- Home

- »

- Power Generation & Storage

- »

-

Waste Heat Recovery System Market Size Report, 2030GVR Report cover

![Waste Heat Recovery System Market Size, Share & Trends Report]()

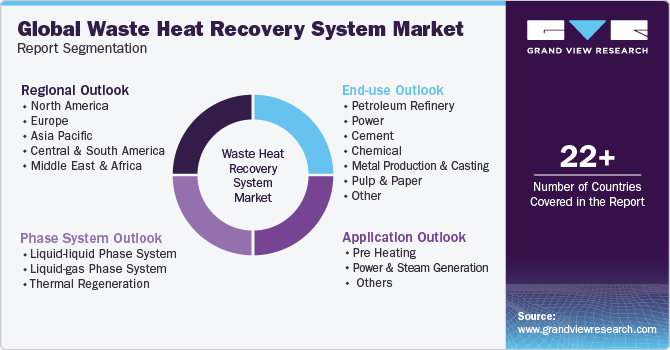

Waste Heat Recovery System Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Pre Heating, Steam & Power Generation), By End-use (Petroleum Refinery, Chemical), By Phase System, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-466-6

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Waste Heat Recovery System Market Summary

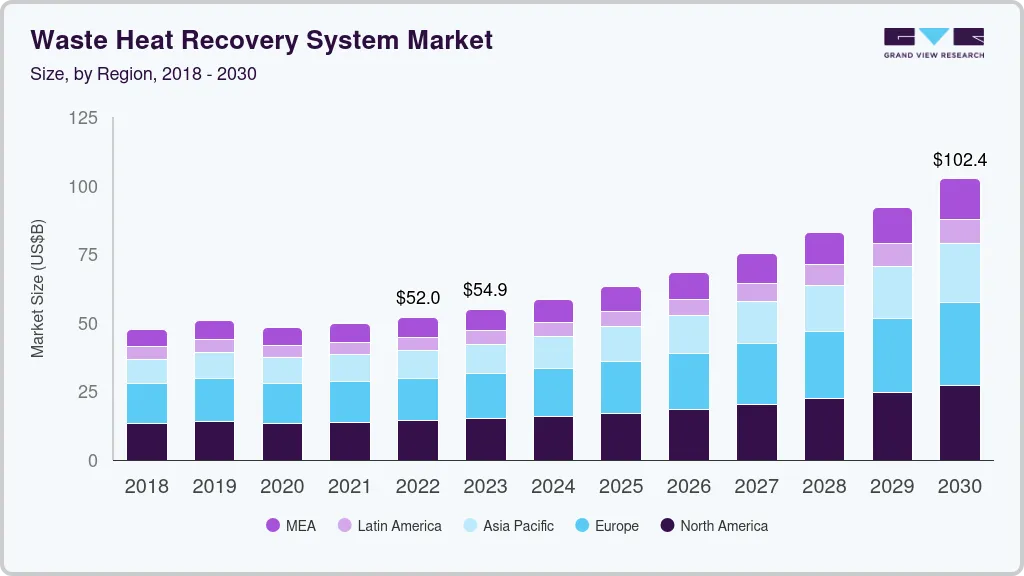

The global waste heat recovery system market size was estimated at USD 54.88 billion in 2023 and is projected to reach USD 102.41 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. Rising environmental concerns have led various countries around the world to take steps to reduce the carbon footprint from the industrial sector and to opt for waste heat recovery systems.

Key Market Trends & Insights

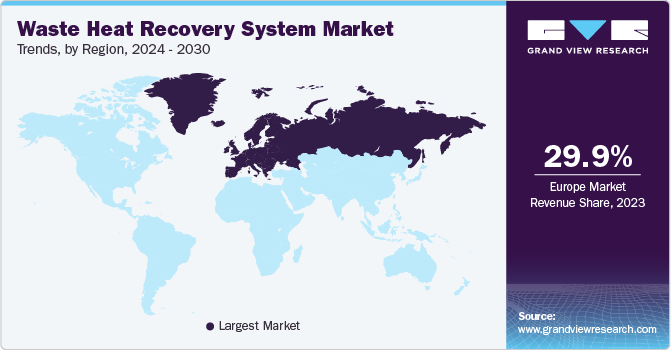

- Europe dominated market and accounted for the largest revenue share of 29.9% in 2023.

- U.S. market is expected to grow at a CAGR of 9.3% from 2024 to 2030.

- In terms of application, power & steam generation segment emerged as the largest one with a market share of 47.1% in 2023.

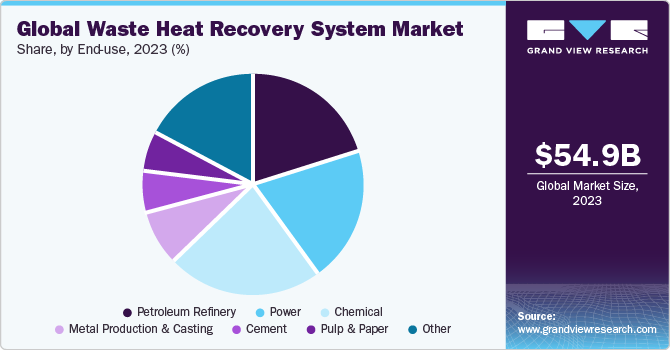

- In terms of end use, petroleum refinery segment emerged as the largest one with a market share of 20.9% in 2023.

- In terms of phase system, Liquid-liquid phase system segment emerged as the largest one with a market share of 40.2% in 2023

Market Size & Forecast

- 2023 Market Size: USD 54.88 Billion

- 2030 Projected Market Size: USD 102.41 Billion

- CAGR (2024-2030): 9.8%

- Europe: Largest market in 2023

Governments of most countries are framing supporting policies and taking financial measures to enhance the pace of deployment of waste heat recovery systems. For instance, in June 2023, a specialized Centre of Excellence, namely, UTPRERAK was established by the Ministry of Power of the Government of India to speed up industrial adoption of clean technologies and increase the participation of the country in the global energy transition. Global efforts to reduce greenhouse gas emissions are fueling demand for energy-efficient solutions. Waste heat recovery systems capture and reuse thermal energy that would otherwise be wasted, significantly lowering a facility's carbon footprint. Advancements in heat exchanger technology are leading to more efficient and compact waste heat recovery systems, making them more viable for a wider range of applications. Integration of sensors and digital controls into waste heat recovery systems allows for real-time monitoring and optimization of performance, further enhancing efficiency and reducing maintenance costs.

However, the market faces some challenges. The upfront cost of installing a waste heat recovery system can be high, which can be a deterrent for some companies. Designing and implementing an effective waste heat recovery system requires careful consideration of factors like heat source temperature, application requirements, and overall plant layout. These factors hinder growth of the market over the forecast period.

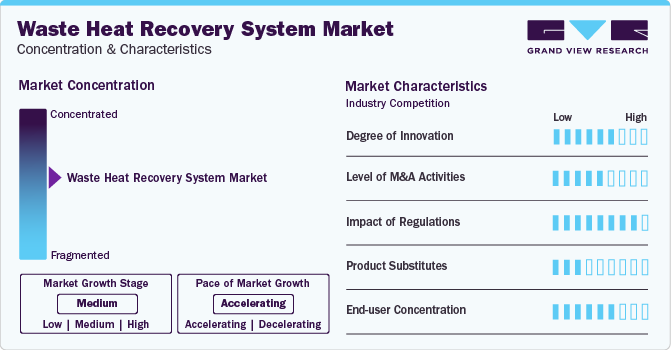

Market Concentration & Characteristics

The market is a dynamic and competitive space with established players and innovative newcomers vying for dominance. Also, the industry is facing fierce competition from established players in various sectors. Leading companies like Siemens Energy,Mitsubishi Power, Ltd., General Electric, ABB, Turboden S.p.A. contribute significantly with their expertise in waste heat recovery systems.

Companies and consortium are increasingly focusing on expansion and collaborations in order to penetrate in the market. For instance, in February 2024, Orcan Energy announced the expansion of its waste-to-heat energy systems manufacturing plant located in Kiel, Germany. The expansion aims to reduce CO2 emissions from cement and other industries.

Application Insights

Power & Steam generation emerged as the largest segment with a market share of 47.1% in 2023 and is expected to witness robust growth over forecast period. Increasing prices of electricity and fuel due to inflation along with ongoing efforts to reduce GHG emissions are expected to boost the adoption of waste heat recovery systems for power and steam generation. According to the Industry Dive update, in June 2023, the price of electricity increased by 14.3% in 2022, due to inflation in the U.S. In addition to this, as per the EIA, the growth in U.S. power generation is primarily attributable to generation from renewable sources. The forecasted share of U.S. renewable energy generation is expected to increase to 24% in 2023 and to 26% by 2024. However, the increasing interest of countries in renewable energy sources opens profitable opportunities for segment growth in the coming years. Moreover, rising demand for onsite power generation and focus on the improvement of plant efficiency are also the key factors driving the segment growth.

Preheating segment is anticipated to grow at the fastest rate over forecast period. Preheating is done in industries for a product or raw material prior to forming, coating, and fitting, welding, or undergoing any industrial process, which requires its application. Products or raw materials are simply placed for a designated time as they are being prepared for the next step in the production process. For instance, metal parts are preheated in a batch or on a conveyor oven prior to powder coating, which provides greater powder thickness.

End-use Insights

Petroleum refinery segment emerged as the largest segment with a market share of 20.9% in 2023 and is expected to register the fastest growth over forecast period. Petroleum refinery is the largest contributor to CO2 emissions worldwide. According to the global inventory research study published in August 2021, CO2 emissions from oil refineries were about 1.3 gigatons (Gt) in 2018, reaching 16.5 Gt between 2020 and 2030. The significant increase in CO2 emissions underscores the need for oil refineries to take immediate and aggressive action to reduce their carbon footprint.

Growing focus of petroleum refineries to conserve waste energy and reduce energy costs is anticipated to drive the market in the coming years. Petroleum refining is an energy-intensive industry and waste-heat recovery systems are essential for the same. In addition, oil & gas companies are taking measures to reduce the carbon footprint of their manufacturing facilities.

Phase System Insights

Liquid-liquid phase system emerged as the largest segment with a market share of 40.2% in 2023 and is expected to register robust growth over forecast period. Rising demand for growing petroleum and power industry across the globe driving the segment growth over the coming years. In the petroleum refining industry, the WHR systems are used for various procedures such as refinement, thermal cracking, and catalytic treatment. The liquid-liquid phase system uses a heat transfer fluid, which offers high reliability of waste heat recovery reboilers and cools the condensers to avoid the usage of water.

Liquid-gas phase system segment is expected to witness the fastest growth rate over the forecast period due to growing demand from chemical industry. The WHR system is essential for increasing energy efficiency in chemical processing industry. The liquid-gas phase products are used in chemical industry to utilize the waste heat and reuse it in the synthesis production of chemicals such as ammonia and nitric acid.

Regional Insights

North America waste heat recovery system market, led by the U.S., Mexico, and Canada, accounted for a significant share 27.30% of the global market in 2023. This growth is attributed to the increasing awareness and commitment to sustainability and energy efficiency. With growing concerns about climate change and the need to reduce greenhouse gas emissions, industries across North America are actively seeking ways to minimize energy wastage, making waste heat recovery systems an attractive option

U.S. Waste Heat Recovery System Market Trends

U.S. market is expected to grow at a CAGR of 9.3% from 2024 to 2030. The market is experiencing steady growth, driven by efficient energy generation methods, which, in turn, is anticipated to increase the deployment of waste heat recovery systems in the country. The upcoming evolution of the industry is expected to be amplified as a result of the investments in several industries such as refineries, heavy metals, paper & pulp, petrochemicals, and chemicals.

Europe Waste Heat Recovery System Market Trends

Europe dominated market and accounted for the largest revenue share of 29.9% in 2023. The European Union (EU) has consistently been a global leader in addressing the challenges associated with climate change. With an ambitious target of becoming the world's first climate-neutral continent by 2050, the EU has been at the forefront of environmental initiatives. However, in 2022, the region faced a significant challenge of combating climate change while navigating a global energy supply crisis. Amid these issues, the emergence of waste heat recovery power generation (WHRPG) systems has gained significant interest, particularly within the energy-intensive cement industry in the region. Rohrdorf, which is located in Bavaria, Southern Germany, is the first region to initiate the adoption of WHRPG systems to address climate change and energy security concerns. Some of the major end-use industries for waste heat recovery systems in Europe are power generation, oil & gas, chemicals, and pulp & paper.

The market in Europe region is expected to witness steady growth over forecast period. Rising population coupled with increasing demand for energy-efficient and clean energy is also expected to propel the market for waste heat recovery systems market in the region. The European region has been very active in the R&D efforts related to clean and energy-efficient power generation. The availability of funding in the European Union for energy conservation and energy efficiency projects has been one of the major factors driving the growth of the region. Some major companies such as Bosch Industriekessel GmbH and EXERGY INTERNATIONAL SRL are operating in the region.

Germany waste heat recovery system market held 20.8% share in the European market in 2023, as it is a key country for waste heat recovery installation in the region. In November 2016, Climate Action Plan 2050 was adopted by the government of Germany. With this, Germany became the first participant of the Paris Agreement to submit its low-greenhouse gas emission development strategy to the United Nations.

Waste heat recovery system market in Spain is anticipated to grow at a CAGR of 11.1%. Spain accounts for the high demand for waste heat recovery systems on account of the growing preference for energy-efficient and on-site power generation from industrial sector. Technological innovations and supportive policies are some of the underlying factors that are expected to fuel product demand in the coming years.

Asia Pacific Waste Heat Recovery System Market Trends

Asia Pacific market is poised for significant growth, exceeding a projected CAGR of over 10.8% between 2024 and 2030. This boom is driven by factors like rising demand of Waste Heat Recovery System in countries such as China, Japan, and India.

China waste heat recovery system market held a dominant share of 43.0% in the Asia Pacific region in 2023. China's refinery capacity in 2023 has potential implications for the Waste Heat Recovery System (WHRS) market in the country. According to the U.S. Energy Information Administration 2022 statistics, there will be a huge expansion in refinery capacity with many major players, such as ShengHong petrochemical group co., LTD, Petroineos, and Zhejiang Petrochemical Corporation (ZPC), expected to expand their refinery capacity during the forecast period. With the expansion of refinery capacity, there will likely be a higher demand for energy-efficient technologies like WHRS.

Waste heat recovery system market in India is anticipated to register a CAGR of 12.6% over forecast period. Growing demand for energy-efficient waste heat recovery systems and deployment of the PAT scheme aimed at reducing harmful emissions are anticipated to have a positive impact on the market in India over the forecast period.

Key Waste Heat Recovery System Company Insights

The market is moderately consolidated with presence of a few medium and large-sized companies. The waste heat recovery system market is a dynamic landscape with established players and innovative startups. Key companies are adopting several organic and inorganic growth strategies, such as new technological development, facility expansion, research & development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Waste Heat Recovery System Companies:

The following are the leading companies in the waste heat recovery system market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Energy

- Mitsubishi Power, Ltd.

- General Electric

- ABB

- Turboden S.p.A.

- Bosch Industriekessel GmbH

- Exergy International Srl

- Forbes Marshall

- IHI Corporation

- Terrapin

Recent Developments

-

In August 2023, Harvest Power Systems, introduced its novel waste heat recovery system within the Hamilton and Greater Toronto Area. The company's clean technology solution, which has been set up and put into service at three Pizza locations, allows restaurants to effectively manage their energy consumption, lower operating expenses, and lower emissions.

-

In September 2023, Solex acquired Econotherm Ltd., a UK-based leader in waste heat recovery technology. With the acquisition, Solex was aimed to be in a better position to assist its clients in lowering the amount of primary energy used to generate industrial goods. The business is an expert in gas, liquid, and solid-to-solid heat exchange.

Waste Heat Recovery System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 58.57 billion

Revenue forecast in 2030

USD 102.41 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, competitive landscape, growth factors and trends

Segments covered

Application, end-use, phase system, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Italy; Spain; Germany; China; Japan; India; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Siemens Energy; Mitsubishi Power, Ltd.; General Electric; ABB; Turboden S.p.A.; Bosch Industriekessel GmbH; Exergy International Srl; Forbes Marshall; IHI Corporation; Terrapin

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waste Heat Recovery System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global waste heat recovery system market report based on end-use, application, phase system, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre Heating

-

Power & Steam Generation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Petroleum Refinery

-

Power

-

Cement

-

Chemical

-

Metal Production & Casting

-

Pulp & Paper

-

Other

-

-

Phase System Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid-liquid Phase System

-

Liquid-gas Phase System

-

Thermal Regeneration

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Based on end-use, petroleum refinery was the dominant segment in 2023, with a share of about 21% in 2023. This is attributable to the significant increase in CO2 emissions underscores the need for oil refineries to take immediate and aggressive action to reduce their carbon footprint.

b. Key factors driving the market growth include stringent emission standards and the growing significance of energy conservation.

b. Some of the key players operating in this industry include Siemens Energy, Mitsubishi Power, Ltd., General Electric, ABB, Turboden S.p.A., Bosch Industriekessel GmbH, Exergy International Srl, Forbes Marshall, IHI Corporation, and Terrapin.

b. The global waste heat recovery system market size was estimated at USD 54.88 billion in 2023 and is expected to reach USD 58.57 billion in 2024.

b. The global waste heat recovery system market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 102.41 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.