- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Plastic Market Size, Share & Trends Report]()

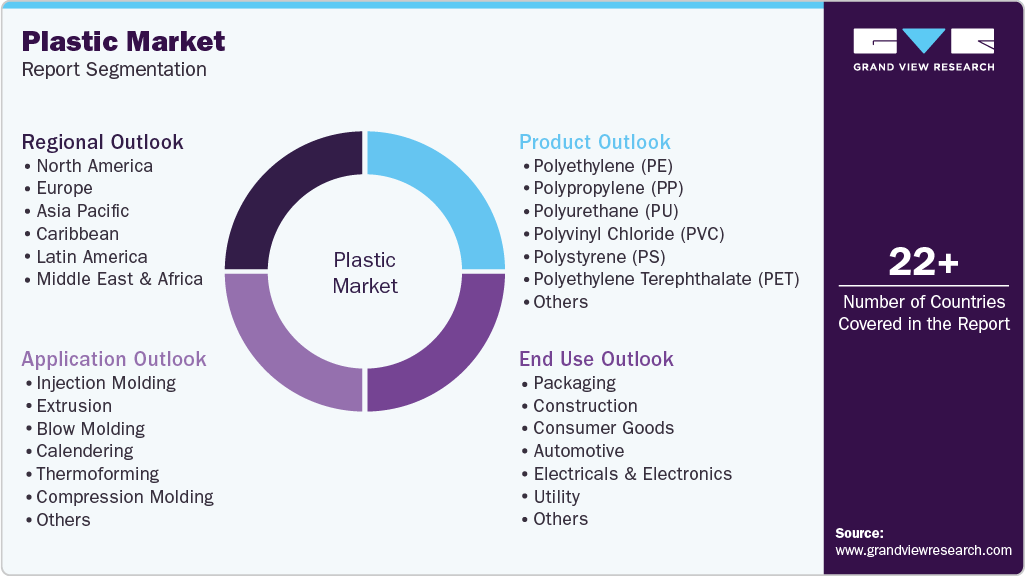

Plastic Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (PE, PP, PU, PVC, PET, PS, Epoxy Polymers, Liquid Crystal Polymers), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-232-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Market Summary

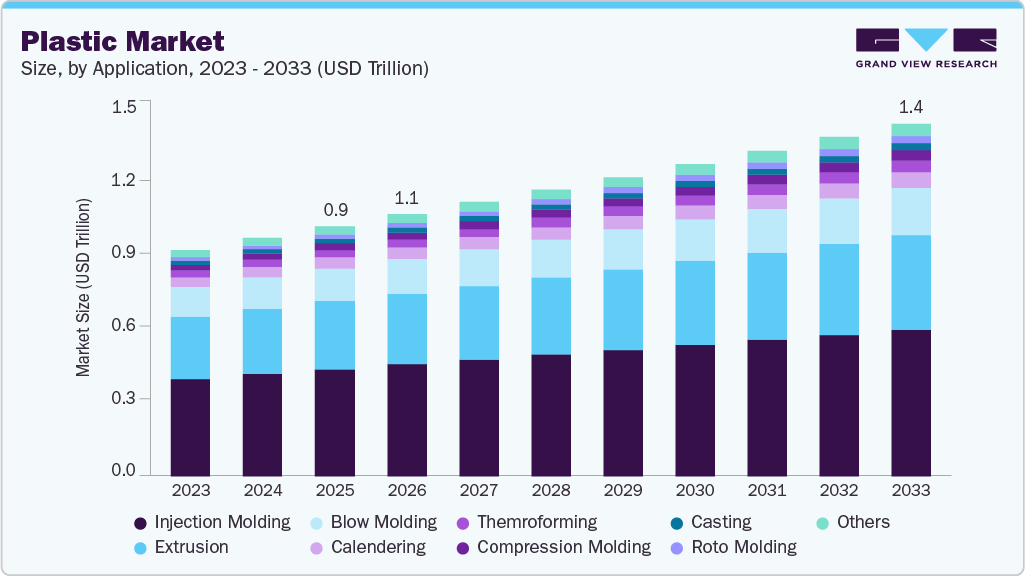

The global plastic market size was estimated at USD 963.65 billion in 2025 and is projected to reach USD 1361.25 billion by 2033, growing at a CAGR of 4.4% from 2026 to 2033. The industry is driven by rising demand from the packaging, automotive, and construction industries due to its lightweight, durable, and cost-effective properties.

Key Market Trends & Insights

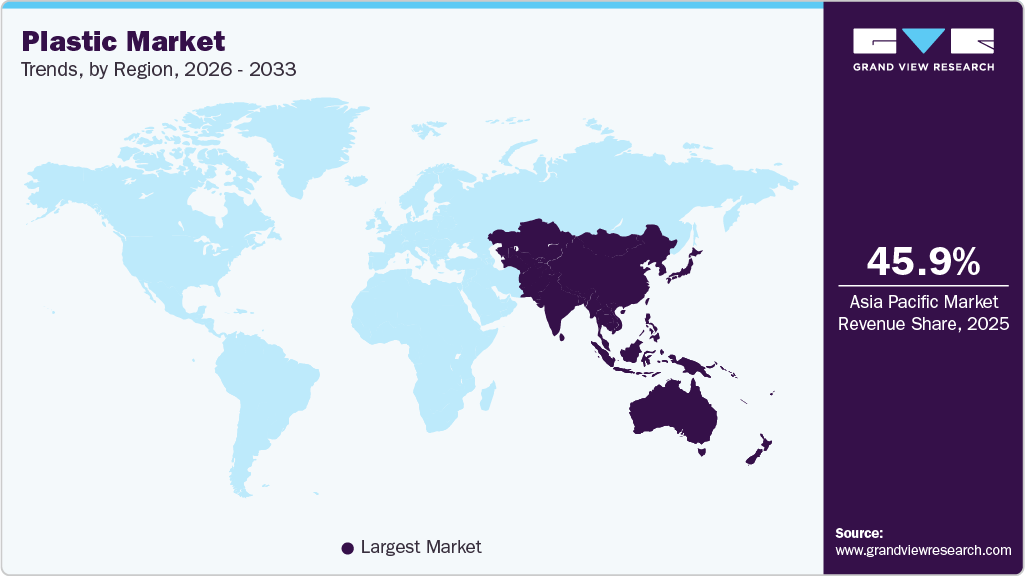

- Asia Pacific dominated the plastic market with the largest revenue share of over 45.92% in 2025.

- The plastic industry in China is anticipated to grow at a substantial CAGR of 4.8% from 2026 to 2033.

- By product, the epoxy polymers segment is expected to grow at fastest CAGR of 8.5% from 2026 to 2033 in terms of revenue.

- By application, the roto molding segment is expected to grow at fastest CAGR of 6.2% from 2026 to 2033 in terms of revenue.

- By end use, the medical devices segment is expected to grow at fastest CAGR of around 6.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 963.65 Billion

- 2033 Projected Market Size: USD 1361.25 Billion

- CAGR (2026-2033): 4.4%

- Asia Pacific: Largest market in 2025

Additionally, advancements in recyclable and bio-based plastics are fueling market growth amid increasing sustainability initiatives. Plastics are lightweight, durable, and versatile, making them ideal for manufacturing a wide range of products. For instance, in the automotive sector, plastics are increasingly used for interior panels, bumpers, and battery casings for electric vehicles due to their weight reduction benefits, which improve fuel efficiency and reduce emissions. Similarly, in packaging, single-use plastics, flexible packaging, and PET bottles continue to dominate due to their cost-effectiveness, recyclability, and convenience for consumers.Technological innovation in polymer chemistry and production methods is another key factor driving the plastic market. The development of high-performance plastics such as polypropylene (PP), polyethylene terephthalate (PET), polycarbonate (PC), and bioplastics has expanded applications in sectors that demand superior strength, heat resistance, or biodegradability. For example, biodegradable PLA (polylactic acid) plastics are gaining popularity in food packaging and disposable cutlery, driven by sustainability trends. Additionally, innovations like nano-reinforced plastics and flame-retardant polymers are opening opportunities in electronics, aerospace, and construction, pushing market growth.

Rapid urbanization and infrastructure expansion in emerging economies such as India, China, and Brazil are significantly boosting plastic consumption. Construction plastics, including PVC pipes, window frames, and insulation materials, are essential for modern housing and commercial projects. The increasing population and urban migration drive demand for durable, lightweight, and cost-effective building materials, positioning plastics as a preferred choice over traditional metals or glass. For example, China’s large-scale residential and transportation projects have consistently driven growth in PVC and polyethylene demand over the past decade.

While environmental concerns are challenging the traditional industry, they are also driving innovation and creating new growth avenues. Increased awareness of plastic waste has led to the adoption of recycled plastics, circular economy initiatives, and regulatory incentives encouraging eco-friendly materials. Companies like BASF and Dow Chemical are investing in chemical recycling technologies and bioplastics to meet stricter regulations in Europe and North America. The shift toward sustainable alternatives, such as compostable films and recycled PET (rPET) bottles, demonstrates how environmental compliance is becoming a growth driver rather than just a constraint.

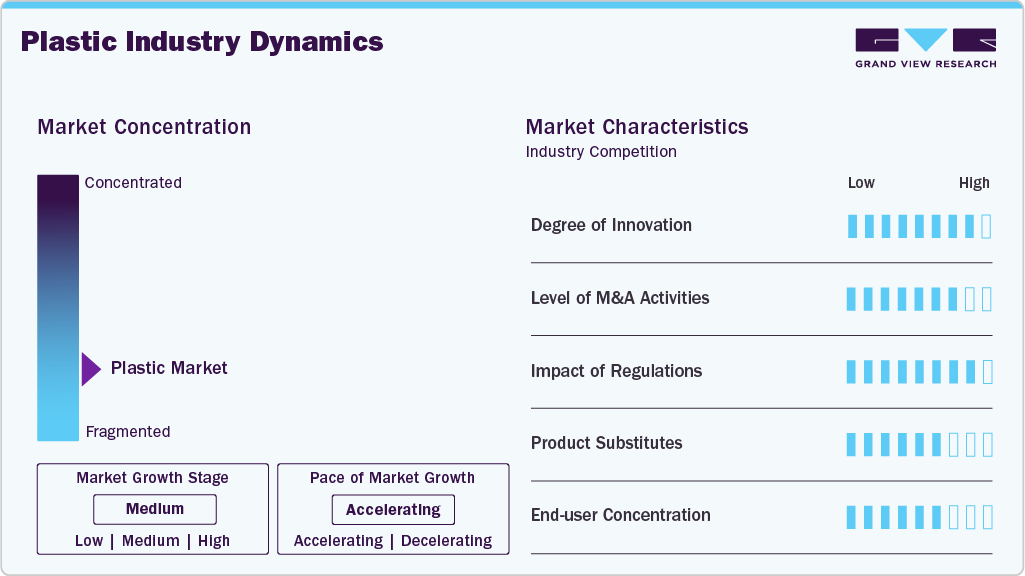

Market Concentration & Characteristics

The global industry is extremely diverse, spanning multiple sectors including packaging, automotive, construction, electronics, healthcare, and consumer goods. Each sector has specific material requirements, such as lightweight polymers for automotive parts, flexible films for packaging, or medical-grade plastics for healthcare applications. This multi-sector presence makes the industry resilient to sector-specific downturns, as demand from one segment can offset declines in another. For example, while single-use plastic restrictions have impacted packaging in some regions, demand in automotive and construction remains strong.

The industry operates under strict environmental regulations and is heavily influenced by global sustainability trends. Governments in Europe, North America, and the Asia Pacific have introduced stringent regulations on single-use plastics, recycling mandates, and chemical safety standards, forcing manufacturers to innovate and adopt eco-friendly alternatives. Companies investing in chemical recycling, biodegradable plastics, or circular economy initiatives are better positioned to navigate regulatory pressures while accessing new market opportunities. For example, the European Union’s Plastics Strategy promotes the use of recycled content in packaging, which directly influences product development and market growth.

Product Insights

The PE segment recorded the largest revenue share of over 24.84% in 2025. Polyethylene is the most widely used plastic, available in forms such as Low-Density (LDPE), High-Density (HDPE), and Linear Low-Density (LLDPE). It’s used in packaging films, containers, pipes, and household goods due to its excellent chemical resistance, flexibility, and durability. For example, HDPE bottles for milk or detergents are a common application. Growing demand for packaging materials in food, pharmaceuticals, and e-commerce is a major driver. Increasing investment in infrastructure, such as pipelines and water distribution systems, also supports PE consumption. The low cost and recyclability further boost adoption.

The epoxy polymer segment is expected to grow at the fastest CAGR of 8.5% during the forecast period. Epoxy resins are widely used as adhesives, coatings, and composite materials. They are applied in electronics, aerospace, automotive, and construction due to their excellent adhesion, chemical resistance, and electrical insulation properties. Growth in electronics, aerospace, and wind energy (composite applications) fuels epoxy polymer demand. Increasing use in industrial coatings, high-performance adhesives, and printed circuit boards is also a driver.

Application Insights

The injection molding segment recorded the largest revenue share of over 42% in 2025. Injection molding is a widely used plastic manufacturing process in which molten plastic is injected into a mold cavity, cooled, and solidified into the desired shape. This method is highly precise and suitable for the mass production of complex parts. Common applications include automotive components, consumer electronics casings, medical devices, and packaging items like bottle caps. The demand for high-volume, consistent, and complex parts is driving growth in the injection molding industry. Industries such as automotive, medical, and electronics require precise tolerances and repeatability, making injection molding a vital process.

The roto molding segment is expected to grow at the fastest CAGR of 6.2% during the forecast period. Rotational molding is used to create large, hollow plastic products by rotating a mold filled with powdered plastic over a heat source. Applications include water tanks, playground equipment, kayaks, and industrial containers. The demand for large, durable, and seamless hollow products drives the growth of roto molding. Its cost-effectiveness for low to medium production volumes and ability to produce complex shapes with uniform wall thickness are appealing. Growing use in water storage, agriculture, and outdoor equipment sectors further boosts adoption.

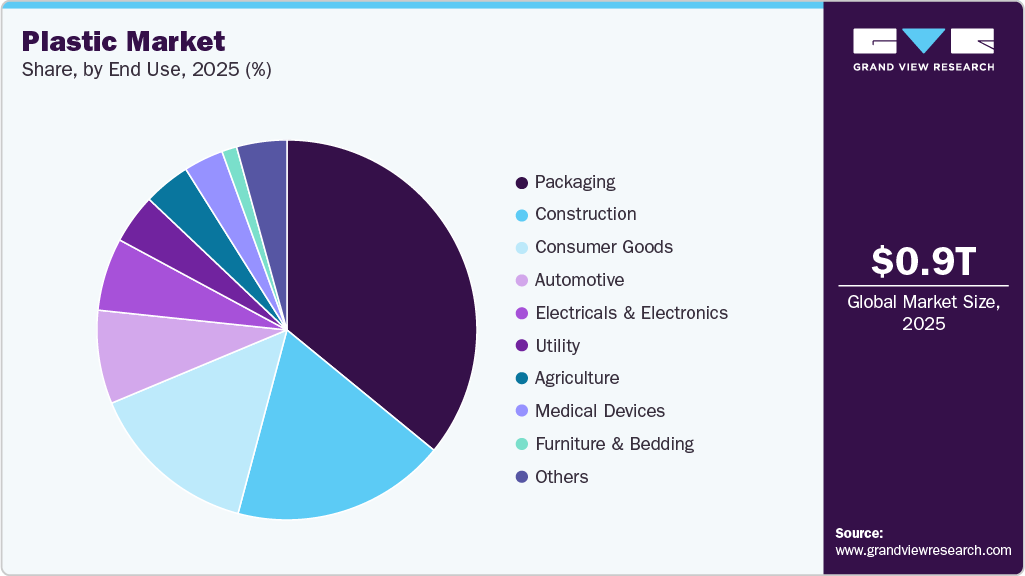

End Use Insights

The packaging segment recorded the largest market share of over 36.0% in 2025. The packaging segment is the largest consumer of plastics globally, driven by its lightweight, durability, and versatility. Plastics are used in flexible packaging (like films, pouches, and wraps), rigid packaging (bottles, containers), and industrial packaging (crates, pallets). For example, PET bottles dominate the beverage industry, while polypropylene (PP) and polyethylene (PE) are widely used in food packaging. The demand is fueled by rising consumer convenience, increasing e-commerce, and the global expansion of the food and beverage sector.

The medical devices segment is projected to grow at the fastest CAGR of 6.0% during the forecast period. Plastics are crucial in medical devices like syringes, IV bags, tubing, surgical instruments, and diagnostic devices. Materials like PVC, polypropylene, and polyethylene are chosen for sterilization compatibility, flexibility, and biocompatibility. Growing healthcare infrastructure, demand for disposable medical devices, rising global population, and innovations in biocompatible and sterilizable plastics fuel growth. Regulatory compliance also drives the development of safe and reliable materials.

Region Insights

Asia Pacific plastic market dominated the global industry and accounted for the largest revenue share of over 45.92% in 2025 and is expected to grow at the fastest CAGR of 4.9% during the forecast period. The region’s growth is driven by rapid industrialization, urbanization, and population growth. Countries such as China, India, Japan, and South Korea have experienced significant growth in end-use industries, including packaging, automotive, consumer goods, and construction. For example, China’s packaging industry is booming due to the rise of e-commerce, food & beverage consumption, and the adoption of flexible and sustainable packaging solutions.

China Plastic Market Trends

China remained the world’s largest plastics manufacturing hub in 2025, supported by an extensive downstream processing and compounding ecosystem that serves domestic and export demand. The country has a broad base of polymer processors, compounders, and converters producing packaging materials, engineered components, sheets, films, and molded parts. China also supplies finished plastic products and compounded materials to neighboring Asian markets, benefiting from scale, integrated logistics, and competitive processing costs. Recycling is playing a growing role, with waste plastics being reprocessed into fibers, films, sheets, and compounded blends for secondary applications.

North America Plastic Market Trends

The plastic market in North America is growing due to its advanced industrial base, high per capita consumption, and adoption of innovative plastic products. The U.S., in particular, drives growth with strong demand in the packaging, healthcare, automotive, and electronics industries. For instance, the growing e-commerce sector in the U.S. has accelerated the use of packaging plastics, while automotive manufacturers are increasingly using lightweight plastics to improve fuel efficiency and reduce emissions. The region’s emphasis on technological innovation, research & development, and environmental sustainability further supports the growth of the market.

Europe Plastic Market Trends

The plastic market in Europe remains significant due to its strong automotive, packaging, construction, and electrical & electronics sectors. Germany, in particular, is a major driver because of its robust automotive and manufacturing industries. High-quality engineering plastics are widely used in machinery, automotive components, and industrial applications. For example, German automotive companies extensively use polypropylene, polycarbonate, and PA-based engineering plastics in lightweight vehicle designs. Sustainability and regulatory frameworks are strong growth drivers in Europe. Policies such as the European Green Deal and restrictions on single-use plastics push the adoption of recyclable and biodegradable plastics, particularly in packaging.

Key Plastic Companies Insights

The global plastic market is moderately consolidated, dominated by large multinational players such as ExxonMobil, SABIC, LyondellBasell, Dow Chemical, and BASF, which have extensive production capacities, global distribution networks, and strong R&D capabilities. Competition is driven by factors such as price fluctuations of raw materials (like crude oil and natural gas), technological innovation in polymer formulations, regulatory compliance related to sustainability, and customer demand for high-performance or eco-friendly plastics.

While large players focus on scale, product differentiation, and backward integration, smaller regional players often compete through niche applications, customization, and cost advantages. Emerging trends like bio-based plastics, recycling technologies, and circular economy initiatives are intensifying competition, as companies strive to balance profitability with environmental responsibility.

Key Plastic Companies:

The following are the leading companies in the plastic market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- SABIC

- Dow Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- Lotte Chemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Covestro AG

- Toray Industries, Inc.

- Mitsui & Co. Plastics Ltd.

- TEIJIN LIMITED

- INEOS Group

- Eni S.p.A.

- LG Chem

- LANXESS AG

- CHIMEI Corporation

- Huntsman International LLC

- LyondellBasell Industries Holdings B.V.

Recent Developments

-

In September 2025, Mitsui Chemicals, Idemitsu Kosan, and Sumitomo Chemical entered into a Memorandum of Understanding to integrate Sumitomo Chemical's polypropylene (PP) and linear low-density polyethylene (LLDPE) businesses in Japan into Prime Polymer, a joint venture owned by Mitsui and Idemitsu.

-

In April 2025, Ube Industries completed the acquisition of Lanxess's polyurethane (PU) business for approximately USD 2.1 billion. The purchase included production facilities in the US, Europe, and Asia, expanding Ube's global footprint in PU materials.

-

In January 2024, LyondellBasell Industries Holdings B.V. agreed to acquire a 35% stake in Saudi Arabia-based National Petrochemical Industrial Company (Natpet) from Alujain Corporation for approximately USD 500 million. Natpet, a longtime user of LyondellBasell’s Spheripol polypropylene (PP) technology, has an annual PP production capacity of about 400,000 tons.

Plastic Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,009.72 billion

Revenue forecast in 2033

USD 1,361.25 billion

Growth rate

CAGR of 4.4% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Caribbean; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Poland; Spain; The Netherlands; Denmark; Sweden; Portugal; China; India; Japan; South Korea; Singapore; Malaysia; Thailand; Indonesia; Vietnam; Australia; Dominican Republic; Brazil; Argentina; Chile; Colombia; Ecuador; Peru; Costa Rica; Guatemala; Panama; Saudi Arabia; UAE; Oman; Kenya; South Africa; Angola

Key companies profiled

BASF; SABIC; Dow Inc.; DuPont de Nemours, Inc.; Evonik Industries AG; Sumitomo Chemical Co., Ltd; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastics Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastics Ltd.; TEIJIN LIMITED; INEOS Group; Eni S.p.A.; LG Chem; LANXESS AG; CHIMEI Corporation; Huntsman International LLC; LyondellBasell Industries Holdings B.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global plastic market report based on product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene terephthalate (PET)

-

Polyamide (PA)

-

Epoxy Polymers

-

Acrylonitrile butadiene styrene (ABS)

-

Polycarbonate (PC)

-

Polybutylene terephthalate (PBT)

-

Polyphenylene Oxide (PPO)

-

Liquid Crystal Polymers

-

Polyether ether ketone (PEEK)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Injection Molding

-

Extrusion

-

Blow Molding

-

Calendering

-

Thermoforming

-

Compression Molding

-

Casting

-

Roto Molding

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Construction

-

Consumer Goods

-

Automotive

-

Electricals & Electronics

-

Utility

-

Agriculture

-

Medical Devices

-

Furniture & Bedding

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Poland

-

Spain

-

The Netherlands

-

Denmark

-

Sweden

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Thailand

-

Indonesia

-

Vietnam

-

Australia

-

-

Caribbean

-

Dominican Republic

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Ecuador

-

Peru

-

Costa Rica

-

Guatemala

-

Panama

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Oman

-

Kenya

-

South Africa

-

Angola

-

-

Frequently Asked Questions About This Report

b. The global plastic market was estimated at around 963.65 billion in 2025 and is expected to reach approximately USD 1,009.72 billion in 2026.

b. The global plastic market is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2025 to 2030, reaching approximately USD 1,361.25 billion by 2033.

b. The PE segment recorded the largest market revenue share of over 24.84% in 2025. Polyethylene is the most widely used plastic, available in forms such as Low-Density (LDPE), High-Density (HDPE), and Linear Low-Density (LLDPE).

b. The injection molding segment recorded the largest market revenue share of over 42.90% in 2025. Injection molding is a widely used plastic manufacturing process in which molten plastic is injected into a mold cavity, cooled, and solidified into the desired shape.

b. The packaging segment recorded the largest market share of over 36.00% in 2025. The packaging segment is the largest consumer of plastics globally, driven by its lightweight, durability, and versatility.

b. Asia Pacific dominated the market and accounted for the largest revenue share of over 45.92% in 2024 and is expected to grow at the fastest CAGR of 4.9% during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.