- Home

- »

- Electronic & Electrical

- »

-

Germany Consumer Appliances Market Report, 2030GVR Report cover

![Germany Consumer Appliances Market Size, Share & Trends Report]()

Germany Consumer Appliances Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Household Appliances, Kitchen Appliances), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-2-68038-080-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

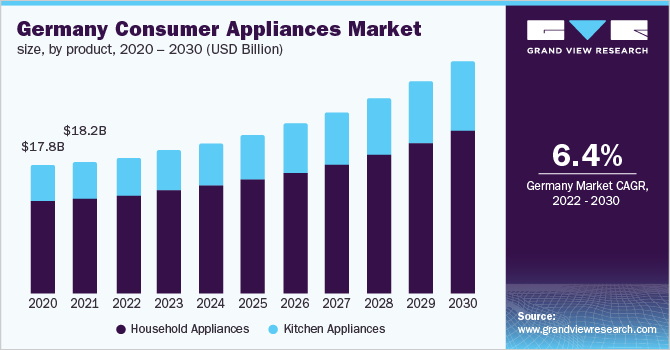

The Germany consumer appliances market size was valued at USD 18.21 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. The consumer appliances market is broadly classified into two categories: brown goods and white goods. The market basically is subdivided into two groups - household appliances and kitchen appliances.

The recent Covid-19 outbreak has severely impacted the growth of the consumer appliances industry in Germany. The pandemic disrupted production as well as sales of appliances through both online and offline channels due to social distancing and stay-home policies. Demand for new orders from retailers has come to a standstill as the major markets are under lockdown, which has drastically altered the supply chain in the market globally.

The companies in Germany household appliances market manufacture both large and small appliances. The large appliances include products like stoves, ovens, and refrigerators, whereas the small appliances include humidifiers, toasters, juicers, and vacuum cleaners to name a few. The increase in sales of luxurious homes across Germany has led to a rise in the demand for high-quality premium kitchen and household appliances. According to Sotheby’s International Realty Survey, 2021, 63% of real estate players are expecting the prices of luxury homes to rise in the next three years and over 70% saw added demand for luxury homes in 2020.

Millennials are considered to be the most influential and educated consumer group. Since the COVID-19 pandemic, they have realized that having a home with more space, bigger rooms, greenery, kids’ playrooms, a dedicated office space, and numerous amenities is important. As a result, the real estate industry has been focusing on millennials’ home buying preferences to ensure the growth of the real estate market.

Increasing per capita income, growing affordability, space constraints, and the demand for convenience are driving the adoption of high-quality and premium products. Additionally, the rising number of dual-income families across the country is fostering the demand for various home appliances as people with dual incomes have higher disposable income as compared to most single-income families.

Moreover, the increasing growth of the country’s economy has led to rising disposable income, which is improving the purchasing power of consumers. The independent companies playing in the household appliances market generate their revenue based upon highly effective advertising strategies and streamlined operations. The already established distribution channels such as large retailers have an edge over the newcomers in the distribution network related to this market.

The big retailers can bargain with manufacturing companies for bulk purchases, offers and discounts, whereas the big household appliances manufacturing companies have advantages as far as the production, operation, marketing, and distribution of products/appliances is concerned. The major companies in the household appliances market are Whirlpool, BSH Bosch GmbH, Electrolux Group, GE appliances, Haier group, Samsung, Gorenje Group, Arcelik A.S., Panasonic Corporation, and LG Electronics.

Product Insights

Household appliances held the largest revenue share of more than 70.0% in 2021. Consumer appliances frequently require a large amount of electricity in order to function and are assigned a specific place or location in the household. The most prominent products in the domestic household appliance industry are refrigerators, freezers, washing machines, air conditioners, and dryers to name a few. These products are also known as white goods. Major household appliances have high demand in the market. Now with the increasing demand for major appliances, there is a growing demand for smart appliances coming into the picture as well.

Consumers have now started utilizing modern and technically advanced devices and appliances due to the associated convenience and time-saving. There is a steady growth predicted in this segment for Germany. The factors responsible for this growth could be due to the improving lifestyles of consumers, improvement in the purchasing power, and migration of the rural population to the urban areas. The demand for major household appliances is highly dependent on the income of the consumer, home renovation and remodeling, and replacement of an appliance due to its malfunction or failure. In the coming years, the market for major domestic household appliances is expected to escalate quickly.

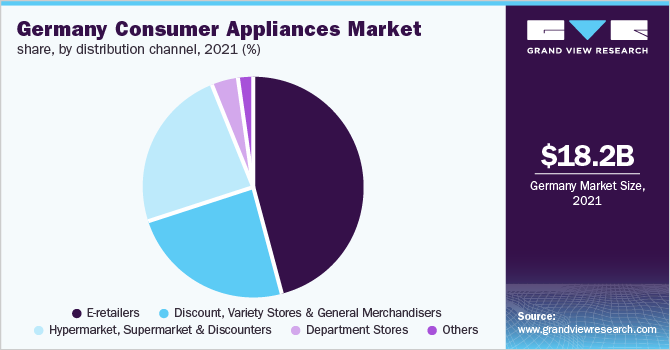

Distribution Channel Insights

The e-retailers segment held the largest revenue share of over 45.0% in 2021. In Germany, there is a greater degree of concentration as large retailers like Metro (Media Markt and Saturn) hold large market shares, thus acting as a greater deterrent to new entrants. E-commerce is booming in the German market with Amazon and Otto being the top e-retailers in the market space. E-retailers are followed by departmental stores, which is the second-highest growing distribution channel in Germany. The German population has demonstrated an inclination towards retail offers and discounts, along with a high number of secured e-payment options. Thus, the German e-retail and departmental stores are expected to witness high growth during the forecast years.

Due to the Eurozone crisis, the European countries had been affected economically and commercially. The countries that were affected the most were Portugal and Greece, but now these are recovering. This impacted the overall European market and the European countries in many ways. Germany, on the other hand, due to its high percentage of exports in the foreign lands did not suffer that much, the demand for technologically advanced, smart appliances, and energy-efficient appliances is increasing day by day.

The distribution channels for consumer appliances are highly fragmented. The distribution channels for the household appliances in Germany constitute larger diversified retailers, such as Aldi and Tesco, who wish to diversify into the household appliances market. These retailers benefit from scale economies, which provide them with greater bargaining power against suppliers. As a result, they are able to be more competitive with price.

Key Companies & Market Share Insights

The market has been characterized by the presence of international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market. For instance, in September 2021, BSH Appliances launched the new model of their pioneering Bosch Smart Indoor Gardening solutions. Additionally, in August 2021, Bosch Appliances lined up product launches across the world. The company plans to launch over 25 models of chimneys and hoods with premium features, such as auto cleaning, and various models of cooking and gas top burners. Some prominent players in the Germany consumer appliances market include:

-

Panasonic Corporation

-

BSH Hausegrate GmbH

-

Electrolux Group

-

Gorenje

-

Arcelik A.S.

-

Bosch

-

Miele

-

Thermador

-

Gaggenau

-

Liebherr

Germany Consumer Appliances Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 18.80 billion

Revenue forecast in 2030

USD 31.86 billion

Growth rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

Germany

Key companies profiled

Panasonic Corporation; BSH Hausgeräte GmbH; Electrolux Group; Gorenje; Arcelik A.S.;Bosch; Miele

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the Germany consumer appliances market report on the basis of product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Household Appliances

-

Kitchen Appliances

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

E-retailers

-

Discount, Variety Stores and General Merchandisers

-

Hypermarket, Supermarket and Discounters

-

Department Stores

-

Others

-

Frequently Asked Questions About This Report

b. The Germany consumer electronics market size was estimated at USD 18.21 billion in 2021 and is expected to reach USD 18.80 billion in 2022.

b. The Germany consumer electronics market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 31.86 billion by 2030.

b. Household appliances dominated the Germany consumer electronics market with a share of 72.5% in 2021. This is attributable to the increased preference for these products such as freezers, washing machines to name a few, as part of daily application.

b. Some key players operating in the Germany consumer electronics market include LG group, Whirlpool Corporation, Samsung, Panasonic corporation, Electrolux, Siemens AG, Gorenje group, Arcelik A.S., and Walton Group.

b. Key factors that are driving the Germany consumer electronics market growth include increasing demand for modern and technically advanced devices due to the associated convenience and time-saving.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.