- Home

- »

- Plastics, Polymers & Resins

- »

-

Perfume & Fragrance Packaging Market Size, Industry Report, 2025GVR Report cover

![Perfume & Fragrance Packaging Market Size, Share & Trends Report]()

Perfume & Fragrance Packaging Market (2019 - 2025) Size, Share & Trends Analysis Report By Product Type (Bottles, Cans), By Raw Material (Glass, Metal), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-301-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global perfume and fragrance packaging market size was valued at USD 9.8 billion in 2018 and is expected to expand at a healthy CAGR over the forecast period. Consumers across the globe consider their fragrance to be a statement of their individuality, nature, personality, and style, which makes this market consumer driven. Growing trend of using different perfumes on different occasions is driving the product’s packaging market as well.

This market is controlled by ever-changing trends since fragrance has become one of the most important parts of personal grooming products. Moreover, perfume packaging is a mainstream element of the cosmetic industry and has gained significant traction over the past few years. Attractive packaging plays a major role as a stimulating attribute for the fragrance industry. Various perfumes are now made available with low concentration of fragrance or essential oils such as eau fraiche and eau de cologne, with the purpose of increasing the number of consumers wearing perfumes daily. This, in turn, increases the frequency of perfume use, thereby creating a huge demand for its packaging in the forecast period.

Nowadays, the younger generation is more apprehensive of personal grooming and are inclined towards experimenting new brands and products with an intention to create their own style statement. This gives the manufacturers an opportunity to customize and introduce more variety in their perfumes, which, in turn, drives the perfume packaging market.

Another factor driving the market is e-retailing. E-retailing promotes the availability of local as well as foreign perfume brands through different online portals. This makes the consumers to experience foreign brands of perfumes they always desired for, which are not available in retail shops or malls. Additionally, increase in the per capita income, along with consumer’s willingness to spend on luxury grooming products, fuels the demand for overall cosmetic market and thus drive the perfume packaging market.

However, growing commercialization of the product’s imitations is anticipated to hinder the market growth. Furthermore, counterfeit perfumes are available in a packaging that looks similar to the original but is duplicate and made from cheap materials. This hampers the importance of packaging and also makes it difficult for the consumers to differentiate between the original and the counterfeit products. Hence, some consumers settle for these products since they are sold at a very low price, thereby impeding the market growth.

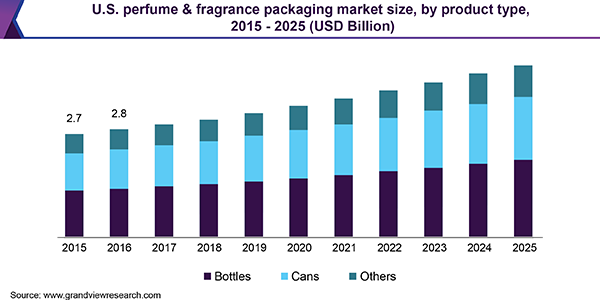

Product Type Insights

The product type segment of the perfume and fragrance packaging market is classified as bottles, cans, and others. Both bottles and cans are anticipated to witness significant growth as compared to other products such as tubes, roll-ons, and stick. The bottles segment held the largest market share in 2018 and is anticipated to reach USD 6.5 billion by 2025. This is because it is believed that perfumes and fragrances look more elegant in bottles than in cans. Manufacturers are focusing on designing bottles of different sizes and shapes to make them attractive.

Adoption of high quality bottles designs for premium perfumes is driving the segment. Moreover, bottles are airtight and they cause a very less wastage of perfumes as compared to roll-ons and cans. Furthermore, glass bottles are considered to be the signature of perfumes, since deodorants and tubes are available in metal or bottles packaging.

Raw Material Insights

This segment comprises glass, plastic, metal, and paperboard. The glass segment is expected to hold 38.8% share of the overall revenue by the end of 2025. The growth of the segment is attributed to its nonporous and impermeable properties that make it chemically non-reactive with the perfume. Hence, it is preferred by most of the manufacturers as the primary packaging material for their perfumes. Moreover, most of the consumers prefer buying glass bottled perfumes owing to the long lasting property of the product. Furthermore, vendors that sell custom-made fragrances are bottled in glass containers.

The metal segment is also expected to witness a significant growth in the coming years. It is used in manufacturing cans both aerosol and non-aerosol, which have high demand among the consumers. However, properties such as easy to mold and lightweight compel the manufacturers use plastic as a packaging material. They are mostly used for roll-on and stick pack perfumes, which do not hold a major share in the market but are finding new grounds among the manufacturers looking for innovations in their products. However, government’s stringent regulations and ban on plastic bags in countries such as India have proven to be a restraining factor for the growth of the plastic segment.

Regional Insights

North America held the largest share of 36.9% in 2018. The region continues to be the leading market owing to adoption of luxurious living style by the consumers in the region. This region is followed by Europe, which also holds a significant share in the market. Currency fluctuation in Europe has led to a considerable rise in tourist consumers, which results in the growth of luxury products including perfume and fragrance.

Asia Pacific is also expected to significantly contribute to the market growth over the forecast period. Countries such as China and Japan are majorly driving the market in the region. Japan accounts for a large share in the luxury goods market, which includes the perfume market. Strong currency rates and rise in the disposable income make the county a promising market, thereby boosting market growth in the overall region.

Key Companies & Market Share Insights

The global market comprises companies that are into glass packaging, metal packaging solutions, and manufacturing and distribution of rigid bottles for the perfume industry. Manufacturers are focusing on expansion of their geographical range by engaging in mergers and acquisitions with other companies. Their key objective is to increase their market share and cut down their operational cost. The competitors mainly compete based on product quality, technological innovations, price, volume, and capacity.

Manufacturers are also engaged in innovative solutions to attract consumer’s attention. For instance, DuPont Packaging & Industrial Polymers had introduced an innovative and interactive game called ‘Design Your Perfume Bottle’ for personalizing the bottles in Cosmoprof Asia. This game provided options for bottles and caps in a variety of forms, transparencies, decorative effects, and colors.

Key players having a strong presence in the global market are Estee Lauder, Gerresheimer AG, Chanel, Swallowfield Plc, Saverglass sas, Albea S.A., Intrapac International Corporation, AVON, Verescence France SASU, and SGB Packaging Group.

Perfume & Fragrance Packaging Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 10.3 billion

Revenue forecast in 2025

USD 14.2 billion

Growth Rate

CAGR of 5.5% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., U.K., France, Japan, China, Brazil, and Saudi Arabia

Key companies profiled

Estee Lauder, Gerresheimer AG, Chanel, Swallowfield Plc, Saverglass sas, Albea S.A., Intrapac International Corporation, AVON, Verescence France SASU, and SGB Packaging Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels, and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global perfume and fragrance packaging market report based on product type, raw material, and region:

-

Product Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

Bottles

-

Cans

-

Others

-

-

Raw Material Outlook (Revenue, USD Billion, 2015 - 2025)

-

Glass

-

Plastic

-

Metal

-

Paperboard

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

U.S

-

-

Europe

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global perfume and fragrance packaging market size was estimated at USD 10.3 billion in 2019 and is expected to reach USD 10.9 billion in 2020.

b. The global perfume and fragrance packaging market is expected to grow at a compound annual growth rate of 5.5% from 2019 to 2025 to reach USD 14.2 billion by 2025.

b. North America dominated the perfume and fragrance packaging market with a share of 36.9% in 2019. This is attributable to the increasing adoption of luxurious living style by the consumers in the region.

b. Some key players operating in the perfume and fragrance packaging market include Estee Lauder, Gerresheimer AG, Chanel, Swallowfield Plc, Saverglass sas, Albea S.A., Intrapac International Corporation, AVON, Verescence France SASU, and SGB Packaging Group.

b. Key factors that are driving the market growth include attractive packaging offerings by manufacturers in order to lure the consumers towards the product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.