- Home

- »

- Medical Devices

- »

-

Wound Debridement Market Size, Industry Report, 2030GVR Report cover

![Wound Debridement Market Size, Share & Trends Report]()

Wound Debridement Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gels, Ointments & Creams, Wound Irrigation Solution), By Method, By Wound Type, By End-use, By Mode Of Purchase, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-462-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Debridement Market Summary

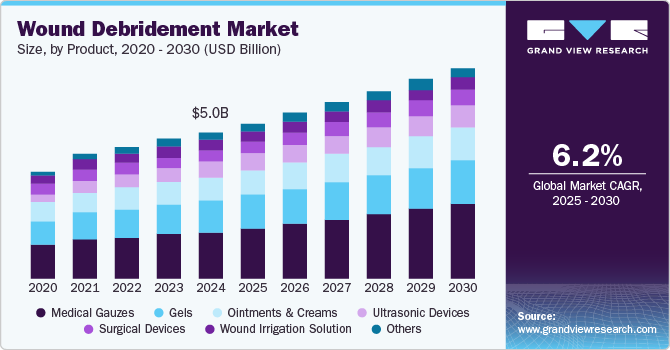

The global wound debridement market size was estimated at USD 5.01 billion in 2024 and is projected to reach USD 7.17 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The high incidence of chronic conditions, such as pressure ulcers, diabetic foot ulcers, and other target wounds, the availability of reimbursement in developed economies, and changing lifestyles are anticipated to drive the market growth.

Key Market Trends & Insights

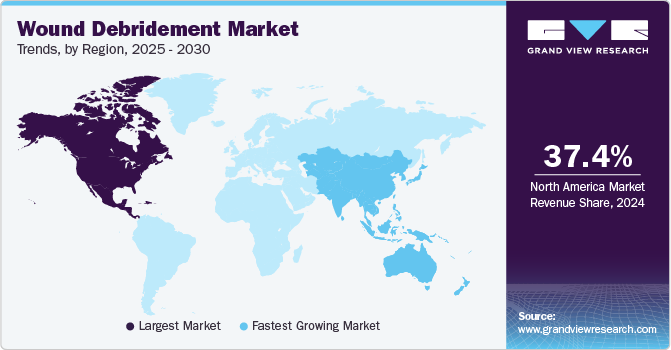

- North America dominated the market with the largest revenue share of 37.36% in 2024.

- The wound debridement market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on product, the medical gauze segment led the market with the largest revenue share of 22.84% in 2024.

- Based on method, the surgical wound debridement segment accounted for the largest market in 2024.

- Based on wound, the diabetic foot ulcers segment accounted for the largest market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.01 Billion

- 2030 Projected Market Size: USD 7.17 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the increasing incidence of accidents such as road accidents, burns, and trauma events across the globe is anticipated to drive the market. In addition, the widening base of the geriatric population and increasing initiatives by the governments and private organizations to raise awareness regarding wound care treatment are projected to work in favor of the market.

The increasing number of people suffering from diabetes is anticipated to impel the market growth further. According to the International Diabetes Federation, diabetes is one of the most prevalent medical disorders in the world, affecting almost 537 million adults in 2021. It is expected to affect 643 million people by 2030 and 783 million people by 2045. According to the 2024 update on Heart Disease & Stroke Statistics, an estimated 9.7 million adults in the U.S. are living with undiagnosed diabetes, while 29.3 million have received a formal diagnosis. Such a rising number of diabetic population possesses a risk of diabetic foot ulcers, and other wounds, which are difficult to treat & take a longer duration to heal. These wounds require advanced wound debridement products, and thus, the wound debridement industry is expected to grow over the forecast period.

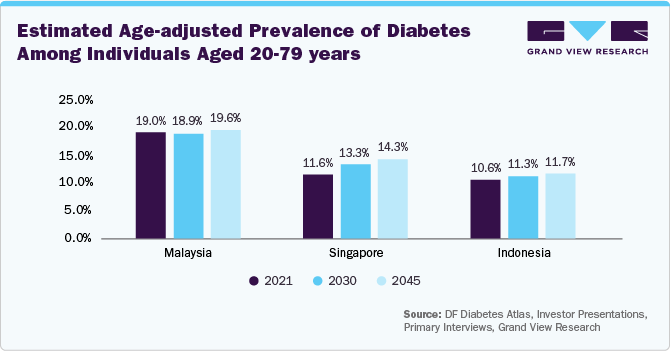

As the prevalence of chronic conditions such as diabetes continues to rise in Southeast Asian countries such as Singapore, Indonesia, and Malaysia, the associated higher risk of foot complications is expected to drive the demand for wound debridement products in the coming years.

Furthermore, tragic accidents have occurred more frequently worldwide. For instance, according to data published by the WHO in December 2023, road traffic crashes claim the lives of approximately 1.19 million people each year. In addition, between 20 and 50 million individuals sustain non-fatal injuries, many of which result in long-term disabilities. These mishaps frequently cause serious bleeding and other injuries, prompting quick medical attention and occasionally requiring surgical operations to provide patients with immediate relief. As wound debridement products help in the debridement of such accidental wounds, the demand for wound debridement is expected to expand significantly over the forecast period.

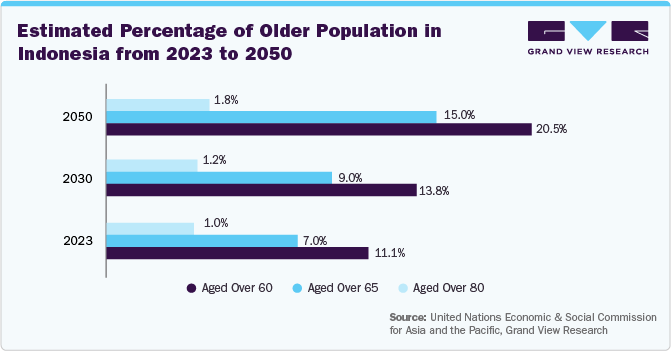

As the global population continues to age, chronic conditions that affect skin integrity, such as diabetes and peripheral vascular disease, are becoming increasingly common. While this pattern is most prominent in developed countries, it is also gaining traction in emerging economies. Aging individuals are more susceptible to health complications that delay wound healing, leading to a greater need for consistent and advanced wound care solutions. For instance, according to the data published by the United Nations Development Programme in June 2024, the Department of Statistics Malaysia (DOSM) projects a significant rise in the percentage of citizens aged 65 and above: from 8.1% in 2024 to 14.5% by 2040. In addition, the population aged over 60 years in Indonesia is also anticipated to witness a significant increase in the coming years.

In addition, the increasing adoption of debridement products and techniques to heal the wound faster is propelling the market growth. The micro-organisms and the presence of toxins on the wound inhibit healing and may lead to infection. Debridement removes the dead or infected tissues from the wound to promote healing.

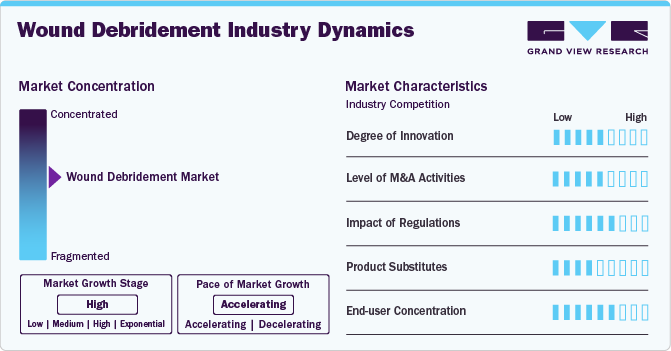

Market Concentration & Characteristics

The wound debridement industry is moderately innovative, with companies focusing on improving the effectiveness of their products. There is a growing trend to use advanced ingredients that help wounds heal faster, prevent infections, and make the healing process more comfortable for patients. In addition, many companies are adopting eco-friendly packaging and more sustainable production methods to meet the rising demand for environmentally conscious products.

Regulations play a significant role in shaping the wound debridement industry. Regulatory bodies like the FDA ensure that wound care products, including wound debridement products, meet high safety and quality standards before they reach consumers. Manufacturers must follow strict testing and approval processes, which can increase development costs and time, but ensure the safety and reliability of these products.

Mergers and acquisitions (M&A) in the wound debridement industry are increasing as companies aim to expand their product lines and strengthen their market presence. Larger companies are acquiring smaller firms that specialize in new wound care technologies or specific niches, enabling them to diversify their offerings, enhance research and development, and improve distribution networks for wider access to advanced products. For instance, in April 2024, Mölnlycke AB agreed to acquire the Austrian manufacturer of Granudacyn wound cleansing and moisturizing solutions, P.G.F. Industry Solutions GmbH. This acquisition will help the company to strengthenits wound cleansing and moisturizing portfolio.

Various product substitutes are available as alternatives to conventional wound debridement techniques. Advanced wound dressings-such as hydrogels, hydrocolloids, alginates, and foam dressings-facilitate autolytic debridement by creating a moist environment to break down necrotic tissue naturally. Enzymatic debriding agents, which utilize proteolytic enzymes to dissolve dead tissue, and negative pressure wound therapy (NPWT), which promotes wound healing and supports debridement indirectly, are also widely adopted.

The wound debridement industry shows a significant level of end-user concentration, with hospitals, home care, and other wound care centers representing the primary consumers of debridement products and services. Hospitals dominate due to the high volume of complex wound cases, availability of skilled healthcare professionals, and access to advanced debridement technologies.

Product Insights

The medical gauze segment led the market with the largest revenue share of 22.84% in 2024. Medical gauzes help in maintaining moisture around the wound, which allows rapid healing. Since these wound care products enable faster healing, wound dressings are highly recommended for chronic wounds, such as diabetic ulcers, burn injuries, pressure ulcers, and other slow-healing wounds. Gauzes are mainly composed of substances such as collagen, hydrocolloids, hydrogels, foams, and alginates.

The gels segment is projected to grow at the fastest CAGR of 5.2% during the forecast duration. Gels maintain a moist wound environment and have certain benefits as compared to other products. Gels are amorphous and clear hydrogels, mainly used for the treatment of sloughy and necrotic tissue in chronic wounds. Increasing cases of surgical wounds or Surgical Site Infection (SSI) among patients and rising incidence of chronic wounds, especially diabetic foot ulcers, are among the major factors contributing to the segment growth.

Method Insights

The market is segmented into autolytic, enzymatic, surgical, mechanical, and others. The surgical wound debridement segment accounted for the largest revenue share in 2024. It is the fastest way of wound debridement procedure to achieve a clean wound bed, thereby contributing to the segment growth.

The autolytic wound debridement segment is expected to expand at the fastest CAGR during the forecast period. Autolytic debridement is the removal of necrotic debris and damaged tissues from a wound site by the body’s endogenous enzymes that engulf specific components of body tissues/cells. This method is usually comfortable and effective, but it takes a longer time than other methods of debridement. However, if significant autolysis is not observed within 1-2 weeks, then another method of debridement is considered.

Wound Type

The market is segmented into pressure ulcers, diabetic foot ulcers, venous leg ulcers, burn wounds, and others. The diabetic foot ulcers segment accounted for the largest market revenue share in 2024. This dominance can be attributed to the increasing number of diabetic patients, coupled with several foot deformities and trauma. For instance, according to the International Diabetes Federation, around 90 million people alone in South East Asia suffer from diabetes. This number further increases to 206 million in the Western Pacific region. As per NCBI, the risk of developing a diabetic foot ulcer in a patient with diabetes is around 2%, which increases to around 17%-60% if the person has suffered from a diabetic foot ulcer previously. Thus, with such a rise in diabetic population along with the risk of diabetic foot ulcers these patients possess, the diabetic foot ulcers segment is projected to have a significant CAGR over the forecast period.

However, the pressure ulcers segment is expected to witness at the fastest CAGR over the forecast duration. Pressure ulcers are also known as bed sores; they usually occur due to prolonged, intense pressure on the skin. Prolonged hospital stay is the most common cause for such ulcers, and it mostly occurs among the geriatric population. Pressure ulcers generally occur at the bony areas of the body, like ankles, hips, and tailbone. The rising geriatric population across the globe is the major driving factor for the segment's growth. For instance, according to WHO, the number of 60+ population in 2019 was expected to reach 254 million, whereas it is anticipated to reach 24% by 2040 of the total population.

End Use Insights

The hospital segment accounted for the largest market revenue share in 2024. This can be attributed to an increase in surgical procedures and a rising number of hospitals. For instance, a study by NCBI in 2020 predicted that 310 million surgical cases were performed annually around the world, of which 40 million to 50 million were done in the U.S. alone. In addition, the number of hospitals and hospitalizations has increased globally.

However, the homecare segment is projected to witness at the fastest CAGR over the forecast period. Homecare settings have been increasing in many countries. Moreover, many surgeries require a prolonged recovery period, leading to frequent debridement of wounds. Further, the geriatric population and bariatric population prefer a home care setting. Thus, the rising bariatric population & geriatric population are anticipated to boost the home healthcare segment.

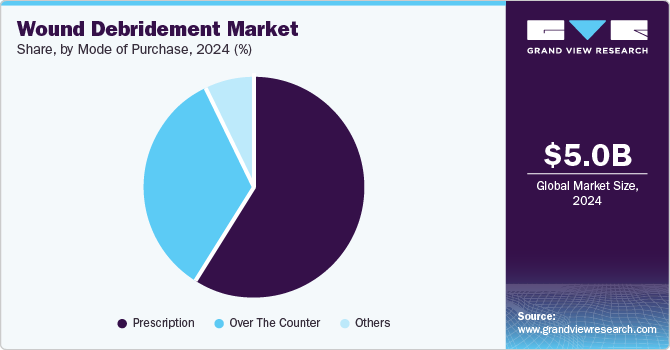

Mode of Purchase Insights

The prescription segment accounted for the largest market revenue share in 2024. The dominance can be attributed to the availability of reimbursement for wound debridement products, if the products are prescribed by a certified medical practitioner. For instance, Medicare covers around 80% of the cost for medically necessary wound care supplies. This encourages people to visit physicians and receive prescribed wound debridement medication.

However, the over-the-counter segment is projected to witness at the fastest CAGR over the forecast period. Several OTC wound debridement products are available in the market for the treatment of various wounds, such as cuts, abrasions, scrapes, and scratches. In addition, easy access to wound debridement products, previous experience, and economic factors play an important role in people opting for OTC wound debridement products. Further, e-commerce platforms, such as Amazon and Walmart, along with the presence of several online pharmacies, such as 1mg, Netmeds, and Apollo Pharmacy, have increased the availability of OTC wound debridement products. Thereby, boosting the segment growth.

Regional Insights

North America dominated the wound debridement market with the largest revenue share of 37.36% in 2024. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and the quick adoption of advanced products are projected to boost the region’s growth further. The region is continuously developing cost-efficient and advanced products for the patients to capture a huge share of the market. In addition, the rising prevalence of chronic diseases and the growing geriatric population are factors responsible for the regional market growth.

U.S. Wound Debridement Market Trends

The wound debridement market in the U.S. accounted for the largest market revenue share in North America in 2024. The U.S. market is experiencing growth, driven by factors such as the rising prevalence of chronic wounds (particularly diabetic foot ulcers and pressure ulcers) due to an aging population and increasing rates of diabetes and obesity. There's a growing demand for advanced wound care solutions, with a push towards less invasive and more effective debridement methods. This includes the increasing adoption of ultrasonic and hydro surgical debridement technologies alongside traditional methods like surgical and enzymatic debridement. The market is further influenced by a well-established healthcare infrastructure, increasing awareness of advanced wound care practices, and the availability of reimbursement for debridement procedures.

Europe Wound Debridement Market Trends

The wound debridement market in Europe is anticipated to grow at a significant CAGR over the forecast period, owing to factors such as high disposable income, the presence of a well-established healthcare infrastructure, and the availability of skilled professionals. Moreover, the presence of favorable reimbursement coverage has increased the adoption of surgical procedures. In addition, the increasing geriatric population and rising cases of chronic diseases are also anticipated to drive the market.

The UK wound debridement market is also expanding, driven by an aging population, the rising prevalence of chronic diseases like diabetes, and the increasing incidence of chronic wounds. For instance, according to a report published by Diabetes UK (The British Diabetic Association) in March 2024, more than five million people in the UK are currently living with diabetes, equating to over one in every 14 individuals. The UK market is characterized by a growing awareness of advanced wound care, increasing government support, and rising healthcare expenditure. This leads to adopting advanced wound debridement products and technologies, focusing on improving patient outcomes and reducing healthcare costs.

The wound debridement market in Germany is anticipated to grow at a significant CAGR over the forecast period. Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies operating in wound care products, are SMEs in the country. Moreover, many companies are entering into strategic alliances, such as partnerships, mergers, agreements, and product launches.

Asia Pacific Wound Debridement Market Trends

The wound debridement market in Asia Pacific is anticipated to witness at a significant CAGR during the forecast period. This can be attributed to the region's growing diabetes population and rising healthcare expenditure. For instance, the Down to Earth organization estimates that India had 74.2 million diabetics between the ages of 20 and 79 as of December 2021. Furthermore, it is expected that this figure would rise to 124.8 million by 2045. Therefore, an increase in the diabetic population may help the market growth in the Asia Pacific region. Furthermore, according to a report published by Insurance Asia, APAC’s healthcare spending is expected to surge 9.9% in 2024. These factors are expected to drive the segment’s growth over the forecast period

The China wound debridement market is anticipated to grow at a significant CAGR during the forecast period. China is a key player in the Asia Pacific region. The increasing prevalence of chronic disorders and the rising geriatric population propels market growth. According to the data published by THE STATE COUNCIL OF THE PEOPLE’S REPUBLIC OF CHINA, in October 2024, China's aging population is a significant demographic shift, with nearly 297 million individuals aged 60 and above in 2023, constituting 21.1% of the total population. These factors fuel market growth.

Latin America Wound Debridement Market Trends

The wound debridement market in Latin America is anticipated to grow at a steady CAGR during the forecast period, driven by several key factors. The region's aging population and the increasing prevalence of chronic conditions such as diabetes and obesity contribute to a higher incidence of chronic wounds, including diabetic foot ulcers and pressure ulcers. These conditions necessitate advanced wound care solutions, including effective debridement methods. Countries like Brazil and Argentina are at the forefront of this growth, owing to their large populations and expanding healthcare infrastructures.

Middle East Africa Wound Debridement Market Trends

The wound debridement market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. The growing geriatric population, increasing number of surgeries, and rising incidence of sports-related injuries are expected to propel the market growth. In addition, the increasing government initiatives to develop healthcare infrastructure, the region is expected to witness a rise in the number of surgeries, leading to an increase in demand for advanced wound debridement products.

Key Wound Debridement Company Insights

The wound debridement industry is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the wound debridement industry, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the wound debridement industry is predicted to grow during the forecast period.

Key Wound Debridement Companies:

The following are the leading companies in the wound debridement market. These companies collectively hold the largest market share and dictate industry trends.

- Coloplast Corp

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Integra LifeSciences

- B. Braun SE

- Molnlycke Health Care AB

- Lohmann & Rauscher

- 3M

- Schülke & Mayr GmbH

- Cardinal Health

- SERAG-WIESSNER GmbH & Co. KG

- Lotus Surgicals Pvt Ltd

- ActiMaris

- BAIHE MEDICAL EUROPE

- URGO MEDICAL

- BD

- Bravida Medical

- Advanced Medical Solutions Limited

- Advancis Medical

- curea medical GmbH

- DEBX MEDICAL

- Dr. Ausbüttel & Co. GmbH (Draco)

Recent Developments

-

In January 2024, Smith+Nephew, the medical technology firm, announced the completion of its acquisition of CartiHeal, the developer of Agili-C, an innovative sports medicine technology for cartilage regeneration in the knee.

-

In April 2024, Mölnlycke AB agreed to acquire the Austrian manufacturer of Granudacyn wound cleansing and moisturizing solutions, P.G.F. Industry Solutions GmbH. This acquisition will help the company to strengthen its wound cleansing and moisturizing portfolio.

Wound Debridement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.31 billion

Revenue forecast in 2030

USD 7.17 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, wound type, end use, mode of purchase, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Coloplast Corp; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Integra LifeSciences; B. Braun SE; Molnlycke Health Care AB; Lohmann & Rauscher; 3M; Schülke & Mayr GmbH; Cardinal Health; SERAG-WIESSNER GmbH & Co. KG; Lotus Surgicals Pvt Ltd; ActiMaris; BAIHE MEDICAL EUROPE; URGO MEDICAL; BD; Bravida Medical; Advanced Medical Solutions Limited; Advancis Medical; curea medical GmbH; DEBX MEDICAL; Dr. Ausbüttel & Co. GmbH (Draco)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Debridement Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound debridement market report based on the product, method, wound type, end use, mode of purchase, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Ointments & Creams

-

Wound Irrigation Solution

-

Surgical Devices

-

Medical Gauzes

-

Ultrasonic Devices

-

Others

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Autolytic

-

Enzymatic

-

Surgical

-

Mechanical

-

Others

-

-

Wound Type Outlook (Revenue, USD Million, 2018 – 2030)

-

Pressure Ulcers

-

Stage 1

-

Stage 2

-

Stage 3

-

Stage 4

-

Deep Tissue Injury

-

-

Diabetic Foot Ulcers

-

Venous Leg Ulcers

-

Burn Wounds

-

Second-degree (partial-thickness)

-

Third-degree (full-thickness) burns

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital (Inpatient)

-

Hospital (Outpatient)

-

Complex Wound Clinic

-

Leg Ulcer Clinic

-

Diabetic Foot Clinic

-

Walking-in Clinic

-

Podiatry Clinic

-

General Practitioners (GP) Surgery

-

Nursing Home

-

Home Health

-

Hospitalization at Home (HAD)

-

-

Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

Over The Counter

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wound debridement market size was estimated at USD 5.01 billion in 2024 and is expected to reach USD 5.31 billion in 2025.

b. The global wound debridement market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 7.17 billion by 2030.

b. North America dominated the wound debridement market with a share of 37.36% in 2024. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the wound debridement market include Coloplast Corp; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Integra LifeSciences; B. Braun SE; Molnlycke Health Care AB; Lohmann & Rauscher; 3M; Schülke & Mayr GmbH; Cardinal Health; SERAG-WIESSNER GmbH & Co. KG; Lotus Surgicals Pvt Ltd; ActiMaris; BAIHE MEDICAL EUROPE; URGO MEDICAL; BD; Bravida Medical; Advanced Medical Solutions Limited; Advancis Medical; curea medical GmbH; DEBX MEDICAL; Dr. Ausbüttel & Co. GmbH (Draco).

b. Key factors that are driving the wound debridement market growth include a growing number of accidents and fire outbreaks are leading to rising in the cases of injuries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.