Cookers & Ovens Market Size, Share & Trends Analysis Report By Type (Ovens, Cookers, Cooktops & Cooking Ranges), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-923-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

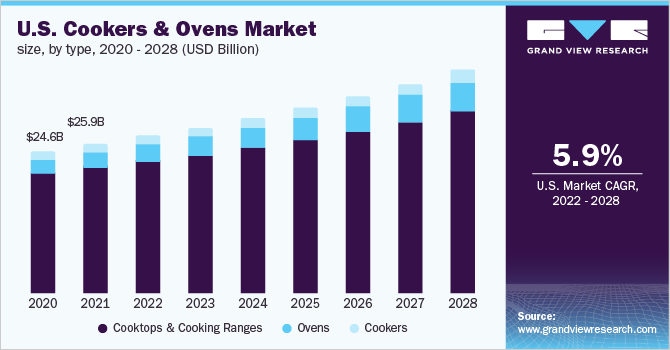

The global cookers & ovens market size was valued at USD 153.05 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2028. This can be credited to the growing demand for seamless and efficient cooking solutions and portable cooktops from consumers in China and India. The rising popularity of ovens among consumers across Europe due to their various functionalities is also anticipated to boost the market growth over the forecast period.

The coronavirus pandemic adversely affected the world economy. To stop the further spread of SARS-CoV-2, lockdown orders were imposed by governments across the globe. This had a devastating impact on trade and development, offline distribution channels, and the supply chain of the market for cookers & ovens. However, the market has, since, bounced back and is on the path to recovery, fueled by continued demand for a host of cooking appliances, including cookers and ovens.

There is a growing demand for freestanding cookers that provide precise temperature control as well as pre-set ovens with automatic power levels, which presents an opportunity in the market. Currently, key players operating in the market are focusing on launching stainless-steel cavity-based ovens as well as smart inverter microwave ovens. Apart from these, while some players are incorporating tandoor technology in the ovens, others are looking to offer built-in cookers, especially to cater to the demand in Europe.

Players have also stepped up their investments to manufacture advanced ovens & cookers at lower prices. For instance, China-based Haier Group invested in procuring technologically advanced ovens at a lower cost. This gives companies a competitive edge. Key players in the market are adopting online marketing channels to boost the sales of kitchen appliances. These e-commerce portals have been improving the commercial outlook for cookers and ovens, fueling the market growth.

Type Insights

Cooktops & cooking ranges accounted for the dominant share of over 80% in 2021 as these are energy-efficient cooking solutions. The growing adoption of dual heat sensor-based induction cooktops is fueling the demand for these kitchen appliances. The rising demand for cooktops with front Bakelite knob control among consumers in China and Saudi Arabia is also likely to boost segment growth over the forecast period. Ovens are projected to register the fastest growth over the forecast period, which is owing to the rising demand for charcoal lighting heater-based ovens from consumers in the U.K. and Germany.

The cookers segment also held a significant share in the cookers & ovens market and is expected to witness strong growth over the forecast period. The growth of the segment can be attributed to the increasing adoption of cookers with multiple burners as they ease the task of cooking. Moreover, cookers are available in varying sizes, depending upon the usage, the size of the kitchen, and the requirements of the consumers. Hot air grilling-based cookers are immensely popular in the market.

Distribution Channel Insights

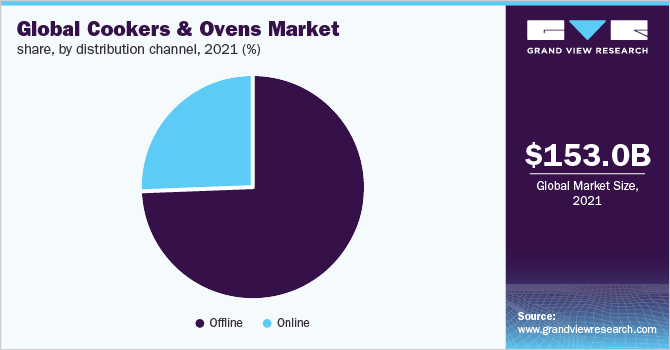

The offline segment held a share of just under 75% in the global market in 2021. The growing demand for micro-ovens in developing countries such as China and India will help build the network of kitchen appliance distributors and resellers. Local stores selling household appliances supply a diversified portfolio of cookers and ovens, both portable and non-portable, and build long-lasting customer relationships. Supportive measures taken by product manufacturers to provide an efficient sales margin for offline stores will propel the segment growth.

The online segment is projected to register the fastest growth over the forecast period. This growth can be attributed to the increased focus of cooker & oven manufacturers to adopt online trading as it is more secure compared to conventional trading. The availability of multiple international and domestic brands, customer-oriented delivery services, efficient transaction solutions, and safe payment methods are major factors driving consumers to purchase cookers & ovens through the online sales channel.

Regional Insights

Asia Pacific accounted for the largest share of over 35% in the global market in 2021, driven by various regional and local market trends. The increasing demand for convection microwave ovens among consumers in China and India, the rising trend in Japan to adopt motorized rotisseries with food-locking capability in ovens, the growing demand for enameled cavity-based cookers in China, and the increasing demand for 4D hot air-based ovens in India are some of the prominent trends anticipated to propel the Asia Pacific market.

Europe held the second-largest share in the market in terms of revenue, fueled by the rising popularity of ovens and built-in cookers among consumers in the region. The Middle East & Africa is projected to witness the fastest growth from 2022 to 2028, primarily owing to the growing disposable income of the upper-middle-class population in emerging economies such as Saudi Arabia and South Africa. The rising adoption of hot air grilling-based ovens and cooktops in Saudi Arabia and drip-free pouring-based cookers in South Africa are estimated to propel the regional market over the forecast period.

Key Companies & Market Share Insights

Some of the leading key players are Electrolux AB, Haier Group, Samsung, LG Electronics, Robert Bosch GmbH, and Koninklijke Philips N.V. These players have been undertaking business initiatives such as mergers & acquisitions, partnerships, product launches, and global expansion. Companies have been focusing on launching cooking equipment with no-pressure steam settings and locking indicator-based pressure cookers. Portable cooktops with a premium glass finish and stacking function in ovens have also been in high demand.

-

In December 2021, LG Electronics introduced and launched the latest range of cooking appliances at CES 2022 the Double Oven Gas Slide-in Range and the Over-the-Range Microwave Oven

-

In December 2021, GROUPE SEB signed an agreement with Preciber, a family company in Morocco, to form a joint venture called Groupe SEB Maroc to strengthen its presence in Africa

Some prominent players in the global cookers & ovens market include:

-

Electrolux AB

-

Haier Group

-

Samsung

-

LG Electronics

-

Robert Bosch GmbH

-

GROUPE SEB

-

Zwilling

-

Fissler

-

Koninklijke Philips N.V.

-

WMF Group

Cookers & Ovens Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 161.2 billion |

|

Revenue forecast in 2028 |

USD 227.8 billion |

|

Growth rate |

CAGR of 5.8% from 2022 to 2028 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Electrolux AB; Haier Group; Samsung; LG Electronics; Robert Bosch GmbH; GROUPE SEB; Zwilling; Fissler; Koninklijke Philips N.V.; WMF Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global cookers & ovens market report based on type, distribution channel, and region:

- Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Cooktops & Cooking Ranges

-

Ovens

-

Cookers

-

- Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

- Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central & South America

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

- Rest of Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."