- Home

- »

- Market Trend Reports

- »

-

Global Lubricants Industry: A $20 Bn Biolubricants Opportunity

Global Lubricants Industry Outlook

The global lubricant industry is undergoing significant shifts in its raw material composition, driven by the increasing demand for bio-based lubricants. Asia Pacific has emerged as a key market for lubricants, propelled by the burgeoning automotive sector and rapid industrial expansion in the region. Predominantly, automotive engine oils, greases, and hydraulic fluids constitute the most widely utilized lubricants in the Asian market.

In response to global trends, Asia Pacific nations, notably Japan and South Korea, are aligning their regulatory frameworks with those of North America and Europe. Consequently, there is a growing emphasis on eco-labeled lubricants to address concerns related to the disposal of conventional mineral oil-based lubricants.

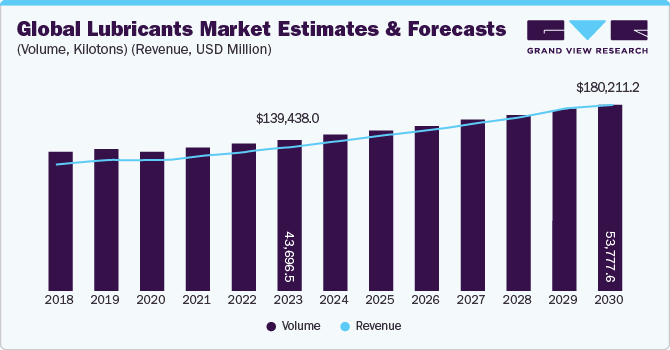

The global lubricant market is anticipated to witness substantial growth, projected to escalate from USD 139.44 billion in 2023 to USD 180.21 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 3.8%.

Lubricants play a critical role in both processing industries and automotive components, particularly in ensuring the smooth operation of brakes and engines. The growth of the lubricants market is being fueled by the escalating imports and exports of piston engine lubricants. Notably, according to the World Bank, the U.S. and Europe have emerged as leading exporters of oil additives and lubricants derived from minerals and petroleum as of 2023.

In the realm of industrial applications, consumers are increasingly discerning when it comes to lubricant selection. Modern consumers are not only focused on the film strength of these oils but also demand a multitude of performance qualities, including corrosion protection, foam suppression, dispersancy, oxidative stability, and viscosity. This consumer demand is spurring innovation in additive packages and lubricant formulations.

Lubricants Industry Competitive Landscape

Against the backdrop of increasing regulatory scrutiny, evolving product landscape, and changing supply chain dynamics, the industry is getting ever more competitive and key success factors of companies are defined by their ability to deliver the fastest route-to-commercialization in terms of sustainable products, diversification of distribution & supply network, integration along the value chain, and most importantly efficiency of production.

Shell plc holds the leading position in the global lubricants market, boasting a market share of approximately 13%, closely followed by ExxonMobil. These industry giants engage in fierce competition due to their robust market presence and extensive product portfolios. Shell's passenger vehicle lubricants dominate markets in the U.S., Philippines, Malaysia, China, and Canada, while the Castrol brand leads the passenger vehicle lubricants segment in India.

The dominance of these top players has been evident in the market for several years, attributed to significant investments in research and development (R&D) activities and the implementation of strategic initiatives such as new product development. Multinational corporations like Chevron, Shell, and ExxonMobil are directing their focus toward emerging markets in Asia Pacific, South America, and the Middle East and Africa to tap into their growth potential. To bolster their market presence, companies are forming strategic alliances with regional players, thereby enhancing their sales and market positioning strategies.

Lubricant Market Opportunity

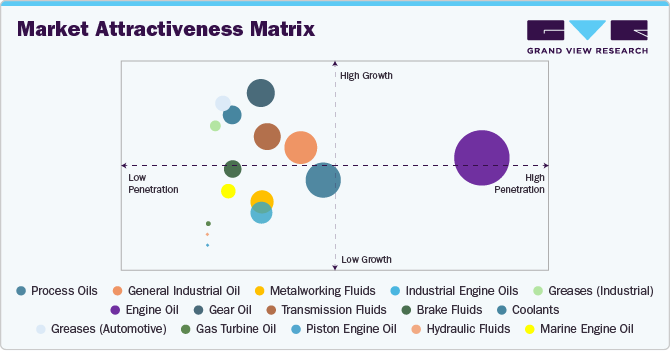

Automotive engine oils are anticipated to drive the highest demand throughout the forecast period, spurred by the rising sales of passenger cars, commercial vehicles, and two-wheelers, particularly in Asian markets. The cumulative demand for automotive engine oils from 2024 to 2030 is forecasted to exceed 112 million tons. Standard scales for both transmission oils and engine oils have been established globally by associations like SAE International, ensuring uniformity. These grades are determined by various factors, including engine type, viscosity index, vehicle capacity, weather conditions, temperature, and other parameters. Fully-synthetic engine oils offer superior performance, excellent cold start capability in freezing temperatures, and reduce deposit buildup, while mineral-synthetic blends provide benefits such as enhanced component protection and extended oil change intervals.

In the industrial lubricants space, process oils and general industrial oils jointly dominate the landscape. Process oils find widespread use across diverse industrial applications, facilitating the finishing and manufacturing of products such as defoamers, fertilizers, crop protection spray oils, hot-melt adhesives, explosives, petroleum jelly, optical cable fill gels, thermoplastic elastomers, textiles, and leather auxiliaries, among others. General industrial oils are employed in boiler feed pumps, steam turbines, and bowl mills for power generation. Their numerous advantages include trouble-free operation in the hydroelectric sector and increased productivity in gas and coal power plants, making them essential in various energy generation sectors such as nuclear, coal, wind, and solar.

Global Lubricants Industry Trends

Specialized formulations: As machinery performance evolves, there's a growing challenge to meet the exacting oil performance demands. Users now recognize the critical role lubricating oils play in ensuring the reliability and extending maintenance intervals of machinery and equipment. Consequently, there's a noticeable shift among consumers away from generic, low-cost formulations towards investing in oils tailored to their specific machinery requirements. This transition underscores a heightened emphasis on precision and performance optimization, reflecting an understanding that the right lubricants can significantly impact operational efficiency and overall equipment lifecycle costs.

Evolving lubricant marketer-customer relationship: Lubricant consumers are adopting a more sophisticated and analytical approach when choosing lube brands and distributors. While cost and performance remain important factors, there's a shift towards considering a broader range of capabilities and lubrication deliverables. Quality, service, support, and contamination control are now at the forefront of consumer priorities.

In response to these changing dynamics, companies are proactively engaging with customers by strategically collaborating with jobbers and leveraging a network of lubricant specialists to provide expertise. This customer-centric approach ensures that consumers receive tailored solutions and personalized support, ultimately enhancing satisfaction and driving long-term relationships.

Lubricants recycling: Additionally, companies are prioritizing the end-of-life management of lubricating oils by providing used lubricant collection services to consumers at designated sites, such as gas stations. This initiative not only benefits consumers by offering a convenient disposal solution but also presents an opportunity for companies to address circular economy challenges within the industry.

By engaging with a broader customer base through structured collection routes, companies can collect used lubricants and recycle them into regenerated or re-refined oils, serving as base oil stock. These regenerated oils are then utilized across various applications, including mold oil, industrial burner oil, hydraulic oils, or bitumen-based products. This approach not only promotes environmental sustainability by reducing waste but also contributes to resource conservation and the efficient utilization of resources throughout the lubricant lifecycle.

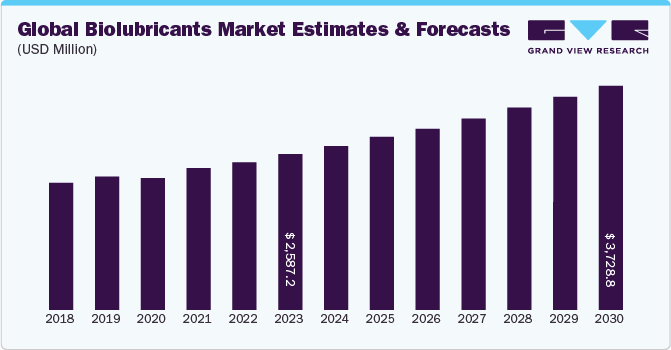

Environmentally friendly lubricants: The biolubricants market landscape is undergoing a significant transformation, with considerable investment from formulators and oil majors into product development. This shift is propelled by the rise of electric vehicles in the mobility sector and an increasing emphasis on sustainability. As the momentum towards sustainability gains traction, the commercialization of Environmentally Acceptable Lubricants (EALs) is anticipated to increase, offering high-performance alternatives to traditional mineral oil-based lubricants. Key industry players are embracing this trend by introducing a diverse range of bio-lubricant solutions. For instance, Shell's PANOLIN and Naturelle portfolio offer biodegradable lubricants tailored for industrial and marine applications.

While there have been advancements in bio-lubricant development over the past decade, the focus has predominantly been on industrial applications. There exists significant potential for bio-based lubricants to penetrate the automotive sector, particularly in engine oils. The ongoing advancements in electric vehicle technology may present opportunities for innovation in automotive tribology, as the mechanical design of motors used in electric vehicles shares similarities with brushless DC motors employed in industrial settings. This convergence of technologies could pave the way for further adoption of bio-lubricants in automotive applications, contributing to the industry's sustainable evolution.

Smart lubrication technologies: Advancements in sensors and the Internet of Things (IoT) have paved the way for the emergence of smart lubrication systems capable of real-time monitoring of lubricant condition, temperature, and machinery performance. This wealth of data enables the optimization of maintenance schedules, reduction of downtime, and enhancement of overall operational efficiency.

Companies like Fuchs Group are leveraging technology to revolutionize their business operations. Through the strategic implementation of technologies such as big data, IoT, machine learning, blockchain, and analytics, they are at the forefront of innovation. By harnessing the power of these advanced technologies, companies like Fuchs Group are not only improving their internal processes but also delivering enhanced value to their customers through more efficient and effective lubrication solutions.

Energy efficient lubricants: The role of lubricants in enhancing energy efficiency, reducing carbon emissions, and controlling greenhouse gases is often underestimated. Lubricants and their additives play a crucial role in reducing our CO2 footprint and mitigating GHG emissions as we transition towards a more sustainable future.

While automotive engine oil and fuel economy have been the primary focus of government regulations such as CAFE and Euro 6, the transportation sector represents only a portion of global energy consumption. The industrial sector, accounting for approximately a quarter of overall lubricant demand, presents a significant opportunity for adopting more energy-efficient lubricants.

The chemistry of lubricant additives and the precise formulation of lubricants enable Original Equipment Manufacturers (OEMs) to maximize the performance of their equipment. High-VI (Viscosity Index) lubricants, for example, offer efficiency benefits for various applications, including hydraulic equipment, gas turbines for power generation and aviation, and gear oils used in wind turbines.

Companies such Evonik are introducing high-VI hydraulic fluids with guaranteed energy savings, while Honda is collaborating with lubricant blenders to develop high-VI engine oils. These advancements are particularly valuable as we increasingly rely on hybrid and electric vehicles to meet future fuel economy standards.

In summary, the adoption of high-performance lubricants across industries can significantly contribute to energy efficiency, emission reduction, and overall sustainability goals, highlighting the vital role of lubricants in our transition towards a greener future.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified