Polyvinyl Chloride (PVC) Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jun, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10590

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

PVC - Procurement Trends

“Rising demand from the construction industry, and growing usage in packaging and healthcare sector are driving the expansion of the PVC market.”

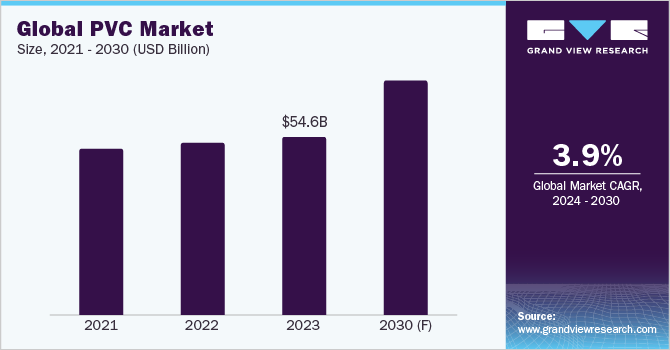

Polyvinyl Chloride (PVC) procurement facilitates substantial benefits to businesses, such as cost-effectiveness, ease of processing, recyclability, and longevity. The global market is projected to grow at a CAGR of 3.9% from 2024 to 2030. The growth is being led by drivers such as rising demand from the construction industry, growing usage in the packaging and healthcare sector, growing utilization of PVC pipes in irrigation, and technology advancements. Key challenges impacting the market include prohibited usage in green buildings, intense competition from steel and concrete pipes, health hazards, and raw material price volatility.

Trends suggest suppliers are increasing the use of sustainable and bio-based materials for production. PVC is a versatile material that is resilient, durable against harsh weather conditions, and lightweight. Moreover, it is resistant to rotting, abrasion, and chemical corrosion and is easy to use, as it can be welded, cut, shaped, and joined in any style. These characteristics make it ideal for many applications, such as flooring, roofing, pipes, and windows. Additionally, owing to its outstanding electrical insulation properties and flexibility, this material finds applications in electric vehicle cable sheathing, insulation, and wiring. The flexibility of this material allows for easy bending and maneuvering, making it well-suited for irrigation systems that require installation in tight spaces.

Bio-based PVC, produced by utilizing renewable resources (e.g., biomass-derived ethanol or plant-based plasticizers), is being increasingly sourced by various end-use industries. It not only lowers carbon emissions but also helps reduce fossil fuel dependency. Regulatory policies and incentives aimed at promoting sustainable materials and reducing greenhouse gas emissions have also bolstered the demand for bio-based PVC.

The global PVC market size was estimated at USD 54.6 billion in 2023. During the COVID-19 pandemic, there was a temporary spike in global prices due to supply chain disruptions. This led to several governments across the globe slashing import duties until the prices were stabilized. The reduction in import duties prompted a surge in imports during the pandemic. In 2023, the supply-demand imbalance stabilized to some extent, although global demand was still slightly lower than pre-pandemic levels due to a slower-than-expected economic recovery.

Key technological trends that are fueling the growth of the industry include Oriented Polyvinyl Chloride (PVC-O) technology. This technology involves molecules to be realigned via biaxial orientation. It is used to enhance the material properties to improve strength and augment the impact resistance compared to traditional materials. It also minimizes pressure losses by providing smooth inner walls. Moreover, the hydraulic capacity of pipes also improves due to this technique. Nanotechnology integration is another key technology being deployed in this market. The incorporation of nanotechnology into PVC pipes is transforming the industry by leveraging nanocomposites to improve the material’s mechanical characteristics.

Cutting-edge technologies like ‘NanoVinyl’ are leading the way in this innovation by exploring the integration of nanomaterials to enhance pipe strength and durability while maintaining their inherent flexibility. Of late, Internet of Things (IoT) integrated pipes have gained traction, along with smart sensors for real-time monitoring by installing them in pipes. These built-in sensors continuously gather data on essential parameters like pressure and flow rates within the pipes. Other key technologies that are poised to redefine the supply chain landscape are hybrid materials, PVC compounding, 3D printing, and climate-resilient designs.

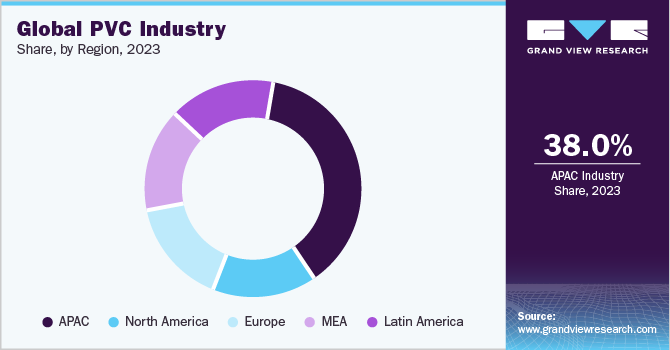

APAC dominates the PVC industry, accounting for 38% of the global market share in 2023. The growth can be attributed to high consumption in countries such as India, China, and Japan, high demand from the construction and packaging sectors, and technological advancements in manufacturing. APAC is also expected to be the fastest-growing region during the forecast period due to the high demand anticipated from the automotive, electric vehicle (EV), electronics, and healthcare sectors.

Supplier Intelligence

"What are the characteristics of the PVC market, and who are the key players involved?"

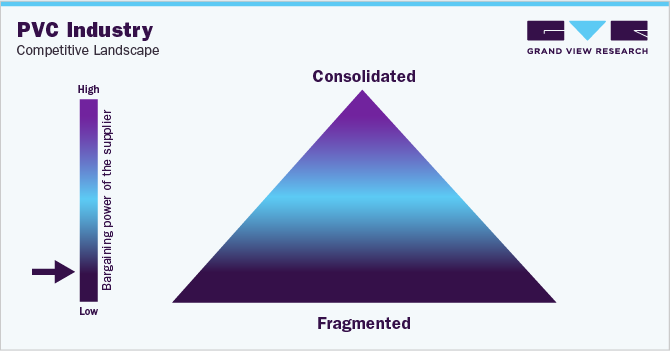

This industry is portrayed by fragmentation, with robust competition among key players. Prominent suppliers are emphasizing product quality, use of sustainable materials, innovations, and R&D. Moreover, leading players in this industry are competing based on pricing, customization, lead time reduction, improving customer service, and enhancing brand reputation. Additionally, in light of recent geopolitical conflicts and global economic slowdown, major players are gradually concentrating on building robust supply chains in order to manage risk of (supply chain) disruptions effectively.

In terms of the demand landscape, buyers are increasingly focusing on material quality (such as high-quality resin), resistance to environmental factors (such as high tolerance to extreme cold and heat conditions), durability (such as longer lifespan and resistance to aging), timely delivery, and regulatory compliance during PVC procurement.

Suppliers in this market have considerably low bargaining capability due to the intense market competition. On the other hand, buyers have significantly high negotiating power due availability of substitutes and the ease of switching to better alternatives. This increases pressure on suppliers to reduce product prices and establish competitive pricing rates while preserving quality standards. Besides, regulations in numerous countries require suppliers to comply with stringent standards related to the use of sustainable materials, product safety, and durability. A few key metrics that buyers can use to assess the performance of PVC suppliers include production efficiency, customer satisfaction, market share, on-time deliveries, and new product development.

Prominent suppliers covered in the industry:

-

Arkema S.A.

-

Formosa Plastics Corporation

-

INEOS AG

-

KEM ONE SAS

-

LG Chem, Ltd.

-

Mitsubishi Chemical Group Corporation

-

Occidental Petroleum Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

Sinochem Holdings Corporation Ltd.

-

Solvay S.A.

-

Westlake Corporation

-

Xinjiang Zhongtai Chemical Co., Ltd.

Pricing and Cost Intelligence

“What are the main components of the cost structure for PVC, and what are the factors impacting the prices?"

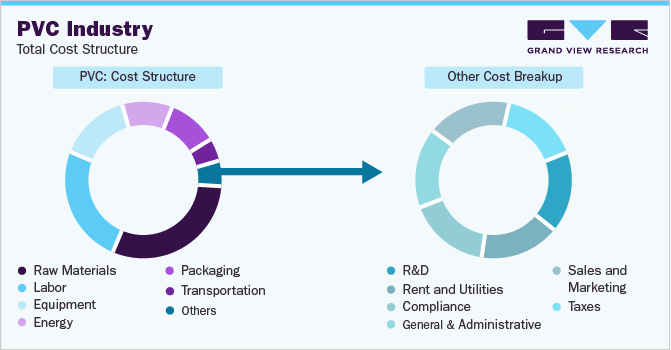

During procurement, buyers need to consider several factors related to cost and pricing before making purchase decisions. The cost structure contains raw materials (such as ethylene and chlorine), labor, equipment, energy, packaging, transportation, and others as the key components. Other costs include R&D, rent and utilities, compliance, general and administrative expenses, sales & marketing, and taxes. Raw materials account for the major component in the cost structure, followed by labor cost.

The accompanying chart showcases the cost structure. The breakdown of other costs may be influenced by various cost components, as depicted below:

The prices of products in the PVC industry alter based on several circumstances, such as raw material price fluctuations, supply chain disruptions, labor cost variations, and fluxes in energy costs. For instance, when demand for raw materials rises, manufacturers may pass on the incremental cost to end users, resulting in higher retail prices for PVC pellets or granules. Energy costs have been steadily increasing in recent times due to a combination of environmental and political factors. These rising energy costs contribute to an upsurge in manufacturing and transportation expenses, which in turn impact the final prices. Moreover, when suppliers encounter shortages or other issues, buyers may need to turn to alternative, potentially costlier suppliers. Recently, global import/export demands have also faced challenges due to insufficient vessel capacity.

Manufacturers often blend PVC with various specialized additives. These additives impact properties, such as mechanical strength, weather resistance, color, clarity, and suitability for flexible applications. This blending process is known as compounding. Functional additives, including heat stabilizers, lubricants, and plasticizers (in the case of flexible PVC) are utilized in this process. The costs of these additives, also considered as raw materials, significantly impact the prices.

In October 2023, the global price of PVC ranged within USD 750 - USD 800 per metric ton, marking the lowest monthly price since July 2020. A few reasons for this price drop can be attributed to a surplus of supplies, lack of buying interest, and slower global macroeconomic activity. In May 2024, the average prices in North America spanned in the range of USD 0.8/KG - USD 0.9/KG, the average prices in Europe fell within the range of USD 1.2/KG - USD 1.3/KG, and those in Northeast Asia varied within the range of USD 0.7/KG - USD 0.8/KG.

Key players in this industry deploy various pricing models. One of the key pricing models being deployed is cost-plus pricing. This pricing structure provides benefits such as providing a consistent rate of return, ease of calculation, and reliability. Other key pricing models used in this industry are volume-based pricing, demand-based pricing, and competition-based pricing.

Sourcing Intelligence

“What methods do suppliers of PVC implement to engage with buyers? What type of operating model is implemented?”

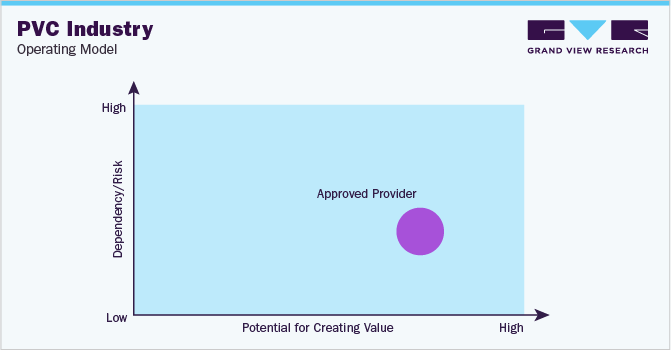

In terms of sourcing and procurement intelligence, buyers follow an approved provider operating model to engage with suppliers. To achieve approved status, suppliers often meet specific criteria or demonstrate reliable performance based on previous experience. These approved suppliers differentiate themselves from other transactional suppliers by offering cost or efficiency advantages. This differentiation may stem from factors such as geographical location, cost-effectiveness, or quality. Additionally, medium-term or long-term contracts (between 1 and 5 years) enable buyers to negotiate product prices and payment terms effectively.

"An approved provider is a vendor that matches a predefined set of selection criteria such as quality standards, prior-proven performances, qualifications, or others."

Buyers generally opt for either local or regional sourcing in this industry to improve supply chain-related costs and procurement costs. China, India, and Vietnam are the preferred low-cost countries in Asia Pacific for sourcing. These countries have substantial cost benefits due to the low costs of raw materials, labor, and equipment. Moreover, in China, the majority of the suppliers produce PVC using cost-effective coal-based feedstock, unlike ethylene-based raw materials.

India has a high domestic production volume, access to abundant raw materials, and a large and skilled labor force. In Europe, Sweden and Germany are cost-effective countries for sourcing this commodity due to advanced manufacturing infrastructure, skilled labor, robust supply chain, and economies of scale.

In South America, Brazil and Argentina are cost-effective countries for sourcing. Brazil is among the largest PVC producers in the region and benefits from a large industrial base and abundant raw materials. It also has a robust infrastructure and advanced manufacturing processes. Argentina has upsides, such as lower labor costs, competitive pricing structures, and favorable economic policies.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis.In this report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Raw materials form the largest cost component while producing PVC. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

PVC Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 3.9% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

5% - 10% increase (Annually) |

|

Pricing Models |

Cost-plus pricing, volume-based pricing, demand-based pricing, competition-based pricing |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, product type (unplasticized / chlorinated / molecularly-oriented / modified), product source (chemical-based / bio-based), delivery mode (offline / online), customer service, lead time, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Arkema S.A., Formosa Plastics Corporation, INEOS AG, KEM ONE SAS, LG Chem, Ltd., Mitsubishi Chemical Group Corporation, Occidental Petroleum Corporation, Shin-Etsu Chemical Co., Ltd., Sinochem Holdings Corporation Ltd., Solvay S.A., Westlake Corporation, and Xinjiang Zhongtai Chemical Co., Ltd. |

|

Regional Scope |

Global |

|

Revenue Forecast in 2030 |

USD 71.4 billion |

|

Historical Data |

2021 - 2022 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global PVC market size was estimated at approximately USD 54.6 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030.

b. Rising demand from construction industry, growing usage in packaging and healthcare sector, growing utilization of PVC pipes in irrigation, and technology advancements are driving the growth of this industry.

b. According to the LCC/BCC sourcing analysis, China, India, Vietnam, Sweden, and Germany are the cost-effective countries in their respective regions for sourcing PVC.

b. This industry displays a fragmented landscape, with an intense level of competition. Some of the key players are Arkema S.A., Formosa Plastics Corporation, INEOS AG, KEM ONE SAS, LG Chem, Ltd., Mitsubishi Chemical Group Corporation, Occidental Petroleum Corporation, Shin-Etsu Chemical Co., Ltd., Sinochem Holdings Corporation Ltd., Solvay S.A., Westlake Corporation, and Xinjiang Zhongtai Chemical Co., Ltd.

b. Raw Materials (such as ethylene and chlorine), labor, equipment, energy, packaging, transportation, and others are the major cost components in PVC. Other costs include R&D, rent and utilities, compliance, general and administrative, sales and marketing, and taxes.

b. In PVC procurement, the best practices for selecting suppliers include comparing the prices quoted by suppliers, evaluating the type of products offered, assessing geographical service capabilities, comparing years of experience, checking adherence to regulatory compliance, evaluating lead time, and comparing sustainability initiatives.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.