- Home

- »

- Beauty & Personal Care

- »

-

Organic Makeup Remover Market, Industry Report, 2030GVR Report cover

![Organic Makeup Remover Market Size, Share & Trends Report]()

Organic Makeup Remover Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Hypermarket & Supermarket, Pharmacies & Drug Stores, E-commerce), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-147-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Makeup Remover Market Trends

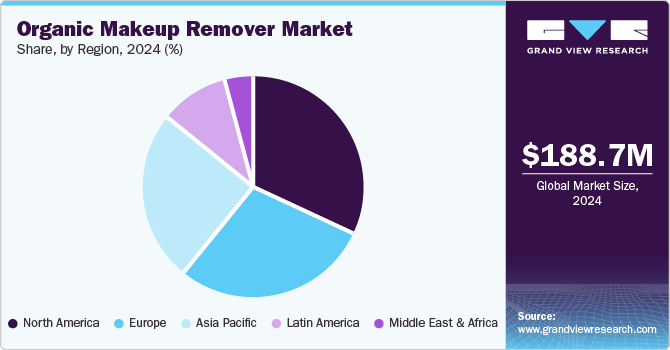

The global organic makeup remover market size was valued at USD 188.7 million in 2024 and is expected to grow at a CAGR of 14.0% from 2025 to 2030. Increasing consumer awareness about the harmful effects of synthetic chemicals used in conventional makeup removers is leading more individuals to seek organic alternatives. The rising trend of health and wellness, coupled with a growing preference for sustainable and eco-friendly products, further propels the demand for organic makeup removers. Social media influence and beauty influencers who advocate for natural and organic skincare routines are significantly boosting market growth.

Innovations in product formulations and the introduction of diverse organic ingredients tailored to various skin types and concerns are attracting a wider consumer base. Moreover, the availability of organic makeup removers through various retail channels, including online platforms, specialty stores, and supermarkets, ensures easy access for consumers. The rise in disposable income and changing lifestyles, particularly in emerging economies, are contributing to increased spending on premium and organic skincare products.

Companies offering organic beauty care products have been meticulously focusing on green processing and practices by using eco-friendly packaging methods, ingredient labeling, and certification labeling to maintain transparency amongst consumers and pique their interest. For instance, in March 2019, Organic Harvest, a certified beauty and cosmetics brand, launched Organic Micellar Water in the facial care segment, containing aloe vera extracts. The product is 100% organic certified, vegan, and cruelty-free. Similarly, in January 2020, MARA Beauty launched Algae Enzyme cleansing oil in the skincare category, which includes moringa, chia, squalene oils, and fruit enzymes such as papaya, pumpkin, pineapple, and grapefruit.

Enthused by the market growth in the e-commerce space, many startups and small-cap brands prefer investing in social media and e-commerce retailing to expand customer offerings by tapping into new markets. Different offers, sales, discounts, and loyalty programs exist on the company’s website or e-retailers, such as Nykaa and Amazon, to attract consumers. For instance, CAUDALIE, an organic and natural skincare brand that offers organic makeup remover products, provides a membership program called The MYCAUDALIE Loyalty Programme that allows customers to buy products to collect points, which can be further exchanged for gifts or value-added benefits.

Distribution Channel Insights

Hypermarkets and supermarkets dominated the market, with the largest revenue share of 40.4% in 2024. The segment growth is attributed to the wide variety of organic makeup removers, making it convenient for consumers to find and purchase these products during their regular shopping trips. The ability to physically inspect products before purchase, along with in-store promotions and discounts, enhances the shopping experience and drives consumer confidence. Additionally, hypermarkets and supermarkets often carry well-known and trusted brands, further encouraging consumers to choose these outlets for their organic skincare needs. The extensive reach and accessibility of these retail channels ensure that a broad range of consumers can easily access organic makeup removers.

The e-commerce segment is expected to grow at the fastest CAGR of 14.6% over the forecast period. The convenience and accessibility offered by online shopping are major drivers, allowing consumers to purchase organic makeup removers from the comfort of their homes. E-commerce platforms provide a wide variety of options, detailed product descriptions, customer reviews, and ratings, helping consumers make informed decisions. The influence of digital marketing and social media advertising is effectively reaching a broader audience and boosting online sales. Exclusive online discounts, promotions, and subscription services further incentivize consumers to choose e-commerce channels. The rise of tech-savvy consumers who prefer the flexibility of online shopping and the ability to compare prices and products across multiple platforms also contributes to the growth of the e-commerce segment.

Regional Insights

North America organic makeup remover market dominated the global market with the largest revenue share of 32.6% in 2024. Increasing consumer awareness about the potential harmful effects of synthetic ingredients in conventional makeup removers is prompting a shift towards organic alternatives.

North American consumers are highly conscious of health and wellness, prioritizing natural, eco-friendly products, and free from harmful chemicals. The influence of social media and beauty influencers advocating for organic skincare routines is significantly boosting market growth. The region's high disposable income levels enable consumers to invest in premium organic makeup removers. Additionally, the availability of a wide range of organic makeup removers through various retail channels, including hypermarkets, supermarkets, specialty stores, and online platforms, ensures easy access for a broad consumer base.

U.S. Organic Makeup Remover Market Trends

The U.S. organic makeup remover industry is expected to grow significantly over the forecast period owing to the increasing consumer awareness about the harmful effects of synthetic chemicals in conventional makeup removers. The health and wellness trend, which emphasizes the use of natural and eco-friendly products, is strongly influencing consumer preferences. Social media and beauty influencers play a crucial role in promoting organic skincare routines, reaching a wide audience, and driving demand. Additionally, the growing focus on sustainable and cruelty-free products is boosting the market as consumers become more environmentally conscious.

Europe Organic Makeup Remover Market Trends

Europe organic makeup remover market held a considerable share in 2024. European consumers are highly health-conscious and prefer products that are free from harmful chemicals and synthetic ingredients. The increasing awareness of environmental sustainability and the demand for eco-friendly and biodegradable products are significant drivers. Social media influence and beauty trends promoting natural beauty routines further boost the market. Additionally, the presence of well-established organic beauty brands and continuous innovation in product formulations cater to the diverse preferences of European consumers.

Asia Pacific Organic Makeup Remover Market Trends

Asia Pacific organic makeup remover industry is expected to grow at the fastest CAGR of 14.2% over the forecast period. The region’s growth is attributed to rapid urbanization and rising disposable incomes, particularly in emerging economies such as China and India. Consumers in this region are becoming more health-conscious and increasingly aware of the benefits of organic and natural products. The influence of traditional beauty practices and using natural ingredients in skincare formulations are significant drivers. The growing middle-class population is willing to spend more on high-quality, premium organic skincare products. The expansion of retail channels, including supermarkets, specialty stores, and online platforms, is making organic makeup removers more accessible to a wider audience.

Key Organic Makeup Remover Company Insights

Some key companies in the organic makeup remover market include Content Beauty & Wellbeing, AROMATICA, Foxbrim Naturals, INIKA Organic Australia, SKY ORGANICS, Nature's Brands, Inc., and others.

-

Content Beauty & Wellbeing is a leading retailer in the natural and organic beauty space. The company offers a wide range of skincare and makeup products, including organic makeup removers. Content Beauty & Wellbeing is committed to offering products that are cruelty-free, vegan, and free from harmful chemicals, making them a trusted choice for those seeking natural and organic skincare solutions.

-

Aromatica is a Korean skincare brand founded by aromatherapist Jerry Kim. The brand is known for its natural, organic, and environmentally conscious products.Aromatica products are ECOCERT & COSMOS certified, vegan, and EWG verified, ensuring that they meet high standards for natural and organic skincare.

Key Organic Makeup Remover Companies:

The following are the leading companies in the organic makeup remover market. These companies collectively hold the largest market share and dictate industry trends.

- Content Beauty & Wellbeing

- AROMATICA

- Foxbrim Naturals

- INIKA Organic Australia

- SKY ORGANICS

- Nature's Brands, Inc.

- Caudalie

- BurtsBees

- Bloomtown LTD.

Recent Development

-

In February 2024, Natracare announced that its COSMOS Organic Certified Cleansing Makeup Remover Wipes received Environmental Working Group (EWG) certification.

Organic Makeup Remover Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 205.5 million

Revenue forecast in 2030

USD 395.2 million

Growth Rate

CAGR of 14.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE

Key companies profiled

AROMATICA; Foxbrim Naturals; INIKA Organic Australia; SKY ORGANICS; Nature's Brands, Inc.; Caudalie; BurtsBees; Bloomtown LTD.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Makeup Remover Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic makeup remover market report based on distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket and Supermarket

-

Pharmacies and Drug Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.