- Home

- »

- Advanced Interior Materials

- »

-

Water Treatment Systems Market Size, Industry Report, 2033GVR Report cover

![Water Treatment Systems Market Size, Share & Trends Report]()

Water Treatment Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Installation (Point-of-Use, Point-of-Entry), By Technology (Reverse Osmosis Systems, Distillation Systems, Filtration Methods), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-137-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Treatment Systems Market Summary

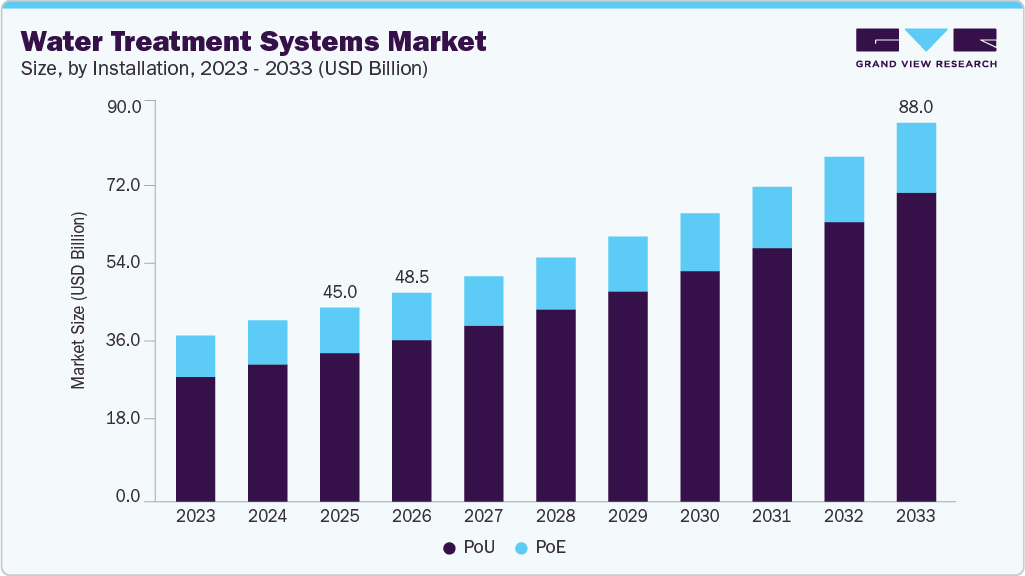

The global water treatment systems market size was valued at USD 42,078.0 million in 2024 and is projected to reach USD 88,023.5 million by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The rising scarcity of clean water resources worldwide is a major factor driving the market.

Key Market Trends & Insights

- North America water treatment systems industry is expected to grow at a robust CAGR of 7.7% during the forecast period.

- By installation, the PoU segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

- By technology, the filtration methods segment is expected to grow at a considerable CAGR of 9.4% from 2025 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a considerable CAGR of 9.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 42,078.0 Million

- 2033 Projected Market Size: USD 88,023.5 Million

- CAGR (2025-2033): 8.7%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing region

Rapid urbanization, industrial growth, and agricultural activities are depleting freshwater sources, creating demand for advanced treatment technologies. Governments and municipalities are investing heavily in desalination, filtration, and wastewater reuse projects to secure water supplies.

Stringent environmental regulations and public health concerns are further accelerating market growth. Authorities in the U.S., EU, and Asia-Pacific are enforcing strict discharge limits and water quality standards, particularly related to contaminants such as PFAS, heavy metals, and microplastics. Rising consumer awareness regarding safe drinking water is also stimulating residential adoption of filtration and purification units. Together, regulatory push and public demand are driving continuous innovation in treatment technologies.

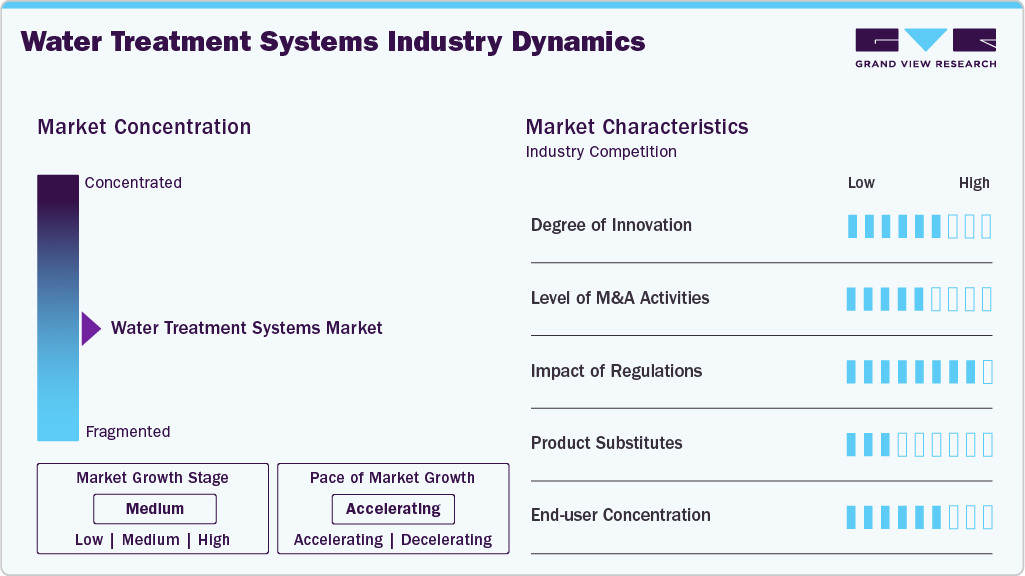

Market Concentration & Characteristics

The water treatment systems industry is moderately fragmented, combining the presence of established international players with a large number of regional and local manufacturers. Larger participants drive innovation through advanced technologies and broad service networks, while smaller firms compete by offering cost-effective and localized solutions. This mix creates a competitive environment where no single entity fully dominates. As a result, the industry remains moderately concentrated but continues to exhibit strong rivalry across different regions.

The market shows a high degree of innovation, driven by the need for advanced filtration, desalination, and wastewater reuse technologies. Emerging solutions like smart monitoring, membrane filtration, and UV disinfection are gaining traction. Companies are investing heavily in R&D to improve efficiency, reduce operating costs, and lower energy consumption. Continuous innovation is essential to address evolving water quality challenges and sustainability goals.

The industry experiences a steady level of mergers and acquisitions as firms look to expand technology capabilities and global reach. Larger players frequently acquire niche technology providers to strengthen portfolios in filtration, chemical treatment, and digital water solutions. These deals often enhance vertical integration and expand service offerings to industrial and municipal customers. M&A also helps companies enter new regions and gain a competitive edge.

Regulations have a strong influence on the global landscape, shaping product standards and compliance requirements. Governments across regions enforce strict norms for drinking water safety, wastewater discharge, and industrial effluent treatment. These policies push companies to adopt advanced treatment methods and maintain sustainable practices. As regulations tighten, compliance becomes a key driver of technology adoption and market growth.

Drivers, Opportunities & Restraints

The water treatment systems market is driven by rising water scarcity, industrial expansion, and increasing urban population. Growing awareness of waterborne diseases is pushing the adoption of safe drinking water solutions. Technological advancements in filtration, desalination, and wastewater reuse are also fueling growth. In addition, government initiatives and infrastructure investments support widespread system deployment.

Opportunities exist in the development of smart and energy-efficient treatment systems to meet sustainability goals. Expanding demand in emerging economies, especially in the Asia-Pacific and the Middle East, presents significant growth potential. The adoption of digital monitoring and IoT-enabled systems is creating new service models. Furthermore, rising focus on PFAS removal and advanced contaminant treatment is opening specialized market niches.

High installation and maintenance costs remain a key restraint, particularly for advanced treatment technologies. Limited awareness in rural areas reduces adoption in certain regions. Technical challenges such as sludge management and energy consumption also hinder system efficiency. Moreover, fragmented regulatory frameworks across countries add complexity for manufacturers and operators.

Installation Insights

The Point-of-Use (POU) water treatment systems segment has dominated the market, accounting for 75.8% share in 2024, due to their affordability, ease of installation, and widespread household adoption. They provide direct solutions for drinking and cooking needs, making them highly popular in residential settings. Increasing concerns about tap water safety and convenience of compact units further boost their demand. Their strong presence across both developed and emerging economies secures their leading position.

Point-of-Entry systems are witnessing steady growth as consumers and industries seek whole-building water purification. These systems treat water at the entry point, ensuring consistent quality for multiple uses, including bathing and cleaning. Rising adoption in commercial spaces, hospitals, and industrial facilities supports their expansion. Growing preference for comprehensive solutions over localized treatment is driving the segment’s upward trajectory.

Technology Insights

Reverse Osmosis systems have exhibited dominance in terms of technology, contributing 28.1% share in 2024, largely attributed to their high efficiency in removing dissolved salts, heavy metals, and contaminants. They are widely adopted in both residential and industrial applications due to their reliability. The growing need for safe drinking water in urban areas further strengthens their demand. Their proven performance and scalability make them the leading technology segment.

Filtration methods are the fastest-growing technology segment, driven by their cost-effectiveness and ease of maintenance. These systems are preferred for removing sediments, chlorine, and microbial impurities without requiring high energy input. Rising demand for portable and household-friendly solutions is fueling their adoption. Continuous innovation in advanced membrane and carbon filter technologies is further accelerating their growth.

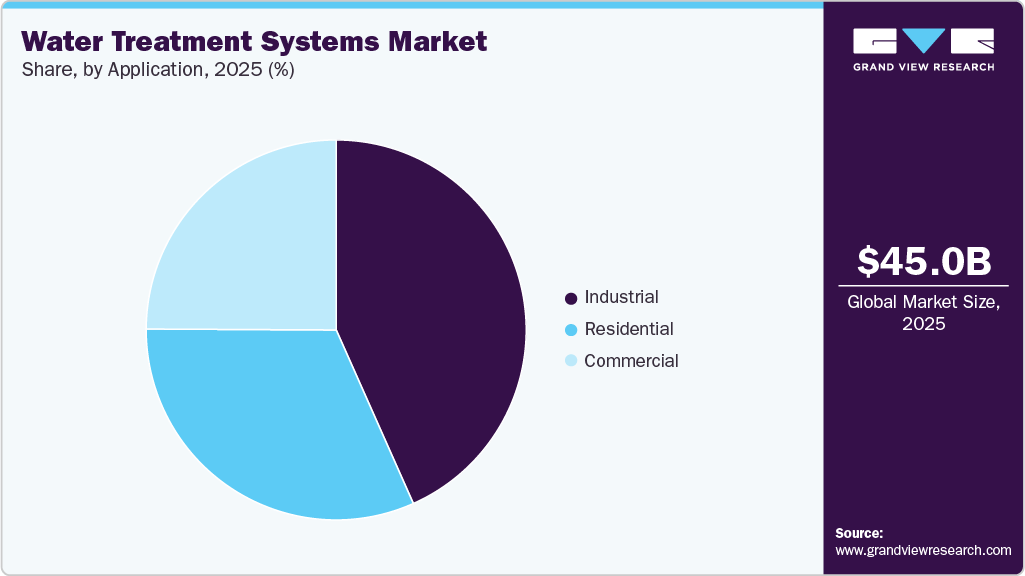

Application Insights

The industrial sector dominated the market and accounted for a 43.3% share in 2024, due to its high demand for large-scale purification and wastewater management. Industries such as power, chemicals, pharmaceuticals, and food processing rely heavily on advanced treatment systems. Strict discharge regulations and the need for process water quality drive significant adoption. This dependence on continuous and efficient treatment solutions secures the sector’s leading share.

The commercial sector is the fastest-growing application segment as offices, hospitals, hotels, and educational institutions expand their water treatment needs. Rising health awareness and regulatory requirements for safe water in public facilities are fueling this growth. Demand for centralized purification and point-of-entry systems is particularly strong in urban regions. Increasing investments in infrastructure and service industries further accelerate market expansion.

Regional Insights

North America water treatment systems industry is expected to grow at a robust CAGR of 7.7% during the forecast period, driven by strict regulatory standards for water quality and wastewater discharge. Rising concerns about contaminants such as PFAS and lead in drinking water boost the adoption of advanced systems. The region also benefits from high consumer awareness and technological innovation. Increasing investments in infrastructure modernization further support market expansion.

U.S. Water Treatment Systems Market Trends

The U.S. water treatment systems industry dominates the North America market, mainly attributed to strict regulatory frameworks and advanced infrastructure. Rising concerns over contaminants such as PFAS, lead, and microplastics have increased demand for purification technologies. Strong adoption is seen across municipal, industrial, and residential sectors. Continuous investment in modernization projects further strengthens the country’s leading position.

The water treatment systems market in Mexico is experiencing strong growth due to rapid urbanization and industrial development. Limited access to safe drinking water in several regions is pushing demand for household and municipal solutions. Government programs to improve sanitation and wastewater treatment are accelerating adoption. Expanding commercial facilities also contribute to the country’s rising market share.

Europe Water Treatment Systems Market Trends

The Europe water treatment systems industry is growing on the back of stringent environmental directives and sustainability initiatives promoting water reuse. Advanced industrial sectors, coupled with strong regulatory compliance, encourage the adoption of cutting-edge treatment technologies. Rising demand for decentralized and energy-efficient systems also supports growth. Furthermore, government-backed water resilience strategies contribute to the regional market’s expansion.

The UK water treatment systems marketspearheads the European market due to strict environmental regulations and strong compliance requirements. High adoption of advanced technologies in municipal and industrial sectors drives demand. Public awareness regarding water safety and sustainability further supports growth. Continuous government investment in infrastructure modernization maintains the UK’s leading position.

The water treatment systems market in Italy is the fastest-growing market in Europe, driven by increasing industrial activity and urban population expansion. Rising focus on wastewater treatment and water reuse projects boosts system adoption. Investments in energy-efficient and smart water technologies are accelerating growth. The combination of regulatory support and infrastructure development fuels the country’s rapid market expansion.

Asia Pacific Water Treatment Systems Market Trends

The Asia Pacific water treatment systems industry has dominated the global market, capturing 36.3% share in 2024, supported by rapid urbanization, industrial expansion, and rising water scarcity. Countries such as China and India are investing heavily in municipal and industrial treatment infrastructure. Growing awareness about safe drinking water is further driving household system adoption. Strong government initiatives and a large population base secure the region’s leading position.

The water treatment systems market in China dominates the Asia Pacific market due to rapid industrialization, urbanization, and rising water pollution levels. Strong government initiatives for water safety, wastewater treatment, and desalination support widespread adoption. Large-scale infrastructure projects and investments in advanced treatment technologies further drive growth. The country’s substantial population and industrial base secure its leading position in the region.

India water treatment systems marketis witnessing strong market growth driven by increasing urban population and industrial expansion. Rising concerns over safe drinking water and waterborne diseases fuel residential and municipal adoption. Government programs focused on sanitation, water recycling, and wastewater treatment are accelerating deployment. Expanding commercial and industrial infrastructure further contributes to the country’s growing market share.

Middle East & Africa Water Treatment Systems Market Trends

The Middle East & Africa water treatment systems industry is growing due to acute water scarcity and dependence on desalination technologies. Investments in large-scale infrastructure projects, particularly in Gulf countries, are propelling the adoption. Rising population and urbanization are further increasing pressure on limited water resources. Government initiatives for sustainable water management are supporting market expansion across the region.

The water treatment systems market in Saudi Arabia spearheads the regional market due to severe water scarcity and high reliance on desalination technologies. Large-scale government investments in municipal and industrial water infrastructure drive market demand. Advanced treatment solutions are widely adopted to ensure safe drinking water and support industrial processes. The country’s strategic focus on sustainable water management secures its leading position in the region.

Latin America Water Treatment Systems Market Trends

The Latin America water treatment systems industry shows rising growth, fueled by increasing urban population and industrial development. Countries such as Brazil and Argentina are investing in wastewater treatment to address pollution challenges. Limited access to safe drinking water in rural areas also drives demand for affordable purification systems. Expanding infrastructure projects are creating opportunities across municipal and commercial segments.

The water treatment systems market in Brazil dominates the regional landscape in the wake of rapid urbanization and expanding industrial activities. Government initiatives to improve sanitation and wastewater treatment drive widespread adoption. Rising awareness about safe drinking water further boosts residential and commercial system deployment. Large infrastructure projects and investments in advanced treatment technologies strengthen the country’s leading market position.

Key Water Treatment Systems Company Insights

Some of the key players operating in the market include Veolia, Honeywell International Inc., ACWA POWER

-

Veolia is a key player in environmental solutions with a strong operational presence in the global water treatment sector. The company is involved in large-scale desalination projects, including the energy-efficient Hassyan RO plant in Dubai and the Az-Zour project in Germany. In the region, Veolia focuses on advanced membrane technologies, wastewater reuse, and smart water network management. It also partners with local governments to integrate renewable energy into water infrastructure. Veolia’s Global projects are often designed to address extreme water scarcity while reducing operational energy costs.

-

Honeywell International Inc. plays a key role in the Global water treatment market through its advanced automation, control, and monitoring systems. The company provides real-time water quality analytics, process optimization tools, and IoT-enabled solutions for desalination and wastewater facilities. Its technologies help improve efficiency, reduce energy consumption, and ensure compliance with regulatory standards. Honeywell collaborates with regional utilities and industrial players to implement smart water management frameworks. In the Global, its solutions are widely used in oil & gas, municipal, and industrial water operations.

Key Water Treatment Systems Companies:

The following are the leading companies in the water treatment systems market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- 3M

- Honeywell International Inc.

- ACWA POWER

- DuPont

- Pentair plc

- Pure Aqua, Inc.

- Xylem Inc.

- Doosan Corporation.

- ACCIONA

- Panasonic

- BWT Aktiengesellschaft

- Watts Water Technologies Inc.

- EcoWater Systems LLC

- Aquaphor

Recent Developments

-

In May 2025, ACWA Power partnered with Malaysia’s Investment Development Authority and other local entities to explore renewable energy and water projects worth up to USD 10 billion. The plan includes developing up to 12.5 GW of clean energy by 2040, supporting Malaysia’s goal of 70% renewable power by 2050. This move marks ACWA Power’s expansion into Southeast Asia while aiding the country’s energy transition.

-

In March 2025, DuPont Water Solutions launched WAVE PRO, a web-based tool for designing and modeling ultrafiltration systems in water treatment applications. The platform allows users to simulate performance, optimize costs, and manage water balance efficiently. It supports cross-platform access, collaboration, and future integration with reverse osmosis and nanofiltration technologies. WAVE PRO aims to enhance sustainable water management by reducing chemical use and improving operational efficiency.

-

In February 2025, ACWA Power agreed to acquire power and desalination assets in Bahrain and Germany from Engie for $693 million. The deal covers stakes in major facilities, including Az Zour North in Germany and several plants in Bahrain, along with related O&M firms. This move strengthens ACWA Power’s Gulf presence and supports its goal of tripling assets by 2030, pending regulatory approval.

Water Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45,075.0 million

Revenue forecast in 2033

USD 88,023.5 million

Growth Rate

CAGR of 8.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Installation, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Veolia; Honeywell International Inc.; ACWA POWER; DuPont; Pentair plc; Pure Aqua, Inc.; Xylem Inc.; Doosan Corporation.; ACCIONA; Panasonic; 3M; BWT Aktiengesellschaft; Watts Water Technologies Inc.; EcoWater Systems LLC; Aquaphor.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

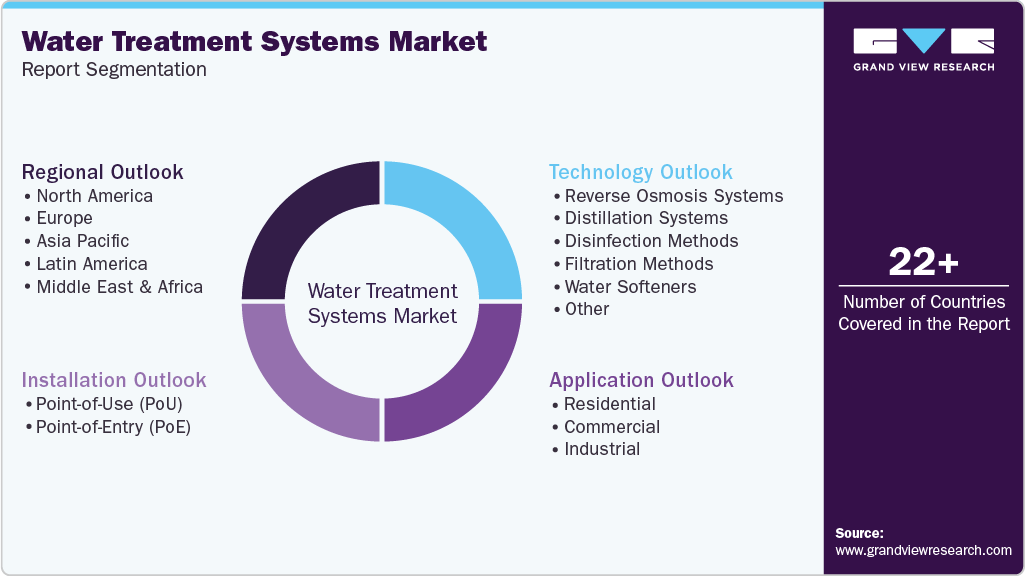

Global Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global water treatment systems market report based on installation,technology, application and region.

-

Installation Outlook (Revenue, USD Million, 2021 - 2033)

-

Point-of-Use (PoU)

-

Point-of-Entry (PoE)

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Reverse Osmosis Systems

-

Distillation Systems

-

Disinfection Methods

-

Filtration Methods

-

Water Softeners

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Others

-

-

Industrial

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global water treatment systems market size was estimated at USD 42,078.0 million in 2024 and is expected to be USD 45,075.0 million in 2025.

b. The global water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 88,023.5 million by 2033.

b. Point-of-Use water treatment systems dominate the global market and accounted for 75.8% share in 2024, due to their affordability, ease of installation, and widespread household adoption. They provide direct solutions for drinking and cooking needs, making them highly popular in residential settings. Increasing concerns about tap water safety and convenience of compact units further boost their demand.

b. Some of the key players operating in the water treatment systems market include Veolia; Honeywell International Inc.; ACWA POWER; DuPont; Pentair plc; Pure Aqua, Inc.; Xylem Inc..; Doosan Corporation.; ACCIONA; Panasonic; 3M; BWT Aktiengesellschaft; Watts Water Technologies Inc.; EcoWater Systems LLC; Aquaphor.

b. The key factors that are driving the water treatment systems market include the growing population, increasing water scarcity, rising industrialization, and government regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.