- Home

- »

- Homecare & Decor

- »

-

Window Coverings Market Size, Share & Trends Report 2030GVR Report cover

![Window Coverings Market Size, Share & Trends Report]()

Window Coverings Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Blinds & Shades, Curtains & Drapes, Shutters), By Application (Residential, Commercial), By Distribution Channel, By Installation, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-970-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Window Coverings Market Summary

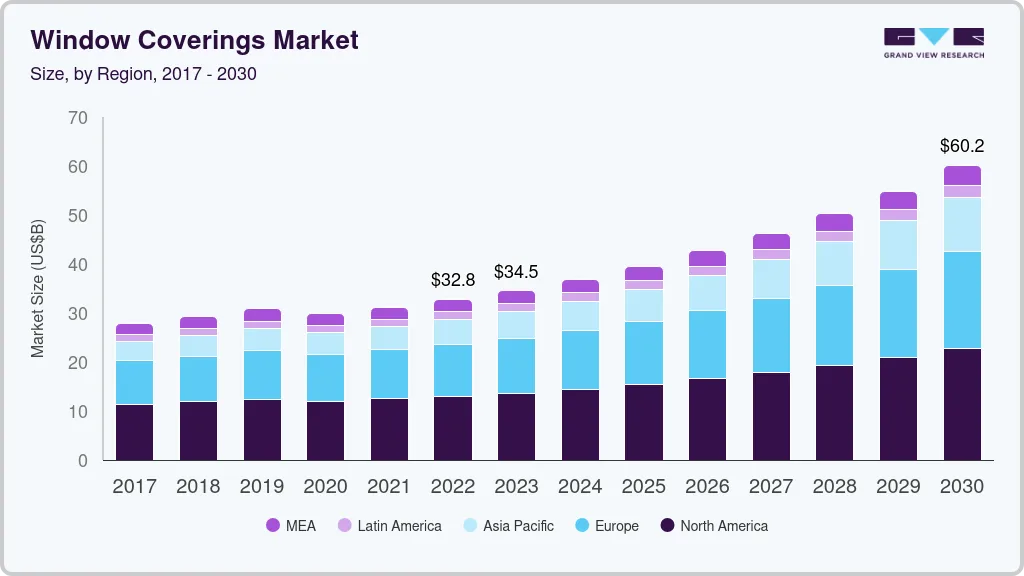

The global window coverings market size was estimated at USD 34.50 billion in 2023 and is projected to reach USD 60.16 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030. In the foreseeable term, the market will most likely be driven by strong economic growth.

Key Market Trends & Insights

- The North America window covering market made the largest revenue contribution of 39% to the global market in 2023.

- The Asia Pacific window covering market is expected to grow at the fastest CAGR of 10.6% from 2024 to 2030.

- By type, blinds and shades segment led the market and accounted for a 40% share of the global revenue in 2023.

- By application, the residential application segment led the market and accounted for over 55% share of the global revenue in 2023.

- By distribution channel, the offline distribution channel segment made the largest revenue contribution of around 85% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 34.50 Billion

- 2030 Projected Market Size: USD 60.16 Billion

- CAGR (2024-2030): 8.5%

- North America: Largest market in 2023

Increasing consumer disposable income has resulted in regular changes in window coverings, as well as wall paint and other home décor items. This has also been a significant driver in the market's expansion. After the outbreak of COVID-19, home renovations became more popular. However, market sellers reported a drop in bespoke window covering sales as house visits were restricted. In addition, a sizable DIY industry arose as a means of facilitating affordable home décor renovations. In contrast, different technologies and improvements, such as sensor-based window coverings, together with an increase in the number of smart homes, create long-term growth potential.

Smart window solutions such as connected shades, blinds, and curtains considerably improve comfort and convenience while always maintaining the proper mix of natural and artificial light, occupant well-being, and comfort. For example, at the Consumer Electronics Show 2020, Somfy, a company that specializes in smart home solutions, unveiled the Sonesse ULTRA 30 WireFree Zigbee Li-Ion motor. It allows users to control window coverings with a smartphone app, a remote control, or a simple voice command. This is propelling the smart window covering industry over the forecast period.

Moreover, AI is being used by several manufacturers to improve the overall consumer experience. For example, a new visualizer offered by Bali, a home design firm, allows clients to see window treatments on their windows. Users may simply submit a photo, select a treatment, and see how it looks in their own homes. To find the perfect window treatment solution for them, users can experiment with different colors, styles, and privacy levels.

The growth in the interior decoration sector, attributable to the rising number of residential and commercial buildings, is projected to fuel demand for window coverings during the forecast period. According to a report published by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, approximately 1,392,300 residential units were finished in 2022, a 3.8% increase from 1,341,000 in 2021. Thus, expansion of the residential household category is expected to drive the need for home décor products, thereby boosting window covering market growth.

Furthermore, the increasing wave of millennials buying homes, particularly older homes that require more repairs, is contributing to product demand. According to studies by HomeAdvisor, millennials are investing in a greater number of home improvement projects each year compared to other age groups. Moreover, according to 2023-US-Houzz&Home-Study, after remodeling, homeowners frequently start decorating. In fact, 82% of millennials more than 4 in 5 did so in 2022.

With the rise of smart homes and home automation, there is a demand for window coverings that can be controlled remotely or integrated into smart home systems. Motorized blinds and shades that can be operated through apps or voice commands are becoming increasingly popular. Moreover, the rising construction of smart homes as a result of consumers embracing luxury lifestyles is driving the demand for smart window coverings in houses.

Market Concentration & Characteristics

Mergers and acquisitions play a vital role in the window covering market for several compelling reasons. These strategic moves allow companies to quickly expand their market presence and reach a broader customer base. By acquiring or merging with other firms, companies can gain access to new technologies, manufacturing capabilities, and distribution channels.

Product launches are a crucial move in the market for several compelling reasons. They allow companies to introduce innovative and updated offerings that cater to evolving customer needs and preferences. By launching new products, companies can differentiate themselves from competitors and generate excitement among customers.

The window coverings market is also subject to moderate regulatory scrutiny. Many regulations address the potential hazards associated with automatic window coverings especially the cords that pose as a strangulation risk.

There are moderate number of direct product substitutes for window coverings. Industrial windows with stained glass act as an alternative in a much more contemporary way. However, curtains, shutters, blinds, and many other window covering solutions are highly preferred owing to lower cost and wide scale availability.

Growing awareness among the end-user regarding children’s safety is increasing the adoption of cordless blinds & shades. Also, the increasing focus of the government on safety concerns regarding window coverings is driving the adoption of cordless and automated window coverings among consumers.

Type Insights

Blinds and shades segment led the market and accounted for a 40% share of the global revenue in 2023. End users are able to reduce energy consumption and carbon emissions thanks to the development of new blinds and better acoustic features of honeycomb blinds. This is expected to boost the blinds and shades market over the forecast period. The window blinds market is driven by rising house developments and a keen interest in home remodeling projects, which are caused by rapid urbanization, rising residential development, and rising disposable income.

The curtains & drapes segment is anticipated to grow at a CAGR of 8.7% from 2024 to 2030. High-tech innovations, such as solar-blocking curtains or remote-controlled curtains, are becoming increasingly popular. Moreover, DIY consumers dominate the window curtain industry. The segment expansion is fueled by the widespread availability of window curtain items and the ease with which they can be installed. To meet the needs of the curtain market, several manufacturers have developed specialized distribution channels.

Application Insights

The residential application segment led the market and accounted for over 55% share of the global revenue in 2023. The category is being driven by an increase in the number of households and rising urbanization in developing economies such as India and China. Furthermore, according to the FMCA, more than 800,000 new homes were sold in the U.S. in 2020, along with more than 5.5 million existing residences.

The commercial category is expected to grow at a CAGR of 8.6% from 2024 to 2030. The market for new buildings is also driven by investments in the standardization of IT infrastructure and product advancements. The need for sliding and insulated profiles is now being driven by replacement demand, owing to their improved insulating capabilities, ease of operation, and effective space usage.

Distribution Channel Insights

The offline distribution channel segment made the largest revenue contribution of around 85% in 2023. Consumers prefer home décor stores such as Home Center as they have a larger selection of patterns and colors. Consumers in countries like India choose to buy from wholesale markets since they are considerably cheaper than other markets. In the forecast term, these reasons are likely to boost the segment.

The online distribution channel is projected to grow at the fastest CAGR of 8.9% from 2024 to 2030. E-commerce in the home décor industry is growing, and it helps companies reach a wider audience. Online and offline channels are frequently combined by retailers. Furthermore, according to a 2020 survey by UNCTAD, there was a 7% increase in the number of online buyers who made at least one home furnishing transaction every two months. During the projection period, these factors are expected to boost the growth of the online segment.

Installation Insights

The retrofit segment led the market and accounted for a 57% share of the global revenue in 2023. In the residential sector, renovation, and retrofitting is a prominent trend driving the market for window coverings. The market is expected to be propelled by increasing investments in home remodeling and the resumption of construction projects following the relaxing of COVID-19 regulations.

Window covering for the new construction segment is anticipated to grow at a CAGR of 8.7% from 2024 to 2030. The demand for window coverings is likely to be driven by expanding residential developments and the robust growth of the commercial construction industry. The market is also driven by the growth of fenestration installations in new industrial buildings.

Technological Insights

The manual window covering market accounted for a revenue contribution of over 90% in the global market in 2023. Dwelling sizes have shrunk as a result of rapid urbanization, necessitating the usage of multipurpose home furniture and window coverings. Companies are incorporating advanced systems for hassle-free operation of shades, as well as offering multiple light filtering options.

3 Blind Mice Window Coverings, Inc., for example, has introduced Silhouette Duolite shades. The company’s Duolite system combines a transparent light-filtering cloth shade in the front of the treatment with an opaque room-darkening roller shade at the back. This integrated treatment is ideal for a room that has numerous purposes, such as a bedroom that also serves as an office.

The automatic window covering market is expected to grow at a CAGR of 9.8% from 2024 to 2030. Smart home automation technologies are becoming increasingly popular around the world, and some home stores are now stocking smart dimmers and motion sensor kits. For example, FYRTUR and KADRILJ are battery-operated smart window blinds that can be controlled wirelessly with the included remote control.

Regional Insights

The North America window covering market made the largest revenue contribution of 39% to the global market in 2023. According to the U.S. Census Bureau, construction spending on public residential buildings grew in the U.S. in 2021. Construction spending in the first 11 months of 2021 was 7.9% higher than in the same period of 2020. The substantial investments in home décor and home improvements are anticipated to accelerate the window blinds market in the U.S.

The Asia Pacific window covering market is expected to grow at the fastest CAGR of 10.6% from 2024 to 2030. The regional market has been fueled by the rapid rise of emerging economies such as India, China, and Australia. The rise of tourism in countries like Thailand and Malaysia has driven the construction of hotels and resorts, creating a positive scenario for market growth over the forecast period. Moreover, in terms of revenue, China’s window covering industry accounted for the largest market share in Asia Pacific, in 2022. This is attributed to the significant expansion of the hospitality sector in cities such as Shanghai, Guangzhou, Chengdu, and Suzhou. The Japan window coverings market is estimated grow at a CAGR of 9.5% from 2024 to 2030, owing to the increasing investment in the commercial infrastructure of the country.

Key Companies & Market Share Insights

Some of the key operating players in the window coverings market are Hunter Douglas Inc., Lotus & Windoware, Inc., Bombay Dyeing & Manufacturing Co Ltd., Insolroll Window Shading Systems, Springs Window Fashions, and Welspun

Hunter Douglas Inc. is a leading manufacturer of window coverings and architectural products. It operates through three main segments such as window coverings, architectural products, and metals trading segments. The company offers its window covering products under different brands in different regions such as Luxaflex in Europe and Australia for the residential segment, Levolor in North America and Hillarys in the UK Hunter Douglas Inc. comprises 133 companies with 47 manufacturing sites and 86 assembly operations.

MechoShade Systems, LLC is an emerging manufacturer of automated window coverings and provides its product solutions in industries like Healthcare, architects, construction sites, interior designer, developer, engineer, and more. The company’s shades reduce solar heat gain and glare which has been proven to improve occupant performance and building efficiency. Its innovative Mecho solutions provide the optimal light and ideal comfort for guests of hotels, conference centers, health clubs, and other hospitality amenities worldwide

Key Window Coverings Companies:

The following are the leading companies in the window coverings market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these window coverings companies are analyzed to map the supply network.

- Hunter Douglas Inc.

- Lotus & Windoware, Inc.

- Bombay Dyeing & Manufacturing Co Ltd.

- Insolroll Window Shading Systems

- Springs Window Fashions

- Welspun

- SKANDIA WINDOW FASHIONS, INC.

- MechoShade Systems, LLC

- Lafayette Interior Fashions

- COMFORTEX WINDOW FASHIONS

Recent Developments

-

In February 2022, Springs Window Fashions acquired the assets of NuLEDs to strengthen its position in the Power-over-Ethernet (PoE) shade market. The intellectual property of NuLED presents a unique opportunity for Mecho in automated shade systems.

-

In March 21, 2022, SelectBlinds.com announced the release of two motorised Architect roller shades with new Eve MotionBlinds and Apple HomeKit technology. The Eve MotionBlinds motors are the connected blinds and shades motors that enable thread smart home technologies in addition to Bluetooth functionality.

-

In August 2020, Blinds.com, a Home Depot Company, expanded its popular cellular shades line to include a comprehensive, integrated system that could cover any window in the house, offering customers the advantages of cordless operation without the need for motorization.

-

In July 2020, Hunter Douglas introduced the Designer Roller Duolite Shade, a roller shade that combines a translucent fabric for light diffusion and a thick liner for room darkening.

Window Coverings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.86 billion

Revenue forecast in 2030

USD 60.16 billion

Growth Rate

CAGR of 8.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million; volume in million Sq. Ft. and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, installation, distribution channel, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; Argentina; UAE; South Africa

Key companies profiled

Hunter Douglas; Lotusblind; Bombay Dyeing; Insolroll; Mariak; Welspun India Limited; Skandia Window Fashion; MechoShade Systems, LLC; Lafayette Interior Fashions; Comfortex Window Fashion

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Window Coverings Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global window coverings market report on the basis of type, application, installation, distribution channel, technology, and region:

-

Type Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

Blinds & Shades

-

Curtains & Drapes

-

Shutters

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

Online

-

Offline

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Multi Brand Stores

-

-

-

Installation Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

New Construction

-

Retrofit

-

-

Technology Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

Automatic

-

Manual

-

-

Technology Outlook (Revenue, USD Million; Volume, Million Sq. Ft., 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global window coverings market was estimated at USD 34.50 billion in 2023 and is expected to reach USD 36.86 billion in 2024.

b. The global window coverings market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 60.16 billion by 2030.

b. North America dominated the window coverings market with a share of around 39% in 2023. The substantial investments in home décor and home improvements are anticipated to accelerate the U.S. window covering industry.

b. Some of the key players operating in the window coverings market include Hunter Douglas; Lotusblind; Bombay Dyeing; Insolroll; Mariak; Welspun India Limited; Skandia Window Fashion; MechoShade Systems, LLC; Lafayette Interior Fashions; Comfortex Window Fashion

b. Key factors that are driving the window coverings market growth include increasing disposable incomes of different consumer groups, along with rising consumer expenditure on home furnishings & decor.

b. The Germany window covering market size was estimated at USD 3.32 billion in 2023 and is expected to reach USD 3.55 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.