- Home

- »

- Plastics, Polymers & Resins

- »

-

Cosmetic Packaging Market Size, Industry Report, 2030GVR Report cover

![Cosmetic Packaging Market Size, Share & Trends Report]()

Cosmetic Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper), By Application (Hair Care, Skin Care, Make-up, Nail Care), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-975-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cosmetic Packaging Market Summary

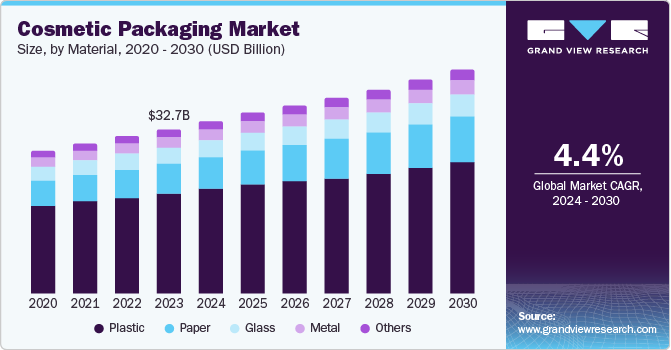

The global cosmetic packaging market size was valued at USD 32.67 billion in 2023 and is projected to reach USD 44.28 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. The increasing demand for cosmetics, fueled by a growing youth population and changing grooming habits among men and women, significantly boosts the market.

Key Market Trends & Insights

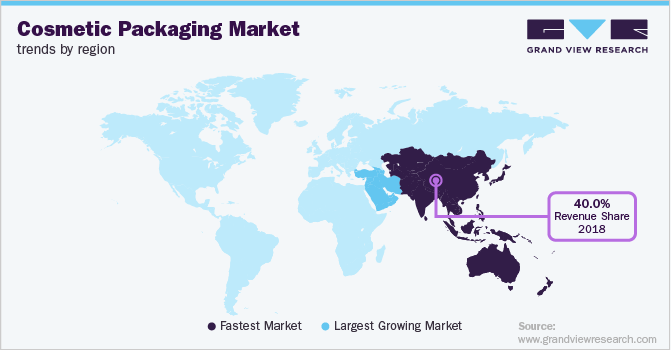

- Asia Pacific cosmetic packaging market accounted for the largest revenue share of 41.1% in 2023.

- The U.S. cosmetic packaging market dominated the North America market in 2023.

- By material, the plastics segment accounted for the largest revenue share of 60.8% in 2023.

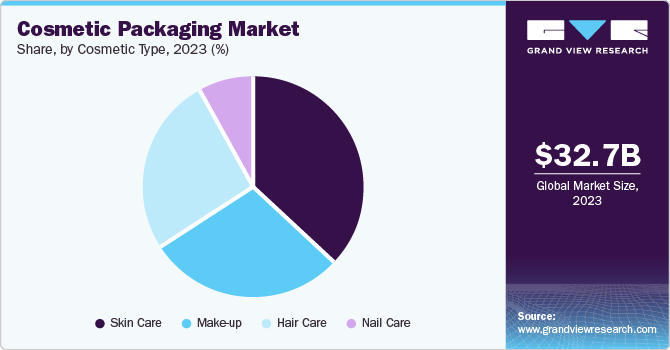

- By cosmetic type, the skin care segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.67 Billion

- 2030 Projected Market Size: USD 44.28 Billion

- CAGR (2024-2030): 4.4%

- North America: Largest market in 2023

The rise of e-commerce and internet penetration has also expanded the reach of cosmetic products, further driving the demand for effective packaging solutions. Moreover, the shift towards eco-friendly and sustainable packaging options, driven by heightened environmental awareness among consumers, is propelling market growth.

The shift towards eco-friendly and sustainable packaging options, driven by heightened environmental awareness among consumers, is propelling market growth. With their increasing disposable incomes and changing lifestyles, emerging economies present substantial opportunities for market expansion. These factors collectively contribute to the robust growth trajectory of the cosmetic packaging market.

Growing development in the cosmetic industry and innovative and aesthetically appealing packaging designs, which are crucial in attracting consumers and differentiating products in a competitive market, are expected to drive market growth. Furthermore, increasing R&D activities and high demand for cosmetic products among consumers is propelling the market expansion.

Material Insights

The plastics segment accounted for the largest revenue share of 60.8% in 2023. This significant market share underscores the widespread preference for plastic materials in cosmetic packaging, driven by their versatility, durability, and cost-effectiveness. The popularity of plastics in this sector is also attributed to their ability to be molded into various shapes and sizes, catering to diverse cosmetic product requirements. Additionally, advancements in sustainable and recyclable plastic options have further bolstered their appeal, aligning with the industry’s growing emphasis on eco-friendly packaging solutions.

The paper segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. This anticipated growth is largely driven by the increasing consumer demand for eco-friendly and sustainable packaging solutions. As environmental concerns continue to rise, more cosmetic brands are opting for paper-based packaging to reduce their carbon footprint and appeal to environmentally conscious consumers. Furthermore, the recyclability and versatility of paper make it an ideal option for secondary packing, further contributed to the market growth.

Cosmetic Type Insights

The skin care segment accounted for the largest revenue share in 2023. The growing consumer focus on skin care products is driven by increasing awareness of skin health and the rising demand for anti-aging and sun protection solutions. The extensive variety of packaging options required for skin care products, ranging from tubes and bottles to jars and pumps, further underscores the segment’s significant market share. Additionally, the trend towards premium and aesthetically appealing packaging in the skin care industry has contributed to the segment’s growth.

The make-up segment is projected to grow at the fastest CAGR over the forecast period. Increasing consumer demand for innovative and aesthetically appealing packaging solutions. As consumers become more conscious of their appearance and seek high-quality cosmetic products, the demand for make-up packaging is expected to surge. Additionally, the rise of e-commerce and social media influencers promoting various make-up brands has further fueled this trend.

Regional Insights

Asia Pacific cosmetic packaging market accounted for the largest revenue share of 41.1% in 2023 and is expected to maintain its dominance over the forecast period. The increasing consumer demand for beauty and personal care products, rapid urbanization, and rising disposable incomes are the factors driving the market growth in the region. The market’s growth is further supported by advancements in packaging technologies and the growing trend of sustainable and eco-friendly packaging solutions.

China Cosmetic Packaging Market Trends

The China cosmetic packaging market led the Asia Pacific regional market in 2023. This leadership position was fueled by China’s robust manufacturing capabilities, increasing consumer demand for beauty and personal care products, and significant investments in innovative and sustainable packaging solutions. The country’s market growth was further supported by the rising disposable incomes and urbanization, which spurred higher consumption of cosmetics.

Europe Cosmetic Packaging Market Trends

The Europe cosmetic packaging market was identified as a lucrative region in 2023. Several factors drive the market's growth, including the increasing demand for sustainable and eco-friendly packaging solutions, the popularity of organic and natural cosmetic products, and major players such as L'Oréal, Beiersdorf, and Unilever. Furthermore, the market is expected to continue growing, with a focus on innovative and sustainable packaging solutions to meet consumer preferences.

The UK cosmetic packaging market is expected to grow rapidly in the coming years owing to the rising consumer awareness about eco-friendly products and the surge in e-commerce, which necessitates robust and attractive packaging. Additionally, the expanding cosmetic industry, fueled by new product launches and the growing trend of personalized beauty products, is further propelling the market.

North America Cosmetic Packaging Market Trends

The North American cosmetic packaging market is expected to witness a significant CAGR over the forecast period. The growing demand for cosmetic products owing to growing awareness of personal grooming among population. Furthermore, rapid development in packaging industries and the presence of several players in the region is expected to drive market growth.

The U.S. cosmetic packaging market dominated the North America market in 2023. Rising awareness of personal care and high disposable income in the country. The growing number of beauty influencers and extensive huge of social media is projected to drive market growth.

Key Cosmetic Packaging Company Insights

Some key companies in the cosmetic packaging market includeAlbea SA; HCP Packaging Co. Ltd; RPC Group PLC (Berry Global Group); Silgan Holdings Inc.; DS Smith PLC; and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Albéa SA is a global leader in the packaging industry, particularly known for its innovative and responsible packaging solutions for the beauty and personal care markets. The company offers wide ranges of products such as applicators, jars, caps, and tubes.

-

Berry Global Group manufactures a wide range of products across various markets including consumer goods, packaging solutions, building and construction, and other sectors.

Key Cosmetic Packaging Companies:

The following are the leading companies in the cosmetic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group PLC (Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor Group GmbH

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corporation

- Gerresheimer AG

- Raepak Ltd

- Ball Corporation

- Verescence France

- SKS Bottle & Packaging Inc.

- Altium Packaging (Loews Corporation)

Recent Developments

-

In April 2024, GEKA announced the launch of a pioneering recycled polypropylene (PP) material tailored for cosmetic packaging applications. This newly developed post-consumer-recycled (PCR) polypropylene (PP) is to comply with stringent formulation requirements for crucial cosmetic packaging.

-

In May 2024, Cosmopak, a prominent manufacturer in the beauty industry, proudly introduced its new "Waves of Beauty" collection. This collection incorporates creative and ecoforward packaging options and accessories. Cosmopak aims to captivate and inspire its clientele through this latest offering, highlighting the latest trends and the breadth of its manufacturing capabilities.

-

In October 2023, Dow unveiled SURLYN REN and SURLYN CIR, two innovative sustainable ionomer grades that are leading the way in circular and renewable feedstocks. This development marks a significant advancement for the cosmetics packaging and plastics industries. These new SURLYN grades enabled beauty brands and manufacturers to produce sustainable, superior cosmetic packaging, ensuring a standout presence on store shelves.

Cosmetic Packaging Market Report Scope

Report Attribute

Details

Market size in 2024

USD 34.22 billion

Revenue forecast in 2030

USD 44.28 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Cosmetic Type, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Albea SA; HCP Packaging Co. Ltd; RPC Group PLC (Berry Global Group); Silgan Holdings Inc.; DS Smith PLC; Graham Packaging LP; Libo Cosmetics Company Ltd; AptarGroup Inc.; Amcor Group GmbH; Cosmopak Ltd; Quadpack Industries SA; Rieke Corporation; Gerresheimer AG; Raepak Ltd; Ball Corporation; Verescence France; SKS Bottle & Packaging Inc.; Altium Packaging (Loews Corporation)

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cosmetic packaging market report based on material, cosmetic type, and region:

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Metal

-

Glass

-

Paper

-

Others

-

-

Cosmetic Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hair Care

-

Skin Care

-

Nail Care

-

Make-up

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.