- Home

- »

- Consumer F&B

- »

-

Cinnamon Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Cinnamon Market Size, Share & Trends Report]()

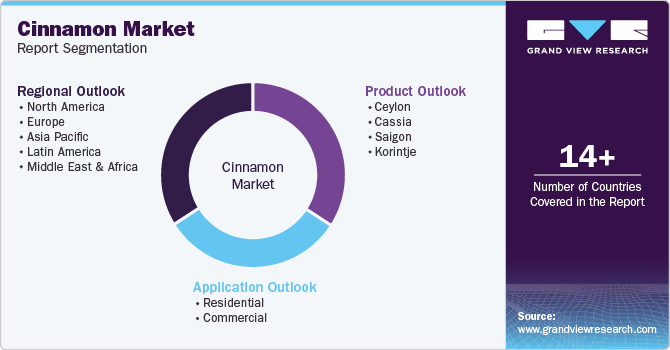

Cinnamon Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Ceylon, Cassia, Saigon, Korintje), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-619-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cinnamon Market Summary

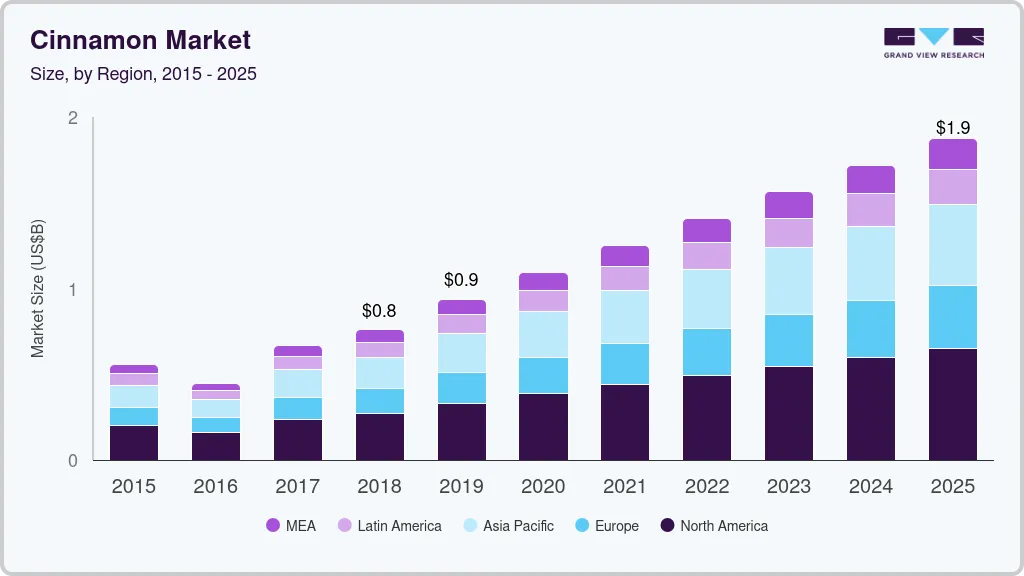

The global cinnamon market size was estimated at USD 1.00 billion in 2023 and is projected to reach USD 1.50 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. The market is mainly driven by the increasing consumer awareness of health benefits, including potential to regulate blood sugar levels and aid digestion.

Key Market Trends & Insights

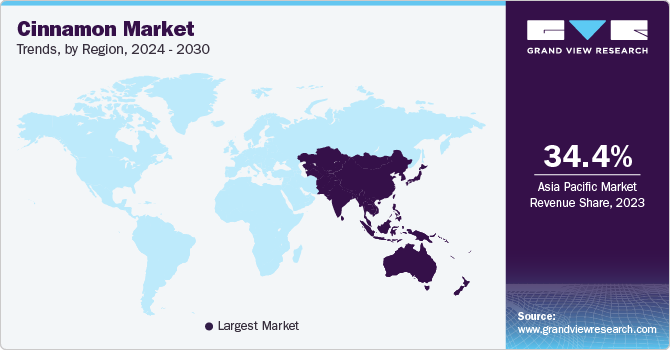

- In terms of region, Asia Pacific dominated the global cinnamon market with a revenue share of 34.4% in 2023.

- Country-wise, India dominated the cinnamon market in 2023.

- By product, Ceylon dominated the market and accounted for a revenue share of 36.7% in 2023.

- By application, the residential segment is expected to register a significant CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1.00 Billion

- 2030 Projected Market Size: USD 1.50 Billion

- CAGR (2024-2030): 6.0%

- Asia Pacific: Largest market in 2023

The growing popularity of organic and natural food products has boosted demand for cinnamon as a clean-label ingredient. Moreover, the spice's versatile applications in food and beverage, pharmaceuticals, and cosmetics contribute significantly to market growth. Furthermore, the rising interest in culinary experimentation and ethnic cuisines, which often feature cinnamon prominently, has expanded its consumer base.

Economic factors significantly influence the cinnamon market. The rise in disposable incomes, especially in emerging economies, has increased spending on premium and specialty food products that often contain cinnamon. Furthermore, the expanding middle class, which prefers convenient and ready-to-eat meals, has driven the demand for cinnamon-flavored processed foods. Additionally, the global emphasis on sustainability and ethical sourcing has led consumers to seek cinnamon products from responsibly managed farms, affecting market dynamics.

The technological advancements have impacted the cinnamon industry. Improved agricultural practices and harvesting techniques have enhanced cinnamon yield and quality. Additionally, innovations in processing and packaging have extended the shelf life of cinnamon products and expanded distribution channels. Technology integration in supply chain management has optimized logistics, ensured product traceability, and built consumer trust, further propelling market growth.

Product Insights

Ceylon dominated the market and accounted for a revenue share of 36.7% in 2023. The growth is mainly attributed to its high quality and unique flavor characteristics. Ceylon cinnamon has gained a loyal following due to its subtle flavor, high oil content, and various health benefits. The increased awareness of cinnamon's health benefits, such as its anti-inflammatory and antioxidant qualities, has driven the desire for ceylon cinnamon. Moreover, the growing demand for natural and organic components in food and beverages has driven the ceylon cinnamon industry. As consumers become increasingly selective and ready to invest more money in genuine and high-quality spices, this is expected to drive the segment’s growth

The cassia segment is expected to register the fastest CAGR during the forecast period. The segment's rapid growth is due to its affordability and comparatively lower price than ceylon cinnamon. Moreover, cassia's strong taste makes it a good fit for savory dishes and spice mixtures, further increasing its use in cooking preparations. The rise in popularity of global cuisines and the cooking trend at home also drive the demand for cassia. Additionally, the presence of different varieties such as powder, sticks, and essential oils meets the diverse needs of consumers and culinary requirements, ultimately driving market expansion.

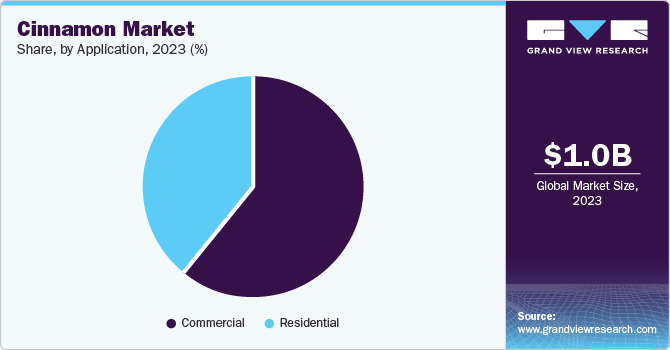

Application Insights

The commercial segment dominated the market in 2023. The growth is primarily attributed to its extensive application across various industries. The rising demand for natural preservatives and flavor enhancers in the food and beverage sector and the growing utilization of cinnamon in pharmaceuticals, cosmetics, and personal care products has significantly boosted the commercial segment's growth. Additionally, the ever-increasing demand for cinnamon-based essential oils and aromatherapy products has contributed to this segment's domination in the cinnamon market.

The residential segment is expected to register a significant CAGR during the forecast period due to consumer awareness about cinnamon's health advantages, such as its anti-inflammatory and blood sugar-regulating properties, which is the cinnamon market's main driver. The rising popularity of natural and organic ingredients, along with the growing usage of cinnamon in home cooking and baking, is driving the residential segment in the cinnamon market. Furthermore, increasing disposable income and urbanization are helping expand the sector by enabling consumers to experiment with various flavors and ingredients.

Regional Insights

Asia Pacific cinnamon market dominated the market revenue share with 34.4% in 2023. The Asia Pacific region is a significant producer and exporter of cinnamon. Various Asian areas such as Sri Lanka, Indonesia, and Vietnam are substantially affecting worldwide cinnamon production. The region's diverse ecosystem and favorable weather provide the optimal conditions for cinnamon cultivation. In addition, the increasing food and beverages sector and an expanding middle class showing a preference for various culinary tastes have increased the desire for spices such as cinnamon. Moreover, the growing recognition of cinnamon's possible health advantages, including its anti-inflammatory and antioxidant qualities, has also boosted consumption in the area.

India dominated the cinnamon market in 2023 as it is one of the biggest cinnamon producers in the world due to favorable climatic conditions and extensive cultivation areas. The nation's rich culinary heritage is known for its extensive utilization of spices and has cultivated a strong consumer base for cinnamon. In addition, the increasing awareness of health and wellness among Indian consumers has driven the demand for cinnamon because of its perceived health advantages. The growing food and beverage sector and the rise in demand for global flavors that include cinnamon have also helped fuel market growth. Furthermore, India's robust export infrastructure and competitive pricing have strengthened its status as a leading global cinnamon producer.

Europe Cinnamon Market Trends

Europe cinnamon market is anticipated to witness a significant CAGR over the forecast period, mainly fueled by increased demand for natural and organic components. European consumers are increasingly prioritizing health and wellness and acknowledging the potential health benefits of cinnamon. Furthermore, the region's wide range of traditional and modern cuisines has led to an increased use of cinnamon in various food and beverage items. Furthermore, the increasing demand for dietary supplements and functional foods containing cinnamon is helping to expand the market.

The UK cinnamon market is expected to grow rapidly in the coming years. The country's diverse population and changing culinary preferences have expanded the use of cinnamon beyond traditional desserts. Furthermore, the increasing demand for convenient food products with cinnamon, such as prepackaged cereals and pastries, is fueling the market's growth.

North America Cinnamon Market Trends

The North America cinnamon market is anticipated to be a lucrative region. The rising consumer awareness about health and the perception of cinnamon as a natural and beneficial ingredient has fueled the demand. The variety of cuisines in the region has broadened the use of cinnamon beyond just desserts due to its diverse culinary landscape. Furthermore, North America's long-standing food and beverage sector offers plenty of chances for including cinnamon in different products. Moreover, the popularity of convenient food options and the wide availability of products with cinnamon flavor have contributed to the expansion of the market in the North American region.

The U.S. cinnamon market held a substantial market share in 2023. The growth is attributed to increasing demand for convenient food products containing cinnamon, such as packaged breakfast cereals and pastries, which has significantly expanded the market. Moreover, the U.S. is a significant importer of cinnamon products, benefiting the worldwide distribution networks and producers. The demand for a broad range of cinnamon products to cater to various consumer preferences further drives the growth of the market in the country.

Key Cinnamon Company Insights

Some of the key companies in the cinnamon market include Ceylon Cinnamon Entices the World., Biofoods Pvt Ltd, HDDES Group, Ceylon Spices Company., Sauer Brands and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Biofoods Pvt Ltd specializes in organic products, with a primary focus on tea, spices, herbs, and coconut products. The company holds Fairtrade Labeling Organization (FLO) certifications and is part of the International Federation of Organic Agriculture Movement (IFOAM).

-

HDDES Group is a prominent Sri Lankan company well known for its expertise in natural products. The group specializes in manufacturing and exporting a wide range of organic and conventional essential oils, oleoresins, spices, floral extracts, and coconut-based products.

Key Cinnamon Companies:

The following are the leading companies in the cinnamon market. These companies collectively hold the largest market share and dictate industry trends.- Pure Ceylon Cinnamon

- Biofoods Pvt Ltd

- HDDES Group

- Ceylon Spices Company

- Sauer Brands

- First Spice Mixing Company

- Elite Spice

- EHL Ingredients

- McCormick & Company, Inc.

- SDS Spices.

Recent Developments

- In March 2023, McCormick & Company, Inc. announced redesigning its core red cap-branded products. It launched a brand new design for its core line of herbs and spices, such as Cinnamon, Garlic Powder, Paprika, Parsley, and Crushed Red Pepper.

Cinnamon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.06 billion

Revenue forecast in 2030

USD 1.50 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE

Key companies profiled

Pure Ceylon Cinnamon; Biofoods Pvt Ltd; HDDES Group; Ceylon Spices Company.; Sauer Brands; First Spice Mixing Company; Elite Spice; EHL Ingredients; McCormick & Company, Inc.; SDS Spices

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cinnamon Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cinnamon market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceylon

-

Cassia

-

Saigon

-

Korintje

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.