- Home

- »

- Plastics, Polymers & Resins

- »

-

Green Packaging Market Size, Share, Industry Report, 2030GVR Report cover

![Green Packaging Market Size, Share & Trends Report]()

Green Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverages, Personal Care, Health Care), By Packaging Type (Recycled Content Packaging, Reusable Packaging), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-052-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Packaging Market Summary

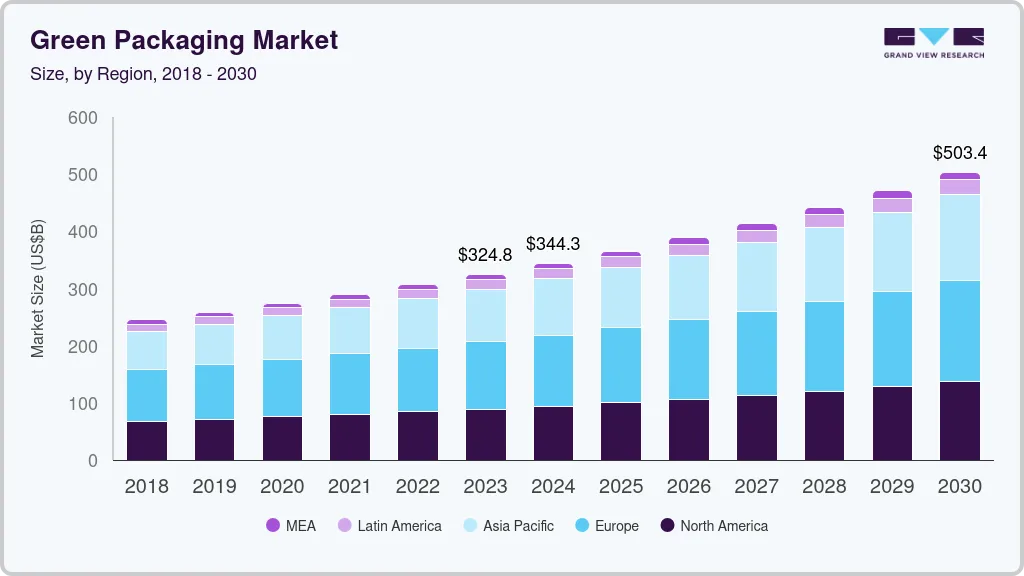

The global green packaging market size was estimated at USD 324,825.5 million in 2023 and is projected to reach USD 503,434.0 million by 2030, growing at a CAGR of 6.5% from 2024 to 2030. This is attributed to the rising consumer awareness regarding sustainable packaging solutions and stringent government regulations such as a ban on single-use plastic packaging products.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, India is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, food and beverages accounted for a revenue of USD 196,062.3 million in 2023.

- Food and Beverages is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 324,825.5 Million

- 2030 Projected Market Size: USD 503,434.0 Million

- CAGR (2024-2030): 6.5%

- Europe: Largest market in 2023

Green packaging solutions made from sustainable materials such as paper, plant-based materials, recycled materials, and other degradable materials reduce their carbon footprint throughout their entire lifecycle, from production to disposal.

Consumers increasingly demand eco-friendly packaging solutions as they become more educated about sustainability and its importance. This shift in consumer behavior has prompted manufacturers to innovate and adopt sustainable practices, increasing the emphasis on green packaging options. Companies are responding by developing products that utilize recycled materials or biodegradable substances, thus aligning their offerings with consumer preferences for environmentally responsible choices.

Government regulations play a crucial role in driving the green packaging industry. Many countries have implemented strict policies to reduce plastic waste and promote sustainable packaging alternatives. For example, bans on single-use plastics and incentives for using recyclable materials encourage businesses to transition towards greener practices. In regions such as Europe and North America, regulatory frameworks are becoming increasingly stringent, compelling companies to comply with sustainability standards or face penalties. This regulatory pressure fosters innovation and creates a competitive advantage for companies that prioritize sustainable packaging solutions.

As online shopping becomes more prevalent, there is an increased need for efficient and sustainable packaging that can withstand shipping while minimizing environmental impact. Similarly, the food service industry is shifting towards compostable and recyclable materials to meet consumer expectations for sustainability in takeout and delivery options. This trend has led to packaging design innovations that prioritize functionality and eco-friendliness, further propelling market growth.

Application Insights

Based on application, the food and beverages segment dominated the market with a revenue market share of over 60.9% in 2024 and is expected to witness robust growth with a CAGR of 7.5% over the forecast period. With growing concerns over plastic waste, F&B companies are pressured to adopt sustainable packaging alternatives that reduce their environmental impact. In April 2024, FoodChain ID announced its sustainable packaging services launch, aimed at helping food and beverage companies meet growing consumer demand for environmentally friendly practices.

Health care is anticipated to grow significantly at a CAGR of 5.7% over the forecast period. Patients and healthcare consumers are becoming more conscious of the environmental impacts of their products, including the packaging. This has increased demand for pharmaceutical products, medical devices, and consumables packaged in recyclable or biodegradable materials.

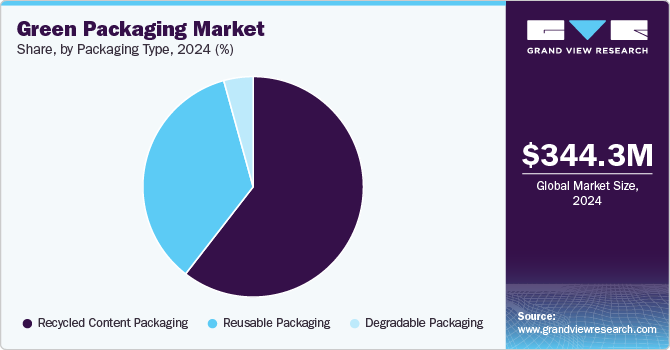

Packaging Type Insights

Based on packaging type, recycled content packaging dominated the overall market with a revenue share of over 60.5% in 2024. Many governments worldwide are implementing stricter waste management and recycling policies, setting higher targets for using recycled materials in packaging. For instance, the European Union’s Circular Economy Action Plan and various Extended Producer Responsibility (EPR) schemes are compelling companies to improve their packaging sustainability. This regulatory environment encourages manufacturers to incorporate higher levels of recycled content in their packaging to ensure compliance with laws and avoid penalties. It also improves their public image as environmentally responsible brands.

The degradable packaging segment is anticipated to register the fastest CAGR of 8.6% over the forecast period. Degradable packaging materials, such as biodegradable plastics and plant-based films, offer an environmentally friendly solution by breaking down more rapidly than conventional plastics. This growing demand for sustainable packaging options is further propelled by consumer preference for brands that prioritize eco-friendly practices.

Regional Insights

North America green packaging market accounted for 27.4% of the global revenue share in 2024. North America has seen an increased inclination toward green packaging, especially in Canada, due to corporate and government responses to consumer demand. Companies seeking competitive advantage have mended their packaging design & materials considering both consumer and cost expectations, thereby addressing ecological concerns. Consequently, the packaging industry in the region has transitioned to sustainable packaging through the innovation of creative solutions that address corporate and global regulations and health and environmental concerns.

U.S. Green Packaging Market Trends

The green packaging market in U.S. is anticipated to grow significantly over the forecast period. Packaging has played a crucial role in consumer purchasing decisions as it preserves product quality, displays vital information, and enhances product appeal. As consumer preference in the U.S. is shifting toward eco-friendly packaging, the manufacturers are changing the look and material of the product packaging accordingly. Informed consumers in the U.S. look for various environmental labels and certification standards, including the Programme for the Endorsement of Forest Certification (PEFC) standard, the Forest Stewardship Council (FSC) standard, and the Sustainable Forestry Initiative (SFI) standard.

Europe Green Packaging Market Trends

The green packaging market in Europe accounted for the largest revenue share of 36.1% in 2024. Many European countries have adopted green packaging as a part of their sustainability initiatives. The European Union has supported sustainable development through EU treaties by recognizing environmental, economic, and social dimensions. In December 2019, the European Commission published a new roadmap for sustainability in the EU’s economy, which largely impacted the end-use industries as the objectives pushed them to adopt green packaging to a great extent.

Germany green packaging market is anticipated to grow significantly over the forecast period. The German government has implemented various regulations to reduce plastic waste and promote sustainable packaging solutions. Initiatives such as the Packaging Act (VerpackG) require manufacturers to take responsibility for the lifecycle of their packaging materials. This legislation encourages recyclable materials and mandates participation in recycling systems.

Asia Pacific Green Packaging Market

The green packaging market in Asia Pacific accounted for a revenue share of 28.5% in 2024. The Asia Pacific region has the fastest-growing consumer base and stringent regulations about packaging products, which is driving the green packaging market in the region. Companies across the packaging value chain are looking for more sustainable alternatives to stay abreast of government regulations and consumer demands by introducing innovative designs and using novel materials. Big brands are also following the trend and increasing adoption of green packaging by including recycled and biodegradable materials.

The Chinese government has been increasingly proactive in implementing regulations aimed at reducing plastic waste and promoting sustainable practices. Initiatives such as the “Plastic Waste Ban” introduced in 2020 have significantly influenced the packaging industry by restricting the use of single-use plastics and encouraging companies to adopt eco-friendly alternatives. The government’s commitment to achieving carbon neutrality by 2060 further supports this shift, as it aligns with global sustainability goals. These regulatory frameworks not only compel manufacturers to innovate but also create a favorable environment for green packaging solutions, driving the growth of the industry.

Key Green Packaging Company Insights

The competitive environment of the green packaging industry is marked by the presence of several major players, including Amcor plc, DuPont, Mondi, and others, who dominate the global market with their extensive product portfolios and advanced technologies. These companies compete on factors such as innovation, sustainability, and cost efficiency, focusing on developing eco-friendly packaging solutions to meet the increasing demand for sustainable packaging in the food and beverage industry. Moreover, increasing production capacity and expansion initiatives are undertaken by major players to gain a competitive edge in the industry.

-

In February 2023, Sealed Air announced the acquisition of Liquibox, a sustainable liquid packaging manufacturer. With this acquisition, Sealed Air is expected to expand its product portfolio in the food & beverage application to meet the growing demand of consumers for sustainable packaging solutions.

-

In September 2022, Sealed Air announced an expansion in its product portfolio by launching a new product range of protective packaging solutions containing more than 50% recycled plastic under its bubble wrap brand.

Key Green Packaging Companies:

The following are the leading companies in the green packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Be Green Packaging

- DS Smith Plc

- DuPont

- Evergreen Packaging LLC

- Mondi

- Nampak Ltd

- Ball Corporation

- Sealed Air

- Tetra Laval

Green Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 365.46 billion

Revenue forecast in 2030

USD 503.43 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application, packaging type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Amcor; Be Green Packaging; DS Smith; DuPont; Evergreen Packaging; Mondi; Nampak; Ball Corporation; Sealed Air; Tetra Laval

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green packaging market report on the basis of application, packaging type, and region:

-

Packaging Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recycled Content Packaging

-

Paper

-

Plastic

-

Metal

-

Glass

-

Others

-

-

Reusable Packaging

-

Drum

-

Plastic Container

-

Others

-

-

Degradable Packaging

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Personal care

-

Health care

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green packaging market size was estimated at USD 344.32 billion in 2024 and is expected to reach USD 365.46 billion in 2025.

b. The global green packaging market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030, reaching USD 503.43 billion by 2030.

b. Food & beverages dominated the green packaging market with a share of 60.9% in 2024, owing to the rising global demand for convenience and ready-to-eat food products.

b. Some of the key players operating in the green packaging market include Amcor; Be Green Packaging; DS Smith; DuPont; Evergreen Packaging; Mondi; Nampak; Ball Corporation; Sealed Air; and Tetra Laval

b. The increasing consumer awareness about the environmental impact of traditional packaging and stringent government regulations regarding single-use plastic packaging products ban is driving the demand for a green packaging market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.