- Home

- »

- Clothing, Footwear & Accessories

- »

-

Tactical Footwear Market Size, Share, Industry Report, 2030GVR Report cover

![Tactical Footwear Market Size, Share & Trends Report]()

Tactical Footwear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Boots, Shoes), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-846-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tactical Footwear Market Size & Trends

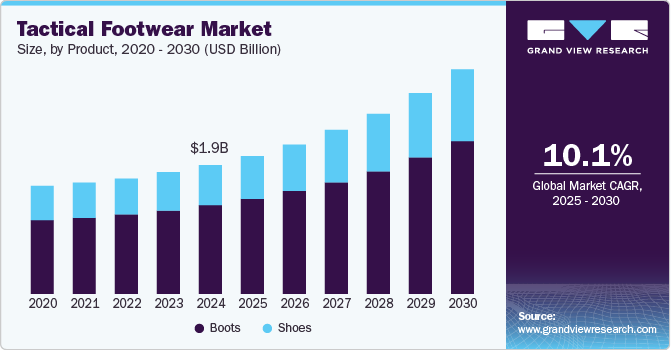

The global tactical footwear market size was estimated at USD 1.88 billion in 2024 and is expected to expand at a CAGR of 10.1% from 2025 to 2030. Professionals mainly influence the demand for tactical footwear in law enforcement, firefighting, military, and outdoor enthusiasts who work in challenging and extreme environments. These footwear are typically designed to operate in extreme environments without any wear and tear.

According to the United States European Command (EUCOM), in early 2025, the U.S. had nearly 84,000 service members stationed in Europe. Following Russia's full-scale invasion of Ukraine in 2022, an additional 20,000 U.S. soldiers were deployed to countries bordering Russia, Belarus, and Ukraine to support Ukraine and help contain the conflict. Throughout the war, the total number of U.S. troops in the region varied between 75,000 and 105,000, primarily from the Air Force, Army, and Navy.

Apart from military operations, tactical footwear is also used in extreme sports, hunting, mountaineering, and rocky terrain sports. Tactical footwear comes with enhanced insole and outsole cushioning, making it suitable for restricting impact and strain placed on the feet while running, jumping, or walking long treks. Many established brands have also been launching tactical boots, tactical sneakers, and tactical shoes for men, women, and children, keeping in mind the premium category of footwear owing to the increase in demand.

For instance, in 2023, 5.11, Inc. launched its first pair of AR 670-1 compliant boots: the EVO 2.0 8” AR 670-1 and the Speed 4.0 8” AR 670-1. Priced at USD 160, the EVO 2.0 8” boots featured an Ortholite footbed and Force Foam cushioning, offering enduring comfort and support. These boots met the requirements of Army Regulation 670-1, making them suitable for wear with Operational Camouflage Pattern uniforms and MultiCam.

Product Insights

The boots segment dominated the tactical footwear industry, with the largest revenue share of 68.7% in 2024. Increasing product technology innovation and product launches have fueled the segment's growth. In addition, tactical boots are popular for military use and are used by soldiers who have to operate in harsh climates. Over the period, the demand for products has increased due to a worldwide increase in military operations. Tactical boots have been made available in different styles to suit the application of the products, such as jump boots, tanker boots, jungle boots, desert boots, and ice waterproof tactical boots for extreme cold. The tactical boots by Thorogood are designed especially for police officers and withstand various physical stresses and heavy demands. It includes safety toe protection for impact and compression, slip resistance, electrical hazard protection, water resistance, and bloodborne pathogen protection.

The shoes segment is expected to grow at the fastest CAGR over the forecast period. These shoes are majorly preferred by hunting, hiking, and extreme sports enthusiasts, who are looking for protection from sand‚ mud‚ water‚ and difficult terrain. Constant product launches have been fueling the segment growth. For instance, in January 2019, 5.11 Boots launched Norris tactical Sneakers in black multicam made with welmax board, which guards feet against up to 1,200 newtons of force. The product has Vibram outsole with XS trek that provides optimal balance, durability, and comfort. Tactical shoes are commonly worn by police officers, likely to be an essential part of their Class B patrol uniform or Class C tactical training and deployment kit.

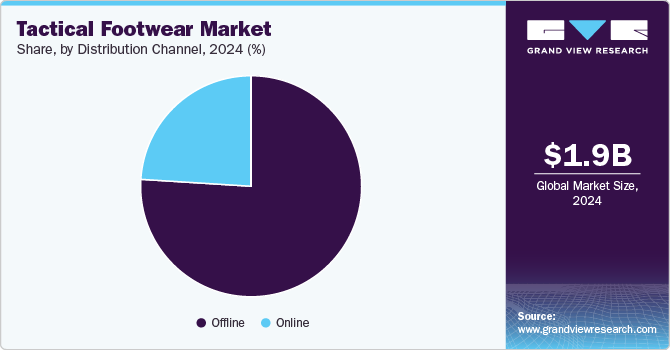

Distribution Channel Insights

The offline segment dominated the tactical footwear market with the largest revenue share in 2024. This channel includes outlets such as sporting goods chains, independent and specialty retailers, department store chains, and institutional athletic departments. Consumers prefer buying tactical footwear from offline stores to find the right fit and comfort. Moreover, it helps them to understand the benefits and functionality of shoes and choose from the available variety of cushioning and materials. There are a variety of high-ankle, mid-ankle, and low-ankle tactical shoes available in the market for different applications and work.

The online segment is expected to grow at the fastest CAGR over the forecast period. The major factors fueling its growth are increasing internet penetration, doorstep delivery facilities, easy exchange offers, and hassle-free payment options provided by e-commerce companies. In addition, internet-savvy millennial consumers have been actively driving e-commerce sales. Online shopping provides the convenience of purchasing products from the comfort of home, available 24/7. In addition, Amazon offers discounted tactical footwear, customer reviews, and options to filter their choices based on individual preferences.

Regional Insights

North America tactical footwear industry dominated the global market with the largest revenue share of 38.7% in 2024. The presence of a large number of established manufactures, such as Under Armour, Inc., Adidas AG, and Maelstrom Footwear, coupled with increasing interest in outdoor physical activities among people, such as mountain climbing, hiking, trekking, and wildlife camping, has been driving the demand for tactical footwear in the region. In addition, the rising demand for tactical boots due to increasing military operations conducted by countries and law enforcement professionals, including the U.S. and Mexico, has been driving the demand in this region. According to the Ibero CDMX Citizen Security Program, the total number of military personnel deployed for public security in Mexico was 261,644, while state and municipal police forces numbered 251,760 in 2023.

U.S. Tactical Footwear Market Trends

The U.S. tactical footwear market led the North America market, accounting for the largest revenue share in 2024. Law enforcement and military personnel require durable, high-performance footwear for their daily operations. Similarly, industries such as construction and emergency services need specialized footwear to protect against hazards such as slips, falls, and impacts. In 2023, the U.S. military had a total of 2.86 million personnel worldwide, making it the third-largest active military force globally, according to the Central Intelligence Agency (CIA). The National Fire Protection Association reported 364,300 career firefighters in 2020, reflecting a 2 percent increase from 2019.

Europe Tactical Footwear Market Trends

Europe held a substantial market share in 2024. In 2025, Ukrainian military intelligence reported that approximately 620,000 Russian soldiers were deployed in Ukraine and Kursk, according to experts from the Institute for the Study of War. In addition, firefighters in Europe contribute to the demand for tactical footwear, as it is an essential part of their uniform, providing crucial protection against flame injuries. In 2023, Europe had 362,400 professional firefighters, accounting for 0.18% of total employment across the region.

Asia Pacific Tactical Footwear Market Trends

The Asia Pacific tactical footwear market is expected to grow at the fastest CAGR of 10.4% over the forecast period. The demand is driven by increasing industrial activities, growing military budgets and law enforcement needs, and a rising focus on safety and protection in high-risk environments. India has become the fourth-largest defense spender, with a budget of USD 75 billion in 2025. Tactical boots are perfect for hiking, climbing, and any other task that demands flexibility and a wide range of motion. In 2023, the Japan National Tourism Organization promoted adventure travel to attract visitors to rural areas, and the Osaka Convention & Visitors Bureau launched Adventure Osaka, a website showcasing hiking, e-biking, kayaking routes, and local cultural experiences, which will further increase adventurous activities and drive demand for the tactical footwear industry.

The China tactical footwear market led the Asia Pacific market with the largest revenue share in 2024. China has many companies, including China xinxing, offering customized tactical footwear at competitive pricing, thereby driving the demand. Qingdao Glory Footwear Co.,Ltd is one of the major companies that manufactures and supplies tactical footwear for the law enforcement sector in China. In addition, the country's growing military strength and budget are also driving its demand. In 2025, China ranked second globally, with a military budget of USD 266.85 billion, with a strong emphasis on modernization.

Key Tactical Footwear Company Insights:

Some major tactical footwear companies include Under Armour, Inc., 5.11, Inc., LaCrosse Footwear, and Wolverine World Wide, Inc., among others. These companies stay competitive in the global market by constantly innovating with advanced materials, incorporating the latest safety features, and focusing on durability and comfort. They respond to the growing demand from military, law enforcement, and outdoor enthusiasts while adapting to regional needs, offering customized solutions, and leveraging e-commerce platforms for wider reach and visibility.

-

Under Armour is a sportswear brand known for designing innovative athletic apparel, footwear, and accessories. The company focuses on performance-driven products using cutting-edge technology to enhance comfort, durability, and flexibility. It designs tactical footwear catering to military, law enforcement, and outdoor enthusiasts. The brand incorporates advanced materials and technology to provide comfort, support, and protection in demanding environments.

-

5.11, Inc. is known for its tactical footwear, designed to meet the needs of law enforcement, military, and outdoor professionals. Their footwear emphasizes durability, comfort, and performance, with features tailored for high-intensity environments. The company offers a wide range of styles to suit various tactical demands.

Key Tactical Footwear Companies:

The following are the leading companies in the tactical footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Under Armour, Inc.

- 5.11, Inc.

- LaCrosse Footwear

- Wolverine World Wide, Inc.

- VF Corporation

- Magnum Boots International

- Maelstrom Footwear

- adidas AG

- Belleville Boot Co.

Recent Developments

-

In March 2025, NORTIV 8 launched the GeoPilot Collection, a line of high-performance men’s tactical boots crafted for durability, comfort, and versatility. Engineered for demanding professionals and outdoor enthusiasts, the collection featured nine models, Terrascope, Peakforce, Metrostrike, VaporGuard, HydroTrek, HydroArmor, Desertstorm, DriftShield, and Paladin-Steel, each designed for specific needs.

-

In November 2024, OTB Boots, a tactical footwear brand, launched its new collection. Developed with U.S. Navy SEALs and tested by elite operators, the boots are designed for amphibious and extreme environments.

-

In July 2024, GC USA was selected for the SWIFT program, a collaboration between DEVCOM Soldier Center, UMass Lowell, and HEROES to develop next-generation U.S. military footwear.

Tactical Footwear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.01 billion

Revenue forecast in 2030

USD 3.25 billion

Growth Rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil

Key companies profiled

Under Armour, Inc.; 5.11, Inc.; LaCrosse Footwear; Wolverine World Wide, Inc.; VF Corporation; Magnum Boots International; Maelstrom Footwear; adidas AG; and Belleville Boot Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tactical Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tactical footwear market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Boots

-

Shoes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global tactical footwear market size was estimated at USD 1.88 billion in 2024.

b. The global tactical footwear market is expected to expand at a compound annual growth rate (CAGR) of 10.1% from 2025 to 2030.

b. The boots segment dominated the tactical footwear industry, with the largest revenue share of 68.7% in 2024. Increasing product technology innovation and product launches have fueled the segment's growth. In addition, tactical boots are popular for military use and are used by soldiers who have to operate in harsh climates. Over the period, the demand for products has increased due to a worldwide increase in military operations. Tactical boots have been made available in different styles to suit the application of the products, such as jump boots, tanker boots, jungle boots, desert boots, and ice waterproof tactical boots for extreme cold. The tactical boots by Thorogood are designed especially for police officers and withstand various physical stresses and heavy demands. It includes safety toe protection for impact and compression, slip resistance, electrical hazard protection, water resistance, and bloodborne pathogen protection.

b. Some of the key players in the global tactical footwear market include Under Armour, Inc.; 5.11, Inc.; LaCrosse Footwear; Wolverine World Wide, Inc.; VF Corporation; Magnum Boots International; Maelstrom Footwear; adidas AG; and Belleville Boot Co.

b. Key factors that are driving the market growth include increasing demand from law enforcement professionals, firefighters, and military service personnel, rising adventure sports trends among consumers, and the rising popularity of e-commerce platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.