Industrial Starch Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10598

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Industrial Starch - Procurement Trends

“High demand in food & beverages, and rising consumption of processed and convenience foods are driving the expansion of the industrial starch market.”

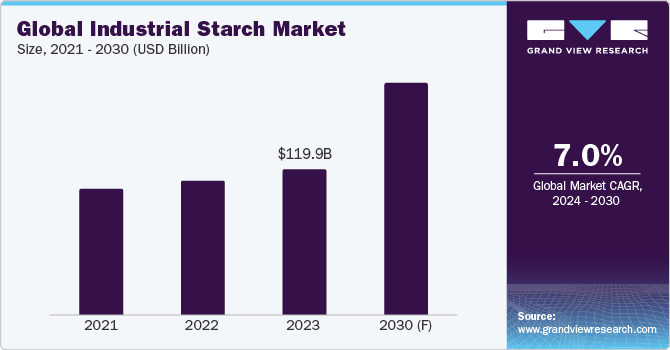

Industrial starch procurement benefits buyers from several industries, such as food and beverages, feed, paper, textiles, pharmaceuticals, and cosmetics. The global industry is predicted to grow at a CAGR of 7.0% from 2024 to 2030. This commodity is commonly used as a thickening agent, texture enhancer, binding agent, and stabilizer. Major drivers are high demand for food and beverages, rising consumption of processed and convenience foods, technological advancements, expanding applications in non-food industries, and robust demand for starch derivatives such as glucose syrup and maltodextrin. For instance, starch derivatives are essential in various industries due to their multifunctional properties. In the F&B sector, glucose syrup is widely used as a sweetener and thickener, while maltodextrin serves as a filler and preservative. Additionally, these derivatives are crucial in the pharmaceutical sector for tablet binding and in the textile industry for fabric finishing.

Key challenges in this industry include volatility in raw material costs, environmental sustainability concerns, supply chain disruptions, and regulatory pressures. Suppliers are faced with growing pressure to adopt sustainable practices and reduce their environmental footprint. This includes reducing water usage, managing waste, and adopting renewable energy sources. Supply chain disruptions may include transportation delays, port congestion, and shortages of shipping containers, which may affect the timely delivery of raw materials and finished products. In 2024, corn starch faced supply disruptions across several European countries due to adverse weather conditions affecting crop yields, coupled with logistical challenges.

In 2024, sustainable and green chemistry approaches have transformed this market by minimizing environmental impact. For instance, leading suppliers are adopting techniques such as solvent-free processing and the use of biodegradable reagents. This shift is helping reduce harmful emissions and waste by enhancing the adoption of eco-friendly materials. Moreover, biotechnology advancements are revolutionizing the industry via the production of starch with tailored properties. Techniques such as genetic modification can endow this commodity with specific functionalities, such as high resistance to temperature and improved texture in food applications.

In essence, Cargill's modified starches offer versatile solutions for the F&B industry in the Europe, Middle East, and Africa regions. They improve texture, stability, and shelf-life in various products, including dairy, bakery, and processed foods. Moreover, they provide functionalities such as thickening, gelling, and moisture retention. Cargill's portfolio includes clean-label options tailored for specific dietary needs, aligning with consumer trends toward healthier and natural ingredients.

The global industrial starch market size was estimated at USD 119.9 billion in 2023. During the COVID-19 pandemic, the market underwent substantial fluctuations due to supply-chain disturbances. For instance, the availability of raw materials such as corn, wheat, and potatoes was severely affected as lockdowns and transportation restrictions hindered their supply, leading to fluctuations in prices and affecting production costs. At the same time, demand for modified starch, used for thickening and stabilizing various food products, increased due to the high consumption of packaged and convenience foods during this period.

Major technology trends impacting the industry in 2024 include nanotechnology integration, modification using ozone technology, use of de-sanding cyclones, starch-based thermoplastic production using green solvents, and use of 3D printing. Predominantly, nanotechnology is being implemented in production to improve the physical and chemical properties of this commodity. Incorporating/blending nanoparticles (such as nanocellulose) in this commodity results in superior mechanical properties and biodegradability. Besides, modification using ozone technology involves treating this commodity with ozone gas to alter its properties. This process facilitates reactive oxygen groups to break down the molecular structure of starch, leading to increased solubility, improved gelation, and enhanced viscosity.

Moreover, SiccaDania, a prominent producer of starch manufacturing equipment, has designed de-sanding cyclones for removing sand and other impurities from slurry during processing. This enhances the starch efficiency and quality and improves performance and reliability, making it ideal for integration into existing starch production lines.

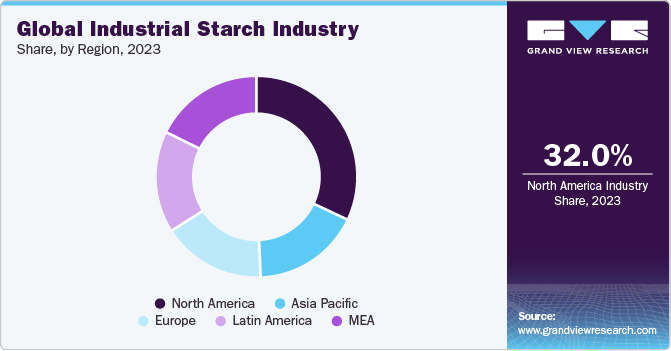

North America currently holds the dominant position in the global market. The region’s growth is fuelled by high demand for native and modified starch and increased consumption of gluten-free products. Modified starch offers enhanced properties, such as improved stability under heat, enhanced texture, and longer shelf life, making it suitable for processed foods, convenience foods, and ready-to-eat meals. Gluten-free and allergen-free products often use it as a substitute for flour and other ingredients.

Supplier Intelligence

"What are the characteristics of the industrial starch market, and who are the key players involved?"

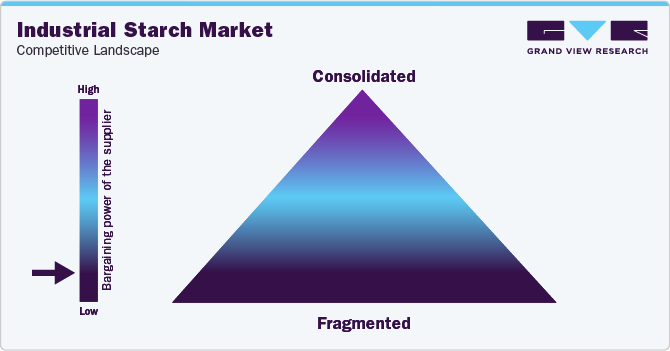

The global industry is fragmented and includes a large number of players competing for market share. Key players are focusing on product diversification and innovation, quality and consistency, sustainability initiatives, cost-efficiency, and improving reach/distribution channels. Prominent suppliers are distinguishing themselves from the competition by customizing this commodity for particular use cases, such as biodegradable plastics, medical applications, and high-performance adhesives. Alternatively, suppliers are emphasizing increasing the production capacity of modified starch due to its advantages over other materials for specific industrial applications.

In terms of the demand landscape, buyers, during the procurement of industrial starch, may exert pressure on suppliers to ensure enhanced quality and lower prices due to the availability of alternative products and the presence of numerous suppliers. Large-scale buyers, such as big F&B companies, often have added leverage due to their significant purchasing volumes. Hence, suppliers face the challenge of balancing cost reduction with quality standards, while also adhering to regulations concerning sustainable materials, product safety, and durability in various countries.

The industry has a high entry barrier due to increased capital investments in manufacturing technology, the benefit of network effect for established players, and adherence to sustainability standards. For instance, the network effect enables established players to gain from a larger customer base and supplier network, which enhances their market power. They can negotiate better terms with suppliers and distributors, ensuring competitive pricing and reliable supply chains.

Prominent suppliers covered in the industry:

-

AGRANA Beteiligungs AG

-

Archer Daniels Midland Company

-

ACH Food Companies, Inc.

-

Cargill Incorporated

-

Coöperatie Koninklijke Cosun U.A (Royal Cosun)

-

General Starch Limited

-

Grain Processing Corporation

-

Ingredion Incorporated

-

Roquette Frères S.A.

-

Tate & Lyle PLC

-

Tereos Group

-

Universal Starch Chem Allied Ltd.

Pricing and Cost Intelligence

“What are the main components of the cost structure for industrial starch, and what are the factors impacting the prices?"

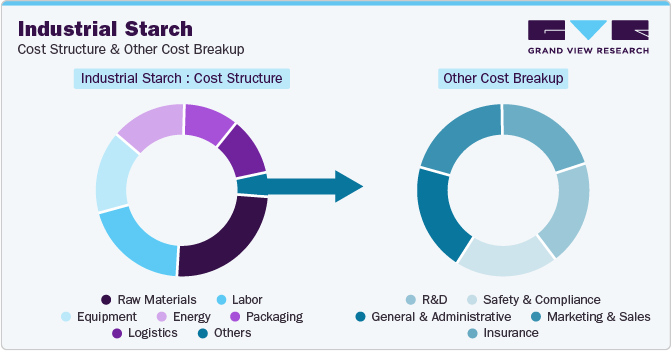

During procurement, buyers need to carefully consider several factors related to cost and pricing, which can help them in cost savings while making purchase decisions. Raw materials, labor, equipment, energy, packaging, logistics and others are some of the key costs associated with this industry. Other cost components comprise R&D, safety and compliance, general and administrative, marketing and sales, and insurance. Raw materials and labor hold the largest portion of the cost structure. The costs of primary raw materials, such as corn, wheat, potatoes, cassava/tapioca, and rice, fluctuate based on factors, including weather conditions, crop yields, and market demand.

Labor costs include wages for plant workers, technicians, supervisory staff, and other employees. Significant amounts of energy are required for processing, which involves drying, grinding, and modification. This consumes a substantial amount of electricity and natural gas, all of which add up to energy costs.

The accompanying chart showcases the cost structure. The breakdown of other costs may be influenced by various cost components, as depicted below:

The prices of products in this market vary based on key factors, including raw material cost fluctuations, currency exchange rates, weather conditions, and government policies. For instance, the prices of key raw materials (such as corn, cassava, and potatoes) have a significant impact on the overall cost of production. In 2024, prices of these commodities showed volatility due to logistical constraints caused by geopolitical factors such as the Russia-Ukraine war. For example, global corn prices increased from USD 189.1 per MT in February 2024 to USD 197.8 per MT in May 2024, due to a reduction in supply amid stable demand.

Moreover, raw materials, such as corn and cassava, are susceptible to weather conditions. Droughts, floods, or other weather conditions affect crop yields and lead to changes in raw material prices. For example, in June 2024, turbulent weather conditions impacted farmers in Iowa and Illinois (in the U.S.), which disrupted agricultural activities and caused soil moisture deficits, thus affecting the growth of several commodities, including corn.

Effective water management and adaptive farming practices will prove to be crucial for mitigating such impacts in the future. Starch is often traded internationally, and fluctuations in currency exchange rates can influence the cost of imports and exports of the commodity, thereby influencing pricing dynamics in different regions.

Key suppliers in this market generally adopt a cost-plus pricing model. This pricing model calculates the price by adding a fixed markup to the cost of production. This method ensures that producers cover their costs and achieve a predetermined profit margin. Another prominent pricing model is volume-based pricing. This model offers price reductions based on the quantity purchased, incentivizing bulk orders and ensuring better utilization of production capacities. Other key pricing models being used include demand-based pricing and contract pricing. The average prices of industrial starch (using corn as a source) in Q1 2024 ranged between USD 600 and USD 700 per metric ton (MT) in the U.S. and USD 400 and USD 500 per MT in China.

Sourcing Intelligence

“What methods do suppliers of industrial starch implement to engage with buyers? What type of operating model is implemented?”

Buyers prefer signing medium- or long-term contracts (usually spanning 3-7 years) with one or two preferred suppliers as a part of their procurement strategy. Long-term contracts provide price stability over a fixed period, which helps buyers manage their budgets and cost structures more effectively. Moreover, long-term agreements also reduce the risk of supply disruptions, which is crucial for industries such as food processing, paper manufacturing, and textiles.

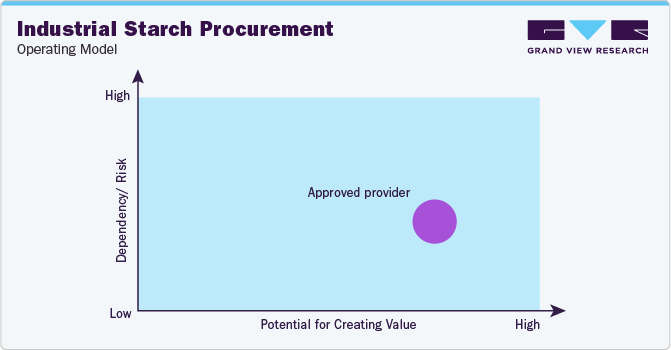

The ‘approved provider’ operating model is preferred by buyers, which involves establishing a list of pre-vetted and approved suppliers who meet the buyer's quality standards, compliance requirements, and performance criteria. Additionally, buyers also consider factors such as comparing the prices quoted by various suppliers, assessing geographical service capabilities, checking years of experience, evaluating technological expertise, and comparing customer service while shortlisting suppliers for procurement.

"An approved provider is a vendor that matches a predefined set of selection criteria such as quality standards, prior-proven performances, qualifications, or others."

Buyers generally opt for local sourcing in this market to improve supply chain-related costs and procurement costs. India, China, Thailand, Vietnam, and Indonesia are the preferred low-cost countries in Asia Pacific for sourcing. India is a prominent hub for sourcing due to its vast availability of raw materials, such as maize and tapioca, coupled with its cost-effective labor. Additionally, India also has a strong production base and supportive government policies that enhance its attractiveness as a sourcing destination.

China is one of the largest producers of corn, a primary raw material. Its extensive and well-developed manufacturing sector benefits from economies of scale, as its large manufacturing facilities lower the cost per unit of production. Meanwhile, Thailand is known for its significant cassava production and is a cost-effective destination for sourcing cassava starch. Vietnam is considered an attractive sourcing destination due to cheap raw material costs, low labor costs and government incentives. Indonesia is one of the leading producers of this commodity, especially known for its tapioca starch. Its large production volume enables it to deploy cost-effective prices.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis. In this report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Procurement of industrial starch enables businesses to enhance the texture and stability of materials, which is crucial for sectors such as F&B and pharmaceuticals. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Industrial Starch Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 7.0% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

5% - 10% increase (Annually) |

|

Pricing Models |

Cost-plus pricing, volume-based pricing, demand-based pricing, contract pricing |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Geographical service provision, industries served, years in service, employee strength, revenue generated, regulatory certifications, key clientele, source (corn/wheat/cassava/potato), type (modified/unmodified), delivery mode (offline/online), technology adoption, customer service, lead time, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

AGRANA Beteiligungs AG, Archer Daniels Midland Company, ACH Food Companies, Inc., Cargill Incorporated, Coöperatie Koninklijke Cosun U.A (Royal Cosun), General Starch Limited, Grain Processing Corporation, Ingredion Incorporated, Roquette Frères S.A., Tate & Lyle PLC, Tereos Group, and Universal Starch Chem Allied Ltd. |

|

Regional Scope |

Global |

|

Revenue Forecast in 2030 |

USD 192.5 billion |

|

Historical Data |

2021 - 2022 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global industrial starch market size was estimated at around USD 119.9 billion in 2023 and is projected to witness a CAGR of 7.0% from 2024 to 2030.

b. High demand from food & beverages, rising consumption of processed and convenience foods, technological advancements, expanding applications in non-food industries, and high demand for starch derivatives such as glucose syrup and maltodextrin are driving the growth of this market.

b. According to the LCC/BCC sourcing analysis, India, China, Thailand, Vietnam, and Indonesia are the low-cost/best-cost countries for the sourcing of industrial starch.

b. This industry is fragmented with intense competition. Some of the key players are AGRANA Beteiligungs AG, Archer Daniels Midland Company, ACH Food Companies, Inc., Cargill Incorporated, Coöperatie Koninklijke Cosun U.A (Royal Cosun), General Starch Limited, Grain Processing Corporation, Ingredion Incorporated, Roquette Frères S.A., Tate & Lyle PLC, Tereos Group, and Universal Starch Chem Allied Ltd.

b. Raw materials, labor, equipment, energy, packaging, logistics and Others are the key cost components in industrial starch. Other cost components involve R&D, safety & compliance, general & administrative, marketing & sales, and insurance.

b. Buyers consider factors such as comparing the prices quoted by various suppliers, assessing geographical service capabilities, checking years of experience, evaluating technological expertise, and comparing customer service while shortlisting suppliers for industrial starch procurement.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.