- Home

- »

- Electronic Devices

- »

-

Kitchen Appliances Market Size, Share, Growth Report, 2030GVR Report cover

![Kitchen Appliances Market Size, Share & Trends Report]()

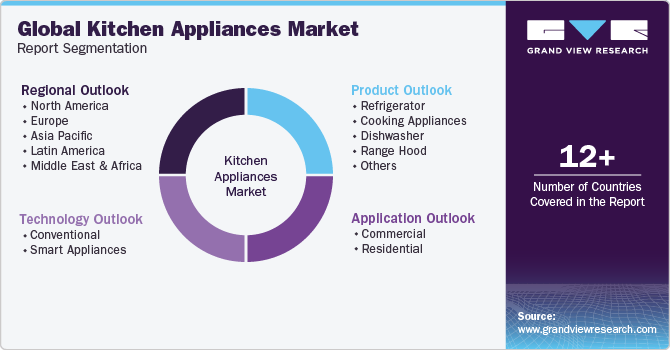

Kitchen Appliances Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (Conventional, Smart Appliances), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-650-9

- Number of Report Pages: 77

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Kitchen Appliances Market Summary

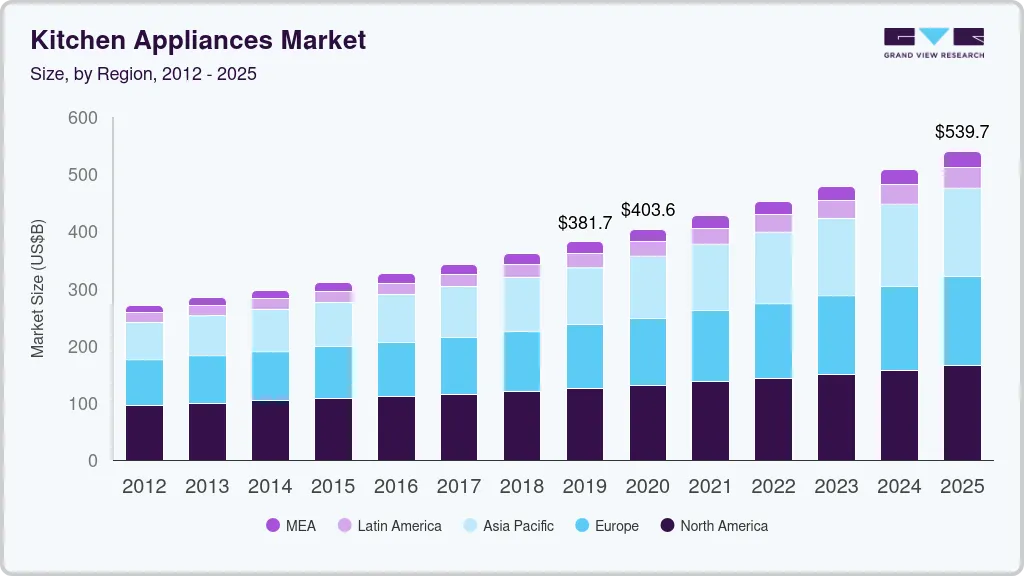

The global kitchen appliances market size was valued at USD 217.74 billion in 2022 and is projected to reach USD 356.47 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. Cost-effective and energy-efficient products are expected to gain revenue share over the next seven years owing to increasing government focus on curbing energy consumption.

Key Market Trends & Insights

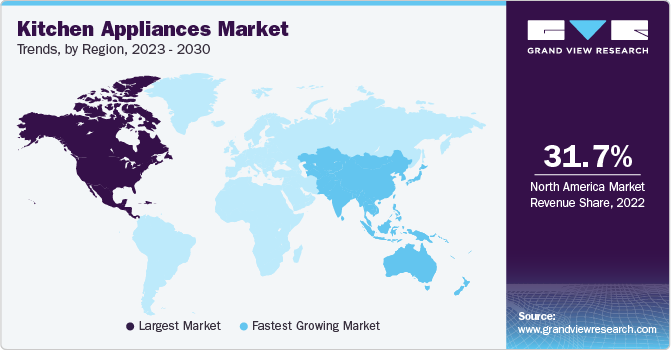

- North America dominated the market and accounted for the largest revenue share of 31.7% in 2022.

- Asia Pacific is expected to register the highest CAGR of 7.2% over the forecast period.

- Based on product, the refrigerator segment accounted for the largest revenue share of over 34.0% in 2022.

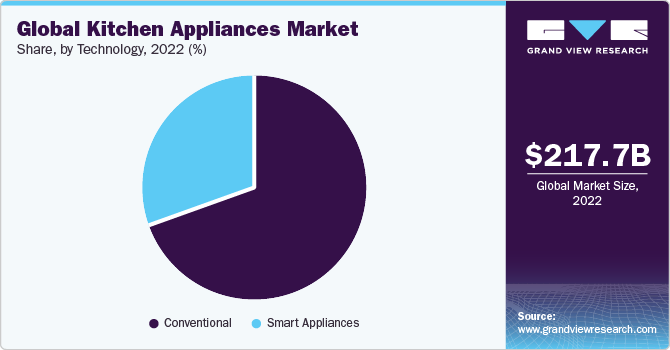

- Based on technology, the conventional segment accounted for the largest revenue share of over 69.3% in 2022.

- Based on application, the residential segment accounted for the largest revenue share of nearly 60.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 217.74 Billion

- 2030 Projected Market Size: USD 356.47 Billion

- CAGR (2023-2030): 5.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Cooking gas, electricity, renewable, and solar energy are primarily used to operate these appliances. Factors affecting the supply and demand of these fuels may affect industry. Rural electrification is anticipated to boost industry growth over the forecast period. Industry participants invest hugely in research and development for product innovation to retain revenue share and cater to changing customer preferences. Quality, price, energy efficiency, and technological advancement of the products affect the customers' buying decisions. The company's supply chain plays a key role in the industry, while the emergence of the e-commerce portal is expected to fuel growth.

Increasing replacement demand is expected to impact revenue over the forecast period favorably. Growing preference for modular kitchen demand is also anticipated to drive the demand for standalone ovens and cooktops. Product upgrades and growing urbanization are key factors driving growth. Increasing electricity cost and government initiative to spread awareness about energy consumption is expected to fuel demand for energy-efficient and eco-friendly product over the next seven years.

The rise in dual-income households and fast-paced modern lifestyles will spur luxury product segment demand over the next seven years. The growing popularity of ready-to-eat food among students and single-working individuals is expected to hinder industry growth over the forecast period.

Product Insights

Based on product, the market is segmented into refrigerators, cooking appliances, dishwasher, range hood, others. The refrigerator segment accounted for the largest revenue share of over 34.0% in 2022. This growth is owing to the increasing need for food and beverage storage along with merchandising purposes in the commercial sector. Replacement of old with new advanced products is also expected to drive demand for these products over the coming years.

The cooking appliances segment is estimated to register the fastest CAGR of 6.5% over the forecast period. The cooking appliances segment is further sub-segmented into cooktops & cooking ranges, ovens, and others. The trend towards smart homes and connected devices also influences the cooking appliances market. Consumers increasingly seek appliances that can be controlled and monitored remotely through smartphones or voice assistants. Smart cooking appliances with features like recipe recommendations, remote temperature adjustment, and integration with smart home ecosystems are gaining traction among tech-savvy consumers.

Technology Insights

Based on technology, the market is segmented into conventional and smart appliances. The conventional segment accounted for the largest revenue share of over 69.3% in 2022. A large consumer base prefers the familiarity and ease of use of conventional appliances. Many people are accustomed to conventional designs and functionalities, which makes them comfortable and confident in their usage. Moreover, the relatively lower cost of conventional appliances than their more advanced counterparts drives their demand. This affordability factor makes them accessible to many consumers, including those with budget constraints.

The smart appliances segment is estimated to register the fastest CAGR of 8.5% over the forecast period. The growing trend of smart homes and the increasing adoption of Internet of Things (IoT) technology have played a pivotal role. These appliances can be remotely controlled and monitored through smartphone apps or voice assistants, providing users with enhanced control and flexibility. Additionally, the growing popularity of digital assistants such as Amazon Alexa and Google Assistant has further accelerated the adoption of smart appliances.

Application Insights

Based on application, the market is segmented into commercial and residential. The residential segment accounted for the largest revenue share of nearly 60.6% in 2022. The rising global population and increasing urbanization have led to the growth of residential construction and housing projects, creating a larger customer base for kitchen appliances. As more individuals and families move into new homes or renovate existing ones, there is a higher demand for modern and efficient kitchen appliances.

The commercial segment is estimated to register the fastest CAGR of 6.4% over the forecast period. Commercial refrigeration equipment is commonly used in grocery stores, convenience stores, cafeterias, restaurants, specialty food stores, and supermarkets. Increasing disposable income, changing lifestyles, and increasing demand to replace old devices will drive the residential kitchen appliances industry over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 31.7% in 2022. Technological advancements have played a significant role in driving the growth of the market in North America. Introducing innovative features such as touch screens, wireless connectivity, and advanced sensors has attracted consumers and increased their interest in upgrading kitchen appliances.

Asia Pacific is expected to register the highest CAGR of 7.2% over the forecast period. Rising residential projects and the growing trend of nuclear families are expected to drive demand in the Asia Pacific region over the forecast period. Power infrastructure development in rural India is expected to open new growth opportunities for industry participants in the region.

Europe's kitchen appliances market is estimated to witness substantial growth over the forecast period owing to the increasing use of green products. Additionally, the consumer shift towards using induction cookers, microwave ovens, induction ranges, and electricity-operated products is expected to facilitate trouble-free operation quickly.

Increasing disposable income is expected to drive demand for MEA over the forecast period. The emerging middle-class population in Argentina and Brazil is expected to drive the upper price segment over the coming years.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2023, LG Electronics launched its latest range of built-in kitchen appliances in the United Arab Emirates. Premium ovens, hoods, and electric and gas cooktops with versatile, attractive designs and simple controls are included. The new appliances are designed to integrate easily into any kitchen interior, bringing the latest innovations and achieving the modern kitchen's highest ergonomics and equipment standards. The following are some of the major participants in the global kitchen appliances market:

-

AB Electrolux

-

Dacor, Inc.

-

Haier Group

-

LG Electronics

-

Morphy Richards

-

Panasonic Holdings Corporation

-

Koninklijke Philips N.V.

-

Whirlpool Corporation

-

SAMSUNG

-

Robert Bosch GmbH

Recent Developments

-

In February 2023, Electrolux widened its appliance lineup by offering built-in appliances in India. The new lineup includes microwaves, stoves, burners and cooker caps, dishwashers, and coffee machines. Electrolux appliances have an Eco program that aids in conserving water and energy. The entire line has pre-programmed meal settings and a steamy mode that can cook food while retaining all nutrients and moisture. Conventional choices such as conventional and fan-assisted cooking are also offered in these appliances.

-

In February 2023, Philips Domestic Appliances partnered with Omnicom Media Group (OMG) as its global media agency. This partnership encompasses a wide range of products, including kitchen appliances, coffee makers, indoor climate control devices, clothes steamers, irons, and floor cleaning appliances, and will extend to over 100 countries. OMG's involvement will be crucial in implementing a new marketing strategy and driving forward Philips Domestic Appliances' ambitious growth plans, aiming to solidify its position as a leading global provider of home appliances.

-

In December 2022, V-Guard acquired Sunflame Enterprises Private Ltd (SEPL) to establish a strong domestic market position. SEPL, operating under the Sunflame brand across India, holds a nationwide presence. This acquisition marks a crucial milestone for V-Guard as it aims to enhance consumer engagement through innovative products and experiences. With the iconic Sunflame brand deeply rooted in Indian households, V-Guard anticipates substantial progress in its ambition to become a leading player in the Indian kitchen appliances sector.

-

In August 2022, Thomson launched a comprehensive selection of kitchen appliances, including juice blenders, sandwich makers, electric cookers, geysers, room radiators, and more. Indian consumers are turning to economical and long-lasting products to make household chores easier. Along with metro cities, tier 3 cities and beyond have boosted demand for small household appliances. Thomson's new product line will provide clients with a wider assortment of best-in-class products while still delivering excellent quality at an affordable price.

-

In June 2022, TTK Prestige and Ultrafresh collaborated to support TTK's aim of becoming a comprehensive kitchen solutions brand. As part of Ultrafresh opened its inaugural experience center in Koramangala, Bengaluru. Spanning 2,700 square feet, the store showcases a variety of kitchen designs. With 120 studios in operation and the production of over 5,000 steel and wooden kitchens across the country, Ultrafresh is making significant strides.

Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 238.25 billion

Revenue forecast in 2030

USD 356.47 billion

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

AB Electrolux; Dacor; Inc.; Haier Group; LG Electronics; Morphy Richards; Panasonic Holdings Corporation; Koninklijke Philips N.V.; Whirlpool Corporation; SAMSUNG; Robert Bosch GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global kitchen appliances market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Refrigerator

-

Cooking Appliances

-

Cooktops & Cooking Range

-

Ovens

-

Others

-

-

Dishwasher

-

Range Hood

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Smart Appliances

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kitchen appliances market size was estimated at USD 217.74 billion in 2022 and is expected to reach USD 238.25 billion in 2023.

b. The global kitchen appliances market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 356.47 billion by 2030.

b. The cooking appliance segment dominated the kitchen appliances market with a share of 33.4% in 2022. Enhanced features, including various sensors and wi-fi connectivity being incorporated within the refrigerator, are anticipated to trigger the demand for the Refrigerator market.

b. Some key players operating in the kitchen appliances market include AB Electrolux, Carrier Corporation, Haier, Inc.; Koninklijke Philips N.V., LG Electronics, Morphy Richards, Samsung, Whirlpool Corporation, and General Electric.

b. Key factors that are driving the market growth include the changing lifestyle of individuals, increasing preference toward a nuclear family system, and growing hospitality industry are some of the factors that are expected to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.