Industry Insights

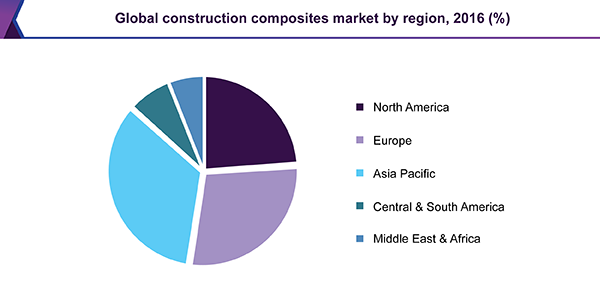

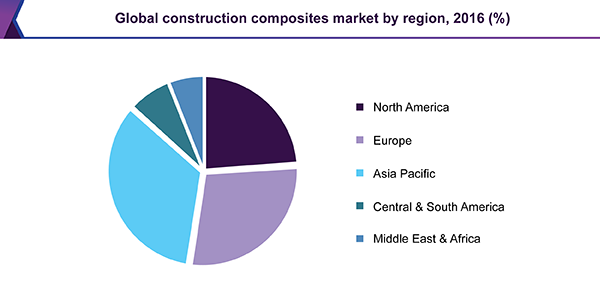

The global construction composites market size was estimated at USD 4.68 billion in 2016. The growth of the construction industry, coupled with rising demand for environmental-friendly and low-maintenance products, is expected to fuel the demand for the product over the forecast years.

The industry is constituted by a vast range of product offerings for application areas including gratings, stairways, decks, railing, and fences, for the industrial, commercial, and household sectors. The industry is majorly driven by the rising infrastructure development activities and investments across the emerging economies of the world. Technological advancements have also led to increased use of the product, primarily as a replacement for traditional materials such as aluminum and wood.

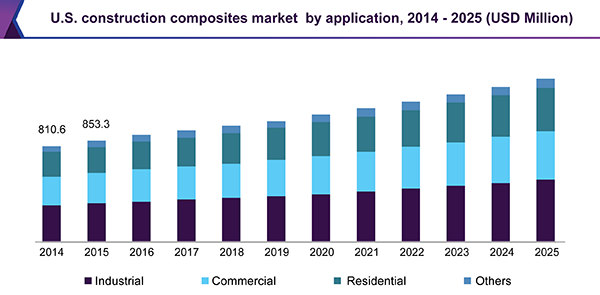

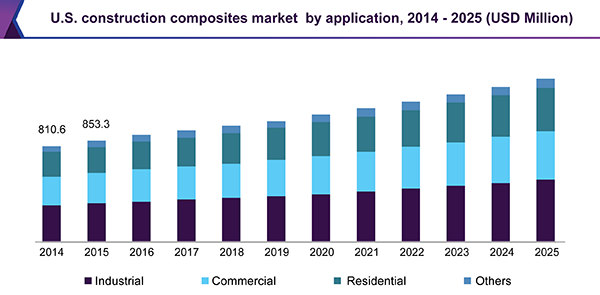

The U.S. product market was estimated at USD 898.7 million in 2016 and is anticipated to grow at a CAGR of 4.9% from 2017 to 2025. A number of research agencies have been conducting R&D investments and activities in the field of construction composites over the past few years. This has helped in discovering various applications of the product, thus increasing its usage scope. Technological innovations have led to the use of the products in the making of various structures that have complex shapes and are impossible to build with other materials such as wood and steel.

The major players in the construction composites market are focused on manufacturing products that suit all types of construction industry requirements. Floor tiles, fences, and railings are now increasingly being used and are replacing traditional materials, such as wood and steel. Composites are much more durable than other materials. They are lightweight, have low thermal conductivity, and are corrosion resistant. These properties have led to increased use of the products in the construction industry.

The products are specially designed for environments that are exposed to corrosion, heat, and pressure. Composites offer a longer life as compared to other materials. For instance, in factories, the railings used on walkways were previously made of steel or other metals. Due to the constant exposure to heat and other environmental conditions, they corrode easily and require to be repainted and polished from time to time. Since the products are resistant to heat and moisture, they do not corrode away and last longer without requiring regular maintenance

The growing demand for customized components in the construction industry has urged industry participants to integrate their portfolios with downstream production technologies. The use of construction composites is approved by various governing bodies and can be used while following the required restrictions and regulations. The manufacturers must strictly accommodate the regulations pertaining to the Toxic Substances Control Act and the Clean Air Act, which specifies the chemical and physical dangers of formaldehyde, which is emitted during the production of composites.

Fiber type Insights

Fibers are one of the major raw materials used for the production of composites. The prices of fibers and the wide usage of these raw materials in various other applications are expected to have a significant impact on the production of composites, which is in turn expected to affect the growth of the concerned industry.

The properties of carbon fibers such as high tensile strength, low thermal expansion, high stiffness, high temperature tolerance, high chemical resistance, and lightweight have led to the widespread use of this material for product manufacturing in recent years. Carbon fibers outperform glass fibers and others mainly in terms of tensile strength and compressive strength. In addition, the shape of carbon fibers does not deteriorate over time and remains consistent even when a constant force is applied to it.

In terms of revenue, the carbon fiber segment is expected to reach a market size of over USD 4.40 billion by 2025, growing at comparatively the slowest CAGR during the forecast period. This slow growth can be attributed to these fibers being increasingly replaced with glass fibers, which is expected to grow at a CAGR of nearly 7.5% during the forecast period.

Glass fiber, also known as fiberglass, is made from fine fibers of glass. Glass fiber is comparatively cheaper and less brittle than carbon fiber, and thus used significantly more in composites. Glass fibers are used as reinforcing agents in various polymer products to form lightweight plastic polymers. Glass fibers are easy to handle and cheap as compared to its counterparts and has the highest breaking point.

Resin type Insights

Thermoplastic resins harden when cooled but retain their plasticity. They can be re-melt and reshaped by heating above processing temperature. Thermoplastics are less expensive, weldable, non-toxic in nature, recyclable for other processes, and have increased toughness. The prices of resins are expected to have a significant impact on the production of composites, which is in turn expected to affect the growth of the product market.

The thermoplastic segment is expected to witness growth to the tune of nearly 7% during the forecast period. This can be attributed to the lower costs, recyclability, and non-toxicity. The thermoset segment, on the other hand, is projected to grow at a slower CAGR of around 5% during the forecast years.

Thermoset or thermosetting resins are synthetic materials that obtain more strength when heated, but cannot be remolded after the initial heating. Thermosetting products are stronger owing to the cross-linking and are suited for applications involving high temperatures. The most commonly used thermoset resins include polyester resin, vinyl ester resin, and epoxy resin. Thermoset resins are popular and more widely used due to it being in a liquid state at room temperature. This allows easier impregnation of fibers such as glass and carbon fibers.

Application Insights

The industrial application was the largest segment for the product in 2016, accounting for nearly 36% of the overall revenues. The increasing use of the product in application areas such as stairways, walkways, trash gates, gratings, and ladders in the industrial segment, owing to the anti-corrosion and moisture-proof properties, is expected to drive the segment growth.

The residential application was the second-largest segment and is expected to grow at the fastest CAGR of 6.2% during the forecast period. This can be attributed to the increasing residential construction activities in emerging economies such as Russia, India, China, South Korea, Brazil, and so on.

Construction composites are increasingly being used as replacements for traditional decking and railing products, such as wood, aluminum, and steel. The industrial and residential segments are expected to be the higher revenue-generating segments owing to the increasing demand for low-maintenance and durable products in the aforementioned countries. In addition, the growing infrastructure spending across the globe is expected to further augment the product demand.

Regional Insights

The Asia Pacific dominated the overall industry in 2016, in terms of revenue, and this trend is expected to continue over the forecast period. This regional segment, estimated at USD 1,606.3 million in 2016, is anticipated to witness growth to the tune of over 6% during the forecast period. The increasing demand for construction composites in countries such as India and China is expected to propel the market growth over the forecast period.

The Asia Pacific was the largest market segment in 2016 in terms of volume and is expected to grow the fastest over the forecast period. The growth of the construction industry in countries such as India and China is expected to propel the demand for construction composites in industrial applications. Industrial growth in these countries is expected to impact the market. In addition, the booming construction industry is expected to fuel market growth over the forecast period.

Construction Composites Market Share Insights

The key players in the global market include Fibergrate Composite Structures, Inc.; Advanced Environmental Recycling Technologies, Inc.; Fiberon LLC; Strongwell Corporation; and Trex Company, Inc as well as a few medium and small regional players such as Zhengzhou Yalong Pultrex Composite Materials Co., Ltd.; Jiangsu Jiuding New Material Co., Ltd.; and Fibrolux GmbH operating in China and Germany. The companies are emphasizing on acquisitions, capacity expansions, and new product developments to increase their shares and competitiveness in the industry.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Actual estimates/Historical data

|

2014 - 2016

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Volume in kilotons; Revenue in USD Million; and CAGR from 2017 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

|

|

Country scope

|

U.S., U.K., Germany, China, India, Japan, Brazil, South Africa

|

|

Report coverage

|

Revenue forecast, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analysts working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global construction composites market on the basis of fiber type, resin type, application, and region:

-

Fiber Type Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Carbon fiber

-

Glass fiber

-

Others

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Industrial

-

Commercial

-

Residential

-

Others

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

North America

-

Europe

-

Asia Pacific

-

Central & South America

-

Middle East & Africa