Point of Sale Materials (PoSM) Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jul, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10594

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Point of Sale Materials (PoSM) - Procurement Trends

“Increasing focus on in-store advertising strategies is fueling the growth of the industry.”

The procurement of point of sale materials (PoSM) is crucial for businesses as it acts as a medium of communication between brands and consumers when they are making selections about what to buy. The global market is anticipated to grow at a CAGR of 6.27% from 2024 to 2030. The industry’s growth is attributed to key factors, including increasing focus on in-store advertising strategies, growing competition amongst brands, and global expansion of retail chains at a faster pace. In addition, incorporating interactive components and digital displays into PoSM, and advancements in the technology are also speculated to supplement the growth of the industry.

The rising use of omnichannel retail strategies is influencing the purchasing decisions of the consumers, which consequently will lead to increased demand for PoSM solutions. However, the growth of retail e-commerce may hinder the growth of the category during the forecasted timeframe as the convenience of purchasing while sitting at home is affecting the significance of retail outlets, hence negatively affecting the demand for the solutions offered in the industry.

PoSMs play a significant part in corporate promotion and operations. Businesses utilize it as a helpful communication tool to introduce clients to their brands and services which supplements in the rapid growth of the sales revenue. Businesses do not need to spend a lot of money to develop concepts, design, and print PoSM, in contrast to pricey marketing and advertising mediums such as ads, seminars, events, and television. In addition, these are lightweight, simple to install, and portable. Also, it assists companies in most efficiently and affordably reaching their target market. Key benefits of utilizing the products offered in the industry include drawing customers' attention using POP and POS displays (considering that consumers have hundreds of options to select from, brands must ensure that their items are visually appealing to consumers at the point of sale), boosting sales using point-of-purchase marketing, and emphasizing sales promotions using point-of-sale marketing.

The global point of sale materials (PoSM) market was valued at USD 38.8 billion in 2023. Retail, food & beverage, and FMCG are the key end-user sectors, with food & beverage contributing to over 34.9% of the global demand. The increased utilization of PoSM by the food & beverage sector to highlight high-end goods like food presents and alcohol. In addition, retailers are investing more in the products as they seize opportunities to grow into emerging regions, such as Asia-Pacific and Latin America. Furthermore, PDQ displays and on-shelf are witnessing higher adoption with an objective to secure customer attention. These trends have increased the importance of displays as they are an effective way to encourage walk-ins. Retailers are looking for new and creative methods to deploy cutting-edge solutions that draw customers in a consistent and growing manner.

Digital signage, interactive kiosks, augmented reality (AR), data-driven & interactive POS, and robotic displays are the key technologies that are supplementing growth. Retailers can provide customers with a more authentic experience with products by using digital signage to highlight their distinctive features, viewpoints, or designs through photos or videos. According to a 2023 report, over 79.9% of the firms utilizing digital signage displays have admitted that their sales improved by over 32.9%. In addition to increasing the possibility of cross-selling, up-selling, and impulsive purchases, it can result in an immersive customer experience. With the use of interactive kiosks, retailers provide a smooth self-service experience to their customers by enabling them to make purchases, get information, use services, and complete tasks without any staff assistance, offering greater autonomy and control. Simultaneously, it enhances operational efficiency and human resource management.

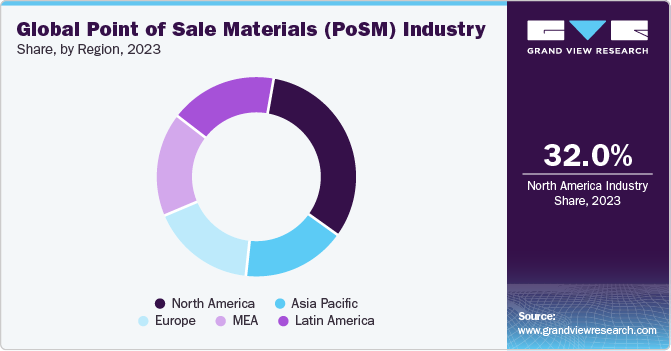

North America region dominates the global market, owing to the strong concentration of both global and regional industry players. It is anticipated that the market in the region will continue to witness growth as a result of the increased usage of a variety of PoSMs, and rising investments on successful product marketing by the players. Given the maturity and sophistication of the region’s supplier landscape, buyers (in this region) tend to choose to work with strong regional players. The region is also being benefitted by the increasing demand from the consumer-packaged goods (CPG) sector. Besides, the Asia Pacific is anticipated to register the fastest rate of growth during the forecast timeframe as the products are becoming more prevalent in in-store marketing in countries such as India, China, and Japan. This would support the region’s growth in the long run.

Supplier Intelligence

“How can the nature of Point of Sale Materials (PoSM) be described? How is the industry’s competitive landscape?”

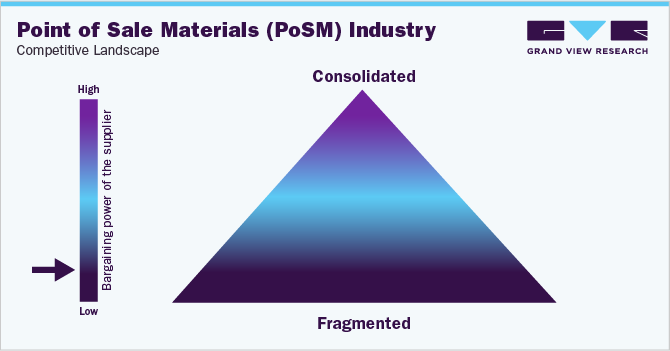

This industry is highly competitive, exhibiting a fragmented landscape with the presence of a large number of regional and global players. Key companies are concentrating on expanding the range of products they offer and providing tailored solutions to meet the various needs of their customers.In addition, they are engaging in strategic activities, such as alliances and mergers and acquisitions to fortify their market positions. Furthermore, the players are expanding their geographic reach and broadening their service offerings as sophisticated customers tend to consolidate their sourcingin order to capture a larger portion of buyers' trade marketing budget. They are also investing heavily in technology to enhance their capabilities and add value to the services they offer, providing buyers a high level of accountability.

The presence of a large supply base at both local and regional levels has provided buyers with a high capability to negotiate with the suppliers for the procurement of the products on the basis of quality, price, lead time, customization and type of solutions available. The buyers can easily select an alternative supplier if they are dissatisfied with either of the above-mentioned variables. Consequently, this reduces the negotiating power of suppliers as well and causes them to compromise the profit margin as the priority is to stay competitive and hold a substantial share in the market, or they may lose their position to their competitors.

The competitive rivalry is intense at both the global and regional levels, as players cover a wide portfolio of products, and the majority of them are capable of delivering at far locations as well. In addition, since the current scenario of the industry puts emphasis on technological solutions, players are investing to ensure they cover such items in their portfolio with the objective of holding a sufficient share of the market to survive in the longer run.

Key suppliers covered in the industry:

-

Amitoje India

-

DS Smith Plc

-

HH Global Ltd.

-

KSF Global Ltd

-

One Plus Management Limited (Rising)

-

RTC

-

Simpson Group

-

Smurfit Kappa Group

-

Tokinomo Marketing S.R.L

-

TPH Global Solutions

-

Trion Industries, Inc.

-

VKF Renzel GmbH

Pricing and Cost Intelligence

“What are the key cost components constituting Point of Sale Materials (PoSM)? What factors influence the prices of the products offered in the industry?"

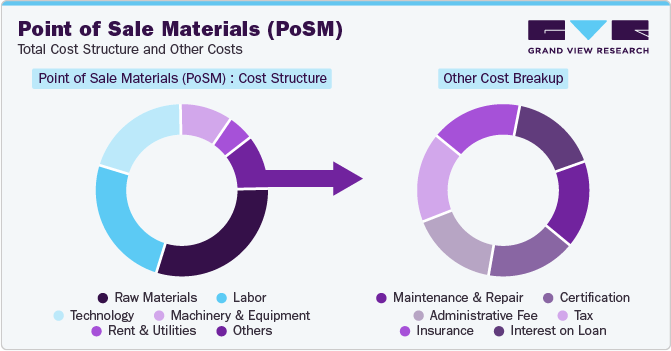

The cost structure for the procurement of point of sale materials industry is constituted by raw materials, labor, technology, machinery and equipment, rent and utilities, and others.Other costs include maintenance & repair, certifications, administrative fee, tax, insurance, and interest on loan. Raw materials (corrugated boards and polyvinyl chloride, among others) hold the largest percentage of cost component for producing the products offered in the market.

Prices of corrugated boards in the U.S. averaged between USD 0.96 per kg to USD 1.1 per kg, during 2018-2023 (witnessing an increase in prices by over 20%). Point-of-sale (POS) display boxes-another name for corrugated display packaging-are a useful and adaptable tool for product promotion and sales in retail settings. Corrugated cardboard is an inexpensive, strong, and lightweight material used to make these boxes.

Similarly, the polyvinyl chloride (PVC) prices in the U.S. averaged between USD 0.79 per kg to USD 1.58 per kg during 2018 - 2023 (witnessing increase in prices initially by over 100% from 2018 to 2022 and decreasing by 43.67% during 2021 to 2023). PVC board is a great material for making exhibition stands, point-of-sale displays, and signage because of its strength and portability. It offers smooth surface that makes printing on it a breeze and offers the greatest foundation for bright, long-lasting prints.

The prices of point of purchase (PoP) displays that fall under point of sales materials are influenced by several factors, such as branding and printing of the display, the materials that have been utilized in making display, size of the display, and the number of items that can be part of the display solution. Photos, images, typography, pricing information, eye-catching aesthetics, and other graphics can all be used to brand a PoP display. While some suppliers will include these components in the price of a POP display, others can charge a retailer with extra amount. The type of printing procedure will be the only element influencing the cost of producing a POP display. These products don't have a set price because they are very case-sensitive.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

Sourcing Intelligence

“What is the engagement model which buyers prefer in the Point of Sale Materials (PoSM) industry? How is the operating model, and best sourcing strategies?”

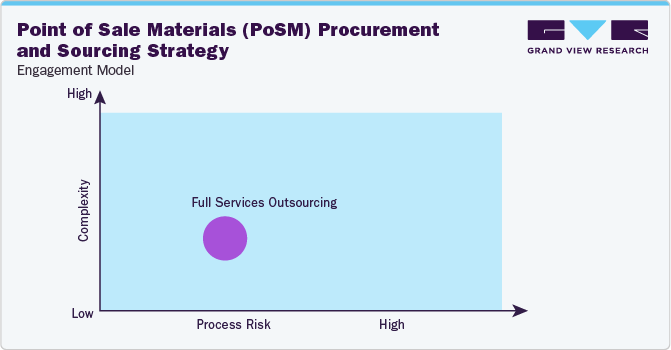

With regards to point of sale materials (PoSM) sourcing intelligence, buyers (typically the retailers) opt for full-service outsourcing model wherein they depend on large number of suppliers for the procurement of products. Since PoSM contains variety of products, it is not possible for all the suppliers to cover the same, hence, the buyers reach out to different suppliers as per their product requirement, such as robotic displays, posters and signage.Reviewing the number of products offered by a supplier, assessing the geographical presence of a supplier, comparing the prices offered by different suppliers, and ensuring that a respective supplier provides customization as per its client requirement are some of the best sourcing practices considered in this industry.

"In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies."

Buyers in the industry select a ‘basic provider’ to get their products.A basic transaction provider is a supplier that operates under a simple buy-sell arrangement where buyers typically pay a set “transaction” price for products or services.PoSMs aren’t supposed to be technologically sophisticated whereby the buyer shouldn't follow a pattern of collaborating with a fixed old supplier to get its goods and services delivered. In addition, having supplier alternatives enables a business to increase its competitiveness and performance while also negotiating better contracts. Also, it leads to reduction of risks including quality concerns, price fluctuations, and supply disruptions. Furthermore, it helps a business in boosting its market impact and ability to negotiate.

In order to optimize the supply chain management for PoSM:

a) The suppliers should ensure that the raw materials should be kept in stock at the warehouse that is closest to the manufacturing location. Also, suppliers must exercise distinct management approaches for manufacturing and assembly. Strategic production management allows suppliers to achieve economies of sales, while flexible assembly management utilizing a local strategy guarantees on-site installation.

b) Business enterprises / retailers must provide the suppliers with precise forecast so that the suppliers may be able to commit for volume with their raw material suppliers. This will enable a PoSM supplier to have more negotiating leverage with the raw material sources.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). The key objective of procuring the PoSMs is to increase the sales, as it enables drawing customer attention and making them curious to learn about the product and related offers. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Point of Sale Materials (PoSM) Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 6.27% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

5% - 10% increase (Annually) |

|

Pricing Models |

Fixed pricing, Competition-based pricing |

|

Supplier Selection Scope |

Cost and pricing, Past engagements, Productivity, Geographical presence |

|

Supplier Selection Criteria |

Geographical service provision, industries served, years in service, employee strength, revenue generated, certifications, types of PoSM (soft / hard), technology integration, customization options, customer support, lead time, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Amitoje India, DS Smith Plc, HH Global Ltd., KSF Global Ltd, One Plus Management Limited (Rising), RTC, Simpson Group, Smurfit Kappa Group, Tokinomo Marketing S.R.L, TPH Global Solutions, Trion Industries, Inc., and VKF Renzel GmbH |

|

Regional Scope |

Global |

|

Revenue Forecast in 2030 |

USD 59.4 billion |

|

Historical Data |

2021 - 2022 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global point of sale materials (PoSM) market size was valued at approximately USD 38.8 billion in 2023 and is estimated to witness a CAGR of 6.27% from 2024 to 2030.

b. Increasing focus on in-store advertising strategies, growing competition amongst brands, and global expansion of retail chains at a faster pace are driving the growth of the industry.

b. According to the LCC/BCC sourcing analysis, India, China, U.S., U.K., and Australia are the ideal destinations for sourcing point of sale materials (PoSM).

b. This industry exhibits a fragmented landscape with intense competition. Some of the key players are Amitoje India, DS Smith Plc, HH Global Ltd., KSF Global Ltd, One Plus Management Limited (Rising), RTC, Simpson Group, Smurfit Kappa Group, Tokinomo Marketing S.R.L, TPH Global Solutions, Trion Industries, Inc., and VKF Renzel GmbH.

b. Raw materials, labor, technology, machinery & equipment, rent & utilities, and others are the major cost components in the point of sale materials (PoSM). Other costs can be further bifurcated into maintenance & repair, certifications, administrative fee, tax, insurance, and interest on loan.

b. Reviewing the number of products offered by a supplier, assessing the geographical presence of a supplier, comparing the prices offered by different suppliers, and ensuring that a respective supplier offers customization as per it’s client requirement are some of the best sourcing practices considered in this industry.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.