- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Carbon Fiber Market Size, Share And Growth Report, 2030GVR Report cover

![Carbon Fiber Market Size, Share & Trends Report]()

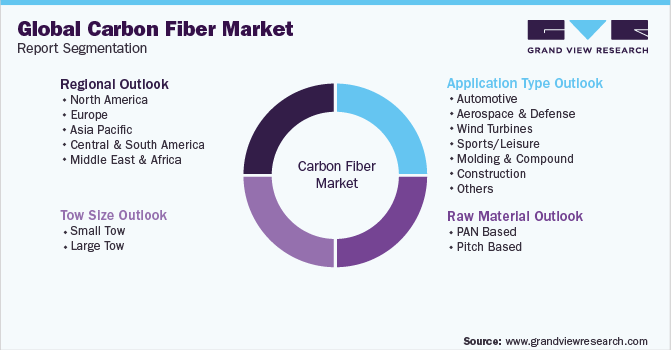

Carbon Fiber Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (PAN-based, Pitch-based), By Tow Size, By Application (Automotive, Aerospace & Defence), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-523-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Fiber Market Summary

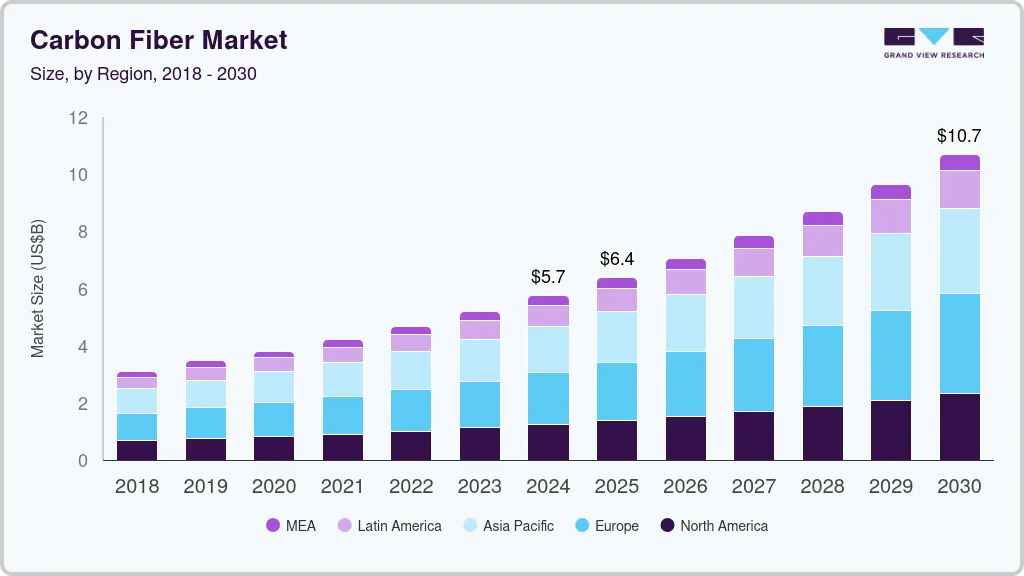

The global carbon fiber market size was estimated at USD 5.75 billion in 2024 and is estimated to reach USD 10.68 billion by 2030, growing at a CAGR of 10.9% from 2025 to 2030. This growth can be attributed to the rising use of carbon fiber in wind energy applications, driven by the global shift toward renewable energy.

Key Market Trends & Insights

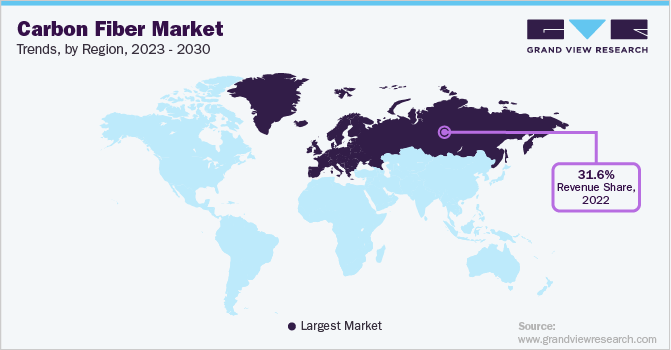

- The Europe carbon fiber market dominated the global market and accounted for 31.9% of global revenue in 2024.

- By raw material, the polyacrylonitrile (PAN) segment accounted for the fastest and largest revenue share of 96.4% in 2024.

- By application , the aerospace & defense segment accounted for the largest revenue share of 32.2% in 2024.

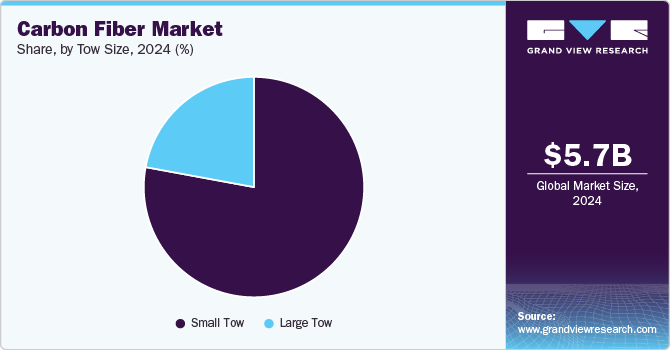

- By tow size, the small tow segment accounted for the largest revenue share of 77.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.75 Billion

- 2030 Projected Market Size: USD 10.68 Billion

- CAGR (2025-2030): 10.9%

- Europe: Largest market in 2024

As countries aim to reduce their dependence on fossil fuels, the demand for wind turbines is increasing, and carbon fiber's strength and durability make it ideal for turbine blades. Carbon fiber allows for longer and more efficient blades that capture more wind energy, thus improving the efficiency of wind farms. Furthermore, the construction and infrastructure industries are recognizing carbon fiber's potential for enhancing the longevity and resilience of structures. In civil engineering, carbon fiber is increasingly used for strengthening and retrofitting bridges, buildings, and other infrastructure, where its corrosion resistance and lightweight nature offer distinct advantages over traditional materials.

The carbon fiber market is driven by the material's advantageous properties and strong demand across diverse sectors. One significant driver is the growing need for lightweight and high-strength materials in the automotive and aerospace industries. Carbon fiber is renowned for its high strength-to-weight ratio, which makes it ideal for manufacturing lighter vehicles and aircraft. This results in increased fuel efficiency and reduced emissions, aligning with global efforts to meet sustainability goals and reduce environmental impact. In aerospace, the use of carbon fiber components contributes to reduced fuel consumption and enhanced aircraft performance, making it highly valued for modern aircraft and spacecraft design.

The electronics and sports equipment sectors are also significant contributors to carbon fiber demand. Electronics manufacturers are incorporating carbon fiber into devices to achieve durability while keeping devices lightweight, appealing to consumer preferences for portable and robust products. Similarly, in sports, carbon fiber is widely used in equipment like bicycles, tennis rackets, and golf clubs due to its superior strength and flexibility, which enhances performance. Lastly, government incentives and subsidies supporting research and development in advanced materials are fueling innovations in carbon fiber production, helping reduce costs, and improving manufacturing efficiencies. With technological advancements, carbon fiber has become more accessible and affordable, which further drives its adoption across multiple industries.

Raw Material Insights

The polyacrylonitrile (PAN) segment led the market and accounted for the fastest and largest revenue share of 96.4% in 2024. The automotive industry’s increasing shift toward electric vehicles (EVs) is driving the demand for PAN-based Carbon Fiber. Manufacturers are using these fibers in vehicle body structures, battery enclosures, and interior components to make EVs lighter and improve battery efficiency, thereby enhancing overall range. This aligns with the broader sustainability goals and regulatory mandates for lower emissions, which many automakers are actively pursuing.

The pitch segment is expected to grow significantly at 12.4% CAGR in terms of revenue over the forecast period. The industrial sector, including electronics and construction, contributes to the rising demand for pitch-based carbon fiber. In electronics, pitch-based fibers are utilized for heat dissipation in devices where maintaining stable temperatures is critical to performance. Similarly, in the construction industry, these fibers are applied in high-stress environments, such as in reinforced concrete for bridges and buildings. Their strength, rigidity, and resilience to environmental stressors make pitch-based carbon fiber highly sought after for extending infrastructure lifespan.

Application Insights

The aerospace & defense segment led the market and accounted for the largest revenue share of 32.2% in 2024. The increased investment in next-generation aircraft and space exploration is driving the demand for carbon fiber in aerospace. As the industry develops advanced aircraft, satellites, and spacecraft, carbon fiber’s properties become essential for achieving the structural integrity and lightness required for long-term missions and extreme environmental conditions. The rise of commercial space ventures, as well as government-led space missions, further strengthens the demand for carbon fiber.

Wind turbine application is expected to grow at the fastest CAGR of 12.3% in terms of revenue over the forecast period. The increasing global emphasis on renewable energy sources to combat climate change and reduce carbon emissions is driving demand for wind energy infrastructure. Carbon fiber is an ideal material for wind turbine blades, offering high strength and lightweight properties that allow for longer, more efficient blades capable of capturing more wind energy.

Tow Size Insights

The small tow led the market and accounted for the largest revenue share of 77.9% in 2024. Rising adoption in the automotive industry, particularly in luxury and high-performance vehicles where weight reduction and mechanical strength are paramount, is driving the market growth. Small tow carbon fiber is preferred in manufacturing body panels, roof structures, and other parts that benefit from its precise structural properties, ultimately enhancing vehicle speed, fuel economy, and stability. This aligns with the automotive sector's emphasis on sustainability and efficiency, with small tow carbon fiber allowing for significant weight reductions without compromising strength or safety.

Large tow’s revenue is expected to grow at 10.3% CAGR over the forecast period. The wind energy sector is a major driver for the large two segments, where the material’s strength and cost-efficiency play a vital role in the production of longer, more durable turbine blades. Large two Carbon Fiber enable the manufacturing of these blades at a lower cost per unit, making it more feasible to build and maintain wind farms on a larger scale. Given the global shift toward renewable energy sources, demand for large two carbon fiber in this sector is expected to continue rising as wind power infrastructure expands globally.

Regional Insights

The North America carbon fiber market is expected to grow at the significant CAGR over the forecast period. The growing investments in electric vehicles (EVs) and lightweight transportation solutions in North America have increased the demand for carbon fiber composites, as they help reduce the overall weight and increase the energy efficiency of EVs. The continued evolution of material science, coupled with government initiatives aimed at promoting clean energy and green technologies, ensures a favorable environment for the expansion of the carbon fiber market in the region.

U.S. Carbon Fiber Market Trends

The carbon fiber market in U.S. is expected to grow at a significant CAGR over the forecast period. The automotive sector, particularly in the United States, is undergoing a transformation with a rapid shift toward electric vehicles (EVs) and more fuel-efficient vehicles. Carbon fiber is a critical material in EVs due to its lightweight nature, which helps improve energy efficiency and extends the driving range of electric vehicles. With major automakers like General Motors, Ford, and Tesla leading the way in EV production, the demand for carbon fiber in automotive manufacturing is rising. Furthermore, government policies aimed at reducing carbon emissions and promoting electric transportation are accelerating the adoption of lightweight materials like carbon fiber in vehicle design.

Europe Carbon Fiber Market Trends

The Europe carbon fiber market dominated the global market and accounted for 31.9% of global revenue in 2024. The aerospace industry in Europe also plays a crucial role in boosting the demand for carbon fiber. With the presence of prominent aircraft manufacturers such as Airbus, there is a growing need for high-strength, lightweight materials to improve fuel efficiency and enhance performance. Carbon fiber’s strength-to-weight ratio is particularly valuable for aircraft, enabling longer flight ranges and lower operational costs. Europe’s aerospace sector is heavily invested in research and development, aiming to leverage advanced composites like carbon fiber for next-generation aircraft.

Germany carbon fiber market is witnessing demanddue to carbon fiber offers high-quality, durable, and aesthetically appealing products in sports, automotive, and electronics industry. In sporting goods, carbon fiber is valued for its lightweight yet robust nature, enhancing performance in products like bicycles, golf clubs, and racquets. In consumer electronics, carbon fiber’s sleek look and strength make it a popular choice for premium device casings and components. As these sectors continue to grow, the demand for carbon fiber is likely to increase alongside them.

UK carbon fiber market is growing due to shift towards automating manufacturing processes, particularly in industries such as robotics, where carbon fiber’s lightweight and durable nature improves efficiency and productivity. Robots that incorporate carbon fiber components are more agile, reducing energy consumption and increasing precision. As the industrial sector continues to invest in automation and robotics, the demand for carbon fiber in these applications is expected to grow.

Asia Pacific Carbon Fiber Market Trends

The automotive industry in Asia Pacific, particularly in countries like Japan, China, and South Korea, is a major driver for carbon fiber demand. As these countries focus on producing lighter and more fuel-efficient vehicles, carbon fiber is becoming a key material in automotive manufacturing. This is especially true for electric vehicles (EVs) where reducing the weight of the vehicle directly impacts range and performance. With the shift towards more sustainable transportation solutions, the automotive sector’s adoption of carbon fiber is increasing rapidly across the region, driven by both government regulations and consumer demand for greener, more energy-efficient vehicles.

China carbon fiber market is witnessing growth due to the pivotal role of government of China. National policies that focus on industrial upgrading, the promotion of sustainable energy, and the support for advanced manufacturing are creating a favorable environment for the use of carbon fiber. Additionally, China’s commitment to reducing carbon emissions and improving energy efficiency across industries has encouraged the adoption of carbon fiber in sectors such as automotive, aerospace, and energy. Government subsidies, funding for R&D, and policies aimed at boosting the green economy are all contributing to the growing demand for carbon fiber in the country.

Central and South America Carbon Fiber Market Trends

Central and South America is expected to grow at the fastest CAGR of 8.6% over the forecast period. The automotive industry, particularly in countries like Brazil and Mexico, is a key driver of carbon fiber adoption. The demand for lightweight, durable materials in vehicle manufacturing is increasing as automakers work to meet stricter fuel efficiency standards and reduce emissions. Carbon fiber is being used to improve vehicle performance and safety while reducing weight. As the region continues to adopt electric vehicles (EVs) and hybrid vehicles, carbon fiber plays an important role in enhancing the energy efficiency and driving range of these vehicles. Local manufacturers and international automotive giants with plants in the region are likely to drive the growth of carbon fiber used in automotive applications.

Key Carbon Fiber Company Insights

Some of the key players operating in the market include Owens Corning, Rockwell International, A&P Technology Inc.,Anshan Sinocarb Carbon Fiber Co. Ltd, among others:

-

Owens Corning offers a range of high-quality products, including FOAMULAR extruded polystyrene (XPS) insulation boards, renowned for their moisture resistance, durability, and thermal performance. Additionally, the company provides Thermafiber mineral wool insulation boards, which offer fire resistance and sound control, meeting the needs of both residential and commercial applications.

-

Rockwell International, a prominent player in the Carbon Fiber market, specializes in providing high-performance insulation solutions designed for both commercial and industrial applications. With a focus on energy efficiency, sustainability, and durability, Rockwell's product portfolio includes an array of mineral wool insulation boards. These offerings cater to multiple needs, including thermal and acoustic insulation as well as fire resistance, making them suitable for walls, roofs, floors, and HVAC systems. The company’s Carbon Fiber products are engineered to meet stringent industry standards, supporting energy conservation efforts and enhancing the safety and comfort of building environments.

Key Carbon Fiber Companies:

The following are the leading companies in the carbon fiber market. These companies collectively hold the largest market share and dictate industry trends.

- A&P Technology Inc.

- Anshan Sinocarb Carbon Fiber Co. Ltd

- DowAksa USA LLC

- Formosa Plastics Corporation

- Hexcel Corporation

- Holding company Composite

- Hyosung Advanced Materials

- Jiangsu Hengshen Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries Inc.

- Zhongfu Shenying Carbon Fiber Co. Ltd

Carbon Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.37 billion

Revenue forecast in 2030

USD 10.68 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Franc; China; Japan; Taiwan; Brazil

Segments covered

Raw material, tow size, application, region

Key companies profiled

A&P Technology Inc.; Anshan Sinocarb Carbon Fiber Co. Ltd; DowAksa USA LLC; Formosa Plastics Corporation; Hexcel Corporation; Holding company Composite; Hyosung Advanced Materials; Jiangsu Hengshen Co. Ltd; Mitsubishi Chemical Corporation; Nippon Graphite Fiber Co. Ltd; SGL Carbon; Solvay; Teijin Limited; Toray Industries Inc.; Zhongfu Shenying Carbon Fiber Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Fiber Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon fiber market report based on raw material, tow size, application, and region:

-

Raw Material Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

PAN Based

-

Pitch Based

-

-

Tow Size Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Small Tow

-

Large Tow

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Wind Turbines

-

Sports/Leisure

-

Molding & Compound

-

Construction

-

Pressure Vessel

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global carbon fiber market size was estimated at USD 5.75 billion in 2024 and is expected to reach USD 6.37 billion in 2025.

b. The global carbon fiber market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2030, reaching USD 10.68 billion by 2030.

b. The aerospace and defense market accounted for the largest revenue share, 32.1%, in 2024. This is attributed to the industry's growing use of carbon fiber to cater to the growing demand for commercial aircraft worldwide.

b. Some key players operating in the carbon fiber market include A&P Technology Inc., Anshan Sinocarb Carbon Fibers Co. Ltd, DowAksa USA LLC, Formosa Plastics Corporation, Hexcel Corporation, Holding company Composite, Hyosung Advanced Materials, Jiangsu Hengshen Co. Ltd, Mitsubishi Chemical Corporation, Nippon Graphite Fiber Co. Ltd, SGL Carbon, Solvay, Teijin Limited, Toray Industries Inc., Zhongfu Shenying Carbon Fiber Co. Ltd.

b. The growing automotive development, along with the development of aerospace and defense sectors, are propelling carbon fiber's market growth. This is due to its light weightiness in comparison to conventional alternatives such as metals and alloys.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.