- Home

- »

- Consumer F&B

- »

-

Spices Market Size And Share, Industry Report, 2027GVR Report cover

![Spices Market Size, Share & Trends Report]()

Spices Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Pepper, Turmeric), By Form (Powder, Whole, Chopped & Crushed), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-088-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spices Market Summary

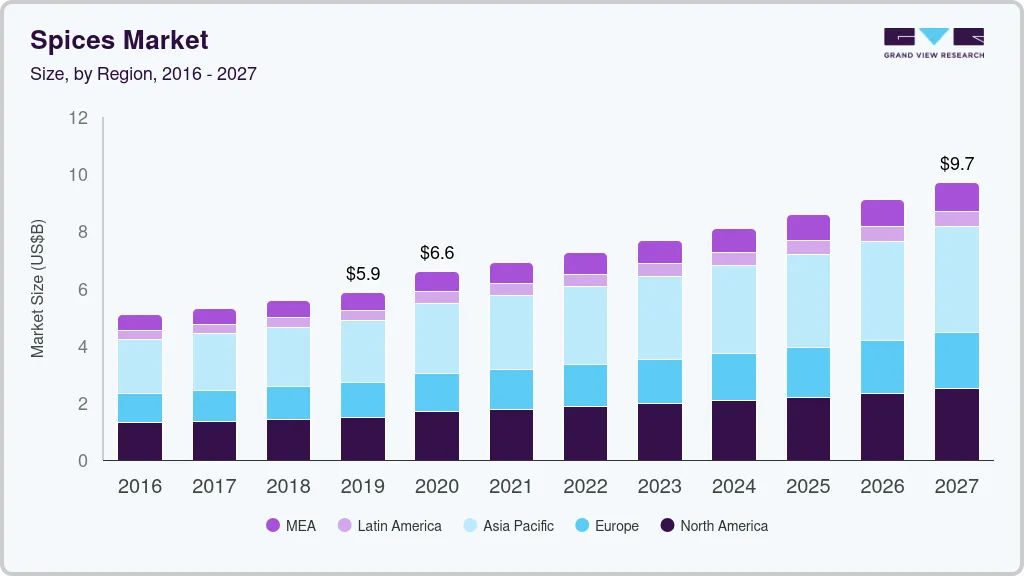

The global spices market size was estimated at USD 5,859.2 million in 2019 and is projected to reach USD 9,700.8 million by 2027, growing at a CAGR of 6.5% from 2020 to 2027. Increasing demand for authentic cuisines globally is one of the foremost factors driving the consumption of spices.

Key Market Trends & Insights

- Asia Pacific market held the largest share of over 35.0% in 2019.

- By product, the pepper segment accounted for more than 15.0% share of the global revenue in 2019.

- By form, the powdered spices segment accounted for more than 50.0% share of the global revenue in 2019.

Market Size & Forecast

- 2019 Market Size: USD 5,859.2 Million

- 2027 Projected Market Size: USD 9,700.8 Million

- CAGR (2020-2027): 6.5%

- Asia Pacific: Largest market in 2019

The growing fondness towards enjoying various kinds of flavors in foods and snacks is likely to prompt manufacturers to produce high-quality, appealing, and reliable products that can maintain consistent standards globally. Spices can alter the taste of specific cuisines and correlate with flavors of various regions. For instance, the Middle East and Southeast Asia are likely to contribute to fusions, which is expected to gain presence in the market over the forecast period.Spices are seeds, dried fruits, roots, and barks used to give flavor, aroma, and color to food. Several spices from various origins and cuisines are available in various forms, including ground, crushed, and whole. Each of these spices provides a unique flavor, aroma, and taste to the food. Some of the commonly used spices are cinnamon, black pepper, cumin seeds, nutmeg, cloves, chili powder, turmeric, ginger, and garlic.

Retail and e-commerce portals are among the sought-after destinations for the distribution of spices. Retailers such as Walmart, Kroger’s, and Tesco are serving consumers with self-labeled products to establish their presence in the market and sustain the competition. However, retailers are also facilitating the availability of products with a higher affinity to showcase their product content through transparent packaging and those with a higher shelf life.

Besides the household consumption of spices, most of the fast-food chains such as Domino’s, McDonald’s, and Starbucks are favorably inclined towards the use of chili flakes, black pepper, dried ginger powders, and parsley to enhance the flavor in any product. Apart from these chains, restaurants, bars, and resorts are also focusing on providing consumers a taste of different culinary from selected regions, which is a part of diving into global trends.

The modern-day use of spices is limited to taste and flavor, but they are extensively used for their health benefits. Many of these act as an antioxidant and thus are used to treat certain health conditions. Spice companies have also started new advertising campaigns to encourage consumers to try recipes at home. Manufacturers like McCormick and Kerry are widely campaigning on social media platforms such as Pinterest, Facebook, and Twitter to create awareness regarding the use of various spices.

Product Insights

Pepper accounted for more than 15.0% share of the global revenue in 2019. Pepper is an aromatic spice derived from the fruit peppercorn and has been used for centuries. It includes black pepper, green pepper, and white pepper, available in whole or ground form. Black pepper is the primarily used form of pepper worldwide and is also commonly known as the king of spices. Its medicinal benefits, such as pain reduction and antioxidant properties, are increasing its usage. However, with supply shortages, the price of pepper is shooting up in many markets and widening the supply-demand gap. This is creating tension in the domestic and export markets, negatively affecting the segment growth.

Turmeric is expected to register the fastest CAGR of 7.1% from 2020 to 2027. Turmeric is relatively new in American cuisine but has been used in Asia and the Middle East for thousands of years. It is more accessible in a ground, bright orange powder form, and can be found in any spice aisle. It is a versatile powder that can be added to numerous dishes and has a range of culinary purposes as it contributes to a peppery flavor, yellow color, and mustard-like scent. It complements both savory and sweet dishes. However, its earthy taste makes it go well along with more savory, spice-based recipes. Turmeric is an essential ingredient in classic dishes, like kedgeree and coronation chicken.

Form Insights

Powdered spices accounted for more than 50.0% share of the global revenue in 2019. Growing consumer preference for whole spices to save time and attain authentic flavor is anticipated to propel their demand. These products are largely sold in the form of various mixes. Powdered forms are used as marinades, rubs, snack mix, and flavoring agents for curries. Furthermore, these products are often used in bread dough and batters to create a rich crust on bread pieces. These have a long shelf life and don’t have to be stored in the refrigerator. They can be mixed with water or can be directly sprinkled into the recipe.

The whole spice segment is expected to register the fastest CAGR of 6.8% from 2020 to 2027. Whole spices are preferred owing to their contribution to fresh and vibrant flavors, which make them immensely important for foods. They have a longer shelf life than other counterparts. These work best for the dishes that are simmered for a long time as it allows the full depth of their flavor to permeate the dish.

Regional Insights

Asia Pacific held the largest share of over 35.0% in 2019. Asia Pacific is one of the leading producers and exporters of spices. The region has the largest population in the world and has been witnessing impressive growth in the demand for spices. Most of the spices and herbs are grown in countries, such as India, Vietnam, China, and Thailand, thus making the region the major exporter in the world.

The consumption in the region is also growing at a fast pace with the emergence of marketing and promotional activities, increasing consumer income, and the growth of domestic brands. Some of the known players in the market are AJINOMOTO, Everest, Catch, Ariake Japan, and MDH. China is one of the largest consumers of spices in Asia Pacific. The demand is primarily driven by domestic consumption, followed by eatery outlets. The diversification in daily diet across China owing to a rise in individual income amid economic growth has led to various possibilities in catering to the demand for seasoning and spices.

Key Companies & Market Share Insights

Most of the supplier base is pivoted to the Asia Pacific region where China and India are among the leading exporters, with many domestic suppliers catering to the manufacturers of export-oriented spices. The demand for Indian spices in the international market has witnessed robust growth, citing the global culinary trends over the past few years.

The marginal increment in the prices of spices, like pepper, ginger, and cardamom, on account of seasonal variation affecting productions, had let manufacturers upscale the packaged price for end consumers. On the other hand, the manufacturers are catering to consumers having a taste for a combination of different spices to penetrate the market with novel products. Some prominent players in the global spices market include:

-

Ajinomoto Co., Inc.

-

Associated British Foods plc

-

ARIAKE JAPAN CO., LTD.

-

Baria Pepper

-

Kerry Group

-

The Bart Ingredients Co. Ltd.

-

DS Group

-

Everest Spices

-

Dohler Group

-

McCormick & Company, Inc.

Spices Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 6.58 billion

Revenue forecast in 2027

USD 9.70 billion

Growth Rate

CAGR of 6.5% from 2020 to 2027

Product year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; China; India; Brazil; South Africa

Key companies profiled

Ajinomoto Co., Inc.; Associated British Foods plc; ARIAKE JAPAN CO., LTD.; Baria Pepper; Kerry Group; The Bart Ingredients Co. Ltd.; DS Group; Everest Spices; Dohler Group; McCormick & Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global spices market report on the basis of product, form, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Pepper

-

Ginger

-

Cinnamon

-

Cumin

-

Turmeric

-

Cardamom

-

Coriander

-

Cloves

-

Others

-

-

Form Outlook (Revenue, USD Million, 2016 - 2027)

-

Powder

-

Whole

-

Chopped/Crushed

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global spices market size was estimated at USD 5.86 billion in 2019 and is expected to reach USD 6.58 billion in 2020.

b. The global spices market is expected to grow at a compound annual growth rate of 6.5% from 2020 to 2027 to reach USD 9.70 billion by 2027.

b. North America dominated the spices market with a share of 37.3% in 2019. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the spices market include Ajinomoto Co, Inc., Associated British Foods plc, ARIAKE JAPAN CO, LTD., Baria Pepper, Kerry Group, The Bart Ingredients Co. Ltd., DS Group, Everest Spices, Dohler Group, and McCormick & Company, Inc.

b. Key factors that are driving the spices market growth include increasing demand for authentic food cuisine and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.