Frozen Fruits Market Size, Share & Trends Analysis Report By Product (Citrus Fruits, Tropical Fruits, Berries, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-245-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Frozen Fruits Market Size & Trends

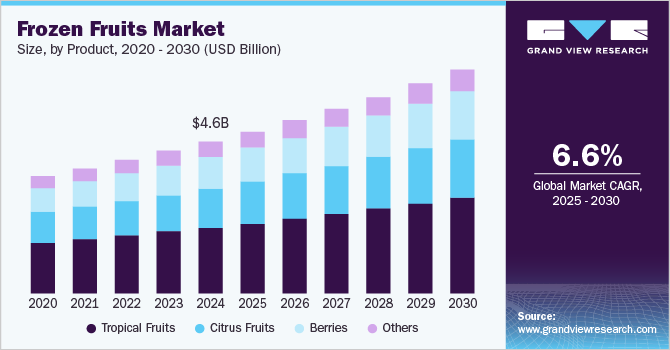

The global frozen fruits market size was valued at USD 4.56 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The rising popularity of nutritional fruits that can be used throughout the year has necessitated the use of freezing technologies to preserve non-seasonal products, driving market demand. One of the key advantages of frozen fruits is their long shelf life compared to fresh fruits, which spoil quickly. Consumers can thus conveniently stock up on frozen fruits and store them for months, reducing the frequency of grocery shopping and preventing food waste. They are also easy to use, requiring no preparation, washing, or peeling, making them a convenient option for consumers with busy lifestyles.

The growing global trend of smoothie consumption, including smoothie bowls, has been a major driver for the frozen fruits industry in recent years. Products such as berries, mangoes, and acai are commonly used in smoothies for their flavor, texture, and nutritional value. The rising demand for health-focused drinks such as juices and cold-pressed beverages has further contributed to the strong sales of frozen fruit items, as they present a quick and nutritious way to prepare health drinks at home or in cafes. As consumers aim to explore global and exotic flavors, frozen tropical fruits, including mango, papaya, and passion fruit, have witnessed high demand. There is a growing preference for clean-label products that are free from artificial ingredients, preservatives, or added sugars. Many brands now market their products as natural, free from additives, and with minimal processing, catering to the demand of this expanding demographic.

Frozen fruits are harvested at peak ripeness and frozen quickly to lock in their nutrients and flavors, which helps extend their shelf life. This makes them a more sustainable choice for consumers looking to minimize waste generation, which is generally seen in fresh fruits. Frozen fruits are versatile ingredients for people following specific dietary trends, including vegan, keto, or paleo. For example, berries and other low-carb fruits are staples in keto diets, while frozen fruits are a popular snack or meal base for vegans and vegetarians. Brands that emphasize eco-friendly sourcing and processing practices are attracting environmentally conscious consumers, increasing their chances of generating sales.

Companies are also undertaking novel collaborations with other brands to drive product awareness. For instance, in November 2023, Golden West Food Group and The Hershey Company, through a partnership, launched HERSHEY’S Frozen Fruit exclusively at Walmart stores in the U.S. The line-up included REESE’S Frozen Fruit Banana Slices, HERSHEY’S White Creme & Milk Chocolate Frozen Fruit Blueberries, HERSHEY’S COOKIES ‘N’ CREME Frozen Fruit Strawberries, and HERSHEY’S White Creme & Milk Chocolate Frozen Fruit Raspberries. The increasing frequency of such launches by other global and regional companies is expected to positively shape the worldwide frozen fruits industry during the forecast period.

Frozen fruits are considered better than canned and dehydrated fruits as the former retains sensory attributes and associated nutritive properties. The industry is highly dependent on the science and technology of freezing. A variety of freezing methods are based on using different equipment, including air-blast freezers, tunnel freezers, belt freezers, fluidized bed freezers, contact freezers, immersion freezers, liquid nitrogen freezers, and liquid carbon dioxide freezers. Furthermore, these products are packaged to avoid contamination and preserve nutrient, flavor, color, and texture. Plastic bags, plastic pots, paper bags, and cans are used for the purpose of packaging. Various forms of packaging include syrup pack, sugar pack, unsweetened pack, and tray pack and sugar replacement pack.

Product Insights

The tropical fruits segment accounted for the largest revenue share of 43.5% in the global market in 2024. Notable frozen tropical fruits that are extensively used in food and beverage preparations include pineapples, papaya, coconuts, mangoes, passion fruit, bananas, guava, avocado, and mamey, among others. They are rich in essential nutrients such as vitamins, antioxidants, and fiber, which are increasingly vital for health-conscious consumers. Their demand has witnessed strong growth, particularly in regions where it is very difficult or impossible to produce them due to unsuitable climatic conditions. Frozen produce such as mango, papaya, pineapple, and avocado have remained in high demand due to their flavor and nutritional benefits, with economies such as India, Mexico, and Costa Rica being leading exporters of these tropical fruits.

Meanwhile, the berries segment is anticipated to grow at the fastest CAGR during the forecast period in the frozen fruits industry. Frozen berries are widely used in smoothies, desserts, snacks, and baking and are considered a nutrient-dense, versatile, and convenient option for consumers. Berries are known for their high antioxidant content, particularly anthocyanins, which are considered to have anti-aging and anti-cancer properties. This has increased their appeal as part of healthy and anti-inflammatory diet patterns. The substantial popularity and sales of smoothies present another growth opportunity for this segment, as berries add natural sweetness and a rich flavor profile to these beverages. Many brands offer frozen berry mixes, which include a variety of berries such as strawberries, blueberries, raspberries, and blackberries. These blends cater to consumers who want a mix of flavors and nutrients in a single product.

Distribution Channel Insights

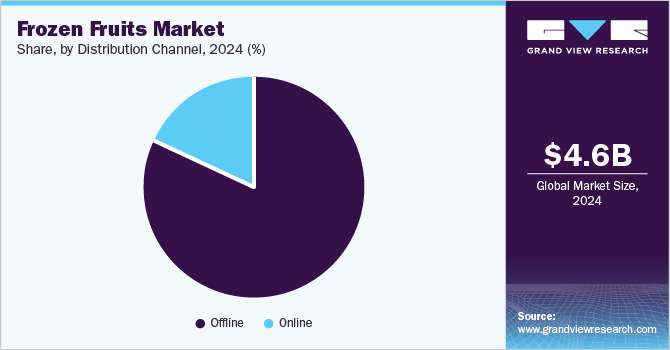

The offline segment accounted for a dominant revenue share in the global market in 2024, aided by the widespread availability of frozen fruits in supermarkets & hypermarkets, and grocery stores. Increasing awareness regarding the health benefits of these products and their growing usage in a variety of dishes and beverages has led consumers to purchase these items frequently through physical stores. These shops generally have deep freezers and chest freezers that can store frozen items for longer durations, maintaining their quality and nutritional profile. Companies are utilizing strategies such as innovative packaging, comprehensive labeling, and discounts to appeal to health-conscious consumers, creating a major revenue generation stream in the frozen fruits industry.

The online segment, on the other hand, is expected to grow at the fastest CAGR from 2025 to 2030. Sales of frozen fruit through online channels have seen a significant increase in recent years, driven by several factors, such as the rapid expansion of the e-commerce sector, changing consumer buying behavior, and increasing demand for convenient food options. A number of online retailers offer the choice to purchase frozen fruits in bulk or in large quantities, making it an appealing option for health-conscious consumers who frequently consume frozen fruits. The expansion of cold chain logistics and advanced freezing and packaging technologies have further helped improve the quality and safety of frozen food deliveries, enabling segment growth.

Regional Insights

The North America frozen fruits market accounted for the largest revenue share of 31.5% globally in 2024. Increasing demand for healthier food options among regional consumers has highlighted the need to incorporate frozen fruits in food preparations as a convenient and nutritious alternative. Moreover, the well-established online grocery shopping sector has made it easier for consumers to access and purchase frozen fruits. Many major grocery chains and specialized stores such as Walmart, Costco, and Instacart are increasingly offering these products through online platforms, expanding their reach.

U.S. Frozen Fruits Market Trends

The U.S. frozen fruits market accounted for a dominant revenue share in the regional market in 2024, aided by increasing adherence to healthy lifestyle practices in the economy. The growing popularity of smoothies, especially as breakfast or post-workout snacks, has substantially boosted frozen fruit demand. Fruits such as berries, mangoes, and pineapples are widely used in smoothie blends. The steadily growing proportion of environmentally conscious citizens also provides opportunities for market expansion, as frozen fruits contribute to sustainability efforts by reducing food waste. Consumers can use only what they need, preventing spoilage and wastage that often happens with fresh produce. Thus, the prioritization of wellness and sustainability objectives has positioned frozen fruits as a necessity in modern kitchens, particularly for health-conscious and busy consumers.

Europe Frozen Fruits Market Trends

Europe frozen fruits market accounted for a substantial revenue share in the global market in 2024. Increasing sales of frozen fruit items such as berries and citrus fruits and continued efforts to reduce food wastage are factors expected to maintain a steady pace of industry expansion. The demand for exotic fruits, such as acai, mangoes, and dragon fruit, has increased noticeably in Europe as consumers seek new flavors and ingredients for health-focused recipes. Europe is a major importer of tropical frozen fruits, with their imports in regional economies having witnessed an increase in volume on an average of 4.0% annually from 2018 to 2022. Developing countries account for approximately 62% of overall imports in Europe, highlighting the sustained popularity of this food category. The use of advanced freezing technologies by food processing companies in this region has ensured the availability of rare and less common fruits throughout the year.

Asia Pacific Frozen Fruits Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the frozen fruits market during the forecast period. The demand for frozen fruits in regional economies such as India, China, and Japan is experiencing significant growth, driven by changing consumer preferences, urbanization, and rising health awareness. The noticeable increase in prevalence of busy lifestyle patterns has compelled consumers to seek convenience in their food preferences. Frozen fruit items require less preparation and have a longer shelf life compared to fresh fruits. Moreover, a constant rise in disposable income levels among consumers has allowed them to purchase premium-quality food products that can be utilized in various recipes without worrying about any reduction in their nutritional value, driving market expansion.

China frozen fruits market accounted for the largest revenue share in the Asia Pacific market for frozen fruits in 2024. The rapidly growing urban population in the economy and presence of advanced food processing technologies and facilities have created a favorable market for these products. Factors such as the extensive utilization of blockchain technology to track the origins of imported frozen food items for authenticity and safety have further helped in market advancement. In August 2024, the country removed quarantine access requirements that had been placed with regard to the import of frozen fruits. This has eventually allowed product imports from any global economy, as per the updated imported food catalog by the General Administration of Customs of China (GACC). The development is also expected to boost durian imports in China, further shaping the market.

Key Frozen Fruits Company Insights

Some major companies involved in the global frozen fruits industry include Del Monte International, Nature’s Touch, and Titan Frozen Fruit, among others.

-

Del Monte Fresh Produce is a global vertically integrated producer, marketer, and distributor of premium fresh and fresh-cut vegetables and fruits. The company operates through 5 major categories, including Fresh Produce, Fresh Cut, Prepared Fruit, Prepared Foods, and Juices & Beverages. Del Monte has expanded its frozen fruit offerings with a range of products that have been designed for cocktails, smoothies, and fruit salads.

-

Titan Frozen Fruit is a premium frozen fruit processor based in California, specializing in high-quality strawberry products. Titan Frozen Fruit focuses on a variety of products, including Individually Quick Frozen (IQF) strawberries that are available in whole, sliced, and diced forms, and Block Quick Frozen (BQF) products for bulk processing requirements. The company also offers fruit purees and concentrates, including strawberry, raspberry, and blueberry options that are available in both conventional and organic varieties.

Key Frozen Fruits Companies:

The following are the leading companies in the frozen fruits market. These companies collectively hold the largest market share and dictate industry trends.

- Del Monte International GmbH

- Nomad Foods

- Nature's Touch

- Harvest Food Group, Inc.

- Titan Frozen Fruit

- Meel corp.

- Val-Mex Frozen Foods, LLC

- Royal Ridge Fruits

- Dole Plc

- Wyman's

View a comprehensive list of companies in the Frozen Fruits Market

Recent Developments

-

In June 2024, Del Monte, a subsidiary of the Fresh Del Monte Inc. group, announced the launch of its frozen British Strawberries offering that had been made exclusively available in Iceland supermarket stores across the UK.

-

In October 2023, Nature's Touch, which specializes in the development of frozen conventional and organic fruits, announced that it had successfully acquired particular assets of SunOpta Inc.'s frozen fruit division Sunrise Growers. The development has enabled Nature’s Touch to diversify its offerings and strengthen its presence across the U.S. and Canada.

Frozen Fruits Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.86 billion |

|

Revenue forecast in 2030 |

USD 6.69 billion |

|

Growth Rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Del Monte International GmbH; Nomad Foods; Nature's Touch; Harvest Food Group, Inc.; Titan Frozen Fruit; Meel corp.; Val-Mex Frozen Foods, LLC; Royal Ridge Fruits; Dole Plc; Wyman's |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Frozen Fruits Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen fruits market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Citrus Fruits

-

Tropical Fruits

-

Berries

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."