Hair And Scalp Care Market Size, Share & Trends Analysis Report By Product (Anti-dandruff, Hair Loss, Dry & Itchy Scalp, Dry & Dull Hair, White & Grey Hair), By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-2-68038-128-3

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global hair and scalp care market size was valued at USD 80.81 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028. Growing concerns among consumers and the availability of new, more effective, and safer hair care products have led to a significant increase in the use of these products, which, in turn, boosted the market growth. The beauty and personal care industry comprising skin care, cosmetics, hair care, and personal care has been affected by the COVID-19 pandemic as there have been widespread retail and convenience store closures leading to the weakening sales of various hair and scalp care products in the global market. For instance, Beiersdorf AG reported a decline of sales across the entire group by 1.9% during the second quarter of 2020 because of the pandemic.

Dandruff, dry and itchy scalp, hair loss, and dull hair are some of the major concerns that trigger any individual. According to the American Academy of Dermatology report, approximately 30 million women in the U.S. suffer from hereditary hair loss and increasingly spend on hair and scalp care products.

Rising concerns regarding the harmful effects of pollution, excessive use of hair straighteners and curlers, increased exposure to ultraviolet sun rays, and frequent use of shampoos with harsh chemicals on one’s hair has been driving the demand for nourishing products, including masks. Hair masks have been gaining significant popularity as a treatment for damaged and frizzy hair, which, in turn, is anticipated to bode well for market growth.

China is one of the major countries contributing to the growth of the global market in terms of consumption as well as production with a CAGR of 8.0% during the forecast period. A high concentration of manufacturers including key players such as L’Oreal is the key reason contributing to the country-level growth.

Additionally, over the last few years, the elderly population has been increasing significantly all over the world. According to 2019 data from World Population Prospects, the population aged above 60 and over is growing faster than all other age groups. This age group has been creating opportunities for white and grey hair products worldwide.

However, the increasing cases of stress and anxiety and other external factors like high pollution levels and exposure to UV rays have increased white and grey hair conditions among the middle-aged population as well. Klorane; Coty Inc. (Clairol); Estée Lauder (Aveda); and L'Oréal (Redken and Kérastase) are among the global companies offering products for white and grey hair.

Dandruff is one of the most common issues related to hair and scalp. A large number of consumers use anti-dandruff shampoos to treat dandruff. Pyrithione zinc is widely used in anti-dandruff shampoos because of its anti-fungal property. However, lately, natural ingredients such as tea tree oils, neem, basil, rosemary oil, lemon oil, and cedarwood are gaining traction in anti-dandruff shampoos.

Product Insights

The anti-dandruff segment held the largest share of over 35.0% in 2020 and is expected to maintain its lead over the forecast period. According to the Everyday Health article published in December 2020, dandruff affects approximately 50 percent of the general adult population worldwide. Many brands have been developing new products in the anti-dandruff segment to capture a large consumer base as it is very concerned with treatment.

For instance, in January 2021, St Botanica launched “Go Range” in the hair care segment and introduced shampoos and conditioners suited for every hair type such as GO Curls Shampoo, GO Purple Shampoo, and GO Anti-Dandruff Shampoo. The anti-dandruff shampoo launched in this range is claimed to be suited for the flaky scalp as it includes Ichthyol Pale, which helps to protect the upper layer of the scalp, keeping it grim and dandruff free.

The hair loss segment is expected to be the fastest-growing segment over the forecast period. Hormonal changes, medical conditions, heredity, and aging are some of the common causes of hair fall. In recent years, hair fall has become a common concern in males as compared to females, which has spurred the product demand. Unilever (Dove); Toppik Inc.; EssyNaturals; and Kiehl’s are among the prominent players in the market.

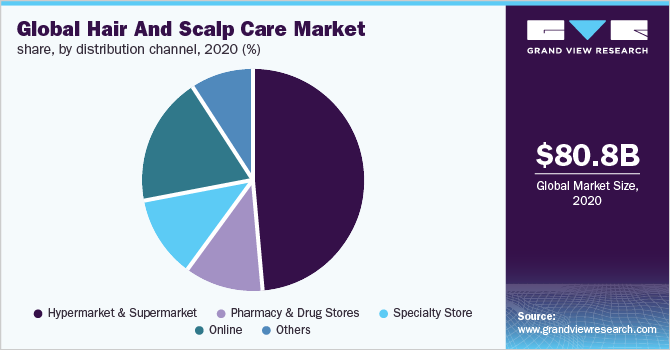

Distribution Channel Insights

The hypermarkets and supermarkets segment held the largest share of over 45.0% in 2020. These stores are quick to launch popular products in the market and offer exclusive deals to their customers, thereby boosting the sale growth.

Hypermarkets and supermarkets have been focusing on offering different categories such as synthetic, natural, and chemical-free products set up to pique customers’ interest and provide them with a facility to choose from numerous brands before making a purchase. For instance, in 2018, the Sephora premium outlet launched a clean beauty category section, which excluded those which are free from parabens, sulfates, and phthalates.

The online distribution channel is expected to witness significant growth over the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network and greater product availability. Purchasing personal care items for hair from these stores has been gaining traction among consumers, especially those who are very certain about the brand or type of product they are looking for.

Regional Insights

Asia Pacific held the largest share of more than 35.0% in 2020. The inclination of consumers towards hair and scalp care concerns, coupled with new brands tapping into the market in the region, is expected to drive the regional market. For instance, in July 2021, Adon Hair Care Clinic, an India-based hair transplant brand, launched Growdense Hair Serum, which is approved by the FDA designed for hair and scalp care.

Europe is expected to register the second-fastest CAGR over the forecast period. Rising consumer interest in different products and increasing online beauty spending are some of the key factors fueling the product demand within the region.

The market in Europe has been disrupted by the mushrooming growth of direct-to-consumer channels and the use of social media. Consequently, mainstream brands such as Head & Shoulders continue to face intense competition from ‘masstige’ (prestige for the masses) brands - Aveda, Palmer’s, and Kérastase.

Key Companies and Market Share Insights

The market is growing at a considerate rate. Manufacturers in the market are increasingly focusing on the factors such as product innovation, packaging, labeling, and marketing campaigns as they play a vital role in the overall image of the product and the company. They are focusing on the expansion of their geographical reach by engaging in mergers and acquisitions and celebrity collaborations with the objective to increase their market share. The competitors mainly compete based on product quality, technological innovations, and price. For instance, in January 2021, Harry’s Inc. incubator Harry’s Labs launched a new women’s scalp care brand as a strategy to help its parent company become a conglomerate. Some prominent players in the global hair and scalp care market include:

-

L’Oréal S.A.

-

Beiersdorf AG

-

Procter & Gamble (P&G)

-

Unilever

-

Johnson & Johnson Services, Inc.

-

Amorepacific

-

The Estée Lauder Companies Inc.

-

Kanebo Cosmetics Inc.

-

Himalaya Global Holdings Ltd.

-

Shiseido Co., Ltd.

Hair And Scalp Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 86.03 billion |

|

Revenue forecast in 2028 |

USD 134.30 billion |

|

Growth Rate |

CAGR of 6.6% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

|

Country scope |

U.S.; Germany; U.K.; France; China; India; Japan, Brazil; South Africa |

|

Key companies profiled |

L’Oréal S.A.; Beiersdorf AG; Procter & Gamble (P&G); Unilever; Johnson & Johnson Services, Inc.; Amorepacific; The Estée Lauder Companies Inc.; Kanebo Cosmetics Inc.; Himalaya Global Holdings Ltd.; Shiseido Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global hair and scalp care market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Anti-dandruff

-

Hair Shampoo

-

Hair Conditioner

-

Others

-

-

Hair Loss

-

Hair Shampoo

-

Hair Conditioner

-

Hair Oil

-

Others

-

-

Dry & Itchy Scalp

-

Hair Shampoo

-

Hair Conditioner

-

Hair Oil

-

-

Dry & Dull Hair

-

Hair Shampoo

-

Hair Conditioner

-

Hair Oil

-

Others

-

-

White & Grey Hair

-

Hair Shampoo

-

Hair Conditioner

-

Hair Oil

-

Others

-

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypermarket & Supermarket

-

Pharmacy & Drug Stores

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hair and scalp care market size was estimated at USD 80.81 billion in 2020 and is expected to reach USD 86.03 billion in 2021.

b. The global hair and scalp care market is expected to grow at a compound annual growth rate of 6.6% from 2021 to 2028 to reach USD 134.30 billion by 2028.

b. North America dominated the hair and scalp care market with a share of 25.0% in 2020. This is attributable to the presence of small and large multinational companies focusing on one or more products such as styling products, conditioners, color, and shampoo.

b. Some key players operating in the hair and scalp care market include L’Oreal, Hindustan Unilever Ltd., P&G, Kao Corporation, Marico Limited, Aveda Corporation, Henkel Corporation, Combe Incorporated, Johnson & Johnson, etc.

b. Key factors that are driving the hair and scalp care market growth include a rising old age population and a growing trend in the fashion industry. Additionally, an increasing number of males have been using hair care products which has boosted demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."