- Home

- »

- Personal Care & Cosmetics

- »

-

Essential Oils Market Size & Share, Industry Report, 2033GVR Report cover

![Essential Oils Market Size, Share & Trends Report]()

Essential Oils Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Orange, Cornmint, Eucalyptus), By Application (Medical, Food & Beverages, Spa & Relaxation, Cleaning & Home), By Sales Channel (Direct Selling), By Region, And Segment Forecasts

- Report ID: 978-1-68038-549-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Essential Oils Market Summary

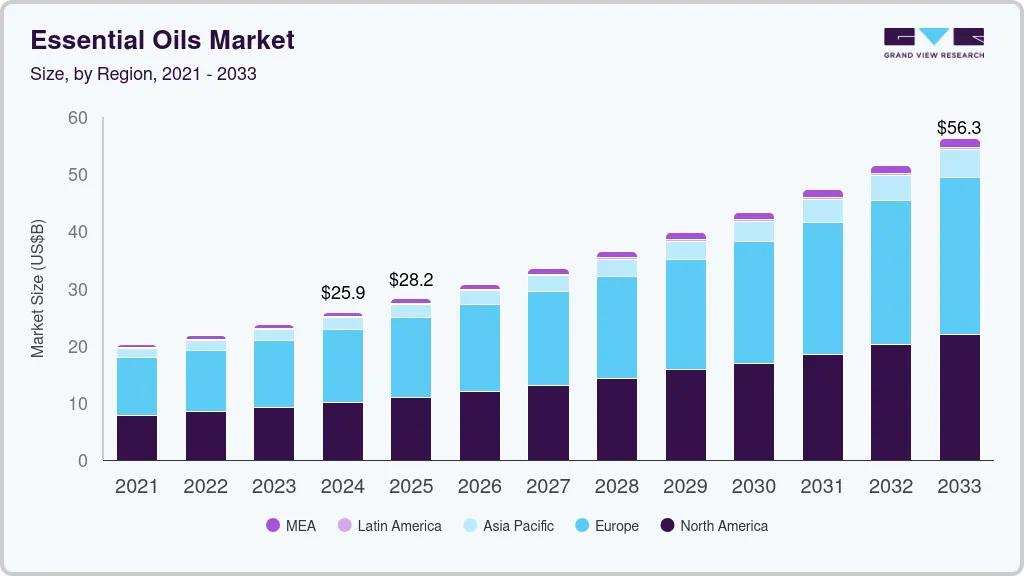

The global essential oils market size was estimated at USD 25.86 billion in 2024 and is projected to reach USD 56.25 billion by 2033, growing at a CAGR of 9.0% from 2025 to 2033. The market is driven by rising demand across food and beverages, personal care, cosmetics, and aromatherapy.

Key Market Trends & Insights

- The Europe segment dominated the market with a revenue share of over 49.4% in 2024.

- The Asia Pacific essential oils market is expected to grow fastest with a CAGR of 9.8% from 2025 to 2033.

- By product, the acorus calamus essential oils segment is expected to grow at a considerable CAGR of 13.5% from 2025 to 2033.

- By application, the food & beverages segment is expected to grow at a considerable CAGR of 9.3% from 2025 to 2033.

- By sales channel, the direct selling segment accounted for the revenue share of 46.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.86 Billion

- 2033 Projected Market Size: USD 56.25 Billion

- CAGR (2025 - 2033): 9.0%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing consumer preference for natural ingredients, clean-label products, and wellness trends fuels adoption. Expanding applications in pharmaceuticals, household care, and spa treatments further boost market growth worldwide. Increasing consumption of beer and other alcoholic beverages is anticipated to fuel the growth of the flavors market. Essential oils contain complex, volatile chemical compounds renowned for their antifungal, antibacterial, anti-inflammatory, and antiviral properties. Unlike many conventional medicines and drugs, these oils generally do not have significant side effects. These factors are expected to be major drivers of market growth. Conventional medicines and pharmaceuticals are also incorporating pleasant-smelling aroma compounds to mask unpleasant chemical odors. Moreover, essential oils are gradually replacing various chemicals, drugs, and medicines due to their health benefits and reduced risk of side effects.

The rising demand for convenience and ready-to-eat meals, along with health and wellness foods, coupled with technological advancements, is expected to propel the growth of the food flavors market. Rapid industrialization and growing disposable incomes in emerging economies such as China and India are also projected to support the global food flavors market during the forecast period.

Essential oils such as rose, sandalwood, Melissa, and German chamomile, which are extensively used in aromatherapy, are costly due to the complex extraction processes involved. The high prices of these key oils pose a challenge to the growth of the aromatherapy industry in developing countries like India and Malaysia, compared to developed nations like the UK, France, and the U.S. However, increasing GDP and numerous untapped market opportunities in the Asia Pacific region are encouraging aromatherapy companies to expand their operations in emerging economies such as India, China, and Indonesia.

Large areas of forests have been cleared to extract small quantities of oil, and extensive arable land has been converted into monoculture farms dedicated to cultivating specific plants for oil production. This cultivation is often carried out by large multinational corporations that neglect environmental sustainability and threaten ecosystems. As a result, it is becoming increasingly challenging to grow sufficient plants to produce even a pound of oil.

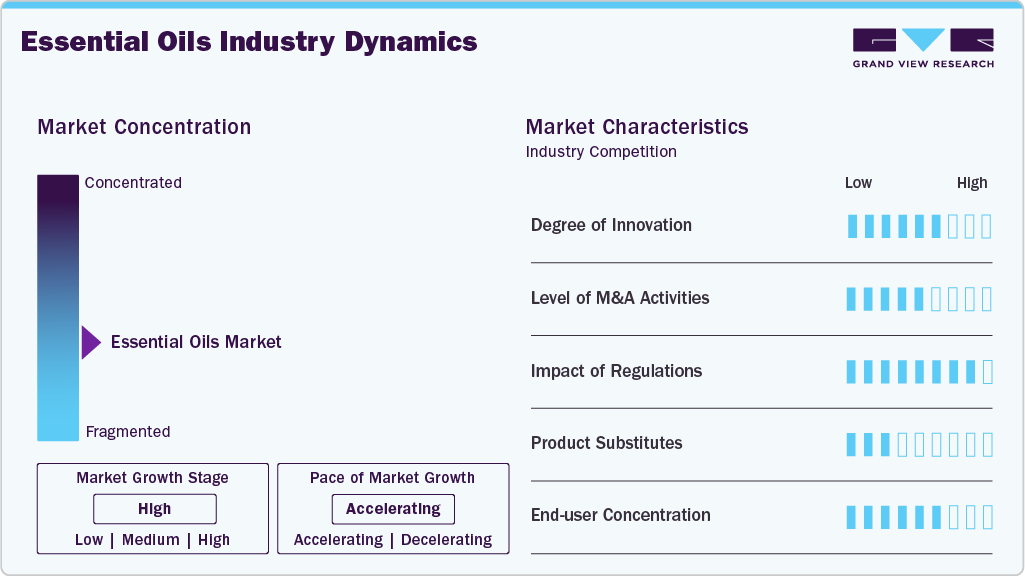

Market Concentration & Characteristics

Market growth is strong and advancing at an accelerating rate. The essential oils market is marked by a high degree of innovation, driven by technological advancements in manufacturing across different stages of the value chain. There is also a notable shift towards adopting green chemistry and biotechnology for product development purposes.

The essential oils market also sees a high level of merger and acquisition (M&A) activity among leading players aiming to strengthen their market position and expand their regional footprint. The rapid growth of major end-use industries has motivated key market participants to pursue this strategy to consolidate their presence.

Additionally, the market faces increasing regulatory oversight. International bodies such as the United Nations (UN) and the European Union (EU) have established specific guidelines and regulations governing the production, harvesting, and processing of flowers and aromatic crops. There are limited product substitutes within the essential oils market. Growing demand for chemical-free cosmetics has driven the use of essential oils as alternatives to traditional chemicals. However, competition may emerge through new technologies or innovative ingredients, with biotechnology and chemical synthesis potentially replacing conventional distillation methods.

End user concentration plays a crucial role in the essential oils market. The rising demand for flavors and fragrances in food and beverages, along with the increasing popularity of natural personal care products formulated with various aroma compounds and essential oils, is expected to drive further market growth.

Product Insights

The orange essential oil segment dominated the market with the largest revenue share of 8.3% in 2024. This growth is primarily driven by its wide-ranging applications in food and beverages, personal care, and aromatherapy. Orange oil is valued for its refreshing scent, antimicrobial properties, and mood-enhancing effects, making it a popular ingredient in natural cleaning products and cosmetics. Its demand has also surged due to increasing consumer preference for citrus-based, organic solutions. Additionally, the rising awareness of the therapeutic benefits of orange oil in stress relief and skincare continues to fuel its market dominance across various industries.

The Acorus Calamus segment is expected to grow at a CAGR of 13.5% from 2025 to 2033. This segment is propelled by increasing demand for natural remedies in traditional and alternative medicine. Acorus Calamus, known for its anti-inflammatory, sedative, and digestive properties, is gaining traction in the pharmaceutical and wellness sectors. Rising consumer interest in Ayurvedic and herbal products, coupled with growing research on their therapeutic benefits, is further driving their adoption. Additionally, its use in perfumery and personal care formulations is contributing to market growth, particularly in emerging economies seeking plant-based solutions.

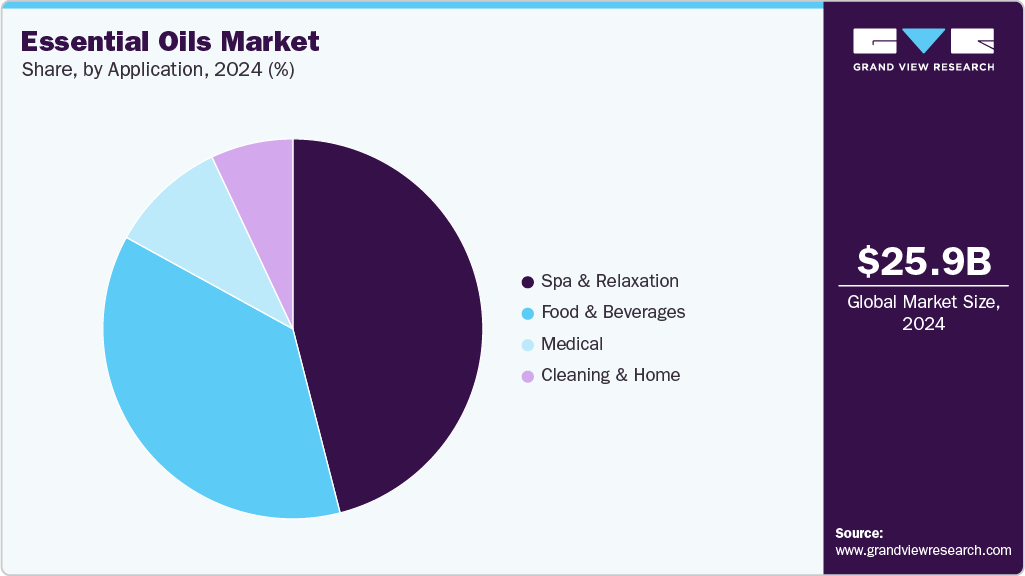

Application Insights

Spa & relaxation segment dominated the market and accounted for the largest revenue share of 45.6% in 2024. This growth is driven by rising consumer focus on wellness, mental health, and stress relief. Growing awareness about the therapeutic benefits of aromatherapy including mood enhancement, anxiety reduction, and improved sleep has fueled demand for essential oils in spas, wellness centers, and home settings. Increasing disposable incomes and lifestyle shifts toward self-care rituals globally are further boosting this segment. Additionally, expanding premium spa chains, wellness retreats, and hotel spas in emerging markets like Asia-Pacific and Latin America contribute to sustained growth in this category.

The food & beverages segment is predicted to grow with a CAGR of 9.3% from 2025 to 2033. This segment is increasing due to rising demand for clean-label, natural flavoring agents. Consumers are increasingly favoring chemical-free, plant-based ingredients for enhanced taste and health benefits. Essential oils are widely used to add unique flavors and extend shelf life in baked goods, beverages, and functional foods. Stricter food safety regulations and a shift away from synthetic additives further boost adoption. Innovation in ready-to-eat meals and health drinks, coupled with growth in the natural and organic food industry, supports robust demand.

The pleasant aroma of essential oils makes them highly suitable for use in personal care items, including cosmetics, toiletries, and fragrances like perfumes, body mists, and air fresheners. In perfumery, essential oils are classified into base notes, middle notes, and top notes based on their volatility. Additionally, rising disposable incomes and growing consumer awareness about the importance of a healthy lifestyle are expected to drive demand for fragrances made with essential oils.

These natural fragrances also play a key role in aromatherapy and various relaxation practices. Oils such as chamomile, cedarwood, peppermint, rose, eucalyptus, sandalwood, tea tree, lavender, jasmine, rosemary, and lemon are believed to help alleviate stress and refresh the mind. Lavender oil, for example, is used to ease migraines, while rosemary oil is known to help improve focus and mental clarity.

Personal care has emerged as a vital sub-segment within spa & relaxation in the global essential oils market, as these oils are frequently used in stress-relief treatments. They are also applied in products for skin and hair care, makeup, and color cosmetics. Furthermore, they find use in oral care for cleaning teeth and gums, and are common ingredients in soaps, shampoos, and baby care products.

Growing consumer preference for natural and organic ingredients continues to strengthen demand for essential oils in personal care formulations. These oils are also extensively used in perfumes, body mists, and air fresheners.

Sales Channel Insights

Direct selling segment accounted for the revenue share of 46.8% in 2024. However, other sales channels, driven by growing awareness of essential oils among consumers, have led to increased retail sales, particularly through convenience stores. At the same time, major players have implemented multi-level marketing strategies to broaden their reach and boost sales.

Many importers and wholesalers have also launched dedicated websites to support online sales alongside their traditional over-the-counter operations. The distribution network for these products is expected to become more complex, as some sellers concentrate exclusively on online channels to strengthen their global presence.

Companies provide attractive compensation plans and discounts to their distributors to help drive sales. For example, doTerra has built a base of 5 million customers worldwide, with 70% comprising wholesale buyers. Such platforms expand product reach, raise awareness among potential customers, and ultimately contribute to higher sales volumes.

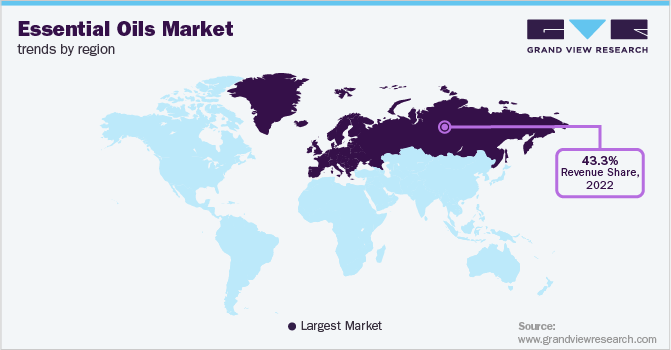

Regional Insights

The Europe essential oil market dominated the global landscape with a revenue share of 49.4% in 2024. This is due to the large population base and the presence of several untapped markets, which are likely to draw the attention of key players looking to expand and set up operations and distribution networks in this region. In Europe, the industry has benefited from organizations such as the European Federation of Essential Oils (EFEO), which was established to protect and promote the interests of stakeholders throughout the market value chain.

The EFEO is actively engaging with the European Commission and the EU Parliament to revise or introduce legislation related to essential oils. These developments have supported market growth in the region. Abundant feedstock availability and the presence of numerous industry participants are key factors behind Europe’s leading market share. Additionally, its early economic development and higher standard of living contribute significantly to the growth of major end-use industries.

Germany essential oils market is propelled by a rising preference for natural and sustainable personal care and aromatherapy products, underpinned by eco-conscious consumer trends and strong regulatory support. High-quality extraction technologies like supercritical CO₂ ensure premium oils, further attracting global interest and investment. Expanding spa, wellness, and home fragrance sectors leverage essential oils for therapeutic and sensory applications. E‑commerce growth and clean‑label demands, combined with Germany’s role as a major importer and exporter, reinforce its market dominance.

North America Essential Oils Market Trends

The North America essential oils market is driven by rising consumer preference for natural and organic products across the personal care, wellness, and food sectors. Growing awareness of aromatherapy’s health benefits, coupled with increasing demand for clean-label, chemical-free ingredients, fuels adoption. Expanding applications in functional beverages, natural flavors, and eco-friendly home care further support growth. Strong retail networks, robust e-commerce penetration, and active product innovation by key players also contribute. Additionally, a health-conscious population and sustainability trends strengthen long-term market expansion.

U.S. Essential Oil Market Trends

The U.S. essential oils market is experiencing sustained momentum due to rising consumer awareness of natural wellness products and growing demand for clean-label ingredients in personal care, aromatherapy, and household products. Increasing use in food and beverage flavoring, coupled with the popularity of DIY home remedies and natural cleaning solutions, is fueling market growth. Expanding e-commerce channels and innovative product launches by major brands further support demand. Additionally, the trend toward sustainable and organic sourcing strengthens the market’s long-term outlook.

Asia Pacific Essential Oils Market Trends

The Asia Pacific essential oils market is expected to grow fastest with a CAGR of 9.8% from 2025 to 2033. The market is increasing steadily due to rising disposable incomes, increasing awareness of natural wellness solutions, and expanding middle-class populations in countries like India, China, and Indonesia. Strong demand for natural ingredients in cosmetics, personal care, and food and beverages supports this trend. The booming spa and aromatherapy sector, coupled with traditional uses of essential oils in Ayurveda and herbal medicine, further drives growth. Additionally, improving production capabilities, sustainable farming practices, and supportive government policies encourage both domestic use and exports across the region.

China essential oils marketis experiencing consistent growth, driven by rising health awareness, a growing middle class, and strong demand for natural, plant-based ingredients in cosmetics, personal care, and traditional medicine. The popularity of aromatherapy, wellness treatments, and spa services is also boosting consumption. China’s large-scale agricultural base ensures ample raw material supply, while government support for herbal and traditional products strengthens domestic production. Additionally, e-commerce growth and international trade partnerships are helping local producers expand their reach in global markets.

Latin America Essential Oils Market Trends

The Latin America essential oils market is growing steadily, driven by increasing consumer interest in natural wellness products and traditional remedies. Rising demand for aromatherapy, spa treatments, and herbal cosmetics supports this trend, especially in Brazil and Mexico. The food and beverage industry is also adopting essential oils for clean-label flavoring. Abundant biodiversity provides rich raw material sources, while sustainable harvesting practices attract ethical buyers. Expanding e-commerce, urbanization, and a younger, health-conscious population further boost market growth across the region.

Middle East and Africa Essential Oils Market Trends

The Middle East and Africa essential oils market is expanding due to rising awareness of natural health products, wellness tourism, and premium fragrance demand. Traditional use of oils like frankincense and oud supports strong cultural acceptance. Growth in luxury personal care, perfume, and spa sectors fuels consumption. Increasing disposable incomes, urbanization, and a focus on holistic well-being contribute to market expansion. Local production capabilities and government initiatives promoting herbal medicine and alternative therapies further strengthen the region’s growth potential.

Key Essential Oils Company Insights

Some key players operating in the market include Givaudan, International Flavors & Fragrances Inc., and ROBERTET GROUP.

-

Givaudan develops, formulates, and distributes flavor and fragrance solutions worldwide. The company caters its services through two major divisions, namely flavors and fragrances. The company has a global presence across 181 locations with 77 production site and 69 creation centers.

-

International Flavors & Fragrances Inc. manufactures and supplies a wide range of ingredients and compounds globally. The company operates through three business segments, namely Taste, Scent, and Frutarom. The taste segment includes savory solutions, flavor compounds, nutrition & specialty ingredients, and inclusions.

-

ROBERTET GROUP develops and distributes specialty ingredients for the flavor, fragrance, cosmetics, food & beverage, and healthcare industries. In addition, the company also develops in-house flavors and fragrances and supplies them to end-use industries for formulating consumer products. The company operates through 4 business divisions, namely natural raw material, flavor, fragrance, and active ingredients. The raw materials division produces a wide range of ingredients such as essential oils, aroma chemicals, fractions, isolates, oleoresins, and floral extracts for aromatherapy, fragrance, flavor, health, and beauty applications.

-

VedaOils and BMV Fragrances Pvt. Ltd are some of the emerging participants in the essential oils market.

-

VedaOils is a manufacturer and distributor of essential oils, carrier oils, and raw ingredients worldwide. It caters its products to the fragrances, cosmetics, personal care, and aromatherapy industries worldwide.

-

BMV Fragrances Pvt. Ltd. manufactures and distributes essential oils and resins worldwide. The company caters its products to the flavors, fragrance, and aromatherapy industries.

Key Essential Oils Companies:

The following are the leading companies in the essential oils market. These companies collectively hold the largest market share and dictate industry trends.

- Sydney Essential Oil Co. (SEOC)

- Biolandes SAS

- India Essential Oils

- H. Reynaud & Fils (HRF)

- Young Living Essential Oils

- DoTerra

- Essential Oils of New Zealand

- Farotti S. R. L.

- Flavex Naturextrakte GmbH

- Falcon

- Ungerer Limited

Recent Developments

-

In October 2023, Azelis, a leading service provider in the specialty chemicals and food ingredients sector, completed the full acquisition of BLH SAS, a French distributor specializing in flavors and fragrances for the fine perfumery industry.

-

In June 2023, Turpaz Industries revealed its acquisition of Food Base, a Hungarian firm known for developing and supplying essential oils, herbal extracts, and flavors for the food and beverage sector, for approximately USD 9.5 million (around 3.3 billion Hungarian Forint).

-

In January 2023, PT Indika Energy Tbk (INDY) announced its expansion into the essential oils sector through its subsidiary, PT Indika Multi Properti (IMP), which secured a 46% ownership stake in PT Natura Aromatik Nusantara (NAN) for IDR 179.60 billion (roughly USD 11.55 billion)..

Essential Oils Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.17 billion

Revenue forecast in 2033

USD 56.25 billion

Growth rate

CAGR of 9.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kiloKilotons, revenue in USD billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; RoEU; China; India; Japan; Taiwan; South Korea; Singapore; Australia; RoAPAC; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Sydney Essential Oil Co. (SEOC); Biolandes SAS; India Essential Oils; H. Reynaud & Fils (HRF); Young Living Essential Oils; DoTerra; Essential Oils of New Zealand; Farotti S.R.L.; Flavex Naturextrakte GmbH; Falcon; Ungerer Limited.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Essential Oils Market Report Segmentation

This report forecasts volume & revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global essential oils market report based on product, application, sales channel, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Acorus Calamus

-

Ajowan

-

Basil

-

Black Pepper

-

Cardamom

-

Carrot Seed

-

Cassia

-

Cedarwood

-

Celery

-

Cinnamon

-

Citronella

-

Clove

-

Cornmint

-

Cumin Seed

-

Curry Leaf

-

Cypress

-

Cypriol

-

Davana

-

Dill Seed

-

De-Mentholised Peppermint

-

Eucalyptus

-

Fennel

-

Frankincense

-

Garlic

-

Ginger

-

Holy Basil

-

Juniper Berry

-

Lavender

-

Lemon

-

Lemongrass

-

Lime

-

Mace

-

Mustard

-

Neem

-

Nutmeg

-

Orange

-

Palmarosa

-

Patchouli

-

Pepper Mint

-

DMO

-

Rosemary

-

Spearmint

-

Turmeric

-

Vetiver

-

Ciz-3 Hexanol

-

Tea Tree

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Medical

-

Pharmaceutical

-

Nutraceuticals

-

-

Food & Beverages

-

Bakery

-

Confectionery

-

Dairy

-

RTE meals

-

Beverages

-

Meat, Poultry & Seafood

-

Snacks & Nutritional Bars

-

-

Spa & Relaxation

-

Aromatherapy

-

Massage Oil

-

Personal Care

-

Cosmetics

-

Hair Care

-

Skin Care

-

Sun Care

-

Makeup And Color Cosmetics

-

-

Toiletries

-

Soaps

-

Shampoos

-

Men's Grooming

-

Oral Care

-

Baby Care

-

-

Fragrances

-

Perfumes

-

Body Sprays

-

Air Fresheners

-

Cleaning & Home

-

-

-

Kitchen Cleaners

-

Floor Cleaners

-

Bathroom Cleaners

-

Fabric Care

-

-

Sales Channel Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Direct Selling

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global essential oils market size was estimated at USD 25.86 billion in 2024 and is expected to reach USD 28.17 billion in 2025.

b. The global essential oils market is expected to grow at a CAGR of 9.0% from 2025 to 2033 to reach USD 56.25 billion in 2033.

b. Europe market dominated the global landscape with a revenue share of 49.4% in 2024. This is due to the large population base and the presence of several untapped markets, which are likely to draw the attention of key players looking to expand and set up operations and distribution networks in this region. In Europe, the industry has benefited from organizations.

b. Some key players operating in the essential oils market include Sydney Essential Oil Co. (SEOC), Biolandes SAS, India Essential Oils, H. Reynaud & Fils (HRF), Young Living Essential Oils, DoTerra, Essential Oils of New Zealand, Farotti S.R.L., Flavex Naturextrakte GmbH, Falcon, Ungerer Limited.

b. The global essential oils market is driven by the rising demand for natural ingredients, growing awareness of health and wellness, expanding applications in food, personal care, and aromatherapy, plus clean-label trends and sustainable sourcing practices are key factors driving the global essential oils market forward.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.