- Home

- »

- Water & Sludge Treatment

- »

-

Water Recycle & Reuse Market Size, Industry Report, 2030GVR Report cover

![Water Recycle & Reuse Market Size, Share & Trends Report]()

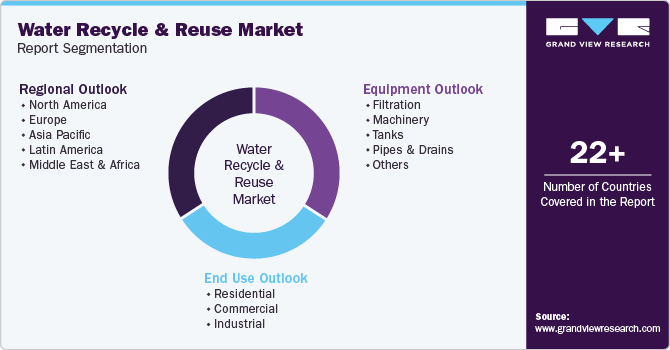

Water Recycle & Reuse Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Filtration, Machinery, Tanks, Pipes & Drains), By End Use (Residential, Commercial, Industrial), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-362-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Recycle & Reuse Market Summary

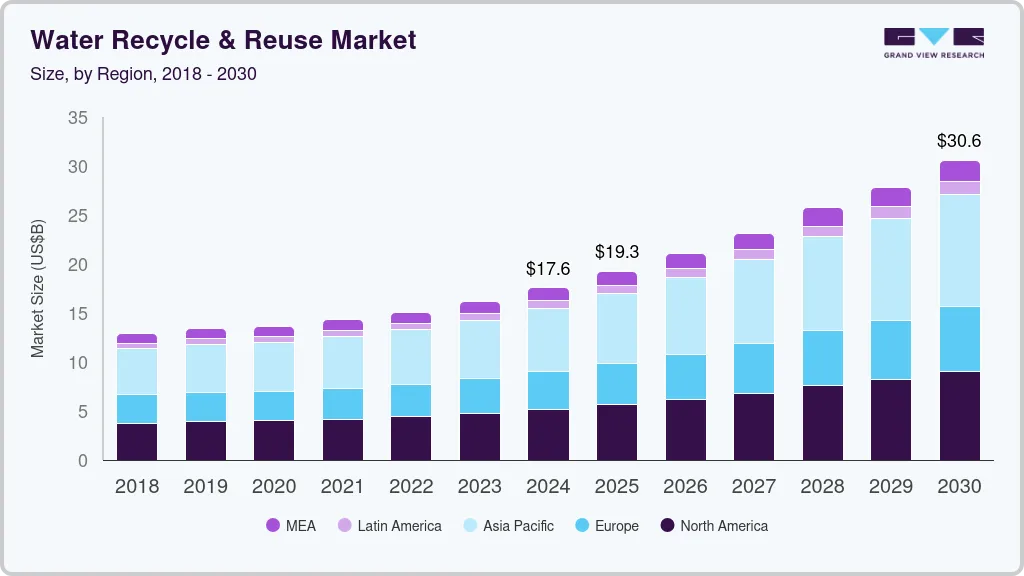

The global water recycle & reuse market size was estimated at USD 17,568.4 million in 2024 and is projected to reach USD 30,562.9 million by 2030, growing at a CAGR of 9.7% from 2025 to 2030. The increasing scarcity of freshwater resources, rising environmental awareness, and stringent regulations on wastewater discharge are driving the demand for water recycling and reuse solutions.

Key Market Trends & Insights

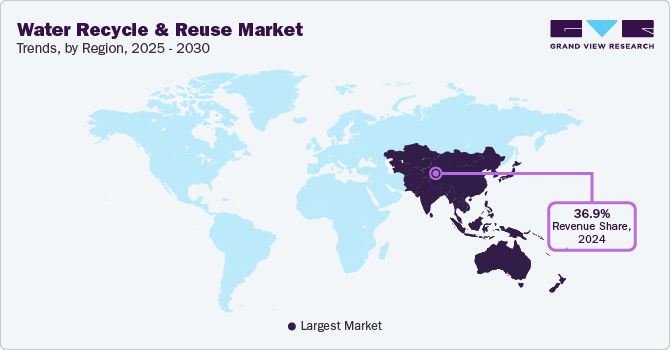

- Asia Pacific water recycle & reuse industry dominated and accounted for 36.9% of the global market share in 2024.

- The water recycle & reuse industry in India is expected to grow at a CAGR of 10.6% from 2025 to 2030.

- In terms of end use, the industrial end use segment led the market, accounting for 48.0% of the global revenue share in 2024.

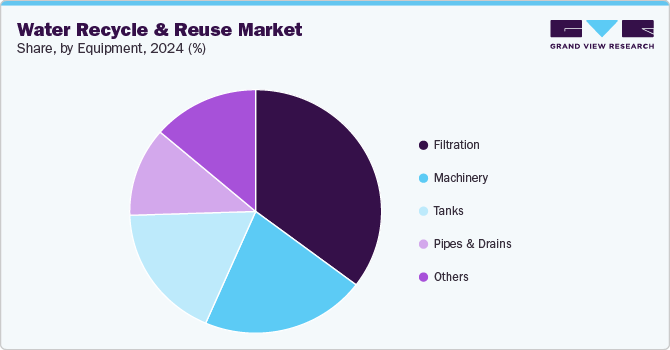

- In terms of equipment, the filtration segment led the market, accounting for 35.3% of the global revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17,568.4 Million

- 2030 Projected Market Size: USD 30,562.9 Million

- CAGR (2025-2030): 9.7%

- Asia Pacific: Largest market in 2024

Moreover, water recycling and reuse involve the treatment of wastewater to make it suitable for various non-potable and potable applications. The process helps in conserving water resources, reducing pollution, and promoting sustainable water management practices.

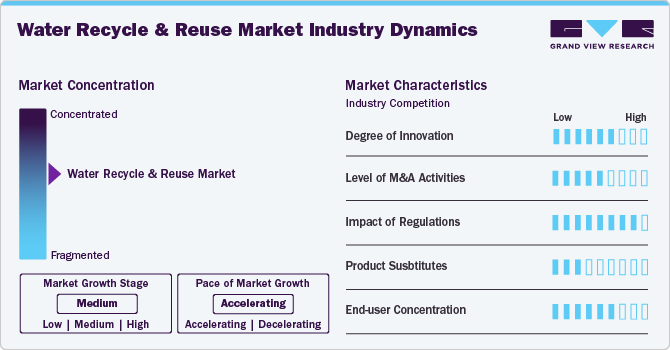

Market Concentration & Characteristics

The water recycle and reuse industry displays a moderately fragmented competitive landscape, featuring a mix of established global players and emerging regional companies. Leading firms such as Veolia, SUEZ, Xylem, Pentair, and A. O. Smith maintain strong market positions with extensive product portfolios and global operations. Simultaneously, regional and local players play a significant role by addressing specific regional needs and complying with local environmental regulations and water management standards.

Market growth is primarily driven by increasing water scarcity, the rising demand for sustainable water management solutions, and stricter government regulations aimed at promoting water conservation and reducing environmental impact. Governments and municipalities are increasingly mandating the implementation of water recycling and reuse systems across industries and urban centers, fostering demand for advanced water treatment technologies and infrastructure development.

Technological advancements are pivotal in shaping the water recycle and reuse industry. Innovations such as membrane filtration, reverse osmosis, UV disinfection, and smart water management systems are enhancing water quality, improving efficiency, and lowering operational costs. These technologies help industries and municipalities optimize water use, reduce waste, and meet regulatory requirements while promoting sustainability.

Regionally, the Asia-Pacific region holds a significant share of the water recycle and reuse industry, driven by rapid industrialization, urbanization, and water scarcity issues in countries such as China, India, and Southeast Asia. Europe follows with a focus on sustainability and water conservation initiatives, while North America also contributes strongly, supported by governmental policies encouraging water reuse and the growing focus on water stewardship.

Drivers, Opportunities & Restraints

The water recycle and reuse industry is driven by several factors, including the increasing water scarcity and the need for sustainable water management practices, stringent environmental regulations, and the growing demand for treated water in industrial and agricultural applications. The rising awareness about the benefits of water recycling and the implementation of water reuse policies by governments are also contributing to market growth.

According to the United Nations, at least half of the world population, around 4 billion people, deal with water shortages for one month of the year. By the year 2025, around 1.8 billion people are expected to experience severe water shortages and deal with absolute water scarcity. Due to the rising severity pertaining to water scarcity, recycling activities and reuse of the treated water are likely to gain momentum across various end use sectors such as industrial, commercial, and residential.

Moreover, advancements in water treatment technologies, such as membrane filtration and advanced oxidation processes, are providing significant growth opportunities. The growing investments in water infrastructure and the increasing adoption of decentralized water treatment systems are also driving the market growth.

End Use Insights

The industrial end use segment led the market, accounting for 48.0% of the global revenue share in 2024. The increasing adoption of water recycling and reuse solutions in various industries, such as power generation, oil & gas, chemicals, and pharmaceuticals, is driving the market demand. Moreover, industries are focusing on reducing their water footprint and complying with environmental regulations, which is boosting the adoption of water recycling and reuse systems.

The commercial sector, including hospitality, healthcare, and education, is increasingly adopting water recycle & reuse to ensure operational efficiency and reduce costs.Increasing adoption of water recycling systems in buildings, hotels, and residential complexes to reduce water consumption and promote sustainability is likely to boost the market growth over the forecast period.

Equipment Insights

The filtration segment led the market, accounting for 35.3% of the global revenue share in 2024. Filtration technologies, such as reverse osmosis, ultrafiltration, and nanofiltration, are widely used in water recycling and reuse due to their high efficiency and ability to remove a wide range of contaminants. The increasing adoption of filtration technologies in industrial and municipal water treatment applications is driving the demand in this segment.

Tackling rising water scarcity and shortages, the demand for water storage solutions is also rapidly increasing for various commercial and residential applications, driving the demand for the tank equipment segment. The treated and reclaimed water is reused mostly for non-potable applications, including irrigation, sanitation purposes, firefighting, car wash, etc.

Regional Insights

The water recycle & reuse industry in North America is being shaped by increasing concerns over water scarcity and environmental sustainability. Industries and municipalities are focusing on advanced treatment technologies to improve water conservation and reduce dependency on freshwater sources. Supportive regulatory frameworks, coupled with growing public awareness, are encouraging the adoption of decentralized and smart water reuse systems.

U.S. Water Recycle & Reuse Market Trends

The water recycle & reuse industry in the U.S. is expected to grow at a CAGR of 9.6% from 2025 to 2030. The market is driven by proactive state-level initiatives and stringent environmental regulations aimed at promoting sustainable water use. Leading states are implementing innovative policies that support industrial and municipal water recycling, while technology providers are advancing solutions in membrane filtration and smart monitoring to optimize usage.

The water recycle & reuse industry in Canada is expected to grow at a CAGR of 10.9% from 2025 to 2030. Canada’s market for water recycle and reuse is growing steadily, supported by environmental policies and urban development pressures. Emphasis is placed on sustainable water practices across industries, and municipalities are investing in infrastructure that integrates advanced treatment solutions. The focus is also on ensuring long-term water security, particularly in regions vulnerable to seasonal water stress.

Europe Water Recycle & Reuse Market Trends

The water recycle & reuse industry in Europe is driven by strong regulatory standards, circular economy goals, and climate resilience initiatives, as the region is at the forefront of water reuse. The region is adopting advanced treatment technologies to support water reuse in agriculture, industry, and urban applications. Sustainability and compliance with EU directives are key priorities, encouraging innovation and cross-border collaboration.

Germany's water recycle & reuse industryis driven by rising technological innovation and integration of smart monitoring systems to ensure optimal water quality and minimal environmental impact. Urban areas are also focusing on stormwater reuse and decentralized water management.

The UK water recycle & reuse industry is driven by rising adopting of water reuse practices in response to climate variability and growing water demand in urban centers. The market is focused on infrastructure upgrades and the use of treated wastewater in non-potable applications such as agriculture and landscaping. Sustainability policies and public engagement campaigns are supporting wider acceptance and implementation.

Asia Pacific Water Recycle & Reuse Market Trends

Asia Pacific water recycle & reuse industry dominated and accounted for 36.9% of the global market share in 2024. The region is witnessing rapid growth in the water reuse market due to urbanization, industrial expansion, and mounting water scarcity. Governments across the region are investing in water infrastructure and encouraging industries to adopt closed-loop water systems. Technological adoption is accelerating, with a focus on cost-effective and scalable solutions tailored to diverse local needs.

China water recycle & reuse industryheld a significant share in the Asia Pacific region. China is prioritizing water reuse as part of its broader environmental and resource management strategy. Industrial sectors are key adopters, and the government supports infrastructure projects that enable large-scale wastewater treatment and recycling. Urban centers are increasingly adopting reclaimed water for landscaping, cleaning, and industrial cooling purposes.

The water recycle & reuse industry in India is expected to grow at a CAGR of 10.6% from 2025 to 2030. India’s market for water recycle & reuse is gaining momentum amid rising demand and shrinking freshwater reserves. Both public and private sectors are investing in water recycling systems, especially in urban areas and water-intensive industries. Policy initiatives and smart city programs are fostering growth, with an emphasis on low-cost, high-impact technologies for widespread implementation.

Middle East & Africa Water Recycle & Reuse Market Trends

The Middle East & Africa water recycle & reuse industry is projected to grow over the forecast period. The Middle East & Africa region is focusing heavily on water recycling due to acute water shortages and arid climate conditions. Governments are investing in large-scale desalination and wastewater reuse projects to ensure long-term water security. The market is also expanding in urban centers through integrated water resource management and sustainable development goals.

Saudi Arabia water recycle & reuse industry is anticipated to grow over the forecast period. Saudi Arabia has made water reuse a central pillar of its national water strategy. Driven by extreme water scarcity, the country is deploying advanced treatment technologies and building infrastructure to recycle wastewater for agricultural, industrial, and municipal applications. Policy mandates and investment in smart water systems are accelerating market growth.

Latin America Water Recycle & Reuse Market Trends

Latin America water recycle & reuse industry is projected to grow over the forecast period. Latin America is gradually embracing water reuse as a strategic response to water stress and urbanization. The market is being shaped by initiatives to modernize water infrastructure and reduce environmental pollution. Regional governments are promoting treated wastewater use in agriculture and industry, while international collaboration is helping build technical capacity.

Brazil water recycle & reuse industry is projected to grow over the forecast period. In Brazil, water reuse is emerging as a critical solution to address water scarcity, especially in densely populated and drought-prone regions. Industrial zones and municipal authorities are beginning to implement advanced treatment systems for non-potable applications. Regulatory development and growing environmental awareness are driving gradual but steady progress.

Key Water Recycle & Reuse Company Insights

Some of the key players operating in the market include Veolia, Fluence Corporation Limited, Kubota Corporation, Siemens, among others.

-

Veolia is a leading provider of water recycling and reuse solutions, offering a wide range of technologies and services for various applications. The company’s focus on innovation, efficiency, and sustainability has solidified its position in the market.

-

Siemens Water Technologies specializes in providing advanced water treatment solutions for industrial and municipal applications. The company’s products are recognized for their durability, efficiency, and advanced technology.

Dow Corporate, Evoqua Technologies & Solutions, Hitachi Ltd., Membracon, Genesis Water Technologies Inc., are some of the emerging market participants in the water recycle & reuse industry.

-

Hitachi Ltd. is known for its advanced water treatment technologies and high-quality products. The company offers a range of solutions that cater to the needs of different industries, ensuring reliable and efficient water recycling operations.

-

Dow Corporate, Dow Water & Process Solutions division, is a key player in the market, offering a comprehensive range of water treatment technologies, including reverse osmosis and ultrafiltration systems. The company’s focus on quality, innovation, and customer-centric solutions has strengthened its market position.

Key Water Recycle And Reuse Companies:

The following are the leading companies in the water recycle & reuse market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- Evoqua Technologies & Solutions

- Fluence Corporation Limited

- Dow Corporate

- Hitachi Ltd.

- Kubota Corporation

- Siemens

- Alfa Laval

- Hydraloop

- Membracon

- Toshiba Infrastructure Systems & Solutions Corporation

- Genesis Water Technologies Inc.

- NEWater China

Recent Developments

-

In March 2025, El Paso Water broke ground on the Pure Water Center in Texas, marking the nation's first direct-to-distribution potable reuse facility. The project is set to be built by a joint venture between PCL and Sundt Construction and will treat secondary effluent from the Roberto R. Bustamante Wastewater Treatment Plant to produce up to 10 million gallons of high-quality purified water per day. With construction now underway, the facility is expected to be operational by 2028.

-

In April 2023, Hydraloop launched water recycling systems for residential purposes, which recycle water from baths, showers, and laundry activities. The new system enables the reuse of water for flushing toilets and irrigation of gardens and landscaping.

-

In March 2022, WOTA Corp. and Kao entered into a partnership in the water and sanitation field. This partnership is expected to create new opportunities in the market.

Water Recycle & Reuse Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19,255.6 million

Revenue forecast in 2030

USD 30,562.9 million

Growth Rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Veolia; Evoqua Technologies & Solutions; Fluence Corporation Limited; Dow Chemical Company; Hitachi Ltd.; Kubota Corporation; Siemens; Alfa Laval; Hydraloop; Membracon; Toshiba Infrastructure Systems & Solutions Corporation; Genesis Water Technologies Inc.; NEWater China.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Recycle & Reuse Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water recycle & reuse market report based on equipment, end use, and region:

-

Equipment Outlook (Revenue, USD Million; 2018 - 2030)

-

Filtration

-

Machinery

-

Tanks

-

Pipes & Drains

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global water recycle & reuse market size was estimated at USD 17,568.4 million in 2024 and is expected to reach USD 19,255.6 million in 2025.

b. The global water recycle & reuse market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 30,562.9 million by 2030.

b. The filtration segment led the market, accounting for 35.3% of the global revenue share in 2024. Filtration technologies, such as reverse osmosis, ultrafiltration, and nanofiltration, are widely used in water recycling and reuse due to their high efficiency and ability to remove a wide range of contaminants.

b. Some of the key players operating in the water recycle & reuse market include Veolia, Evoqua Technologies & Solutions, Fluence Corporation Limited, Dow Corporate, Hitachi Ltd., Kubota Corporation, Siemens, Alfa Laval, Hydraloop, Membracon, Toshiba Infrastructure Systems & Solutions Corporation, Genesis Water Technologies Inc., NEWater China

b. The demand for water recycle & reuse market is attributed to the increasing scarcity of water resources and rising population coupled with growing industrialization

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.