and is projected to reach USD 1.9 billion by 2030, growing at a CAGR of 18.8% from 2020 to 2027. The demand for 3D printing filament is driven by the increasing applications in the aerospace and defense industry for design communication and prototyping.

Key Market Trends & Insights

- North America dominated the market in 2019 and accounted for the largest revenue share of more than 37.0%.

- In 2019, the U.S. was the largest consumer of 3D printing filament in North America.

- By type, the plastics segment dominated the market and accounted for the largest revenue share of 60.5%.

- By plastics type, the polylactic acid (PLA) segment led the market and accounted for the largest revenue share of more than 39.0% in 2019.

- By application, the aerospace and defense segment accounted for the largest revenue share of 26.5% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 471.3 Million

- 2027 Projected Market Size: USD 1.9 Billion

- CAGR (2020-2027): 18.8%

- North America: Largest market in 2019

Furthermore, increasing demand for high-quality print in automotive and industrial applications is fueling market growth. Primarily, 3D printing filament is the thermoplastic feedstock for fused deposition modeling or fused filament fabrication (FDM/FFF) technique. The use of more than one filament for printing numerous materials at a time is the major driving factor for the market. Moreover, reasonable pricing of the filaments and ease of use provides further opportunities for market growth.

In the U.S., the market is anticipated to witness a CAGR of more than 21.0% over the forecast period. Aerospace and defense component enhancements coupled with the adoption of eco-friendly parts in the country are likely to offer growth opportunities. For instance, NASA (National Aeronautics and Space Administration), takes minutes to hours to manufacture space components and parts with the 3D printer whereas conventional manufacturing takes months to years to build the same before sending them into orbit..

Rising innovation and research and development in the 3D printing filament such as multi-property materials and bio-degradable 3D filaments are highly attracting the market players to invest in the same. Moreover, strict environmental regulations imposed by the countries in Europe are widening the scope for bio-degradable 3D printing filaments.

The 3D printing filaments made from plastic are being widely used owing to their low cost, water resistance property, and ease of manufacturing. Unlike regular printing such as composites, nylon, and other hybrid filament material, plastics uses fused filament fabrication techniques more efficiently to create prototypes for aerospace and defense, automotive, and industrial application segments.

Various trends and product development phases in the 3D printing filament are spurring a positive trend in the growth of the market. Countries such as India, China, Brazil, South Korea, and Malaysia are the major component manufacturers in the field of aerospace and defense, automotive, industrial, and healthcare. This is likely to add further growth to the market during the forecasted period.

Type Insights

In 2019, the plastics segment dominated the market and accounted for the largest revenue share of 60.5% and is expected to ascend at a CAGR of 19.0% over the projected period. The demand for plastic-type 3D filament printing is driven by the easy manufacturing process and ability to fuse at any surface. Moreover, the product’s malleable property enables its use in a multitude of components construction in various applications such as space-aircrafts, motor vehicles, machining tools, educational models, and various others is further adding growth to the market.

Metal-filled 3D printing filament uses very fine metal powders such as stainless steel, copper, brass, bronze, and others. These metals provide an aesthetically appealing metal finish and do not need a high-temperature extruder. In addition, unlike plastic printing filaments, metal filaments are heavier and remain on the surface for a longer duration. However, producing metal filament for printing requires three to four times more energy as compared to plastics and ceramics, which hinders the metal-based 3D printing filament segment.

An alternative to plastics and metal-based 3D printing filament is ceramics. The application of ceramics for printing is attributed to the production of artistic figurines, models, statues, and art & designing projects. In addition, it is widely used in biomedical to make custom implants such as 3D bone substitutes. However, producing complex components and parts by the ceramics filament is costly and takes time to manufacture. As a result, the key players in the market are investing in research & development of the new printing techniques in the same.

Other materials used in the 3D printing filament include composites, nylon, hybrid materials, alumide (polyamide and aluminum powder), soluble materials, and various others. These aforementioned materials are often mixed with plastics for easy manufacturing and flexibility. This, in turn, has resulted in the growth of the market.

Plastic type Insights

The Polylactic Acid (PLA) segment led the market and accounted for the largest revenue share of more than 39.0% in 2019, owing to its property towards ease of printing, which does not need a heating platform while printing on the structure. Moreover, the material being biodegradable is preferred in Europe due to stringent environmental policies.

Acrylonitrile Butadiene Styrene (ABS) is the most commonly used 3D printing filament owing to its high flexibility and shock-resistant properties. It is highly used in the manufacturing of outside parts (bumpers) of motor vehicles, mobile phone cases, and electronic appliances. Countries such as the U.S., China, South Korea, and Hong Kong are considered prominent electronics producers that use 3D filament printing on electronic items, thus adding significant growth to the market.

Increasing awareness regarding product sustainability is likely to increase the use of PLA-type material for 3D printing during the forecast period. However, other materials such as Acrylonitrile Styrene Acrylate (ASA), Polyethylene Terephthalate Glycol (PETG), Polyethylene Terephthalate (PET), and others exhibit rigid and good chemical resistance that is expected to increase their application in aerospace and defense and automotive segments.

Increasing year-on-year expenditure on space exploration programs by the leading space agencies around the globe are spurring the demand for 3D filament printing for limiting warehouse space, cutting storage cost, and manufacturing aerospace parts such as aircraft structures and engine parts. Moreover, sustainable 3D filaments such as PLA from corn starch and plant-based 3D printing material have attracted the attention of various key players in the market, thereby adding positive growth to the market.

Application Insights

The aerospace and defense application segment accounted for the largest revenue share of 26.5% in 2019 on account of high usage in the production of design prototypes. Increasing the use of additive manufacturing in aerospace components, across the globe for cost-effective solutions is expected to create demand for the 3D printing filament in the projected period.

An average aerospace component and parts designed by 3D printing technology are lighter and result in the reduction of air drag, thereby reducing the fuel cost. In addition, factors such as increasing environmental awareness, and reduction of fuel costs and emission are likely to minimize the environmental impact, thereby increasing the demand for 3D printing filament during the projected period.

The automotive application segment is expected to gain a notable share in the 3D printing filament market owing to a rise in demand for more robust, lighter, stronger, and safer designs. For instance, in June 2020, the giant electric car manufacturer Tesla Inc. used the 3D printing technique for its newest electric car, Model-Y for its rear underbody component manufacturing.

Industrial and other manufacturing application accounts for a fair share in the market owing to the rise in the manufacturing of components such as automotive spares and replacement parts, injector heads, wall panels, and others. Components and parts such as jigs and fixtures, robotics grippers & sensor mounts, and various other applications in the education segment including artwork and model designs are likely to add significant growth to the market.

Regional Insights

North America dominated the market in 2019 and accounted for the largest revenue share of more than 37.0% and is expected to witness a CAGR of over 18.8% over the projected period. Increasing investment by the U.S. aerospace and defense sector for the manufacturing of high-end designs and models for critical components such as spacer panels, circuit boards, spare parts, and others, is expected to support the regional market growth in the estimated time frame.

In 2019, the U.S. was the largest consumer of 3D printing filament in North America. Development in defense industrial operation and an increase in the production of motor vehicles in the automobile sector within the region are expected to support the demand for complex parts and components such as exterior and interior vehicle body components that requires 3D printers is thus expected to have a positive impact on the market.

In Asia Pacific, the market accounted for the second-largest revenue share in 2019 on account of the increasing expenditure in the manufacturing sector involving the production of tooling, fixtures, electronics, toys, and others. The 3D printers offer a significant reduction in the manufacturing time for the aforementioned products as compared to the conventional CNC machines.

In Europe, the market is expected to grow at a significant rate of 17.6% over the forecast period on account of the increasing manufacturing of aircraft and automotive components. However, stringent policies concerning the use of non-biodegradable materials such as ABS and other high-performance polymers made from petrochemical feedstock are likely to act as a restraint for the market growth.

Key Companies & Market Share Insights

The key players adopt several market strategies such as acquisition, investment, and innovation. Moreover, the key companies are expanding their capacities to facilitate the respective markets. The market is competitive due to the presence of key players adopting the 3D filament printing technique for better product quality in less time. The market is characterized by the existence of various application industries that concerns with higher lead time at minimal operation costs by the printing technique. Some of the prominent players in the 3D printing filament market include:

-

Höganäs AB

-

3D Systems Corporation

-

General Electric

-

Arkema S.A

-

Royal DSM N.V

-

Stratasys, Ltd.

-

Evonik Industries AG

-

ExOne

-

Arcam AB

3D Printing Filament Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 330.8 million

Revenue Forecast in 2027

USD 1.9 billion

Growth rate

CAGR of 18.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, plastic type, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Brazil; Argentina

Key companies profiled

Höganäs AB; 3D Systems Corporation; General Electric; Arkema S.A; Royal DSM N.V; Stratasys, Ltd.; Evonik Industries AG; ExOne; Arcam AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global 3D printing filament market report on the basis of type, plastic type, application, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Plastics

-

Metals

-

Ceramics

-

Others

-

-

Plastic Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Polylactic Acid (PLA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate Glycol (PETG)

-

Acrylonitrile Styrene Acrylate (ASA)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Industrial

-

Aerospace & Defense

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global 3D printing filament market size was estimated at USD 471.3 million in 2019 and is expected to reach USD 330.8 million in 2020.

b. The 3D printing filament market is expected to grow at a compound annual growth rate of 18.8% from 2020 to 2027 to reach USD 1,865.2 million by 2027.

b. Plastic filaments dominated the 3D printing filament market with a share of 60.4% in 2019, due to the high molding ability of the plastic leading to ease in the printing process.

b. Some of the key players operating in the 3D printing filament market include Höganäs AB, 3D Systems Corporation, General Electric, and Arkema S.A.

b. The key factors that are driving the 3D printing filament market include increasing applications in the aerospace and defense industry for design communication and prototyping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.