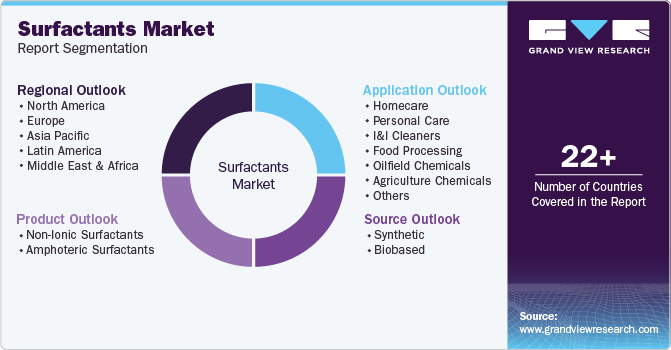

Surfactants Market Size, Share & Trends Analysis Report By Source (Synthetic, Biobased), By Application (Homecare, Personal Care), By Product (Non-Ionic, Amphoteric), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-592-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Surfactants Market Size & Trends

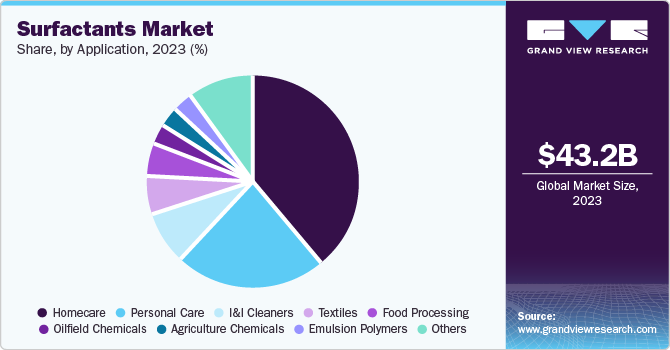

The global surfactants market size was valued at USD 43.2 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The increased demand for personal care goods, including skincare, haircare, and cosmetics has primarily fueled the surfactants market. These chemicals play a crucial role in formulations such as shampoos, shower gels, and lotions, enhancing their cleansing and foaming properties.

The surfactants are essential components in detergents, both for household and industrial use. Their ability to disperse, wet, and emulsify makes them effective cleaning agents, contributing to the market growth. In addition, the flexibility of surfactants makes them suitable for various applications, including textiles, agriculture, and industrial processes. Consumers have increasingly become aware of the benefits of eco-friendly and biodegradable surfactants over petroleum-based synthetic ones. Bio-surfactants found applications as emulsifying agents, biocides, and anticorrosive agents, aligning with eco-friendly trends.

In addition, technological advancements in the production of surfactants have led to more cost-efficient oil recovery techniques in the oil & gas industry, fueling the market demand. Moreover, the rising urbanization in Asia Pacific economies is projected to increase the adoption of eco-friendly, sustainable products. Furthermore, various government regulations imposed in European countries have propelled industries to invest in bio-based technologies that are environmentally friendly.

Source Insights

The synthetic segment secured the dominant market share in 2023 owing to their low production costs and easy availability. Anionic surfactants, in particular, gained prominence for their affordability and widespread use in household detergents, shampoos, and cleaning products. However, environmental concerns have posed significant challenges related to metal toxicity and non-degradability. Ongoing research and development efforts in improving the performance and environmental profile of surfactants are expected to mitigate these environmental consequences, driving market growth.

The bio-based segment is expected to register the fastest CAGR of 5.7% during the forecast period. The demand for sustainable technologies has led to the increased adoption of bio-based surfactants. Bio-surfactants, derived from renewable resources such as sugar and oil, gained prominence due to their eco-friendliness and reduced environmental impact. The shifting consumer preference to sustainable options with the rising per-capita spending capacity drove demand for natural and organic products in personal care and household cleaning goods. These surfactants found versatile applications as emulsifying agents, biocides, and anticorrosive agents. Their compatibility with various products, including detergents, cosmetics, and industrial formulations, contributed to market growth.

Product Insights

The amphoteric surfactants segment dominated with 86.5% of the market share in 2023. These products are known for their mildness and skin-friendly nature which makes them ideal for application in baby care products, sensitive skin products, and high-end cosmetics. They have very excellent properties such as foaming properties, stability in hard water, and great compatibility with other surfactants, which drives their demand. Additionally, consumers have increasingly sought mild and natural ingredients in everyday products such as shampoos, body washes, toothpaste, detergents, and surface cleaners. This has further driven innovation in green surfactants.

Non-ionic surfactants are expected to emerge as the fastest-growing segment over the forecast period. Their excellent stability in hard and soft water, low toxicity, and mildness on skin and eyes make them suitable for extensive applications in personal care, home care, and industrial cleaning. Non-ionic surfactants also perform well in complex formulations and challenging conditions. Hence, they are valued in industrial applications, including agrochemicals, textiles, and oil recovery. Moreover, the increasing consumer awareness about the advantages of non-ionic surfactants over conventional ones has propelled the market. In addition, growing investments in research and development have focused on enhancing the performance, sustainability, and safety of these products.

Application Trends

The homecare segment dominated the market in 2023. Surfactants have been majorly used in household cleaning products such as cleaners, sanitizers, hand wash, laundry detergents, and dishwashing liquids. These are essential ingredients in cleaning agents for their dispersing, wetting, washing, and emulsifying properties. Additionally, the heightened awareness about cleanliness and hygiene, particularly in the post-pandemic era has resulted in the increased adoption of surfactants in this segment. Additionally, the expanding population and rapid urbanization in emerging economies have led to increased consumption of home care goods.

The personal care segment is expected to register growing at the fastest CAGR of 6.0% over the forecast period. The rising disposable income coupled with the increasing awareness about hygiene and cleanliness have driven the demand. Consumers have increasingly sought personal care products containing surfactants, such as shampoos, body washes, and skincare items. Furthermore, the demand for organic and sustainable substances in cosmetics including cleansers, hand sanitizers, and other cleansing products is expected to boost the market.

Regional Trends

The Asia Pacific surfactants market accounted for the dominant market share of 35.4% in 2023 owing to population growth, rapid urbanization, and industrialization in the region. The booming manufacturing sector, especially in personal care and household cleaning has primarily driven the regional market growth. For instance, the Japan surfactants market is expected to grow rapidly in the coming years due to the advanced personal care and cosmetics industry.

North America Surfactants Market Trends

The surfactants market in North America held 26.2% of the global share in 2023 owing to the changing customer preferences. The increasing demand for bio-based and naturally derived surfactants and increasing recognition of environment-friendly products have augmented the market growth.The personal care and home cleaning sectors products are expected to increase the market growth.

U.S. Surfactants Market Trends

The U.S. surfactants market dominated the North America market with a share of 78.5% in 2023 due to the rising awareness towards sustainable products and stricter regulations on chemical products.Moreover, the industrial sector has witnessed increased adoption of specialty surfactants in areas including agriculture, oil and gas, and advanced materials, driving the market growth in the country.

Europe Surfactants Market Trends

The Europe surfactants market registered 24.0% of the market share in 2023. The market was propelled by stringent government regulations and an increasing emphasis on cleanliness and hygiene. The region’s strong focus on green chemistry and circular economy principles has led to an increased adoption of surfactants. Furthermore, Europe's robust industrial sector, particularly in automotive, textiles, and specialty chemicals has contributed to significant demand.

Key Surfactants Company Insights

The surfactants market is intensely competitive. Some of the key companies including Nouryon, Evonik Industries, BASF SE, and others have focused on product development, mergers and acquisitions, and strategic partnerships to increase their competitive edge.

-

Nouryon, a global chemical company, produces essential chemicals for a wide range of industries including personal care, cleaning products, paints and coatings, agriculture, food, and pharmaceuticals. Nouryon-produced surfactants are utilized in the production of shampoos, body washes, dishwashing liquids, and laundry detergents, and specialized applications such as agrochemicals and oilfield chemicals.

-

Evonik Industries majorly focuses on four main business segments, Specialty Additives, Nutrition & Care, Smart Materials, and Performance Materials. The company’s portfolio serves various industries, including automotive, pharmaceuticals, consumer goods and agriculture. They have developed innovative surfactants such as REWOFERM, a bio-based surfactant derived from renewable raw materials.

Key Surfactants Companies:

The following are the leading companies in the surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Nouryon

- Evonik Industries

- Kao Corporation

- BASF SE

- Stepan Company

- Clariant

- Huntsman International LLC

- Dow

- Henkel Adhesives Technologies India Private Limited

- Bayer AG

- Akzo Nobel N.V.

- Godrej Industries Limited

Recent Developments

-

In April 2024, Nouryon announced the launch of Structure M3 co-surfactant, featuring innovative biodegradable personal care technology. This product effectively minimizes the irritation associated with commonly used surfactant systems, offering gentleness, cleansing efficacy, and foaming performance in formulations such as shampoos, facial cleansers, and body washes.

Surfactants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 45.2 billion |

|

Revenue forecast in 2030 |

USD 61.6 billion |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa |

|

Key companies profiled |

Nouryon; Evonik Industries; Kao Corporation; BASF SE; Stepan Company; Clariant; Huntsman International LLC; Dow; Henkel Adhesives Technologies India Private Limited; Bayer AG; Akzo Nobel N.V.; Godrej Industries Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surfactants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surfactants market report based on source, product, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Synthetic

-

Biobased

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Non-Ionic Surfactants

-

Alcohol Ethoxylates

-

Alkyl Phenol Ethoxylates

-

Fatty Acid Esters

-

Fatty Amine Ethoxylates

-

(EO-PO) co-ethoxylates

-

Others

-

-

Amphoteric Surfactants

-

Fatty Alcohol Ethoxylates

-

Lauryl Alcohol Ethoxylates

-

Ceto Stearyl Alcohol Ethoxylates

-

Behenyl Alcohol Ethoxylate

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Homecare

-

Personal Care

-

I&I Cleaners

-

Food Processing

-

Oilfield Chemicals

-

Agriculture Chemicals

-

Textiles

-

Emulsion Polymers

-

Paints & Coatings

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."