Polyethylene Terephthalate (PET) Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jun, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10588

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Polyethylene Terephthalate (PET) - Procurement Trends

“Increasing innovation and technological breakthroughs in packaging applications are fueling the growth of the industry.”

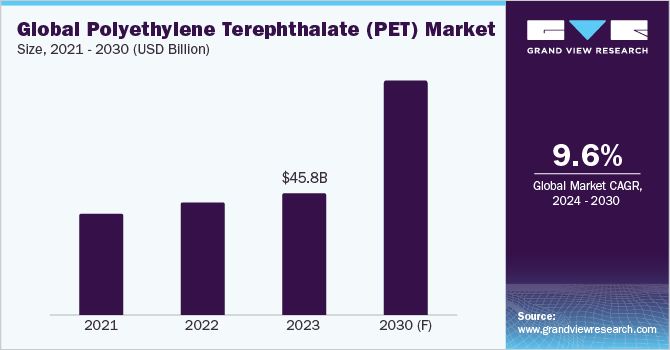

Businesses have widely emphasized procurement of polyethylene terephthalate (PET) due to its properties of possessing a high strength-to-weight ratio and being non-reactive when in contact with water or food. The global market is anticipated to grow at a CAGR of 9.63% from 2024 to 2030. It is being driven by factors such as increasing innovation and technological breakthroughs in packaging applications, rising fabric and textile consumption, growing rate of collection and recycling of market products, and increasing demand for recycled market products from various sectors such as automotive and food and beverages.

The growth of the market is also being fueled by increasing global demand for recyclable and sustainable goods, high economic growth, and rapid urbanization, irrespective of the geographical location. However, widespread availability of alternate polymers, such as polystyrene, polyethylene and polypropylene is restricting the consumption of the product offered in the industry. Hence, this may hinder the growth of the market during the projected timeframe.

PET finds extensive use in the packaging as well as in the electrical and electronics sectors. Foods and drinks, especially convenience-sized soft drinks, water, coil shapes, electrical encapsulation, electrical devices, solenoids, and smart meters, are packaged using it.The largest chunk of the revenue generated in this industry is derived from the packaging segment. Therefore, the global packaging sector (which is being driven by several key reasons, including changing lifestyles, rising income levels, and population growth.) is the largest end-user sector for the product offered in the industry whereas the electrical and electronics sectors are anticipated to witness the fastest rate of growth during the projected timeframe.The rise in the market for consumer electronics is ascribed to the increasing demand for lightweight items, the expansion of e-commerce, the emphasis on sustainability, and the increased adoption rates of these products by leading producers of consumer goods.

The global polyethylene terephthalate (PET) market size was valued at USD 45.8 billion in 2023. It is anticipated to witness steady growth over the course of the projected period due to a plethora of advantages that are provided by the product on offer, such as affordability, a high strength-to-weight ratio, shatterproof nature, and ease of recycling.PET, being the most widely used polymer in the world, is widely utilized as a fiber for apparel and is also widely used in bottling and packaging.One specialized use for PET bottles is in eco-bricks. This involves filling PET bottles with dirt, fly ash, or other construction-grade material.This can take the place of conventional bricks. Eco-bricks also feature low light penetration and a high sound reduction index. In addition, the load on centralized waste management systems is lessened by these eco-bricks. Furthermore, research and development efforts are leading to innovations and discoveries that have the potential to accelerate the global market.

Artificial intelligence (AI), 3D printing, material simulation, predictive analytics, and the Internet of Things (IoT) are a few of the key technologies that are supplementing the growth of the global industry. The engineering plastic and composites sector is anticipated to be significantly impacted by AI. As a result, new qualities for polymers and composites may be designed considerably more quickly, opening up an even wider range of applications. In addition, since it will be simpler to extract information and insights from big, complicated data sets, competition will rise. AI may make it easier to pursue radical inventions and ultimately lead to the development of a new technology paradigm, allowing upstart businesses to surpass previous industry leaders. Furthermore, AI is predicted to have a big impact on polymer research and revolutionize a lot of different areas in the science, such as process optimization, data-driven insights and materials design and discovery.

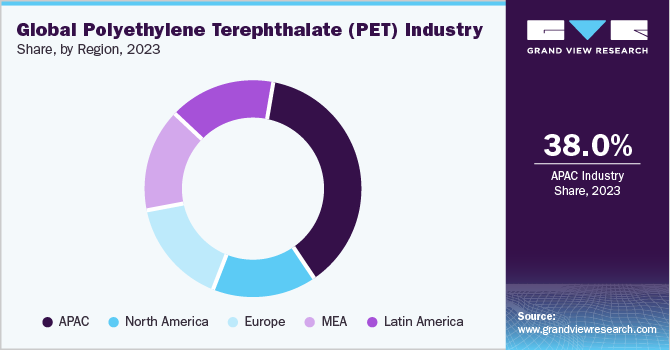

Asia-Pacific region dominates the global market, owing to higher consumption of packaged food, and rising demand for films used in automotive in nations such as Malaysia, Indonesia, India, and China. The Intergovernmental Panel on Climate Change (IPCC), the International Union for Conservation of Nature (IUCN), and the Environmental Protection Agency (EPA) have established a number of environmental regulations that have contributed to the region's growth (by promoting the usage of PET over other plastics, since it is highly sustainable and 100% recyclable) and will likely impact the demand for product offered in the industry. In addition, the fastest-growing regional economies, such as India and China, offer a wealth of opportunities for the consumer goods sector, given their rising GDP per capita and improving domestic consumer goods production environment. Furthermore, the region's rivalry is expected to get more intense due to variables like the products' price sensitivity and the abundance of companies in the PET industry.

Supplier Intelligence

“What best describes the nature of the Polyethylene Terephthalate (PET) industry? Who are the key players operating in the market?”

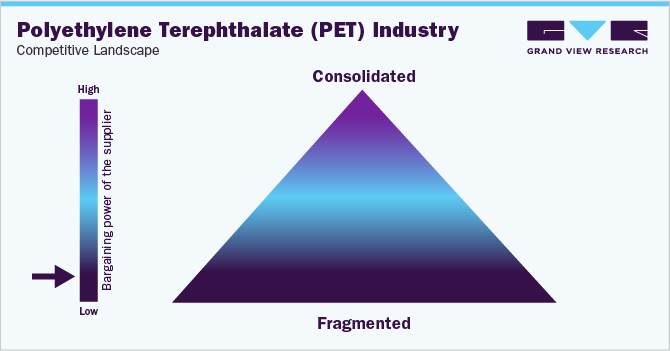

This industry is highly competitive, exhibiting a fragmented landscape with the presence of large number of regional and global players operating in the global polyethylene terephthalate (PET) market. With an objective to expand their global footprint and enhance the quality of their resin, most of the key players in the industry have integrated their distribution operations and resin production. As a result, the players are witnessing increased profit margins due to the decrease in costs. In addition, the players are making significant investments in research & development activities to effectively meet the constantly changing end-user requirements and develop new scope for applications, in an effort to obtain a competitive edge in the market. Furthermore, the players are undertaking strategic initiatives such as mergers & acquisitions, joint ventures, and increasing production capacity.

Buyers possess high negotiation capability due to the abundance of supply base, which enables them to assess and select a supplier based on several factors such as quality of the materials, pricing, lead time, production capacity and geographical service provision. As a result, buyers always have an option to move to a different supplier for the procurement of market’s product, if any particular supplier is unable to qualify on their parameters. In addition, the threat of new entrants in the industry is low as it requires significant investment to establish a polymer manufacturing facility that is equipped with state-of-the-art technologies to meet the market requirements. Furthermore, the fragmented nature of the market can present challenges for new entrants if they fail to secure a significant enough market share to reach the minimum efficient scale, as they often incur higher costs.

Key suppliers covered in the industry:

-

Alfa Chemistry

-

Alpek S.A.B. de C.V.

-

China Petrochemical Corporation (Sinopec)

-

China Resources (Holdings) Co., Ltd.

-

DuPont de Nemours Inc.

-

Far Eastern New Century Corporation (FENC)

-

Indorama Ventures Public Company Limited

-

Jiangsu Sanfangxiang Group Co., Ltd.

-

LOTTE Chemical Corporation

-

Reliance Industries Ltd. (RIL)

-

Saudi Basic Industries Corporation (SABIC)

-

SK Inc.

Pricing and Cost Intelligence

“What are the key cost components for Polyethylene Terephthalate (PET) industry? What factors influence the charges/prices?"

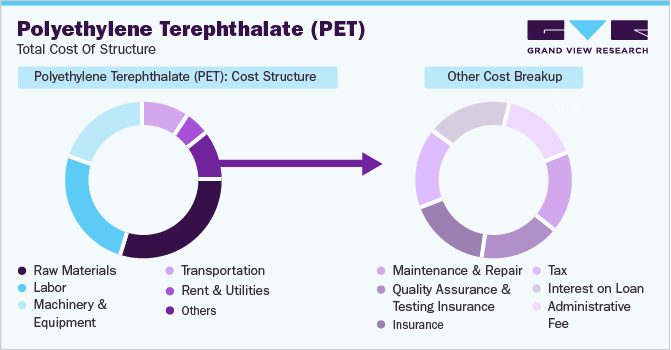

The cost structure of the global polyethylene terephthalate industry is constituted by raw materials, labor, machinery and equipment, transportation, rent and utilities, and others.Other costs include maintenance and repair, quality assurance and testing, insurance, tax, interest on loans, and administrative fees. Raw materials (ethylene glycol and terephthalic acid) hold the largest percentage of cost component for manufacturing the product offered in the industry.

Key factors that influence the prices of the product include supply chain expenses, current state of the market, production and processing expenses, raw material prices, government regulations at national and global level, and commodity markets. Assessment of transportation expenses in procurement is invaluable to navigate international trade. Companies that export their goods modify their prices to reflect the associated expenses.The expenses can’t just be restricted to ocean freight expenses, rather the length of the shipping process, port labor, and import duties all affect how much a kilogram of fiber costs. At times, these expenses can make up as much as 27.9% of the cost per kilogram of landing staple fiber.

In the U.S., the average prices for ethylene glycol had been 0.59 USD/Kg, during 2018 to 2023 (witnessing a decrease in prices by over 35%, with a slight increase during 2021). The price of ethylene glycol in the U.S. markets steadily decreased in the fourth quarter of 2023 following a rise during the third quarter of 2023. The fluctuations in the price of crude oil at this period also had an impact on this oscillation. The industrial demands in the latter part of the fourth quarter of 2023 were restrained by freight challenges throughout the year-end months. The average prices for terephthalic acid had been 0.82 USD/Kg, during 2018 to 2023 (witnessing an increase in prices by over 40%).

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

Sourcing Intelligence

“How do buyers of Polyethylene Terephthalate (PET) engage with their suppliers? What is the type of engagement model?”

The sourcing intelligence for polyethylene terephthalate suggests that the buyers in the industry opt for full services outsourcing model to engage with the suppliers for product procurement. Buyers of the product belong to various sectors, and they ideally utilize it for the purpose of packaging in order to further move their goods to their end-consumers. They may not hold the expertise through which they can produce PET in-house, hence, they depend on the dedicated players who produce PET to meet their requirements. In addition, completely outsourcing the product requirement helps the buyers in reducing labor expenses, overhead expenses and risk. Producing the product in-house would require the buyers to indulge in significant investments in raw materials, facilities, equipment, labor, etc. therefore, they cut these expenses in half or completely by outsourcing, freeing up funds to invest in other facets of their operations.

"In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies."

Approved Provider’ is the ideal operating model in the industry which the buyers typically follow.The key reason why buyers opt for this model is that a supplier has already met a predefined set of qualifications, quality standards, and the buyer is completely satisfied with it. Besides, a supplier's knowledge of the buyer's market, company, and business processes gets improved with the length of their collaboration.This makes it possible for business, IT, and financial processes to be more integrated and for both sides to effectively incorporate more stakeholders.As a result, the service turns better and more effective, with "gray areas" going away and problems being addressed more skillfully when they do occur. Furthermore, many suppliers would agree to be more reasonable and/or flexible price structures for long-term agreements to reduce risk and exposure. A buyer can safeguard its company's interests by considering its margins and priorities.

China can be considered as the low/best country for sourcing polyethylene terephthalate in the Asia-Pacific region. Due to the low expenses for doing business there, the nation leads the international market for the manufacturing of PET on the back of minimal labor costs, subsidies by the government, easy accessibility of raw materials, considerable demand, robust production capabilities, and tactical financial commitments. Further, manufacturers are able to sell a substantial amount of their goods within the country due to its vast and quickly expanding domestic PET market. Meanwhile, India is the 2nd best nation in the region to source PET, because of its enormous production capability. The nation easily meets the export criteria to fulfill the demand of the product from many nations not just in the Asia-Pacific region but other regions as well, across the globe.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s).The key benefit of procuring PET is that its electrical insulating qualities are outstanding. It is incredibly light and has good moisture and gas-resistant (oxygen, carbon dioxide) properties.Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Polyethylene Terephthalate (PET) Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 9.63% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

4% - 9% increase (Annually) |

|

Pricing Models |

Cost-plus pricing, Fixed pricing, Competition-based pricing |

|

Supplier Selection Scope |

Cost and pricing, Past engagements, Productivity, Geographical presence |

|

Supplier Selection Criteria |

Industries served, geographical service provision, years in service, employee strength, revenue generated, certifications, key clientele,types of PET, technologies deployed in production, customization options, regulatory compliance, customer support, lead time, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Alfa Chemistry, Alpek S.A.B. de C.V., China Petrochemical Corporation (Sinopec), China Resources (Holdings) Co., Ltd., DuPont de Nemours Inc., Far Eastern New Century Corporation (FENC), Indorama Ventures Public Company Limited, Jiangsu Sanfangxiang Group Co., Ltd., LOTTE Chemical Corporation, Reliance Industries Ltd. (RIL), Saudi Basic Industries Corporation (SABIC), and SK Inc. |

|

Regional Scope |

Global |

|

Revenue Forecast in 2030 |

USD 87.2 billion |

|

Historical Data |

2021 - 2022 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global polyethylene terephthalate (PET) market size was valued at approximately USD 45.8 billion in 2023 and is estimated to witness a CAGR of 9.63% from 2024 to 2030.

b. Increasing innovation and technological breakthroughs in packaging applications, rising fabric and textile consumption, growing rate of collection & recycling of market product, and increasing demand for recycled market product from various sectors such as automotive, food & beverages, etc. are driving the growth of the industry.

b. According to the LCC/BCC sourcing analysis, China and India are the ideal destinations for sourcing polyethylene terephthalate (PET).

b. This industry exhibits a fragmented landscape with intense competition. Some of the key players are Alfa Chemistry, Alpek S.A.B. de C.V., China Petrochemical Corporation (Sinopec), China Resources (Holdings) Co., Ltd., DuPont de Nemours Inc., Far Eastern New Century Corporation (FENC), Indorama Ventures Public Company Limited, Jiangsu Sanfangxiang Group Co., Ltd., LOTTE Chemical Corporation, Reliance Industries Ltd. (RIL), Saudi Basic Industries Corporation (SABIC), and SK Inc.

b. Raw materials, labor, machinery & equipment, transportation, rent & utilities, and others are the key cost components for polyethylene terephthalate (PET). Other costs can be further bifurcated into maintenance & repair, quality assurance & testing, insurance, tax, interest on loan, and administrative fee.

b. Assessing how well a supplier is equipped with equipments and cutting-edge machineries, reviewing the manufacturing certifications possessed by a supplier, prioritizing a supplier whose practices are committed towards environment protection, and price comparison of different suppliers are some of the best sourcing practices considered by the procurement professionals in this category.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.