- Home

- »

- Plastics, Polymers & Resins

- »

-

Acrylonitrile Butadiene Styrene Market, Industry Report, 2030GVR Report cover

![Acrylonitrile Butadiene Styrene Market Size, Share & Trends Report]()

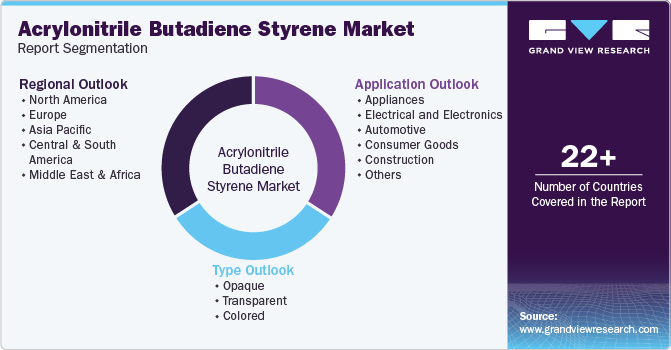

Acrylonitrile Butadiene Styrene Market (2025 - 2030) Size, Share & Trends Analysis Report Type (Opaque, Transparent, Colored), By Application (Appliances, Electrical & Electronics, Automotive, Consumer Goods, Construction), By Region, And Segment Forecasts

- Report ID: 978-1-68038-142-9

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Acrylonitrile Butadiene Styrene Market Summary

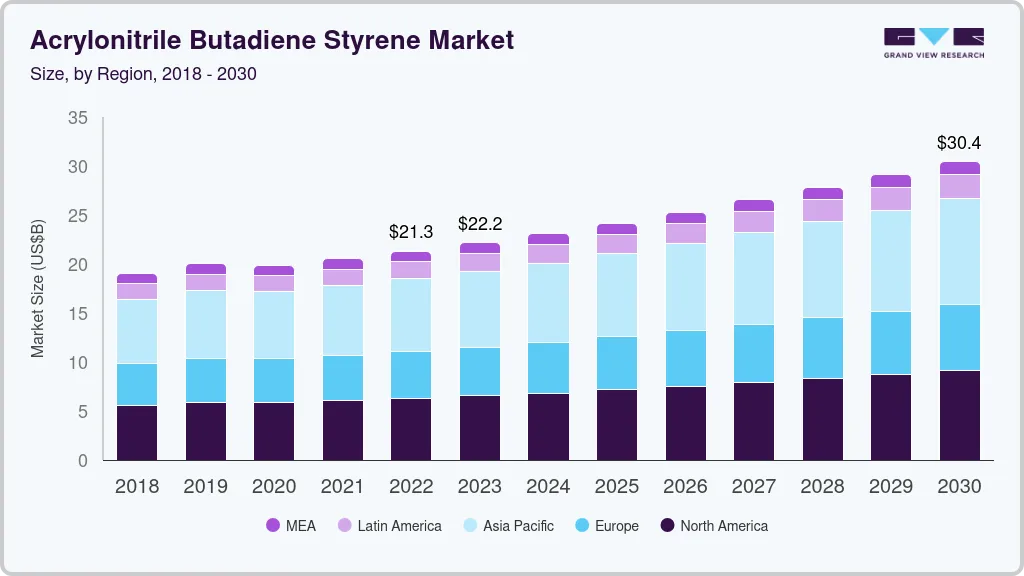

The global acrylonitrile butadiene styrene market size was estimated at USD 23,109.5 million in 2024 and is projected to reach USD 31,204.8 million by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The demand for acrylonitrile butadiene styrene (ABS) is likely to increase in the automotive industry owing to its lightweight properties.

Key Market Trends & Insights

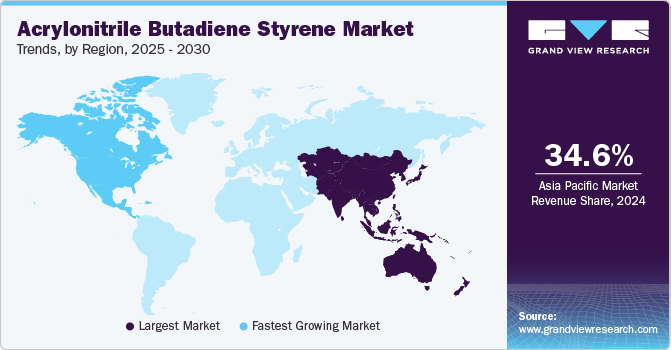

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, opaque accounted for a revenue of USD 10,773.6 million in 2024.

- Opaque is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 23,109.5 Million

- 2030 Projected Market Size: USD 31,204.8 Million

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

ABS is used to manufacture various automotive components including seating, bumper, interior trim, dashboard, center consoles, headliners, and lighting.

About 12.5% of all automotive polymers used in the manufacturing of passenger automobiles are made of ABS. The developing automotive industry is likely to boost market growth over the forecast period. Moreover, ABS is used for pipes and fittings and vacuum construction owing to its properties such as excellent mechanical strength, resistance, and lightweight. ABS is widely used in the production of waste collector products owing to its superior corrosion resistance and long-lastingness. These factors are likely to boost the market growth globally in the forecast period.

To cater to the developing healthcare industry, ABS plastics are being utilized for providing higher stability to medical devices and products, such as masks, gloves, shoe and head covers, and gowns. In addition, the market offers opportunities for the usage in varieties of construction products for deteriorating infrastructures such as broadband, bridges, roads, water systems, and power grids.

Drivers, Opportunities & Restraints

The expanding consumer electronics industry is a significant driver for the acrylonitrile butadiene styrene industry. Acrylonitrile butadiene styrene is widely used in the manufacturing of durable housings for smartphones, laptops, and other electronic devices due to its superior thermal stability, aesthetic appeal, and ease of molding into complex shapes. Rapid technological advancements, coupled with the growing global demand for electronic gadgets, especially in emerging economies, are propelling ABS consumption. In addition, the trend of smart home devices and wearable electronics is creating sustained demand for ABS as a preferred material for precision engineering applications.

The increasing emphasis on recycling and sustainability presents a substantial opportunity for growth in the acrylonitrile butadiene styrene industry. With stricter regulations and consumer awareness around reducing plastic waste, companies are focusing on developing bio-based and recycled ABS products. These innovations not only align with sustainability goals but also provide competitive differentiation for manufacturers. The growing use of recycled ABS in industries such as automotive and construction highlights its potential to meet environmental standards while maintaining the material's performance. Companies investing in advanced recycling technologies are likely to gain a competitive edge.

Volatility in raw material prices, particularly acrylonitrile, butadiene, and styrene, poses a significant restraint for the acrylonitrile butadiene styrene industry. These raw materials are derived from crude oil and natural gas, making their prices susceptible to fluctuations in global energy markets. Such volatility impacts production costs and profit margins for manufacturers, especially in regions heavily reliant on imported raw materials. Moreover, the growing adoption of alternative materials like polycarbonate and bio-based polymers in certain applications adds competitive pressure, further restraining the market’s growth potential.

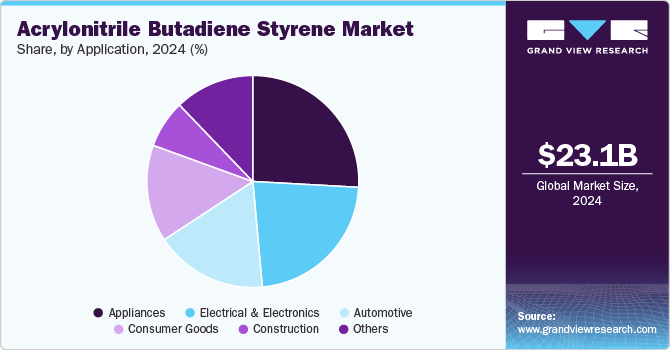

Application Insights

Based on application, the appliances segment dominated the market with the largest revenue share of 25.88% in 2024. The rising demand for household appliances, such as microwave ovens, dryers, and washing machines, along with increasing consumer spending on appliances, is expected to boost the demand for acrylonitrile butadiene styrene in the appliances industry.

The growth in automotive production is likely to create demand for ABS in the automotive industry. According to OICA, the industry accounted for the worldwide production of 21.44 billion light commercial vehicles in 2023, an increase of 9% from 2022. Factors such as growing economy, rapid urbanization, growing demand for electric vehicles, and advancements in technology are expected to drive demand over the coming years.

Type Insights

Based on type, the opaque segment led the market with the largest revenue share of 44.52% in 2024. Opaque acrylonitrile butadiene styrene has various physical properties including good chemical resistance, aging resistance, hardness, gloss, and rigidity, owing to which it has multiple uses in the automotive industry. In addition, owing to its properties, it is used in various applications including computer parts, automotive parts, luggage cases, and aircraft applications.

Opaque ABS is used to provide a smooth, long-lasting finish with high resistance to chemical and UV exposure. The hydrophobic nature of opaque ABS has led to the increased usage of acrylonitrile butadiene styrene products being used in the automotive industry for the production of various parts such as bumpers, seating, dashboard, interior trim, headliners, centre consoles, and lighting.

Factors such as suitable demographics for production and an increase in the population are expected to drive the market globally in the construction industry. Moreover, acrylonitrile butadiene styrene is used for vacuum construction and pipes and fittings due to its excellent mechanical strength and lightweight. These advantageous properties are anticipated to augment demand for opaque acrylonitrile butadiene styrene in the construction industry.

Regional Insights

The acrylonitrile butadiene styrene market in North America is anticipated to grow at the fastest CAGR during the forecast period. The increasing demand for ABS in the healthcare industry is a major driver. The material's non-toxicity, chemical resistance, and ability to be easily sterilized make it a preferred choice for medical devices, equipment housings, and drug delivery systems.

U.S. Acrylonitrile Butadiene Styrene Market Trends

The acrylonitrile butadiene styrene market in the U.S. accounted for the largest market share in North America in 2024. The booming electric vehicle (EV) market in the U.S. is significantly driving the demand for ABS. EV manufacturers are increasingly adopting ABS for lightweight components such as battery enclosures, dashboards, and trims, as they look to optimize vehicle performance and enhance energy efficiency. The strong support for EV adoption through federal incentives and state-level policies, along with substantial investments in EV production facilities by companies like Tesla and Rivian, is amplifying the demand for ABS in automotive applications. This trend reflects a growing reliance on advanced materials to meet sustainability goals and regulatory requirements in the transportation sector.

Asia Pacific Acrylonitrile Butadiene Styrene Market Trends

Asia Pacific dominated the acrylonitrile butadiene styrene market with the largest revenue share of 34.58% in 2024. The rapid industrialization and urbanization in the Asia Pacific region are key drivers for the ABS market. The construction sector is experiencing robust growth due to increasing infrastructure development in countries like India, Indonesia, and Vietnam, creating high demand for ABS in pipes, fittings, and insulation applications.

The China acrylonitrile butadiene styrene market dominance as a global manufacturing hub is the key driver for its ABS market. The country’s vast production of automotive components, consumer electronics, and household appliances heavily relies on ABS for its superior molding and mechanical properties. Moreover, the Chinese government’s push for domestic innovation and high-tech industries under initiatives like "Made in China 2025" is creating additional demand for ABS in advanced applications. The increasing adoption of 5G technology and smart devices further fuels the need for ABS in precision engineering, reinforcing its critical role in China’s rapidly evolving industrial landscape.

Europe Acrylonitrile Butadiene Styrene Market Trends

The acrylonitrile butadiene styrene market in Europe is anticipated to grow at a sustainable CAGR during the forecast period. In Europe, the increasing focus on sustainability and energy efficiency in construction is a major driver for the ABS market. Governments across the region are emphasizing green building practices, which include the use of high-performance materials like ABS in insulation, window frames, and piping systems. The rising adoption of modular construction, known for its efficiency and reduced environmental impact, further promotes the use of ABS due to its lightweight and durable properties.

Key Acrylonitrile Butadiene Styrene Company Insights

The acrylonitrile butadiene styrene industry is highly competitive, with several key players dominating the landscape. Major companies include LG Chemicals, Asahi Kasei, Chi Mei Corporation, Formosa Plastics, KKPC, SABIC, Styron, Styrolution, BASF SE, and DuPont. The acrylonitrile butadiene styrene industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Acrylonitrile Butadiene Styrene Companies:

The following are the leading companies in the acrylonitrile butadiene styrene market. These companies collectively hold the largest market share and dictate industry trends.

- LG Chemicals

- Asahi Kasei Corporation

- CHIMEI

- Formosa Plastics Corporation

- KUMHO PETROCHEMICAL

- SABIC

- Trinseo

- INEOS Styrolution Group GmbH

- BASF SE

- DuPont

Recent Developments

-

In June 2024, Trinseo introduced SAN and ABS resins containing up to 60% recycled content, marketed under the trade names MAGNUM CR, MAGNUM ECO+, and TYRIL CR.

-

In June 2023, MBA Polymers UK launched a new high-quality recycled ABS product, named ABS 4125 UL, which contains over 95% post-consumer recycled content. This innovative material serves as a sustainable alternative for industries such as electronics, automotive, and cosmetics, which are increasingly seeking lower carbon products to meet rising global demand.

Acrylonitrile Butadiene Styrene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24,153.24 million

Revenue forecast in 2030

USD 31,204.72 million

Growth rate

CAGR of 5.26% from 2024 to 2030

Base year for estimation

2024

Historical data

2019 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India, Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

LG Chemicals; Asahi Kasei; Chi Mei Corporation; Formosa Plastics; KKPC; SABIC; Styron; Styrolution; BASF SE; DuPont

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acrylonitrile Butadiene Styrene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global acrylonitrile butadiene styrene market report based on the type, application, and region:

-

Type Outlook (Revenue, USD Million, Volume, Kilotons, 2019 - 2030)

-

Opaque

-

Transparent

-

Colored

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2019 - 2030)

-

Appliances

-

Electrical and Electronics

-

Automotive

-

Consumer Goods

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global acrylonitrile butadiene styrene market size was estimated at USD 23,109.48 million in 2024 and is expected to reach USD 24,153.24 million million in 2025.

b. The global acrylonitrile butadiene styrene market is expected to grow at a compound annual growth rate of 5.26% from 2025 to 2030 to reach USD 31,204.72 million by 2030.

b. Appliances dominated the acrylonitrile butadiene styrene market across the application segmentation in terms of revenue, accounting to a market share of 25.88% in 2024.

b. Some key players operating in the acrylonitrile butadiene styrene market include LG Chemicals, Asahi Kasei Corporation, CHIMEI, Formosa Plastics Corporation, KUMHO PETROCHEMICAL, SABIC, Trinseo, and INEOS.

b. Key factors that are driving the market growth include a rising focus on lightweight automobiles & emission control and increasing demand from electrical & electronics applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.