- Home

- »

- Advanced Interior Materials

- »

-

Waterproof Tapes Market Size, Share & Growth Report, 2030GVR Report cover

![Waterproof Tapes Market Size, Share & Trends Report]()

Waterproof Tapes Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin Type (Silicone, Acrylic, Butyl), By Substrate Type (Plastic, Metal, Rubber), By End-use (Healthcare, Automotive, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Waterproof Tapes Market Size & Trends

The global waterproof tapes market size was estimated at USD 14.25 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The market growth is expected to be driven by exponential growth in the end-use industries, such as healthcare, building & construction, automotive, and electrical & electronics. Waterproof tapes are widely used in the abovementioned industries on account of their durability and cost-effective nature. Waterproofing tapes are used to create a barrier between a structure and moisture or airflow offering long-lasting and practical solutions. The product possesses various attributes, such as flexibility, thickness, and durability, ensuring superior contour of the material it is applied to.

Therefore, increased production in the manufacturing sector, construction sector, and electrical & electronics sector coupled with the rising use of these tapes in healthcare treatments and the packaging industry are expected to drive market growth. The initial cost of setting up the production unit for waterproof tapes is quite high, which restricts the entry of new players into the market. Existing manufacturers are involved in capacity expansion to gain market share. However, increasing demand for waterproof tapes owing to their ability to be effective on any difficult surface is expected to attract new players in the market looking at long-term return on investment.

Market Concentration & Characteristics

The market growth stage is medium, and pace of its growth is accelerating. The industry is fragmented on account of the involvement of many large-scale players with high production capacities. Furthermore, with the increasing product demand in various end-use industries is expected to attract new players; thereby, increasing market competition.

The industry is characterized by a high degree of innovation as many manufacturers have aimed at producing products with improved performance, versatility, and lifespan. The emergence of nanotechnology has further offered new growth opportunities to manufacturers as nanoparticles are used to improve the water-repellant property of the tapes. Furthermore, with a growing emphasis on sustainability, the product is expected to be manufactured using eco-friendly and recycled materials.

There are various substitutes for the product such as waterproof sealants, membranes, adhesives, heat-activated tapes, and self-adhesive tapes. However, there are several factors to consider while choosing the type of product such as cost-effectiveness and durability. Furthermore, the product also faces internal substitution on account of the presence of many backing materials, substrate types, and resin types.

The waterproof tapes serve a diverse range of end-users across various industries, such as automotive, building & construction, electrical & electronics, packaging, and healthcare. Therefore, the end-use concentration is high in the market. Understanding the specific needs of end-users along with providing efficient products to the clients are among the major factors that manufacturers consider.

Substrate Type Insights

Based on substrate type, the plastic segment dominated the global market in 2023. Various end-use industries including aerospace, automotive, and marine use waterproof tapes on plastic substrates. This helps in reducing application time, cost, and wastage created with traditional sealing methods such as welding and fasteners.

Metal substrates comprise superior heat-resistant properties in comparison to plastic substrates, thereby making them an ideal option for applications that are subjected to excess heat. In addition, metal substrates can be recycled after their service life, which results in low wastage, leading to sustainability.

Rubber substrates are expected to witness significant growth over the forecast period on account of their ability to maintain flexibility at high temperatures. The flexibility further helps in the easy application of a product on challenging and irregular shapes ensuring an effective layer of barrier between moisture and structure.

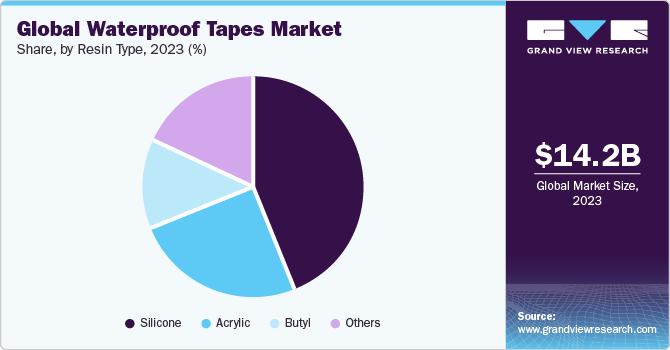

Resin Type Insights

The silicone resin type segment led the market with a revenue share of around 43.7% in 2023 and is projected to expand further at a significant CAGR over the forecast period. Waterproof tapes made using silicone resin are widely used for applications, such as appliances, interior components of automotive, metal furniture, and industrial equipment, on account of their characteristics, such as superior adhesion to various substrates and chemical, heat, & water resistance.

The acrylic resin segment is expected to witness significant growth over the period. Waterproof tapes made with acrylic resin offer durable and effective solutions for waterproofing or sealing structures or components even in harsh environmental conditions. In addition, these tapes are UV resistant, which helps in preventing degradation from sunlight, thereby, offering long-lasting results for outdoor applications.

End-use Insights

The healthcare end-use segment accounted for the largest revenue share of around 25% in 2023 and is expected to grow further at the fastest CAGR over the forecast period. Waterproof tapes are used for many applications in the healthcare sector, such as wound dressing, surgical covers & drapes, and braces. The product properties, such as water resistance and hygiene, make it an ideal option for the abovementioned applications.

In the building & construction sector, waterproof tapes are used to create a superior waterproofing system for structural parts that may come in contact with air, moisture, and water. Furthermore, for residential buildings, waterproofing systems are a must to ensure public safety. Moreover, in the electrical & electronics sector, waterproof tapes are used for many applications, such as high-voltage cables, electrical conductors, motor lead distribution, and insulating generator coils.

Regional Insights

The North America waterproof tapes market accounted for a revenue share of 27% in 2023. The region consists of countries with established end-use sectors, such as construction, electronics, automotive, and healthcare, which are driving the product demand

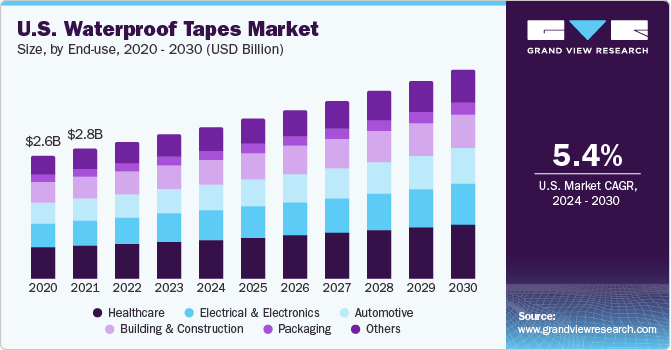

U.S. Waterproof Tapes Market Trends

The waterproof tapes market in the U.S. is expected to grow significantly over the forecast period. The presence of production facilities of major automotive manufacturers such as Ford, Toyota, GM, Nissan, and Chevrolet in the country is expected to positively drive product growth in the U.S. over the coming years.

The Mexico waterproof tapes market is witnessing high demand on account of the emergence of the country as an automotive manufacturing hub due to its proximity to the U.S. In addition, increasing demand for residential units on account of a growing population and increasing buying power of consumers is further expected to fuel market growth.

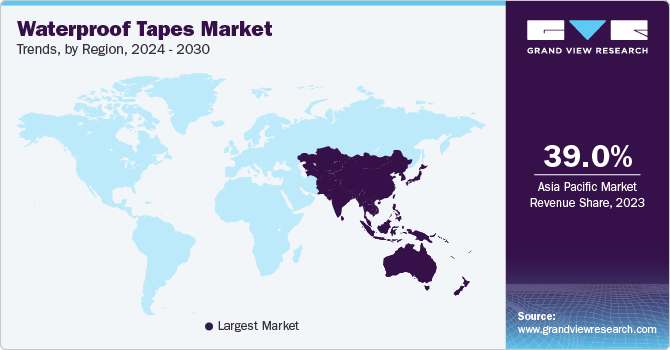

Asia Pacific Waterproof Tapes Market Trends

The waterproof tapes market in Asia Pacific accounted for the largest revenue share of around 39% in 2023. The region is home to many industries, such as automotive, electrical & electronics, building & construction, and packaging. This has significantly kept the demand for waterproof tapes in the region. Furthermore, rising investments in setting up production units by the manufacturing sector on account of easy availability of low-cost labor are further expected to boost market growth.

The China waterproof tapes market accounted for the largest revenue share of the Asia Pacific market revenue in 2023. The large production base for electronics coupled with rising construction activities in the country supports the product demand.

The waterproof tapes market in India is expected to have significant growth. India, being a developing country, is witnessing large-scale projects for infrastructure development. In addition, increasing per capita income of consumers, rising population, and rapid urbanization are boosting the demand for commercial and residential buildings. This, in turn, is expected to increase the product demand.

Europe Waterproof Tapes Market Trends

The Europe waterproof tapes marketaccounted for a significant share of global revenue in 2023. The region comprises many developed economies, such as the UK, Germany, Russia, Italy, and France, with well-established construction sectors. Furthermore, the presence of an established automotive sector in the region is expected to contribute to product demand.

The waterproof tapes market in Germany is projected to have lucrative growth. The automotive industry in Germany is one of the largest in Europe, in terms of revenue and volume, owing to the specific and innovative nature of country-based manufacturers and suppliers of cars. Major automotive companies in the country include BMW, Audi, Porsche, and Volkswagen. This has kept the demand for waterproof tapes in the country.

Middle East & Africa Waterproof Tapes Market Trends

The Middle East & Africa waterproof tapes market is expected to grow at a significant CAGR over the years owing to flourishing construction and automotive end-use industries in the region that are key consumers of this product.

The waterproof tapes market in Saudi Arabia is likely to have a steady product demand on account of increasing public and private investment in the construction sector, such as the Neom City and Red Sea projects.

Central & South America Waterproof Tapes Market Trends

The Central & South America waterproof tapes market is projected to grow steadily due to increasing investments in the automotive industry and infrastructure development, which are boosting the product demand.

The waterproof tapes market in Brazil isanticipatedto grow in the future due to the presence of leading electronic companies, such as LG, Foxconn, Dell, Flextronics, Lenovo, Multilaser, and IntelBras, which is expected to open new growth avenues for waterproof tapes manufacturers.

Key Waterproof Tapes Company Insights

Some of the key players operating in the market are Tesa SE, 3M, and Henkel:

-

Tesa SE is involved in the manufacturing of self-adhesive products and adhesive tapes. The company caters to the demand from many industries, such as appliances, automotive, construction, electronics, paper & print, transportation, food, specialty vehicles, renewable energies, and the metal industry. It employs over 5000 employees with a presence in across 100 countries

-

Henkel is a Germany-based company involved in the manufacturing of chemicals and consumer goods. It sells its products through two business segments namely consumer brands, and adhesive technologies

Metalnastri S.r.l, Chowgule Construction Chemicals Pvt. Ltd., and Shurtape Technologies, LLC are some of the emerging participants in the market.

-

Metalnastri S.r.l is a company involved in anti-corrosion technology, especially for metal surfaces. The company’s products focus on increasing the durability of reinforced concrete and steel structures. In addition, its products are categorized into two segments, cathodic protection of steel and cathodic protection of steel in concrete

-

Shurtape Technologies, LLC is a manufacturer of consumer office & home products and adhesive tapes. The company serves various industries including building & construction, transportation, industrial packaging, converting, specialty, industrial MRO, and arts & entertainment. Furthermore, the company operated offices across the UK, U.S., Germany, Australia, UAE, China, Peru, Denmark, and Mexico

Key Waterproof Tapes Companies:

The following are the leading companies in the waterproof tapes market. These companies collectively hold the largest market share and dictate industry trends.

- Tesa SE

- Metalnastri S.r.l

- 3M

- Scapa

- Chowgule Construction Chemicals Pvt. Ltd.

- A.B.E. Construction Chemicals

- Shanghai Richeng Electronics Co. Ltd.

- Henkel

- Shurtape Technologies, LLC

- Nitto Denko Corporation

Recent Development

-

In January 2023, FLEX SEAL PRODUCTS launched its new product line under The Flex Seal, named Flex Seal Flood Protection. The range consists of products, such as tapes, liquid, and paste, which will help prevent water from entering residential and commercial spaces, especially at the time of floods

-

In February 2021, Gorilla Glue launched its new waterproof tape named Gorilla Waterproof Patch & Seal. The product can be easily applied over cracks, gaps, and holes. Furthermore, it can be stretched and flexed and can also be used for underwater applications

Waterproof Tapes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.14 billion

Revenue forecast in 2030

USD 23.22 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, substrate type, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Tesa SE; Metalnastri S.r.l; 3M; Scapa; Chowgule Construction Chemicals Pvt. Ltd.; A.B.E. Construction Chemicals; Shanghai Richeng Electronics Co. Ltd.; Henkel; Shurtape Technologies, LLC; Nitto Denko Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterproof Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global waterproof tapes market report based on resin type, substrate type, end-use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Acrylic

-

Butyl

-

Silicone

-

Others

-

-

Substrate Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Metal

-

Rubber

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Electrical & Electronics

-

Automotive

-

Building & Construction

-

Healthcare

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global waterproof tapes market size was estimated at USD 14.25 billion in 2023 and is expected to reach USD 15.14 billion in 2024.

b. The global waterproof tapes market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 23.22 billion by 2030.

b. Plastic substrate type dominated the global waterproof tapes market in 2023 with the revenue share of around 35% on account of its use in various end-use industries including aerospace, automotive, and marine.

b. Some of the key players operating in the waterproof tapes market include tesa SE, Metalnastri S.r.l, 3M, Scapa, Henkel, Shurtape Technologies, LLC, and Nitto Denko Corporation.

b. The key factors that are driving the global waterproof tapes market include utilizing of the product for wide range of application in various growing industries such as automotive, electronics, and construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.