- Home

- »

- Advanced Interior Materials

- »

-

Water Heater Market Size & Share, Industry Report, 2033GVR Report cover

![Water Heater Market Size, Share & Trends Report]()

Water Heater Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Electric, Gas, Solar), By Application (Residential, Commercial, Industrial), By Technology (Tankless, Hybrid), By Capacity (Below 30 Liters), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-824-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Heater Market Summary

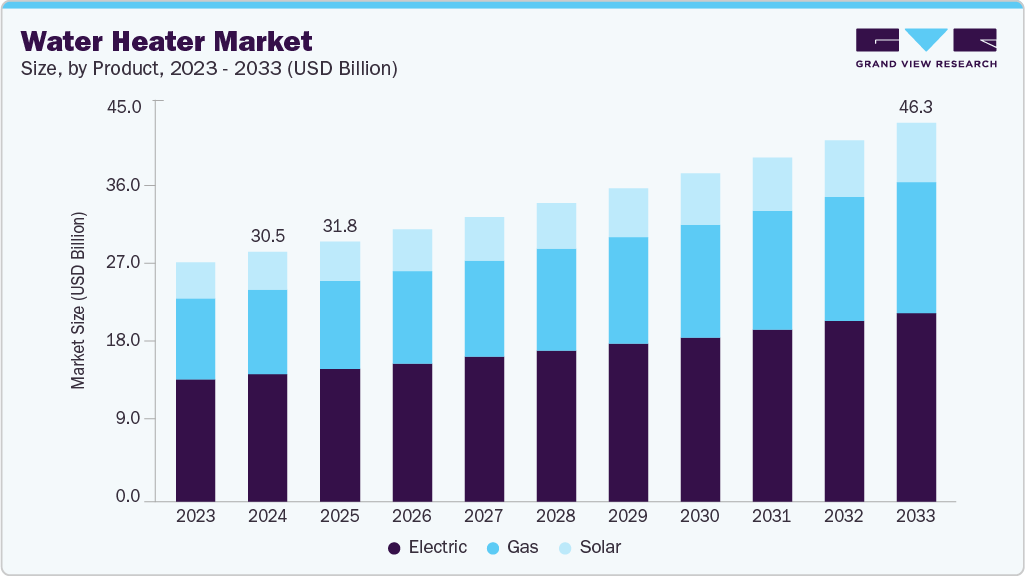

The global water heater market size was estimated at USD 30,485.9 million in 2024 and is projected to reach USD 46,338.2 million by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The growing focus on reducing energy consumption is pushing consumers toward high-efficiency water heaters. Governments worldwide are offering incentives for energy-saving home appliances.

Key Market Trends & Insights

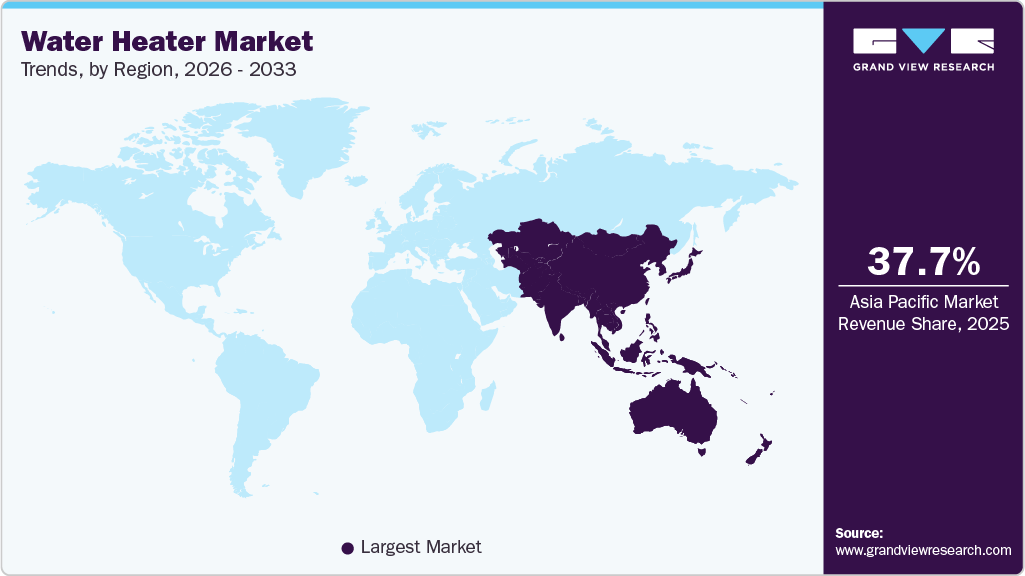

- Asia Pacific dominated the global water heater industry with the largest revenue share of 37.5% in 2024.

- The water heater industry in India is expected to grow at a substantial CAGR of 5.9% from 2025 to 2033.

- By capacity, the above 400 liters segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By product, the solar segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By technology, the hybrid (Heat Pump) segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 30,485.9 Million

- 2033 Projected Market Size: USD 46,338.2 Million

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Advanced technologies like heat pumps and solar water heaters are gaining popularity. This shift is significantly driving market expansion. Rapid urbanization and infrastructure development, especially in the Asia Pacific and Africa, are fueling the demand for water heaters.

Increasing residential and commercial construction projects require reliable hot water solutions. Rising disposable incomes are also boosting consumer spending on modern appliances. These trends are accelerating the growth of the global water heater industry.

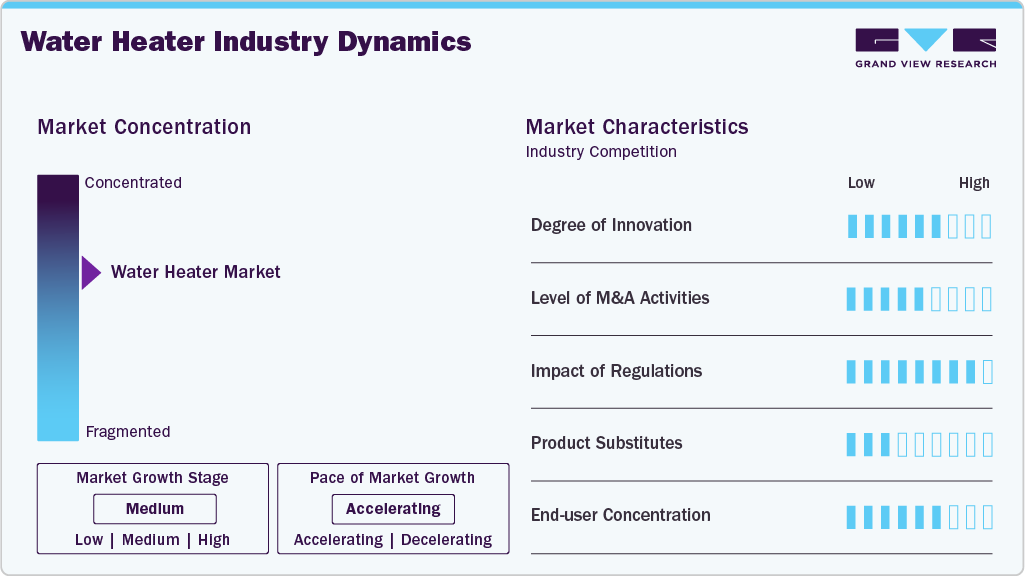

Market Concentration & Characteristics

The global water heater industry is moderately concentrated, with a few major players such as A.O. Smith, Rheem, and Ariston Thermo holding significant shares. These companies benefit from strong distribution networks, brand recognition, and advanced technologies. However, the presence of numerous regional and local manufacturers adds a degree of fragmentation. This mix of global dominance and regional competition shapes the industry landscape.

The water heater industry shows a steady pace of innovation, particularly in energy efficiency and smart features. Manufacturers are integrating IoT, automation, and eco-friendly technologies. Demand for tankless and solar-powered systems is rising due to innovation. These advancements help companies stay competitive and meet changing consumer needs.

Mergers and acquisitions are fairly active as major players aim to expand their global reach. Companies acquire regional firms to strengthen product portfolios and enter emerging markets. This also helps in gaining access to new technologies and distribution channels. Such consolidation enhances competitiveness and market presence.

Government regulations strongly influence product development and market trends. Energy efficiency standards and environmental rules shape design and manufacturing processes. Compliance with safety and emission norms is crucial for global operations. These regulations promote sustainability but also raise development costs for manufacturers.

Drivers, Opportunities & Restraints

The increasing demand for energy-efficient and smart home appliances is a key market driver. Rapid urbanization and rising disposable incomes are boosting residential installations. Government incentives for eco-friendly products further support growth. In addition, the commercial sector’s need for reliable hot water systems is expanding.

Growing adoption of solar and heat pump water heaters presents major opportunities. Emerging economies with expanding housing and infrastructure sectors offer untapped potential. Technological advancements, including IoT integration, are creating new product segments. Rising awareness of sustainability is also opening up green market opportunities.

High initial costs of advanced water heaters may limit adoption, especially in price-sensitive markets. Inconsistent electricity access and infrastructure in some regions pose challenges. Strict regulatory compliance can increase production costs for manufacturers. In addition, market saturation in developed countries may hinder rapid growth.

Capacity Insights

The 30 - 100 liters segment dominated the market with a revenue share of 29.1% in 2024, due to its suitability for residential use. It meets the hot water needs of small to medium-sized households efficiently. These models are compact, affordable, and energy-efficient, driving high consumer demand. Urban housing trends further support this segment’s growth.

Water heaters with a capacity above 400 liters are expected to witness rapid growth over the forecast period, mainly in commercial and industrial applications. Hotels, hospitals, and large facilities require high volume hot water systems. The shift toward centralized heating systems in large buildings supports this demand. Growing infrastructure development accelerates the segment’s expansion.

Product Insights

The electric water heaters segment dominated the market and accounted for a share of 51.0% in 2024 owing to their ease of installation and widespread availability. They are suitable for both residential and commercial applications with varying capacity options. Low upfront costs and consistent performance make them a preferred choice. Expanding urban electrification further boosts their adoption globally.

Solar water heaters are the fastest growing segment driven by rising demand for sustainable solutions. Government incentives and subsidies are encouraging consumers to switch to solar-powered systems. Advancements in solar panel efficiency are improving performance and reliability. Increasing environmental awareness is further accelerating market uptake.

Technology Insights

Storage tank water heaters dominated the market and accounted for a revenue share of 54.5% in 2024, due to their reliability, cost-effectiveness, and widespread availability. These systems store and heat a large volume of water, ensuring a consistent supply for household use. They are easy to install, require minimal maintenance, and are compatible with both electric and gas energy sources. Their strong presence in residential applications, especially in developing countries, sustains their leading position.

Hybrid water heaters are anticipated to be the fastest growing segment over the forecast period, driven by increasing demand for energy-efficient solutions. These systems use heat pump technology combined with traditional electric heating, significantly lowering energy consumption. Consumers are attracted to their long-term savings despite the higher upfront cost. Government incentives for energy-efficient appliances and growing environmental concerns are further accelerating their adoption.

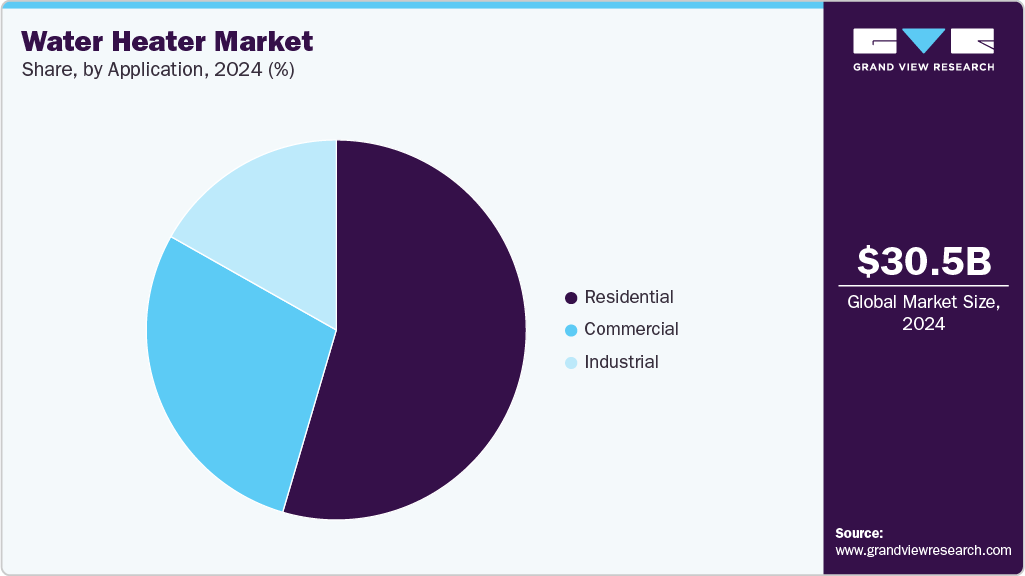

Application Insights

The residential segment accounted for a share of 54.5% in 2024 due to rising urbanization and increasing homeownership. Growing demand for convenient and energy-efficient water heating solutions is boosting installations in households. Compact designs, affordability, and ease of use make water heaters ideal for domestic applications. Expanding housing projects in emerging economies further strengthen this segment’s position.

The industrial segment is anticipated to be the fastest growing segment over the forecast period, driven by rising demand for large-scale hot water systems in sectors such as manufacturing, food processing, and chemicals. Industries require consistent and high-capacity water heating for various processes. Growth in industrial infrastructure and adoption of advanced systems are supporting this surge. In addition, increasing investments in energy-efficient industrial equipment are fueling market expansion.

Regional Insights

North America water heater industry is anticipated to grow at a significant CAGR of 4.4% over the projected period, driven by rising demand for energy-efficient and smart appliances. Government regulations promoting eco-friendly products are influencing consumer choices. Replacement of aging systems and increasing home renovations are boosting sales. Technological advancements and strong distribution networks support market expansion.

U.S. Water Heater Market Trends

The U.S. water heater industry dominated the North American region in 2024 due to high residential demand and widespread adoption of advanced technologies. Replacement of aging water heating systems drives consistent sales. Energy efficiency standards and smart home integration support product upgrades. The strong presence of leading manufacturers further strengthens market leadership.

Canada water heater industry is growing due to rising urbanization and increased focus on energy-efficient appliances. Cold climatic conditions create a steady demand for reliable hot water solutions. Government incentives and green building codes are encouraging the adoption of modern systems. Growth in residential construction also supports market expansion.

Europe Water Heater Market Trends

The water heater industry in Europe is growing steadily, driven by strict energy regulations and sustainability goals. Consumers are increasingly adopting solar and heat pump water heaters. Renovation of old housing stock and green building initiatives are supporting demand. Key players are investing in innovative solutions to meet evolving energy standards.

Germany water heater industry is growing due to a strong emphasis on energy efficiency and sustainability. The government promotes the use of renewable energy systems, including solar and heat pump water heaters. Consumers are increasingly upgrading to eco-friendly models in both new and renovated buildings. Supportive regulations and incentives are driving the adoption of advanced technologies.

The UK water heater industry is expanding as consumers shift toward low-emission and energy-saving water heating solutions. Government policies promoting carbon reduction are influencing product choices. Growth in residential renovations and new housing developments is boosting demand. Increasing awareness of smart and tankless systems is also contributing to market growth.

Asia Pacific Water Heater Market Trends

Asia Pacific water heater industry dominated globally with a revenue share of 37.5% in 2024, fueled by rapid urbanization and population growth. High demand from countries such as China, India, and Japan is driving large-scale installations. Rising disposable income and expanding residential construction further support the market. Both global and local manufacturers have a strong presence in the region.

China water heater industry is growing due to rapid urbanization and rising disposable incomes. The demand for energy-efficient and smart water heating systems is increasing in urban households. Government initiatives promoting green technologies are supporting solar and heat pump adoption. Strong domestic manufacturing and distribution networks drive market expansion.

The water heater industry in India is witnessing strong growth due to rising middle class income and increased electrification in rural areas. The residential sector is the major driver, supported by affordable electric and solar models. Government schemes for sustainable housing further fuel demand. Local and international brands are expanding their presence to tap into this growing market.

Middle East & Africa Water Heater Market Trends

The Middle East & Africa water heater industry is growing, fueled by rising infrastructure development and increasing hot water demand. Residential and commercial construction projects are creating new opportunities. Solar water heaters are gaining popularity in sun-rich regions. Economic development and urbanization are key drivers of regional growth.

Saudi Arabia water heater industry is growing due to expanding residential and commercial construction projects across the country. The push toward sustainable development and high solar irradiance make solar water heaters especially appealing. Rising tourism and hospitality investment are increasing demand in hotels, resorts, and large facilities. Government initiatives supporting green buildings and energy-efficient appliances further drive market growth.

Latin America Water Heater Market Trends

The water heater industry in Latin America is experiencing steady growth due to increasing electrification and improved living standards. Urban expansion and growing awareness of modern appliances are contributing to demand. Governments are promoting energy-efficient technologies through incentives. Brazil and Mexico are key markets leading regional adoption.

Brazil water heater industry is growing steadily due to increasing demand for energy-efficient and cost-effective solutions. Consumers are shifting toward solar and tankless systems to reduce long-term utility expenses. Supportive government regulations and energy standards are promoting the adoption of sustainable technologies. Growth in commercial infrastructure, such as hotels and hospitals, is further driving product demand.

Key Water Heater Company Insights

Some of the key players operating in the market include A.O. Smith, Bosch Thermotechnology Corp., Ariston Holding N.V.

-

A.O. Smith specializes in manufacturing a wide range of residential and commercial water heating systems. The company offers electric, gas, tankless, and solar water heaters tailored to specific regional needs. It has a strong footprint in North America, China, and India, with localized manufacturing facilities. A.O. Smith emphasizes R&D to improve energy efficiency and smart control features. Its distribution network includes plumbing wholesalers, contractors, and retail partners.

-

Bosch Thermotechnology focuses on advanced heating and hot water solutions for residential and commercial sectors. It produces energy-efficient tankless, electric, and condensing water heaters with an emphasis on sustainability. The company integrates digital and IoT-based features to enhance user control and system diagnostics. It has a strong presence across Europe, North America, and Asia. Bosch’s operations are aligned with EU climate goals, driving innovation in green technologies.

Key Water Heater Companies:

The following are the leading companies in the water heater market. These companies collectively hold the largest market share and dictate industry trends.

- A.O. Smith

- Bosch Thermotechnology Corp.

- Ariston Holding N.V.

- Rheem Manufacturing Company.

- Rinnai America Corporation.

- Bradford White Corporation, USA.

- Noritz America Corp

- Whirlpool.

- Westinghouse Electric Corporation.

- Bajaj Electricals India.

- Haier Inc.

- Havells India Ltd.

- Lennox International Inc.

- FERROLI S.p.A

- Transform SR Brands LLC.

Recent Developments

-

In June 2025, LG Electronics acquired Norway-based OSO Group, a specialist in premium stainless-steel water heaters. The move enhances LG’s HVAC portfolio, especially in Europe. OSO’s technology will support LG’s integrated heat pump and water heating solutions. OSO will continue to operate independently under LG’s ownership.

-

In May 2025, Ariston Group and Lennox formed a joint venture to introduce Lennox-branded residential water heaters in North America by 2026. Ariston holds a 50.1% stake, while Lennox owns 49.9%. Product will be sold through Lennox’s dealer network and distributors. Ariston will continue offering its own brands separately.

-

In September 2024, A.O. Smith launched a compact point-of-use electric tankless water heater for light commercial and residential sinks. It requires no venting and includes features like dry-fire protection, leak detection, and scale monitoring. The design helps improve safety and reduce maintenance needs. It's ideal for space-constrained installations.

Water Heater Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31,814.5 million

Revenue forecast in 2033

USD 46,338.2 million

Growth rate

CAGR of 4.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

A.O. Smith; Bosch Thermotechnology Corp.; Ariston Holding N.V.; Rheem Manufacturing Company.; Rinnai America Corporation.; Bradford White Corporation, USA.; Noritz America Corp; Whirlpool.; Westinghouse Electric Corporation.; Bajaj Electricals India.; Haier Inc.; Havells India Ltd.; Lennox International Inc.; FERROLI S.p.A; Transform SR Brands LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Heater Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global water heater market report based on capacity, product, technology, application, and region:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 30 Liters

-

30 - 100 Liters

-

100 - 250 Liters

-

250 - 400 Liters

-

Above 400 Liters

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Solar

-

Gas

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Tankless

-

Storage

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global water heater market size was estimated at USD 30,485.9 million in 2024 and is expected to be USD 31,814.5 million in 2025.

b. The global water heater market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 46,338.2 million by 2033.

b. Storage tank water heaters dominate the market and accounted for 54.5% share in 2024, due to their reliability, cost-effectiveness, and widespread availability. These systems store and heat a large volume of water, ensuring a consistent supply for household use. They are easy to install, require minimal maintenance, and are compatible with both electric and gas energy sources.

b. Some of the key players operating in the water heater market include A.O. Smith; Bosch Thermotechnology Corp.; Ariston Holding N.V.; Rheem Manufacturing Company.; Rinnai America Corporation.; Bradford White Corporation, USA.; Noritz America Corp; Whirlpool.; Westinghouse Electric Corporation.; Bajaj Electricals India.; Haier Inc.; Havells India Ltd.; Lennox International Inc.; FERROLI S.p.A; Transform SR Brands LLC.

b. The growing focus on reducing energy consumption is pushing consumers toward high-efficiency water heaters. Governments worldwide are offering incentives for energy-saving home appliances. Advanced technologies like heat pump and solar water heaters are gaining popularity. This shift is significantly driving market expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.