- Home

- »

- Clothing, Footwear & Accessories

- »

-

Footwear Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Footwear Market Size, Share & Trends Report]()

Footwear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Athletic, Non-Athletic), By End User (Men, Women, Children), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-396-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Footwear Market Summary

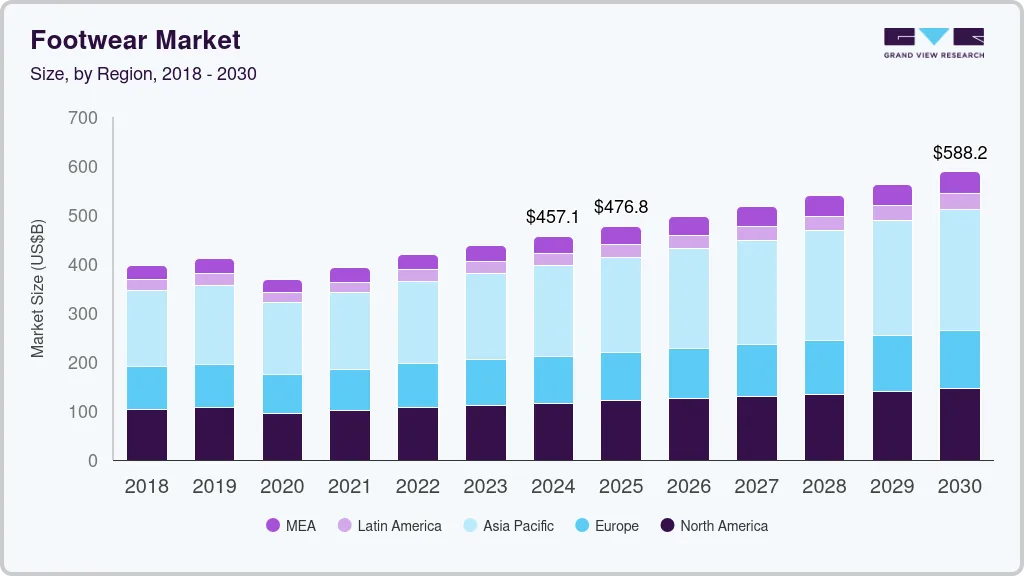

The global footwear market size was estimated at USD 457.09 billion in 2024 and is projected to reach USD 588.22 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The rise in disposable income, particularly in emerging economies, has led to increased spending on footwear.

Key Market Trends & Insights

- The footwear market in North America accounted for a share of 25.3% of the global revenue in 2024.

- The footwear market in the U.S. is projected to grow at a CAGR of 3.7% from 2025 to 2030.

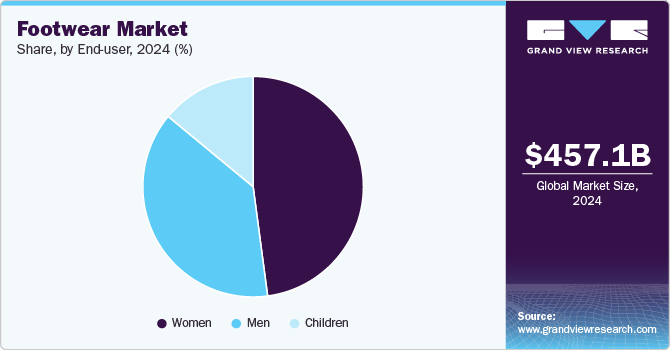

- By end user, the women segment accounted for a share of 47.8% of the global revenue in 2024.

- By product, the non-athletic accounted for a share of 66.3% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 457.09 Billion

- 2030 Projected Market Size: USD 588.22 Billion

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2024

Moreover, brands are launching limited-edition shoes, as well as premium and luxury footwear for consumers aiming to live aspirational lifestyles. This trend has resulted in increased spending on these types of footwear. These factors are expected to continue as major drivers for the growth of the footwear market during the forecast period. The landscape of footwear retail has undergone significant transformations, spanning from distribution channels to evolving consumer trends and preferences. Footwear companies allocate substantial resources, often tens of millions of dollars annually, toward enhancing their workforce, retail outlets, and digital platforms, ensuring the prompt delivery of superior-quality shoes. Notably, the footwear sector boasts one of the most resilient and efficient supply chains globally.

Moreover, the industry grapples with retail challenges akin to other sectors, including the need to swiftly adapt to shifting consumer demands spurred by the pandemic and the prevalence of discounting practices. Furthermore, there is a growing emphasis on devising and implementing speed-to-market strategies. Despite these hurdles, footwear retailers persist by leveraging innovative and robust approaches, both online and in brick-and-mortar stores, to navigate the changing landscape successfully.

Historically, purchasing footwear online has presented considerable challenges for consumers. Unlike other products, such as clothing or electronics, shoes inherently involve a tactile experience that cannot be fully conveyed through mere photographs or sizing charts. Customers often struggle with uncertainty regarding how a pair of shoes will fit or feel once worn.

According to findings from the 2022 PowerReviews’ State of Apparel & Footwear Shopping survey, a remarkable 74% of footwear purchases are now being made online. Casual footwear emerges as the most sought-after category, commanding a staggering 96% of online sales, closely trailed by athletic footwear, which captures 84% of the online market.

Consumer Insights for Footwear

Consumers are becoming more environmentally conscious, increasing demand for sustainable footwear options. With millions of pairs of shoes ending up in landfills annually, brands are under pressure to adopt eco-friendly practices. Major players in the global footwear market, including Timberland, PUMA, and Adidas, are prioritizing sustainability initiatives by incorporating recycled materials and promoting circular economy principles. Manufacturers are increasingly seeking sustainable raw material options for footwear to align with consumer preferences and address environmental concerns, which drives the need for more sustainable product offerings in the market.

Advancements in 3D printing technology are revolutionizing shoe design and manufacturing processes in the footwear industry. Beyond rapid prototyping, 3D printing offers the potential for custom-made footwear and enhances the online shopping experience through immersive 3D modeling features. Brands are showcasing products with interactive 360-degree views, providing buyers with a comprehensive perspective before purchasing. This integration of 3D technology not only enhances product visualization but also offers a competitive edge to brands in the digital marketplace.

In August 2023, the AR Mirrors by ZERO10 animated the JD Sports x Nike Need it Now collection, enabling shoppers at JD Sports’ Times Square New York and State Street Chicago flagship stores to virtually try on 18 items. Some items were accompanied by additional AR enhancement effects, such as water droplets.

Online retailers are witnessing a surge in casual and athletic footwear purchases, emphasizing the importance of offering comfortable options that cater to evolving lifestyle needs. Brands that prioritize comfort and versatility in their product offerings are likely to resonate well with consumers seeking footwear for both work and leisure activities.

Customization is emerging as a key trend driving consumer engagement and brand loyalty in the footwear market. Brands are leveraging this to create personalized experiences for buyers, tailoring product assortments based on customer preferences and market trends. Access to sales data enables brands to identify consumer needs and offer bespoke solutions, mimicking the personalized experience associated with DTC models. By offering customized footwear options, brands can differentiate themselves in the market and foster stronger relationships with buyers, enhancing overall brand appeal and competitiveness.

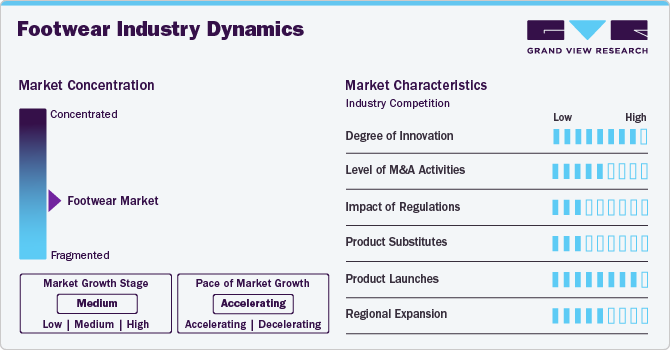

Market Concentration & Characteristics

The footwear market presents a plethora of opportunities for brands and manufacturers to capitalize on various emerging trends and consumer preferences. One significant opportunity lies in the growing demand for sustainable and eco-friendly footwear. As consumers become increasingly environmentally conscious, there is a rising preference for shoes made from recycled materials, sustainable fabrics, and ethically sourced components. Brands that prioritize sustainability in their product offerings and adopt eco-friendly manufacturing practices stand to gain favor among environmentally conscious consumers and differentiate themselves in the competitive market.

Moreover, the expanding footwear market offers ample opportunities for growth and innovation. With evolving fashion trends, changing consumer lifestyles, and technological advancements, there is a constant demand for new styles, designs, and functionalities in footwear. Brands that stay abreast of market trends, invest in product development, and offer innovative footwear solutions tailored to consumer needs can capture a larger share of the market and drive revenue growth.

The availability of affordable and cost-effective manufacturing options also presents opportunities for footwear companies to optimize production processes and reduce manufacturing costs. Outsourcing production to countries with lower labor and production costs, leveraging automation and technology in manufacturing, and streamlining supply chain operations can enable brands to offer competitively priced footwear without compromising on quality.

Furthermore, emerging markets present a promising opportunity for expansion and market penetration in the footwear industry. As disposable incomes rise and consumer purchasing power increases in developing regions, there is a growing demand for branded footwear products. By identifying and targeting emerging market segments, investing in marketing and distribution channels, and adapting products to local preferences and cultural norms, footwear brands can capitalize on untapped market potential and establish a foothold in new geographical regions.

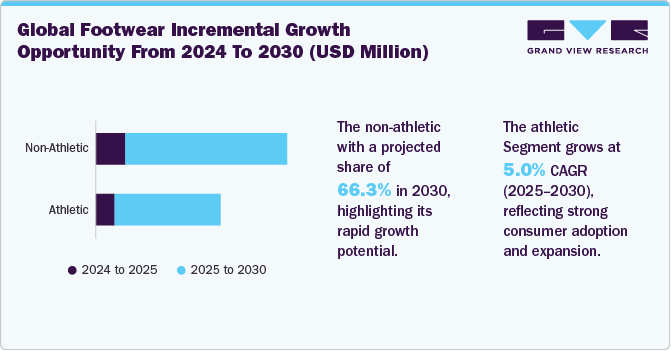

Product Insights

The non-athletic accounted for a share of 66.3% of the global revenue in 2024. The non-athletic category consists of flats, heels, mules, sandals, sneakers, and boots, which can be worn on different occasions. A large number of niche, big market players, and designers worldwide have been contributing to this broad category of footwear, owing to the growing consumer inclination toward eco-friendly sneakers and footwear. Reduced use of water and plastics, coupled with constant efforts from various multinational corporations to shift toward sustainable types, has contributed to the rising adoption of sustainable footwear, thereby driving the demand for non-athletic footwear.

According to the World Footwear Yearbook, more than 24 billion pairs of shoes are manufactured each year, predominantly produced under exploitative conditions, with sneakers comprising the largest portion. This industry-wide production level underlines the urgent need for sustainable solutions. To address this need, manufacturers have been increasingly launching sustainable footwear made from recycled materials that are gaining popularity among environmentally conscious consumers. In August 2023, Allbirds, Inc. announced the launch of Courier, a vintage-inspired sneaker that features a layered design with unique stitching and overlays. The sneaker is made with sustainable materials such as Tencel Lyocell ripstop, organic cotton canvas, and the brand's SweetFoam midsole material, which is made from sugarcane-derived green EVA.

The athletic segment is projected to grow at a CAGR of 5.0% from 2025 to 2030. Athletic shoes are worn by people who are involved in outdoor activities, such as running, walking, gymming, and playing sports like basketball, volleyball, cricket, hockey, and golf. Athletic shoes provide comfort, flexibility, and traction on surfaces like roads and trails, as well as benefits like torsional stability, superior cushioning, and better protection for users. The demand for comfortable, lightweight, and fashionable sports shoes from professional players for use on wet, soft, and rough ground drives the growth of the athletic segment. The increasing participation and inclination toward daily physical activities such as running, gymming, and cycling are the key factors driving the demand for athletic shoes across the globe.

Furthermore, there has been a significant surge in the popularity of athleisure wear, where athletic apparel is worn not just for sports but also for everyday activities. This trend has blurred the lines between performance and casual footwear, expanding the market for athletic shoes beyond traditional sports enthusiasts to a broader demographic of consumers seeking both comfort and style. Technological innovations in materials and design have also played a crucial role in driving the market for athletic footwear. Brands are continuously investing in research and development to create shoes that offer superior comfort, performance, and durability. Features such as lightweight construction, cushioning technologies, and enhanced stability contribute to the appeal of athletic footwear among consumers.

End User Insights

The women segment accounted for a share of 47.8% of the global revenue in 2024. Comfort and functionality are key drivers in the women's footwear market. With the increasing emphasis on wellness and self-care, women prioritize comfort without compromising style. This has led to a surge in demand for footwear brands that offer ergonomic designs, cushioned soles, and supportive features. Whether for daily wear, exercise, or special occasions, women seek footwear that provides both style and comfort to accommodate their busy and active lifestyles.

According to a survey conducted by MESH01, in the U.S., in 2023, consumers, including women, made their preferences regarding workplace footwear clear. A staggering 95% of respondents indicated that comfort was the top trait they desired in work shoes. Style (68%), durability (63%), and versatility (43%) were also significant considerations. Surprisingly, only 21% mentioned "degree of formality" as a crucial factor. Athletic styles were favored for the workplace, closely followed by casual options.

Furthermore, technological advancements have revolutionized the design and manufacturing processes of women's footwear. Innovations such as sustainable materials, 3D printing, and customizable options have expanded the possibilities in shoe design, offering women more choices than ever before. Eco-conscious consumers are also driving the demand for sustainable and ethically sourced footwear options, prompting brands to incorporate eco-friendly practices into their production processes to meet the evolving preferences of environmentally aware consumers.

The men segment is projected to grow at a CAGR of 3.8% from 2025 to 2030. The surging interest in outdoor pursuits is a crucial factor fueling the demand for men's footwear. Activities like cricket, hockey, and hiking have long been popular among men, prompting a need for specialized footwear tailored to these specific sports categories. In addition, the rise of upscale e-commerce platforms is forecast to serve as a catalyst for the expansion of the men's footwear market. E-commerce and digital platforms have revolutionized the way men shop for footwear.

The convenience of online shopping, coupled with the availability of extensive product selections and personalized recommendations, has contributed to the growth of the men's footwear market. This shift toward online retail has also allowed emerging brands and niche players to reach a wider audience, challenging traditional market leaders and fostering greater competition and innovation within the market.

Furthermore, athletic footwear manufacturers are offering innovative and sustainable options tailored to the needs and values of active men. In August 2023, U.S.-based sneaker brand Psudo announced the launch of PSUDO blue, a collection of shoe styles for men and women, in partnership with Blumaka, a manufacturer of shoe insoles and outsoles. PSUDO blue sneakers are manufactured near-shore at the Blumaka factory in El Salvador, which operates on solar power. The launch of the PSUDO blu line brought PSUDO closer to achieving its objective of actively participating in and promoting a circular economy.

Regional Insights

The footwear market in North America accounted for a share of 25.3% of the global revenue in 2024. North American consumers tend to prioritize footwear that reflects current trends, personal style, and individual expression. As such, brands and retailers constantly innovate and introduce new designs, colors, and styles to cater to evolving fashion tastes and preferences. In addition, the growing focus on health and wellness plays a crucial role in driving the footwear market. With an increasing awareness of the importance of foot health and comfort, consumers are seeking footwear that offers both style and functionality. This has led to a rise in demand for athletic and athleisure footwear, as well as comfortable and supportive shoes for everyday wear.

U.S. Footwear Market Trends

The footwear market in the U.S. is projected to grow at a CAGR of 3.7% from 2025 to 2030. Americans are often influenced by celebrities, social media influencers, and fashion designers, leading to changing tastes and preferences in footwear styles. Whether it's sneakers, boots, sandals, or formal shoes, consumers seek out the latest styles and designs that reflect their individuality and lifestyle.

Another significant driver is the increasing emphasis on health and wellness. With the growing awareness about the importance of foot health and comfort, consumers are increasingly seeking out footwear that not only looks good but also provides proper support and comfort. This has led to a rise in demand for shoes with advanced cushioning, ergonomic designs, and materials that promote breathability and moisture-wicking properties. Brands that prioritize comfort and functionality while still offering stylish options tend to perform well in the market.

The footwear market in Canada is projected to grow at a CAGR of 4.1% from 2025 to 2030. The market for footwear in Canada is primarily driven by several key factors, including changing fashion trends, consumer preferences, and demographic shifts. As a highly fashion-conscious society, Canadians are often influenced by the latest styles and designs, leading to a constant demand for new footwear options. Whether it's casual sneakers, formal dress shoes, or outdoor hiking boots, Canadians are always on the lookout for footwear that not only reflects their personal style but also offers comfort and functionality. Moreover, the growing emphasis on health and wellness has contributed to the rise of athleisure footwear, as more Canadians prioritize comfortable and supportive shoes for everyday wear. This trend has been further accelerated by the increasing adoption of active lifestyles and participation in sports and fitness activities. As a result, brands offering innovative and performance-oriented footwear have seen significant growth in the Canadian market.

Europe Footwear Market Trends

The footwear market in Europe is projected to grow at a CAGR of 3.6% from 2025 to 2030. The rise of e-commerce has transformed the retail landscape, making it easier for consumers to access a vast array of footwear options online. This convenience factor has contributed to the growth of the European footwear market, with online sales channels witnessing significant expansion in recent years. Brands and retailers are leveraging digital platforms to reach a broader audience, enhance customer engagement, and offer personalized shopping experiences, thereby driving sales and market penetration.

The footwear market UK is projected to grow at a CAGR of 3.9% from 2025 to 2030. Economic factors such as rising disposable incomes and changing consumer lifestyles have contributed to the growth of the footwear market in the UK. As consumers have more purchasing power, they are willing to invest in higher-quality footwear products that offer durability, comfort, and style. In addition, the rise of online retail channels has provided consumers with greater accessibility to a wide range of footwear options, enabling them to explore different brands, styles, and price points conveniently from their homes.

Germany footwear market is projected to grow at a CAGR of 4.1% from 2025 to 2030. Fashion trends play a crucial role in shaping the footwear market in Germany. As a country with a strong fashion industry and a population that prides itself on individual style, there is a constant demand for innovative designs and trendy styles. This includes everything from casual sneakers to formal dress shoes, with consumers seeking footwear that reflects their personal taste and complements their wardrobe.

Asia Pacific Footwear Market Trends

The footwear market in Asia Pacific is projected to grow at a CAGR of 4.9% from 2025 to 2030. The increasing penetration of e-commerce and digital platforms has significantly contributed to the expansion of the footwear market in Asia Pacific. With the proliferation of smartphones and internet connectivity, consumers have greater access to a wide array of footwear options, leading to increased competition among both local and international brands. This digital transformation has also facilitated easier access to global fashion trends, driving consumer preferences toward more diverse and stylish footwear offerings.

Sustainable footwear has emerged as a significant trend within the global footwear industry, including the Asia Pacific region. With growing awareness of environmental issues and social responsibility, consumers are increasingly seeking footwear options that minimize their ecological footprint and promote ethical manufacturing practices.

The footwear market in China accounted for a share of 38.2% of the regional revenue in 2024. China's dominance in the global footwear market is a significant factor driving the market in China. The country's vast manufacturing capacity, low labor costs, and extensive infrastructure have made it an attractive destination for footwear production. The increasing demand for footwear in both domestic and international markets, as well as government support for the industry, have contributed to the steady growth of the Chinese footwear industry.

According to the statistics released by World Footwear, an initiative of the Portuguese Footwear, Components and Leather Goods Manufacturers' Association (APICCAPS) in 2022, China produces more than 50% of the world's footwear. In addition, China is also the largest consumer of footwear, accounting for approximately 20% of global footwear consumption.

India footwear market is projected to grow at a CAGR of 5.7% from 2025 to 2030. The landscape of the footwear market in India has been drawing a lot of attention in recent years. Consumer purchasing behavior has been changing dramatically owing to the rise in disposable and per capita incomes. The impact of Western culture has also driven consumer behavior, which can be seen in the rising popularity of styles like Derby shoes made from full-grain Argentinian leather or reliable Oxford shoes.

Latin America Footwear Market Trends

The footwear market in Latin America is projected to grow at a CAGR of 4.2% from 2025 to 2030. The footwear market in Central and South America benefits from the expansion of retail channels and e-commerce platforms. Increased accessibility to a wide range of footwear options through online shopping platforms has made it easier for consumers to browse and purchase footwear from the comfort of their homes. The proliferation of retail outlets and shopping malls in urban centers has further contributed to the accessibility and availability of footwear products in the region, driving market growth.

Middle East & Africa Footwear Market Trends

The footwear market in the Middle East & Africa is projected to grow at a CAGR of 4.5% from 2025 to 2030. In the Middle East, several local and international brands produce footwear to cater to the regional demand. These brands offer a wide range of styles, including traditional slip-on sandals, flip-flops with embellishments, and more contemporary designs. Footwear can be found in markets, shopping malls, and online platforms, allowing consumers to choose from a variety of options. Footwear like PVC has gained popularity across the Middle East, primarily owing to the region's warm climate, cultural practices, and lifestyle preferences. Many international PVC footwear brands cater to this regional market, such as Crocs, Inc., Havaianas, Decathlon SE, and Bata Corporation, along with local manufacturers like Al Jazira Plastic Industries.

Key Footwear Company Insights

Established companies and emerging players create a competitive environment by focusing on product innovation, quality, and pricing strategies. Many manufacturers in the footwear market are expanding their presence on online retail channels to tap into the growing trend of online shopping. Furthermore, these manufacturers are collaborating with influencers, actors, athletes, and other prominent figures to launch shoes to benefit from the influence and reach of these individuals.

Key Footwear Companies:

The following are the leading companies in the footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- Puma SE

- Geox S.p.A

- Timberland

- Skechers USA, Inc.

- ECCO Sko A/S

- Crocs Retail, LLC

- Under Armour, Inc.

- Wolverine World Wide, Inc.

Recent Developments

-

In March 2024, Timberland Pro broadened its product range to include footwear tailored for the hospitality sector. Through its specialized division for skilled trade professionals, Timberland launched the Burbank Collection, marking the brand's inaugural line of footwear designed specifically for workers in the restaurant and hotel sectors. The collection features industry-standard all-black designs meticulously crafted to prioritize comfort, durability, protection, and slip resistance.

-

In February 2024, Crocs Retail, LLC teamed up with Famous Footwear for its newest project. Together, they introduced two exclusive designs in support of the Ticket to Dream Foundation. This non-profit organization is committed to offering assistance and opportunities to children in foster care and their foster families. The collaboration introduced a women's clog priced at USD 54.99 and a kids' clog priced at USD 44.99, both exclusively available at Famous Footwear outlets and online.

Footwear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 476.83 billion

Revenue Forecast in 2030

USD 588.22 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain: China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Nike Inc.; Adidas AG; Skechers USA, Inc.; Puma SE; Crocs Retail, LLC; Wolverine Worldwide, Inc.; ECCO Sko A/S; Under Armour, Inc.; Timberland; Geox S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the footwear market based on product, end user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Athletic

-

Non-Athletic

-

-

End user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global footwear market size was estimated at USD 457.9 billion in 2024 and is expected to reach USD 476.83 billion in 2025.

b. The global footwear market is expected to grow at a compounded growth rate of 4.3% from 2025 to 2030 to reach USD 588.22 billion by 2030.

b. The non-athletic segment accounted for a share of 66.3% of the global revenue in 2024, as the non-athletic category consists of flats, heels, mules, sandals, sneakers, and boots, which can be worn on different occasions.

b. Some key players operating in the footwear market include Nike, Inc.; Adidas AG; SKECHERS USA, Inc.; Puma SE; Crocs Retail, LLC; Wolverine Worldwide, Inc.; ECCO Sko A/S; Under Armour, Inc.; Timberland; Geox S.p.A. and others

b. Key factors that are driving the market growth include the rise in disposable income, particularly in emerging economies, which has led to increased spending on footwear. Moreover, brands are launching limited-edition shoes and premium and luxury footwear for consumers aiming to live aspirational lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.