- Home

- »

- Medical Devices

- »

-

Medical Tourism Market Size, Share, Industry Report, 2033GVR Report cover

![Medical Tourism Market Size, Share & Trends Report]()

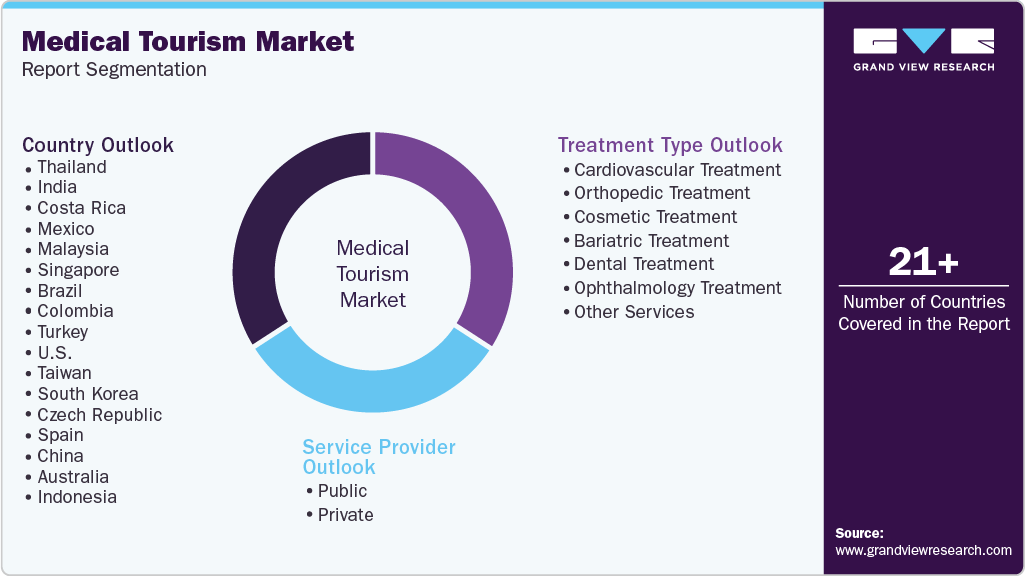

Medical Tourism Market (2026 - 2033) Size, Share & Trends Analysis Report By Treatment Type (Cardiovascular Treatment, Orthopedic Treatment, Cosmetic Treatment, Bariatric Treatment, Dental treatment), By Service Provider, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-508-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Tourism Market Summary

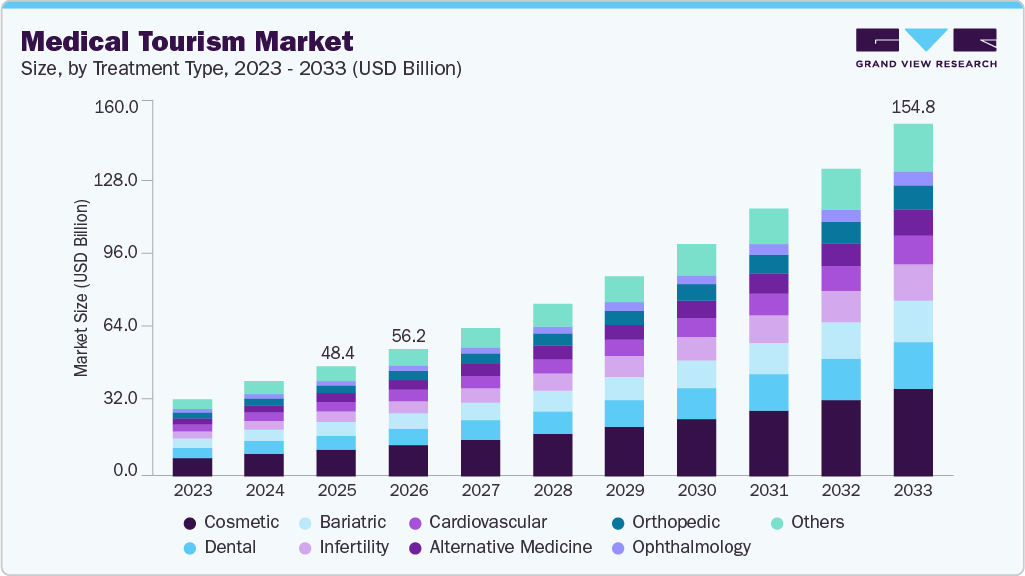

The global medical tourism market size was estimated at USD 48.40 billion in 2025 and is expected to reach an estimated value of USD 154.79 billion by 2033, growing at a CAGR of 15.58% from 2026 to 2033. Major market growth drivers include cost savings and extra benefits to visitors, such as cutting-edge technologies, enhanced healthcare, sophisticated equipment, breakthrough medicines, superior hospitality, and personalized care.

Key Market Trends & Insights

- Thailand dominated the medical tourism market in 2025 with a revenue share of 23.25%.

- By treatment type, the cosmetic segment accounted for the largest revenue share of 24.23% in 2025.

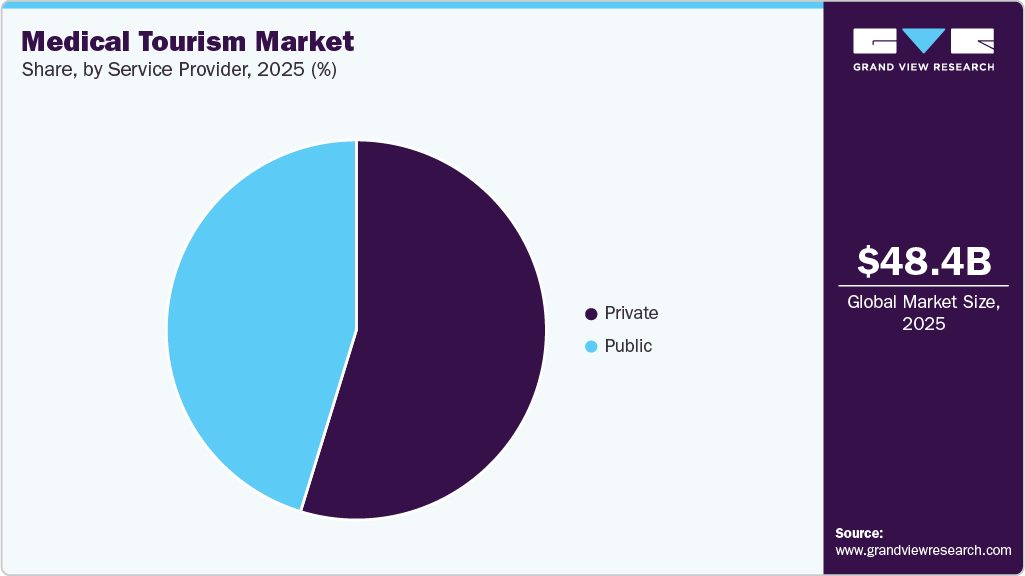

- By service provider, the private segment accounted for the largest revenue share of 54.75% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 48.40 Billion

- 2033 Projected Market Size: USD 154.79 Billion

- CAGR (2026-2033): 15.58%

During the forecast period, the medical tourism industry is projected to advance at a breakneck pace. The high cost of health services in home countries is the primary factor driving market growth. In addition, the industry is being driven by rising demand for procedures that are not covered by insurance, such as gender reassignment surgeries, reproductive therapy, dental reconstruction, and aesthetic surgery.

In developing countries such as Thailand and Malaysia, a high-quality treatment can be availed at a lower cost than in developed countries. Even though the cost of treatments in developing countries is minimal, the quality of the procedure is not compromised due to the availability of resources at relatively lower costs. This factor leads to an influx of people seeking health services in these countries. For instance, an angioplasty procedure costs around USD 55,000 to USD 57,000 for an individual in the U.S., compared to around USD 2,500 to USD 3,500 in Malaysia. People travel for treatment from America and Europe to Singapore, Malaysia, India, and Thailand, saving between 55% and 70% on medical costs.

Common cosmetic surgery procedures cost comparison between different countries (USD):

Common Cosmetic Surgery Procedures

U.S.

Malayasia

Thailand

Singapore

Blepharoplasty

1,500

2,300-3,500

1,300-4,000

3,500-7,000

Botox injection

400

112-450

115-885

150-1200

Breast augmentation

6,000-8,000

6,512-7,549

3,380-8,990

11,000-16,000

Breast lift (mastopexy)

5,503

3358

3,821

12,000

Breast reduction

5,000

2,253-4,507

3,900

18,000-43,000

Source: health365 Pte Ltd, Grand View Research Analysis

Most elective surgeries, including cosmetic surgery, certain dental procedures, fertility treatments, and weight loss surgeries, are not covered by insurance companies in the U.S. The limited availability or lack of insurance coverage drives people to seek medical procedures in countries such as Thailand and Malaysia. Thailand has emerged as a sought-after destination for international patients seeking fertility treatments due to its world-class medical facilities, experienced fertility specialists, and affordable treatment options. Bangkok and Phuket are home to leading fertility centers offering a full spectrum of ART services, including IVF, ICSI (intracytoplasmic sperm injection), and fertility preservation, all delivered with a focus on patient comfort and satisfaction.

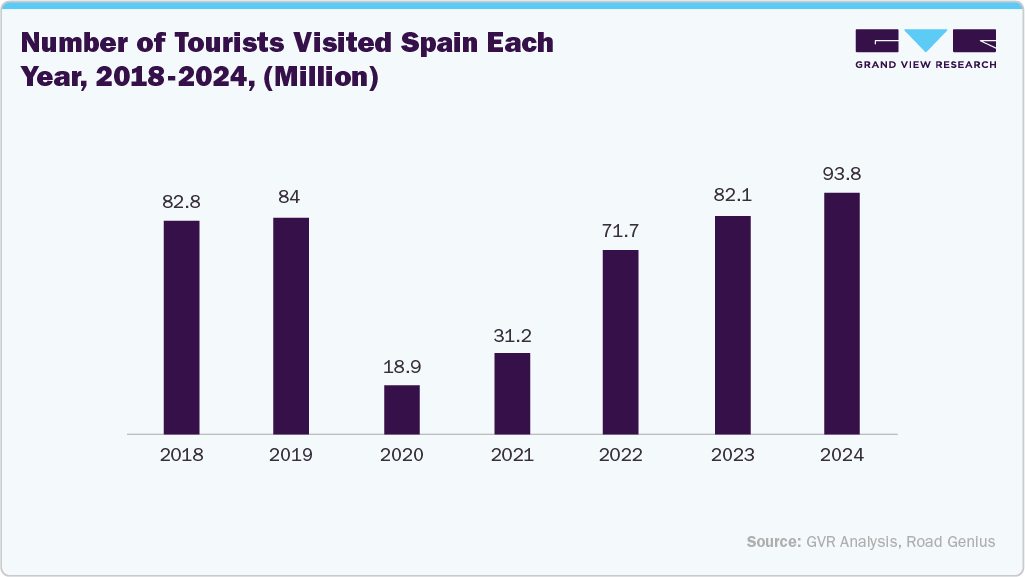

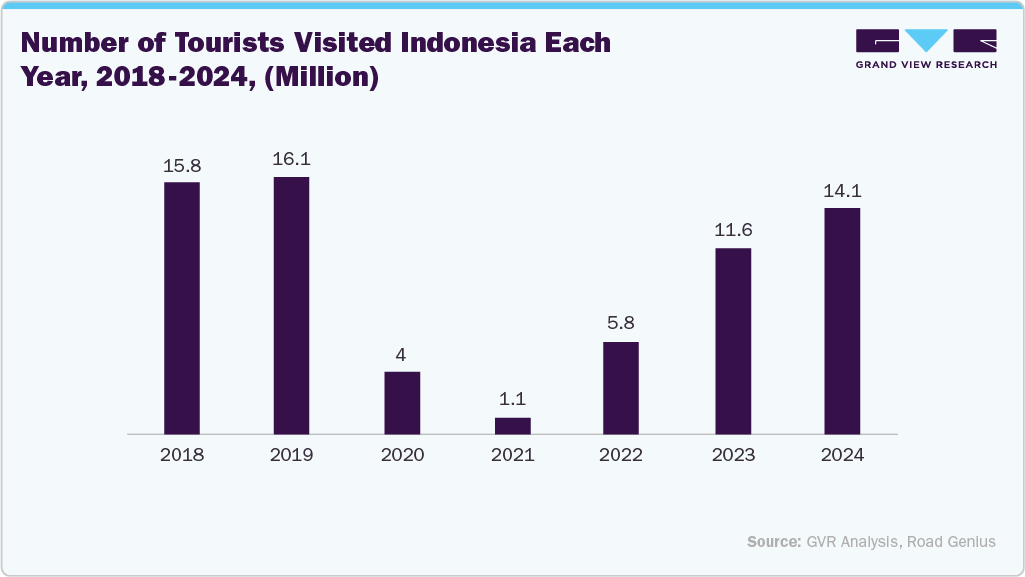

In addition, emerging countries are known to have renowned surgeons, which is attracting millions of patients per year for various treatments. The price of medical treatments in Malaysia is 30% to 40% lower than in countries such as the U.S., UK, and other European economies. A large population of foreigners seeks surgeries such as facial aesthetics procedures, dental implants, breast implants, facelifts, and liposuction in these countries. Improvements in healthcare infrastructure and the availability of high-quality healthcare services at affordable prices will drive global market growth. Moreover, the increasing number of tourists across the globe will foster market growth.

In addition, emerging countries such as Malaysia and Thailand are known to have renowned surgeons, which is attracting more than 1 million patients per year for various treatments. According to a report published by The Nation in August 2024, Thailand is poised to become a global leader in aesthetic surgery, driven by increasing demand both domestically and internationally, as stated by the president of the Association of Plastic and Cosmetic Surgeons of Thailand. In addition, he said:

"The cosmetic surgery sector, including both surgical and non-surgical treatments, has witnessed remarkable growth. Thailand's competitive service fees have attracted both local and international clients."

Furthermore, delaying necessary treatments might worsen pre-existing conditions, and the risks associated with delaying various surgeries can lead to other complications. For instance, delaying hip replacement surgery can lead to deterioration of the hip joint, limited mobility, and an increase in pain. In addition, the possibility of undergoing minimally invasive surgery, such as hip resurfacing, would no longer be an option for the patient.

Similarly, delaying root canal treatment can lead to the destruction of the tooth, resulting in tooth loss. For instance, in developed countries such as the UK and Canada, there is typically a 4-week wait between the time a patient makes an appointment and the time they can see the physician. Canada has the highest percentage of patients (36%) who have to wait 6 days or more for an appointment with a doctor. In the UK, waiting lists for non-essential surgeries, such as knee reconstructions, are up to 18 months, while in Australia and Canada, they can take up to 2 years.

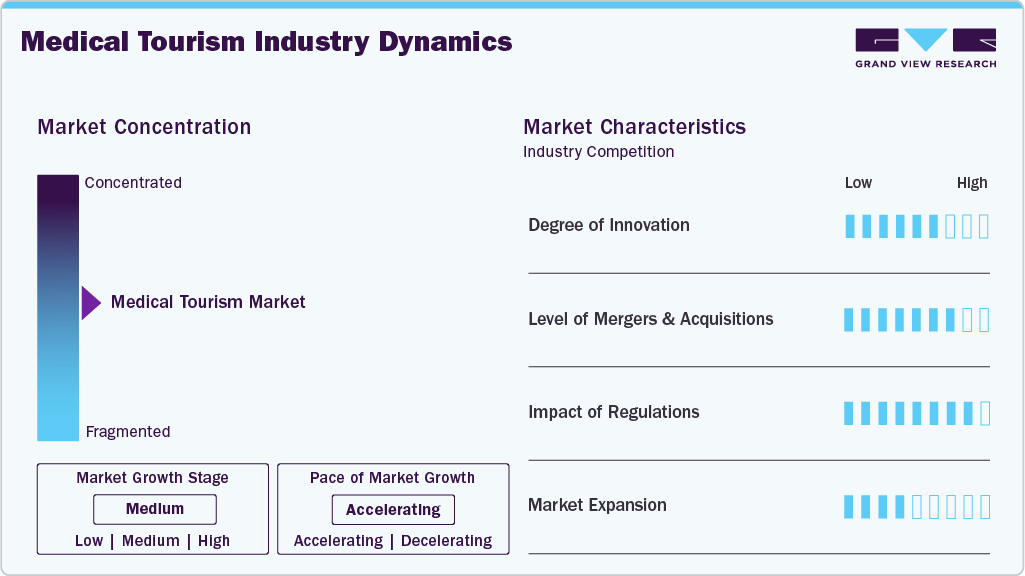

Market Characteristics & Concentration

The chart below illustrates the relationship between industry concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The market is fragmented, with the presence of many local providers in the market. Furthermore, the degree of innovation is high, and the level of M&A activities is moderate to high. The impact of regulations on the market is high, and service expansion is also high, while regional expansion is moderate.

The degree of innovation is high in the medical tourism market. The integration of technologies such as telemedicine, artificial intelligence (AI), and data analytics is revolutionizing patient care. These innovations enhance treatment options, improve patient outcomes, and streamline processes for medical tourists. The rise of digital health platforms allows patients to access services such as online consultations, appointment scheduling, and health records management from anywhere in the world. For instance, Egypt's government is launching an online health tourism platform to facilitate medical travel bookings.

The medical tourism industry is expected to continue expanding rapidly, driven by factors such as rising disposable incomes, increased healthcare needs, and technological advancements. The anticipated growth is expected to lead to further M&A activities as companies seek to enhance their service offerings and expand their market presence. For instance, in September 2024, EaseMyTrip.com, a prominent online travel technology platform in India, announced its strategic entry into the growing medical tourism sector by acquiring a 49% equity stake in Pflege Home Healthcare and 30% in Rollins International. These acquisitions are part of EaseMyTrip's broader mission to provide comprehensive travel solutions that integrate wellness and healthcare services into its offerings. This move aligns with the increasing demand for accessible and quality healthcare services among travelers seeking medical treatment and wellness options abroad.

Many governments recognize the economic potential of medical tourism and offer incentives, such as tax breaks, financial grants, and streamlined visa processes, to attract medical tourists. These measures not only attract international patients but also encourage healthcare organizations to align their marketing strategies with governmental initiatives, enhancing their competitiveness in the global market. For instance, in India, there is a significant presence of accredited hospitals that meet international standards; however, the absence of comprehensive regulations leaves the sector vulnerable to unregulated practices.

High treatment costs in developed nations are prompting patients to seek more affordable options abroad. Countries such as India, Thailand, and Malaysia offer significant savings on procedures without compromising quality. Major healthcare institutions in countries such as India are expanding their offerings to include comprehensive care packages that cover everything from visa assistance and airport transfers to accommodation and language interpretation services. This approach ensures a seamless experience for international patients. The affordability of medical procedures in Asia-Pacific countries attracts patients from developed nations where healthcare costs are high. For instance, surgeries that may not be covered by insurance in the U.S. are often available at lower prices abroad. Medical treatments in countries such as Thailand, Malaysia, and India are often significantly cheaper, up to 90% less expensive than in Western countries.

Treatment Type Insights

The cosmetic segment accounted for the largest revenue share of 24.23% in 2025. Various factors, such as growing patient awareness, increasing demand for anti-aging treatments, and the high cost of cosmetic implants in developed countries, are propelling the market growth. Growing awareness of personal care has significantly increased the demand for cosmetic procedures, including body fat reduction and acne treatments. Common surgeries performed in this context include liposuction, abdominoplasty, breast augmentation, and gluteal augmentation. According to data from the International Society of Aesthetic Plastic Surgery, there was an overall decrease in cosmetic procedures performed by plastic surgeons in 2022. Approximately 33.7 million surgical and non-surgical procedures were performed globally that year, a rise from around 30.3 million in 2021.

On the other hand, the infertility segment is anticipated to grow at the fastest CAGR over the forecast period. Global trade in health commodities and services is experiencing robust growth, driven by increased production inputs and a surge in international capital flows. The scenario of international trade in health services is undergoing a paradigm shift due to the emergence of technological advancements in medicine and communication, thereby enhancing the international mobility of medical tourists across borders. Furthermore, developing countries, such as India, Thailand, Turkey, and Singapore, are offering subsidized healthcare plans and other favorable care policies, promoting medical tourism.

Service Provider Insights

The private segment led the medical tourism industry, accounting for the largest revenue share of 54.75% in 2025, and is expected to have the fastest growth rate during the forecast period. The rapid increase in healthcare expenses, coupled with a large number of uninsured or underinsured individuals, is prompting medical tourists to seek affordable healthcare services and treatments in developing nations. However, medical tourism faces several challenges in the form of endemic tropical diseases, communication barriers, organ trafficking, and unregulated hospitals. Healthcare providers play a vital role in mitigating these risks by educating and spreading awareness among medical tourists. Healthcare providers are influencing the decision-making of medical tourists by accrediting their practices.

The public segment is projected to have a substantial CAGR during the forecast period. Healthcare globalization and an increase in patient mobility across borders are driving the growth of the medical tourism industry. The growth is further accelerated by incorporating advanced technologies, such as telemedicine and e-health, thus improving accessibility to medical care and treatments in foreign countries. In addition, easy access to transportation facilities, state-of-the-art hospitality & accommodation, and improved communication channels are boosting medical tourism.

Country Insights

The Thailand medical tourism market dominated, with a global revenue share of 23.25% in 2025. Thailand is a key medical tourism destination and is highly popular among foreign travelers. Every year, millions of medical tourists visit Thailand due to its low costs and high-quality medical services. Significantly lower treatment costs compared to developed economies are a key driver of its growing number of inbound medical tourists. For instance, a hip replacement procedure at Bumrungrad International Hospital in Bangkok costs an average of USD 18,151.37, which is approximately half the price in the U.S.

The medical tourism market in Mexico has gained popularity among health tourists from North America in recent years. The fact that prices are lower south of the U.S. border is Mexico's strongest selling factor for individuals willing to travel for medical treatment. This is supported by the data on medical tourism in Mexico, which demonstrates that the savings for a variety of procedures can be substantial. Even something as simple and commonplace as dental care can be up to 70% cheaper in Mexico than in the U.S., while cosmetic surgery can be up to 75% cheaper. Numerous American individuals and families find that healthcare costs place a substantial financial strain on their budgets, making a trip to Mexico all the more attractive from this perspective.

The India medical tourism market is developing as a popular destination for medical treatment. The healthcare system in India combines traditional and modern medical practices, making it distinct from those in other countries. Further, India's central government has launched various health and social schemes to promote health and wellness tourism in Jammu & Kashmir. The government is developing the infrastructure of the AYUSH Department and has also launched a promotional film highlighting the use of AYUSH in the treatment of diseases. Prime Minister Modi also recently announced plans to launch an AYUSH mark. A sign to give credibility to AYUSH products in India and to promote the Indian medical tourism sector. Additionally, other medical services and facilities are supported by the World Health Organization (WHO) and the U.S. Food and Drug Administration (FDA).

Key Medical Tourism Company Insights

These companies employ a range of strategies to enhance their market position, including the development of new products and services utilizing cutting-edge technology, collaborations with other companies, outlet expansion, and corporate investments.

Key Medical Tourism Companies:

The following are the leading companies in the medical tourism market. These companies collectively hold the largest market share and dictate industry trends.

- MOHW Hengchun Tourism Hospital

- Apollo Hospitals Enterprise Ltd.

- Bumrungrad International Hospital

- Mount Elizabeth Hospitals

- Raffles Medical Group

- Dr. B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Mission Hospital

- Bangkok Hospital

- Miot Hospital

- Penang Adventist Hospital

Recent Developments

-

In June 2025, MIOT Hospital launched the Tibia Nail Advanced System for treating tibial fractures for the first time in India. This innovative system, designed by AO-Synthes from Switzerland, incorporates Angle-Stable technology, which enhances stability and promotes faster healing in patients suffering from tibial fractures.

-

In March 2025, Shanghai Renji Hospital and Singapore’s Raffles Medical Group signed a strategic collaboration agreement aimed at establishing a “dual circulation” service system for medical resources. This partnership is designed to enhance the development of medical services by integrating the strengths of both institutions, aligning with China’s Healthy China 2030 Plan, and supporting Shanghai’s goal to become a hub for international medical tourism.

-

In January 2024, Ferns N Petals launched a medical tourism venture named MediJourney, which will provide a comprehensive range of healthcare services across over 30 treatment segments, including cardiology and oncology. This initiative aims to streamline medical travel processes and enhance patient care.

Medical Tourism Market Report Scope

Report Attribute

Details

Market size in 2026

USD 56.19 billion

Revenue forecast in 2033

USD 154.79 billion

Growth rate

CAGR of 15.58% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, service provider, and country

Country scope

Thailand; India; Costa Rica; Mexico; Malaysia; Singapore; Brazil; Colombia; Turkey; U.S.; Taiwan; South Korea; Czech Republic; Spain

Key companies profiled

MOHW Hengchun Tourism Hospital; Apollo Hospitals Enterprise Ltd.; Bumrungrad International Hospital; Mount Elizabeth Hospitals; Raffles Medical Group, Dr. B. L. Kapur Memorial Hospital; Kasemrad Hospital International Rattanathibet; Mission Hospital; Bangkok Hospital; Miot Hospital; Penang Adventist Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the medical tourism market report based on treatment type, service provider, and country:

-

Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular treatment

-

Orthopedic treatment

-

Cosmetic treatment

-

Bariatric treatment

-

Dental treatment

-

Ophthalmology treatment

-

Infertility treatment

-

Alternative medicine

-

Other services

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Public

-

Private

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Thailand

-

India

-

Costa Rica

-

Mexico

-

Malaysia

-

Singapore

-

Brazil

-

Colombia

-

Turkey

-

U.S.

-

Taiwan

-

South Korea

-

Czech Republic

-

Spain

-

China

-

Australia

-

Indonesia

-

Frequently Asked Questions About This Report

b. The global medical tourism market size was estimated at USD 48.40 billion in 2025 and is expected to reach USD 56.19 billion in 2026.

b. The global medical tourism market is expected to grow at a compound annual growth rate of 15.58% from 2026 to 2033 to reach USD 154.79 billion by 2033.

b. The cosmetic segment accounted for the largest revenue share of 24.23% in 2025. Various factors, such as growing patient awareness, increasing demand for anti-aging treatments, and the high cost of cosmetic implants in developed countries, are propelling the market growth.

b. Some key players operating in the medical tourism market are MOHW Hengchun Tourism Hospital; Apollo Hospitals Enterprise Ltd.; Bumrungrad International Hospital; Mount Elizabeth Hospitals; Raffles Medical Group, Dr. B. L. Kapur Memorial Hospital; Kasemrad Hospital International Rattanathibet; Mission Hospital; Bangkok Hospital; Miot Hospital; Penang Adventist Hospital

b. Key factors that are driving the medical tourism market growth include significant cost-saving and availability of additional benefits, including better healthcare, latest technologies, innovative medicines, modern devices, better hospitality, and personalized care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.