- Home

- »

- Renewable Chemicals

- »

-

Hydroxypropyl Methylcellulose Market Size Report, 2030GVR Report cover

![Hydroxypropyl Methylcellulose Market Size, Share & Trends Report]()

Hydroxypropyl Methylcellulose Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Construction, Pharmaceuticals, Food, Cosmetics & Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-918-7

- Number of Report Pages: 121

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

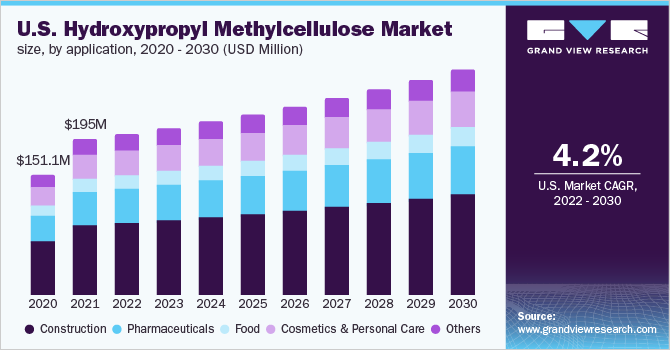

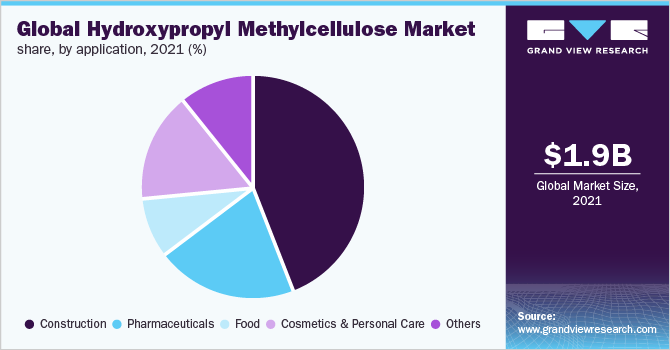

The global hydroxypropyl methylcellulose market size was valued at USD 1.87 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030. The expanding application of hydroxypropyl methylcellulose (HPMC) across diverse end-use industries such as construction, pharmaceuticals, food, and personal care and cosmetics is expected to create a positive outlook for the market.

The market is highly competitive due to the increasing demand from major applications including pharmaceuticals, food, construction, and personal care. The increasing number of new participants across the value chain is expected to boost the HPMC market growth. Key market participants are focusing more on custom manufacturing and tailored solution offering by using advanced technologies to strengthen their customer base and generate more revenue in the near future.

Hydroxypropyl methylcellulose is a powdered substance that can be used in multiple industries. HPMC acts as a thickening agent, stabilizer, and emulsifier in the preparation of frozen fruits, ketchup, sauces, toppings, and a variety of bakery products. The increasing demand for low-fat products on the account of the rising health-consciousness of consumers is one of the key factors driving the demand for HPMC.

HPMC is also used in the manufacturing of various cosmetic products such as ointments, pastes, creams, and lotions due to its ability to act as a bioadhesive, excipient, and dispersing agent. In addition, HPMC finds a major application in ophthalmology, where it is utilized as a lubricant and helps reduce eye irritation. On the industrial side, it is used in inks, printing and dyeing of textiles, and papermaking.

HPMC is an alkali cellulose derivative procured by treating wood pulp or cotton liner with propylene oxide, methyl chloride, and caustic soda. It is derived from wood cellulose by partial etherification with hydroxypropyl groups. HPMC is gaining popularity in foods as an alternative to gelatin or gluten as it is functionally similar to them. It is not digestible and so contains no calories. They are also widely used in pharmaceuticals and supplements. It is produced from cellulose, a natural polymer, and fiber, which are considered safe for human consumption.

Application Insights

The construction application segment dominated the market with a revenue share of over 40.0% in 2021. The large share is attributed to the increasing demand for HPMC in the industry due to its qualities such as water-holding capacity, ability to reduce flocculation and improve viscosity, and prevention of cracks.

HPMC functions as a dispersant, water-retaining agent, thickener, and binder that is used to increase cohesiveness, workability, and shrinkage in the construction industry. It is extensively used due to its low price and different properties. HPMC is widely used in cement-based mortars, gypsum products, masonry mortars, joint fillers, tile adhesives, and self-leveling compounds, among others. Hydroxypropyl methylcellulose has application in cement mortar, plasters, refractory materials, paints, gypsum concrete slurry, fiber walls, and others.

The pharmaceuticals application segment accounted for the second-largest revenue share in 2021. It is commonly used as a thickener in alcohol hand sanitizers. The rising demand for hand sanitizers following the outbreak of COVID-19 has significantly triggered the demand for HPMC globally. Depending on the viscosity requirement, the application dosage can be adjusted to optimize the production process and lower operational costs. HPMC solutions with maximum viscosity are widely used in eye drops. They have optimal compatibility with electrolytes and are thus, appropriate for use in eye drops as a thickening agent. In addition, the rising number of pharmaceutical companies across global emerging economies is expected to boost the overall demand for the product.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 50.0% in 2021. This is attributed to the rising demand and investments in the construction and infrastructure industries to meet the needs of the growing population. According to the European Federation of Chemical Engineering (EFCE), China and India accounted for a major share in the global construction industry in 2020.

According to the International Trade Centre (ITC), China accounted for a share of 26.1% while India accounted for a share of 14.1% of this growth in 2020. India is among the fastest-growing economies of the world, and hence the demand for construction and infrastructure rises due to the increasing urbanization and some government initiatives like PM Aawas Yojana, under which multiple houses are being constructed.

In addition to the construction industry, HPMC is widely utilized in the food industry of Asia Pacific for stabilizing, thickening, suspending, and emulsifying a wide range of food items. It is also used as a substitute for gelatine in a wide range of confectionery and bakery products. HPMC is also used to reduce fat content in food items, leading to its popularity among health-conscious customers. Moreover, flourishing key end-use industries such as construction and food and beverages in Asia Pacific are projected to trigger the growth of the HPMC market in Asia Pacific over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive with manufacturers intensely focusing on improving their products. Strong experience and expertise in the HPMC market have helped manufacturers maintain significant market shares. Various strategic tactics and decisions of the leading companies have helped them to grow in the market and acquire a large customer base.

In July 2021, Dow Chemical Company announced a series of incremental, high-return capacity expansions to address the rising worldwide demand for innovative and sustainable additives for the fast-growing performance materials and coatings markets and other high-growth end markets.

The major distribution channels present in the market include the manufacturers’ distribution network, direct supply agreements with industrial users, and third-party distribution channels. Direct supply agreements are gaining prominence as end users are entering into agreements with manufacturers to ensure uninterrupted supply and avail cost benefits. The online distribution channel is also gaining importance on account of significant investments by multinationals in e-commerce platforms in order to capture a larger potential market share. Some prominent players in the global hydroxypropyl methylcellulose market include:

-

Ashland

-

Shin-Etsu Chemical Co., Ltd.

-

Chemcolloid Limited

-

Zhejiang Haishen New Materials limited

-

DuPont de Nemours, Inc.

-

CP Kelco U.S., Inc.

-

Celotech Chemicals Co., Ltd.

-

Hebei Yibang Building Materials Co., Ltd.

-

Changzhou Guoyu Environmental S&T Co., Ltd.

Hydroxypropyl Methylcellulose Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.94 billion

Revenue forecast in 2030

USD 2.85 billion

Growth rate

CAGR of 4.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ashland; Shin-Etsu Chemical Co., Ltd.; Chemcolloid Limited; Zhejiang Haishen New Materials Limited; DuPont de Nemours, Inc.; CP Kelco U.S., Inc.; Celotech Chemicals Co., Ltd.; Hebei Yibang Building Materials Co., Ltd.; Changzhou Guoyu Environmental S&T Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hydroxypropyl methylcellulose market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Cement Mortar

-

Plasters

-

Refractory Materials

-

Paints

-

Gypsum Concrete Slurry

-

Fiber Wall

-

Others

-

-

Pharmaceuticals

-

Food

-

Cosmetics and Personal Care

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydroxypropyl methylcellulose market size was valued at USD 1.87 billion in 2021 and is expected to reach USD 1.94 billion in 2022

b. The global hydroxypropyl methylcellulose market is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030 to reach USD 2.85 billion by 2030.

b. Construction applications dominated the hydroxypropyl methylcellulose market with a revenue share of 44.2% in 2021. Its high share is attributable to the increasing demand for HPMC in the industry due to its qualities such as water-holding capacity, reduce flocculation, improves viscosity, and prevention of cracks

b. Some prominent players in the hydroxypropyl methylcellulose market include Ashland, Shin-Etsu Chemical Co., ltd, Chemcolloid Limited, Zhejiang Haishen New Materials limited, DuPont de Nemours, Inc., CP Kelco U.S., Inc., Celotech Chemicals Co., ltd., Hebei Yibang Building Materials Co., Ltd, Changzhou Guoyu Environmental S&T Co., Ltd.

b. The growth of the HPMC market is majorly driven by the rising demand for low-fat food among the young population and product penetration in food and cosmetics applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.