- Home

- »

- Beauty & Personal Care

- »

-

Makeup Remover Market Size, Share & Growth Report, 2030GVR Report cover

![Makeup Remover Market Size, Share & Trends Report]()

Makeup Remover Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Liquid, Lotion, Wipes), By Price (Low, Medium, High) By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-206-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Makeup Remover Market Summary

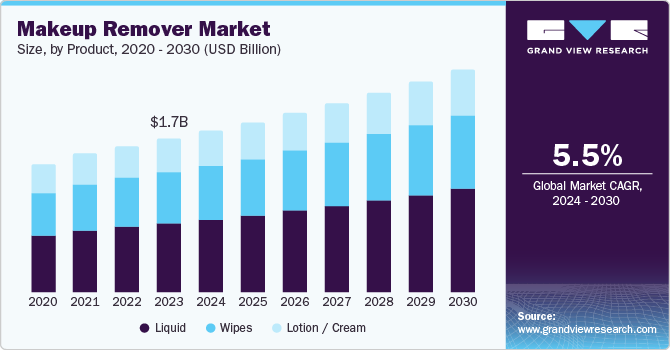

The global makeup remover market size was estimated at USD 1,735.4 million in 2023 and is projected to reach USD 2,516.1 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The market surge can be credited to the increased awareness and consciousness about skincare and beauty routines.

Key Market Trends & Insights

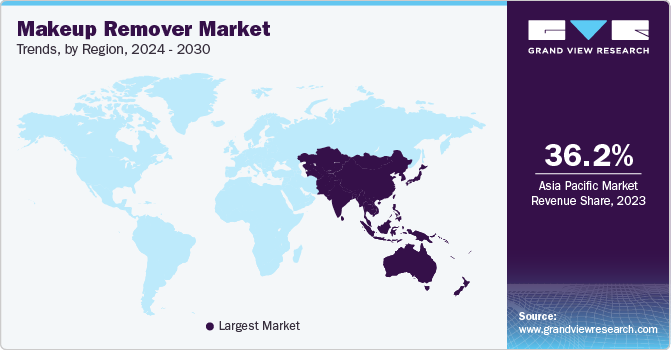

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, liquid accounted for a revenue of USD 1,735.4 million in 2023.

- Liquid is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,735.4 Million

- 2030 Projected Market Size: USD 2,516.1 Million

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

Consumers have increasingly become concerned about the potential harmful effects of synthetic chemicals and are seeking products that are gentle on the skin and environmentally friendly. This shift has led to a rise in the popularity of makeup removers that use natural ingredients, such as micellar water and oil-based formulations.

The proliferation of online retail channels has also played a crucial role in driving the makeup remover market. E-commerce platforms offer a wide range of products, often at competitive prices, and provide the convenience of shopping from home. This has made it easier for consumers to access a variety of makeup removers, compare products, and read reviews before making a purchase. In addition, the influence of beauty influencers and social media has significantly boosted consumer awareness and interest in makeup and skincare products. Online tutorials and reviews have helped consumers make informed decisions and discover new products, further fueling market growth.

Moreover, technological advancements in product formulations and packaging have significantly driven the market. Innovations such as micellar technology, which offers gentle and effective cleansing, have made makeup removers more appealing to consumers. To cater to the growing consumer demand, brands have increasingly focused on creating convenient and user-friendly packaging, such as wipes and pads, to suit the on-the-go lifestyle of modern consumers. These advancements enhance the user experience and differentiate products in a highly competitive market.

Products Insights

Liquid products have dominated the market with a 44.8% share in 2023 attributed to the increasing consumer preference for products that offer both efficacy and convenience. Liquid makeup removers, particularly those formulated with micellar water, are highly effective in removing makeup without the need for rigorous scrubbing, which makes them a popular choice among consumers. These products are especially favored for their ability to cleanse the skin gently while maintaining their natural moisture balance -- crucial for consumers with sensitive skin. In addition, liquid makeup removers that incorporate natural oils and botanical extracts have gained significant traction as they align with the growing trend towards clean beauty and sustainability. This shift is also driven by the increasing availability of information about the potential long-term effects of synthetic ingredients on skin health.

Wipes are expected to register the fastest CAGR during the forecast period as they offer a quick and hassle-free solution for removing makeup. These are particularly popular among busy consumers and those who travel frequently. Their portability and single-use nature make them an ideal choice for on-the-go makeup removal, catering to the fast-paced lifestyles of modern consumers. Consumers have become increasingly conscious of the potential skin issues caused by leaving makeup on overnight, such as clogged pores and breakouts. This awareness has led to a higher demand for effective and efficient makeup removal solutions including wipes. In addition, the trend towards natural and organic skincare products has influenced the wipes market. Brands including Unilever and P&G have offered wipes infused with natural ingredients such as aloe vera, chamomile, and green tea, attracting consumers looking for gentle and skin-friendly options.

Price Insights

The medium price products dominated the market with a revenue share of 47.3% in 2023 owing to their balance between quality and affordability. Consumers in this segment have looked for effective makeup removers that deliver good results without premium price tags. In addition, medium-priced makeup removers feature advanced formulations that effectively cleanse the skin without causing skin irritation and acne. Manufacturers have increasingly introduced products at this price range to attract a larger consumer base including both budget-conscious individuals and those willing to spend more for quality skincare.

The low-price segment is expected to register the fastest CAGR of 6.4% during the forecast period with the increasing demand for affordable beauty and skincare products. As consumers become more budget-conscious, especially in the wake of economic uncertainties, the market observed a heightened preference for cost-effective makeup removers that deliver satisfactory results. Furthermore, discount stores, drugstores, and supermarkets offer a wide range of budget-friendly options, making these products easily available to a broad range of consumers. Moreover, the proliferation of private-label brands has also contributed to the growth of this segment. Retailers have increasingly offered their own branded makeup removers at competitive prices, providing consumers with more choices and driving market expansion.

Distribution Channel Insights

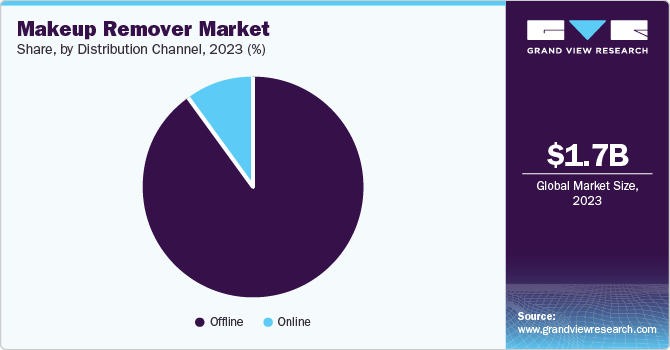

Offline distribution channels secured 89.8% of the market share in 2023 with tangible shopping experiences. Consumers have increasingly preferred testing sensitive products including makeup removers before purchasing. This hands-on experience allows consumers to assess the product’s texture, fragrance, and effectiveness, leading to more informed purchasing decisions. In addition, retail outlets offer personalized customer service. Beauty advisors and skincare experts in stores offer tailored recommendations based on individual skin types and concerns. This enhances the shopping experience and builds customer loyalty.

Online distribution channels are expected to emerge as the fastest-growing segment at a CAGR of 6.2% during the forecast period owing to convenience and ease of shopping. Consumers can browse a wide range of products, compare prices, read reviews, and make purchases from the comfort of their homes. This ease of access is particularly appealing in today’s fast-paced world, where time-saving solutions are highly valued. These channels enable retailers to cater to a global audience with D2C (direct-to-consumers) business strategy and allow consumers from different regions to access products that may not be available locally. This has expanded the market for makeup removers, enabling brands to reach a broader customer base.

Regional Insights

Asia Pacific makeup remover market dominated with a share of 36.2% in 2023 due to rapid urbanization and rising disposable incomes across countries such as China, India, Japan, and South Korea. The market was driven by a greater emphasis on personal grooming and skincare. Furthermore, consumers have become more aware of the importance of proper makeup removal as they are alarmingly influenced by global beauty trends. This awareness is particularly strong among younger demographics, who are highly influenced by beauty influencers and online tutorials that emphasize the need for thorough cleansing to maintain healthy skin.

North America Makeup Remover Market Trends

The makeup remover market in North America held a significant market share in 2023 and is anticipated to witness significant growth during the forecast period owing to the increasing beauty consciousness and skincare awareness among consumers. Consumers have increasingly sought makeup removers free from harsh chemicals and synthetic additives. They have opted for products that use natural oils and botanical extracts. This shift is driven by concerns about the potential long-term effects of synthetic ingredients on skin health and the environment. Brands that prioritize clean beauty and sustainability have significantly gained a competitive edge in the market.

U.S. Makeup Remover Market Trends

The U.S. makeup remover market was augmented by the increasing awareness and emphasis on skincare. Consumers have become progressively more educated about the importance of proper makeup removal to maintain healthy skin, driving demand for effective and gentle makeup removers. They have opted for formulations that include natural oils and botanical extracts shifting towards clean beauty. This trend is particularly strong among millennials and Gen Z, who are highly influenced by social media and beauty influencers advocating for comprehensive skincare routines.

Europe Makeup Remover Market Trends

The makeup remover market in Europe secured a significant revenue share in 2023 owing to the increasing demand for natural and organic products. European consumers have become highly conscious of the ingredients in their skincare products and prefer formulations that align with the clean beauty trend. This is driven by concerns about the potential long-term effects of synthetic ingredients on skin health and the environment.

Key Makeup Remover Company Insights

Some of the leading market players are Procter & Gamble (P&G), L’Oreal, and more. These companies have significantly invested in R&D to diversify their product portfolios in the market, providing further dynamics to its growth. Market players have invested in strategic partnerships to increase their market along with product launches, acquisitions, and mergers.

-

Procter & Gamble (P&G) is a multinational consumer goods company. The company offers a wide range of products including personal care, house cleaning, laundry, and baby care. They have increasingly focused on sustainable product development, and ecofriendly packaging.

-

Johnson & Johnson global healthcare company offers a product in consumer health and pharmaceuticals. The company plans to separate its consumer health business into a separate business to focus on new innovative products in both the businesses.

Key Makeup Remover Companies:

The following are the leading companies in the makeup remover market. These companies collectively hold the largest market share and dictate industry trends.

- L’OREAL GROUPE

- Estée Lauder Inc

- Unilever PLC

- Procter & Gamble

- Natura&Co

- Coty Inc.

- Shiseido Co., Ltd.

- Johnson & Johnson Services, Inc.

- LVMH

- BIODERMA

Recent Development

-

In November 2023, Loreal Paris patented a cosmetic formulation (makeup remover), that contains an antimicrobial agent, this composition is free from surfactants, salicylic acid. This is useful in reducing eye irritation while using the product.

-

In November 2023, Neutrogena, a brand of Johnson & Johnson, completed its partnership with Lenzing’s Veocal fiber brand for the production of their makeup removal wipes, which are 100% plant-based and eco-friendly. The aim of this partnership was to develop a product that has moved from synthetic materials to a cellulose-based solution.

Makeup Remover Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.83 billion

Revenue forecast in 2030

USD 2.52 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Price, Distribution Channel, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Russia, Brazil, South Africa

Key companies profiled

L’OREAL GROUPE; Estée Lauder Inc; Unilever PLC; Procter & Gamble; Natura&Co; Coty Inc.; Shiseido Co.,Ltd.; Johnson & Johnson Services, Inc.; LVMH; BIODERMA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Makeup Remover Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global makeup remover market report based on product, price, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Lotion / Cream

-

Wipes

-

-

Price Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Russia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.