- Home

- »

- Advanced Interior Materials

- »

-

Fiberglass Market Size & Share, Industry Report, 2033GVR Report cover

![Fiberglass Market Size, Share & Trends Report]()

Fiberglass Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Insulation, Composites), By Product Type (Glass Wool, Yarn, Roving, Chopped Strand), By End Use (Automobiles, Construction), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-027-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiberglass Market Summary

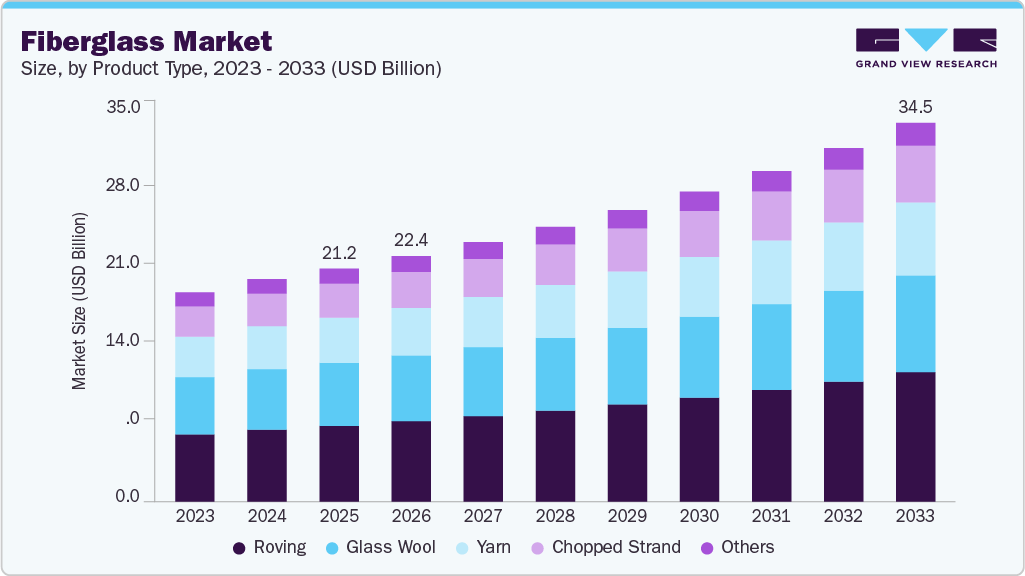

The global fiberglass market size was estimated at USD 21.24 billion in 2025 and is projected to reach USD 34.52 billion in 2033, growing at a CAGR of 6.4% from 2026 to 2033. This growth is attributed to the increasing demand for lightweight and durable materials in the automotive and aerospace sectors, which enhances fuel efficiency and performance, driving market growth.

Key Market Trends & Insights

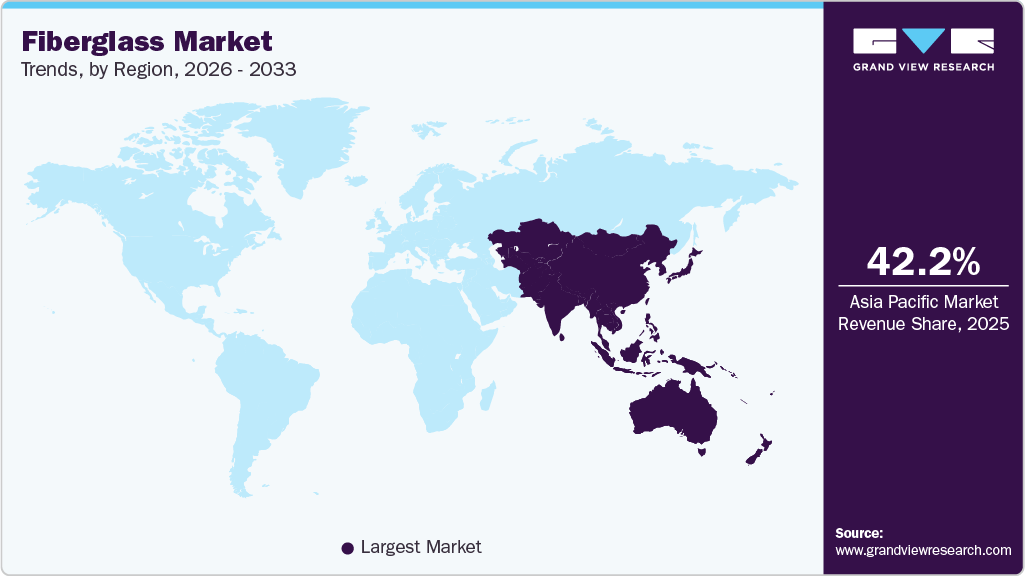

- Asia Pacific dominated the fiberglass market with the largest revenue share of 42.2% in 2025.

- By product type, the roving segment is expected to grow at the fastest CAGR of 7.0% over the forecast period.

- By application, the composites segment is expected to grow at fastest CAGR of 6.7% over the forecast period.

- By end use, the wind energy segment is expected to grow at fastest CAGR of 7.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 21.24 Billion

- 2033 Projected Market Size: USD 34.52 Billion

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

In addition, investments in renewable energy, particularly for wind turbine blades, are driving up fiberglass usage. The construction industry's focus on energy-efficient buildings further propels demand, particularly in emerging economies. Furthermore, technological advancements and sustainability initiatives also play a significant role in this growth trajectory.Fiberglass is a chemically stable, lightweight, and durable material extensively used in various industries, including marine, aerospace, electronics, automotive, plumbing, and storage solutions. The growing emphasis on reducing vehicle weight and enhancing fuel efficiency significantly boosts demand for fiberglass. In addition, the increasing demand for insulation and composite materials in the automotive sector is expected to further drive market growth in the coming years.

Moreover, fiberglass also plays a crucial role in energy-efficient buildings by maintaining temperature and reducing energy costs. This trend aligns with increasing investments in sustainable construction. However, the environmental impact of fiberglass disposal poses challenges due to its inorganic fillers, which complicate recycling efforts and contribute to landfill waste. In the automotive industry, fiberglass is commonly used for components such as headliners and fenders.

Furthermore, stringent emission regulations worldwide encourage manufacturers to adopt lightweight materials, such as fiberglass, to comply with standards like CAFÉ. The construction sector remains a significant consumer of fiberglass for applications like mesh fabrics that prevent wall cracks and enhance waterproofing. Demand for fiberglass is expected to increase as renovation activities rise in North America and Europe. Moreover, the International Building Code now recognizes fiber-reinforced polymer (FRP) as a viable construction material for use above certain heights, thereby further promoting the adoption of fiberglass in architecture and construction projects.

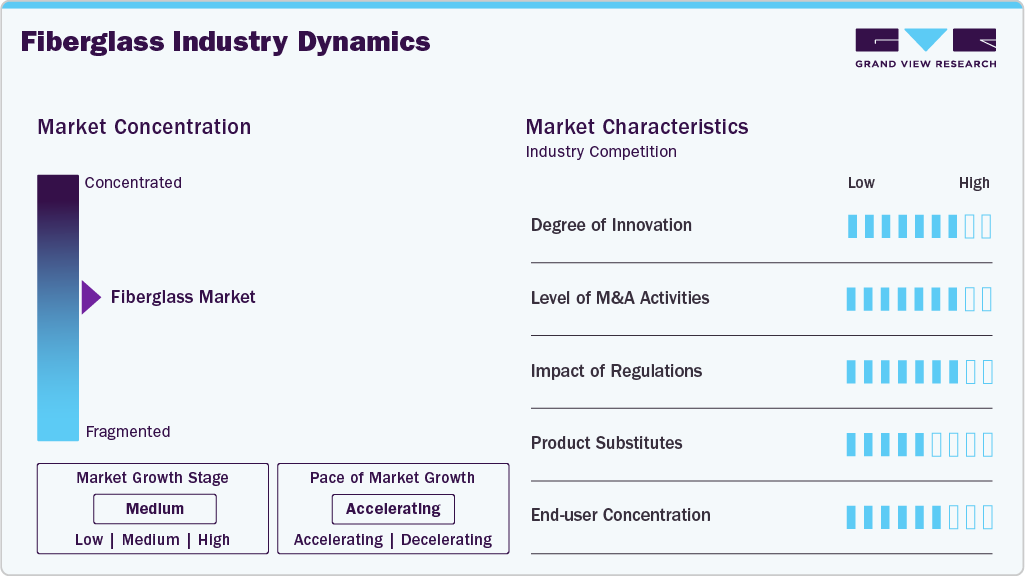

Market Concentration & Characteristics

The fiberglass market is moderately consolidated, with a few global players controlling a significant share of production capacity. Major manufacturers benefit from vertically integrated operations, strong distribution networks, and long-term supply contracts. However, regional players remain competitive, particularly in Asia Pacific, due to lower manufacturing costs. Entry barriers include high capital investment, technology requirements, and energy-intensive production processes. Leading companies focus on capacity expansions and technological upgrades to maintain market dominance. Strategic partnerships with composite manufacturers are strengthening supplier positioning.

Fiberglass faces competition from carbon fiber, basalt fiber, and natural fiber composites in certain applications. Carbon fiber offers superior strength and stiffness, but remains significantly more expensive, which limits its widespread substitution. Basalt fiber is emerging as a potential alternative due to similar properties and better thermal resistance. Natural fibers such as jute and flax are gaining attention in low-load and sustainability-focused applications. However, fiberglass maintains an advantage in cost, versatility, and established supply chains. Substitution risk remains moderate, particularly in automotive and wind energy sectors. Performance-to-cost balance continues to favor fiberglass for mass-market applications.

Product Type Insights

The roving segment led the market and accounted for the largest revenue share of 32.6% in 2025, due to its extensive use as a primary reinforcement material across various construction, wind energy, automotive, and industrial applications. Continuous roving offers high tensile strength, excellent fiber alignment, and superior load-bearing capability, making it ideal for processes such as filament winding, pultrusion, and weaving. Strong demand from wind turbine blade manufacturing significantly supports roving consumption, as it provides the structural integrity required for large composite structures. In addition, increasing use of fiberglass pipes, tanks, and pressure vessels in chemical and water infrastructure projects boosts demand. Cost-effectiveness compared to advanced fibers further strengthens its adoption.

Chopped strand is expected to grow at the fastest CAGR of 6.8% over the forecast period, owing to its versatility and high mechanical strength, making it suitable for various applications across industries such as automotive, aerospace, and marine. Their lightweight nature helps enhance vehicle fuel efficiency while meeting stringent regulatory requirements. In addition, the growing trend towards sustainable materials also boosts demand for chopped strands, as they can replace traditional materials in composite applications. Furthermore, continuous innovations and technological advancements in production are expanding their applications, driving market growth significantly in sectors that require durable and efficient materials.

Application Insights

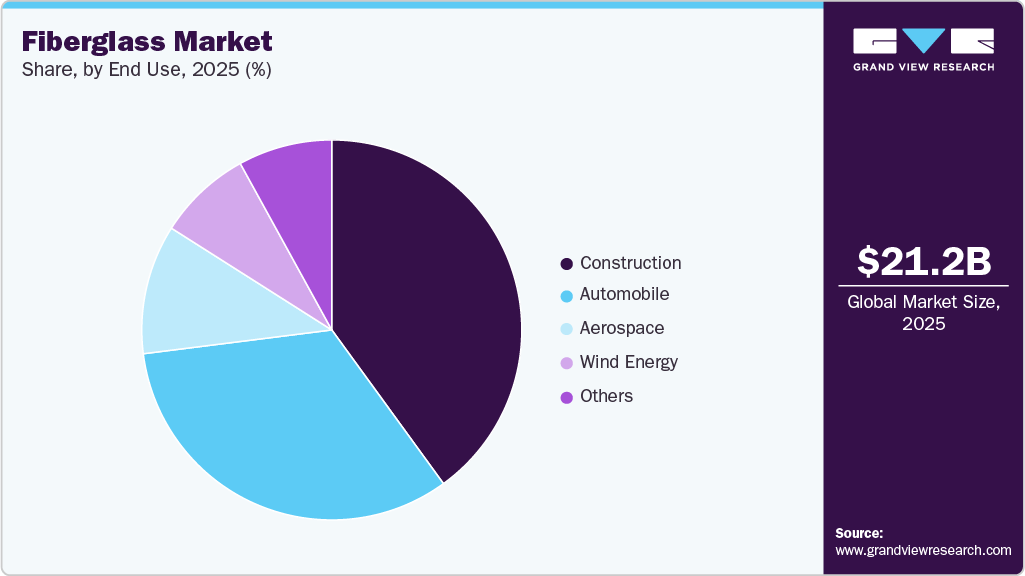

Composites dominated the market and accounted for the largest revenue share of 65.8% in 2025, attributed to the increasing demand for lightweight and high-performance materials across various industries, particularly automotive and aerospace. As manufacturers strive to enhance fuel efficiency and reduce emissions, composites offer an ideal solution due to their strength-to-weight ratio. Furthermore, the construction sector is increasingly adopting composites for their durability and resistance to environmental degradation. This trend is supported by stringent regulatory requirements encouraging the use of advanced materials, driving innovation and investment in composite technologies.

The insulation segment is expected to grow at a CAGR of 5.7% over the forecast period, driven by the increasing focus on building energy efficiency. As construction activities expand globally, there is a heightened demand for effective thermal and electrical insulation materials. Fiberglass insulation helps maintain indoor temperatures, thereby reducing energy consumption and associated costs. In addition, the increasing emphasis on sustainable building practices further propels this demand, as fiberglass products are often recyclable and contribute to eco-friendly construction standards. Furthermore, ongoing renovations and remodeling projects replace traditional materials with fiberglass, enhancing structural stability and improving overall insulation performance.

End Use Insights

The construction segment held a dominant position in the market and accounted for the largest revenue share of 39.9% in 2025, driven by the increasing demand for energy-efficient and sustainable building materials. Fiberglass is widely used in insulation, roofing, and facade reinforcement applications due to its durability and excellent thermal properties. As urbanization accelerates, particularly in emerging economies, a heightened focus on infrastructure development further propels fiberglass demand. Furthermore, government regulations promoting sustainable construction practices contribute to the rising adoption of fiberglass in various building projects, enhancing its market value.

The automobile segment is expected to grow at a CAGR of 6.8% from 2026 to 2033. This growth is attributed to the industry's shift toward lightweight materials that improve fuel efficiency and reduce emissions. Stringent regulations such as Corporate Average Fuel Economy (CAFÉ) standards prompt manufacturers to incorporate fiberglass into vehicle components such as body panels and bumpers. In addition, the material's high strength-to-weight ratio enables enhanced performance without compromising safety. Furthermore, the increasing focus on sustainability and the need for innovative materials in vehicle design are driving the adoption of fiberglass in automotive manufacturing, supporting overall market growth.

Regional Insights

Asia Pacific fiberglass market dominated the global market and accounted for the largest revenue share of 42.2% in 2025, due to strong manufacturing capabilities and high demand from construction and industrial sectors. China leads global production, supported by large-scale infrastructure projects and cost-efficient manufacturing. Rapid urban development in India and Southeast Asia is boosting demand for insulation and reinforced materials. The region benefits from easy availability of raw materials and skilled labor. Expanding wind energy installations further support fiberglass consumption. Export-oriented production strengthens regional dominance. Continuous capacity expansions reinforce Asia Pacific’s leadership position.

The fiberglass market in China dominated the Asia Pacific market, accounting for the largest revenue share in 2025, due to its status as the largest producer and consumer globally. The country's aggressive infrastructure development and urbanization efforts are key drivers, resulting in heightened demand for construction materials. Furthermore, China's automotive industry is increasingly incorporating fiberglass to meet stringent emission regulations and enhance vehicle performance. Moreover, the government's focus on renewable energy initiatives, particularly in wind energy, also contributes to the rising need for fiberglass products, positioning China as a pivotal player in the global market.

Europe Fiberglass Market Trends

Europe fiberglass market is expected to grow at the fastest CAGR of 5.3% over the forecast period. This growth is attributed to its established automotive and aerospace industries. In addition, the construction sector's emphasis on energy-efficient buildings drives demand for insulation materials, such as glass wool. Furthermore, the region's commitment to sustainability and innovation fosters advancements in fiberglass technology, further enhancing its applications across various industries.

The German fiberglass market is expected to experience significant growth over the forecast period, driven by a strong manufacturing base and a robust automotive sector that prioritizes lightweight materials. In addition, the country's focus on high-performance engineering and sustainability results in an increased use of fiberglass in in-vehicle components and construction applications. Furthermore, Germany's commitment to renewable energy sources promotes the use of fiberglass in wind turbine production, aligning with national goals for energy transition.

North America Fiberglass Market Trends

North America fiberglass market held a significant revenue share of 22.1% in 2025. This growth is driven by extensive infrastructure development and rising automotive sales. The region's focus on energy efficiency increases the demand for fiberglass insulation in buildings, enhancing overall energy performance. In addition, innovations in manufacturing processes are leading to enhanced product quality and increased applications across various sectors. Furthermore, as companies seek sustainable solutions, adopting fiberglass as a lightweight material for automotive components further supports market expansion in North America.

U.S. Fiberglass Market Trends

The U.S. market is driven by residential and commercial construction activity. Fiberglass insulation remains widely used due to cost effectiveness and regulatory compliance. Wind turbine blade manufacturing is a major contributor to fiberglass demand. Automotive lightweighting trends further support market growth. High defense and aerospace spending drives the development of advanced composite applications. Manufacturers focus on automation and efficiency improvements. The market exhibits steady growth, driven by innovation and expansion.

Latin America Fiberglass Market Trends

Latin America is experiencing gradual growth in fiberglass demand, driven by the construction and infrastructure development sectors. Brazil leads regional consumption due to industrial expansion. Renewable energy projects are supporting the use of fiberglass in wind power applications. Cost-effective materials are preferred, which benefits the adoption of fiberglass. Limited domestic production leads to reliance on imports. Industrial modernization initiatives support long-term growth. The market remains emerging with moderate penetration.

Middle East & Africa Fiberglass Market Trends

The Middle East & Africa market is driven by infrastructure development and industrial expansion. Fiberglass is widely used in pipes, tanks, and construction applications due to corrosion resistance. Oil and gas projects support a steady demand for fiberglass-reinforced products. Urban development in Gulf countries increases demand for insulation materials. Renewable energy investments are gradually increasing fiberglass usage. Local manufacturing capacity remains limited, creating import opportunities. The market exhibits stable growth driven by infrastructure-led demand.

Key Fiberglass Company Insights

Some of the key companies in the market include Owens Corning, Saint-Gobain, Nippon Electric Glass, and others. These companies leverage various strategies, including strategic collaborations, mergers and acquisitions, and new product launches, to enhance competitiveness. These strategies facilitate innovation, expand market reach, and optimize production efficiency while aligning with sustainability trends and consumer demands.

-

Saint-Gobain produces a wide range of fiberglass solutions, such as glass fiber mesh for insulation, wall coverings, and reinforcement grids for pavements. Beyond fiberglass, the company operates in various segments, including gypsum products, insulation solutions, and high-performance materials for the construction industry. With a strong commitment to sustainability, Saint-Gobain focuses on developing innovative materials that contribute to energy efficiency and environmental responsibility in building projects.

-

Jushi Group Co., Ltd. specializes in producing E-glass and S-glass fibers used in various applications, including construction, automotive, and aerospace industries. The company also offers fiberglass yarns, chopped strands, and woven fabrics that enhance the performance of composite materials. In addition to fiberglass, Jushi Group produces other advanced materials, such as resin systems and specialty composites, catering to diverse industrial needs while focusing on innovation and quality.

Key Fiberglass Companies:

The following key companies have been profiled for this study on the fiberglass market.

- Owens Corning

- Saint-Gobain

- Nippon Electric Glass

- Jushi Group Co. Ltd.

- 3B-The Fiberglass Company

- PPG Industries

- Johns Manville

- Taishan Fiberglass, Inc.

- Chongqing Polycomp International Corp.

- Knauf Insulation

Recent Development

-

In April 2023, Saint-Gobain announced the acquisition of U.P. Twiga Fiberglass Ltd., a leader in India's glass wool insulation market. This strategic move aims to enhance Saint-Gobain's position in interior and façade solutions, addressing the increasing demand for energy-efficient and acoustic comfort solutions. U.P. Twiga functions two manufacturing services near Delhi and Mumbai and has used Saint-Gobain technology since 2005. The acquisition was expected to be finalized by the end of Q1 2023, aligning with Saint-Gobain’s commitment to sustainable construction practices.

Fiberglass Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.38 billion

Revenue forecast in 2033

USD 34.52 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Owens Corning; Saint-Gobain; Nippon Electric Glass; Jushi Group Co. Ltd.; 3B-The Fiberglass Company; PPG Industries; Johns Manville; Taishan Fiberglass, Inc.; Chongqing Polycomp International Corp; Knauf Insulation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiberglass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global fiberglass market report based on product type, application, end use, and region.

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Glass Wool

-

Yarn

-

Roving

-

Chopped strand

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Insulation

-

Composites

-

-

End use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automobile

-

Construction

-

Aerospace

-

Wind Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiberglass market size was estimated at USD 21.24 billion in 2025 and is expected to reach USD 22.38 billion in 2026.

b. The global fiberglass market is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 34.52 billion in 2033.

b. The roving segment led the market and accounted for the largest revenue share of 32.6% in 2025, due to its extensive use as a primary reinforcement material across various construction, wind energy, automotive, and industrial applications.

b. Some of the key players operating in the fiberglass market include Owens Corning, Saint-Gobain, Nippon Electric Glass, Jushi Group Co. Ltd., 3B-The Fiberglass Company, PPG Industries, Johns Manville, Taishan Fiberglass, Inc., Chongqing Polycomp International Corp, and Knauf Insulation.

b. Rapid growth in construction and infrastructure, rising wind energy installations, increasing demand for lightweight and corrosion-resistant materials in automotive and industrial applications, and strong adoption of energy-efficient insulation solutions are driving the fiberglass market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.