- Home

- »

- Communications Infrastructure

- »

-

Virtual Customer Premises Equipment Market Report, 2033GVR Report cover

![Virtual Customer Premises Equipment Market Size, Share & Trends Report]()

Virtual Customer Premises Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution/Tools, Services), By Deployment Type (Cloud-based, On-premise), By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-647-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Customer Premises Equipment Market Summary

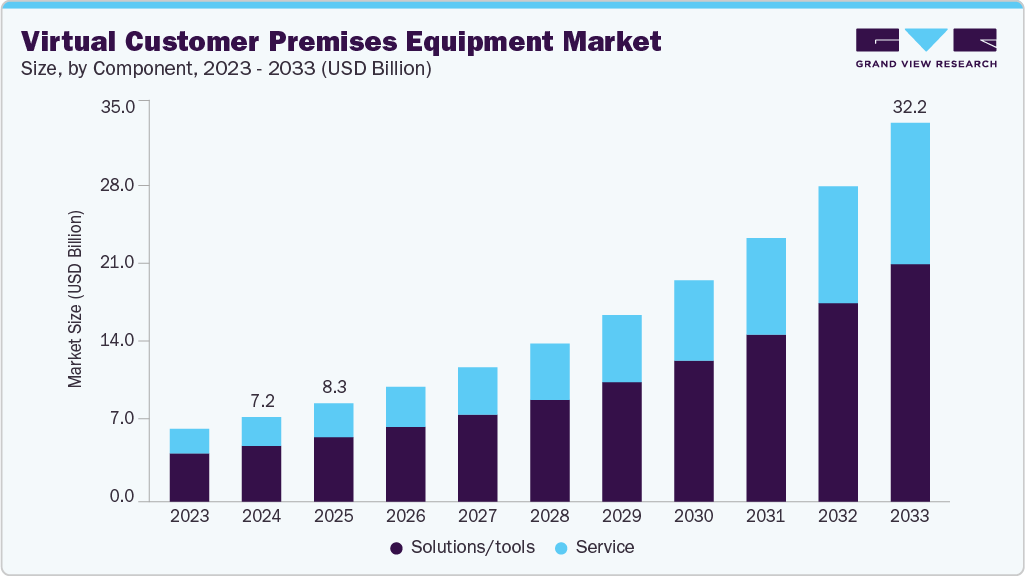

The global virtual customer premises equipment market size was estimated at USD 7.19 billion in 2024 and is projected to reach USD 32.18 billion by 2033, growing at a CAGR of 18.4% from 2025 to 2033. The virtual customer premises equipment (vCPE) market is being driven by the growing demand for flexible, scalable, and cost-efficient network solutions across various industries.

Key Market Trends & Insights

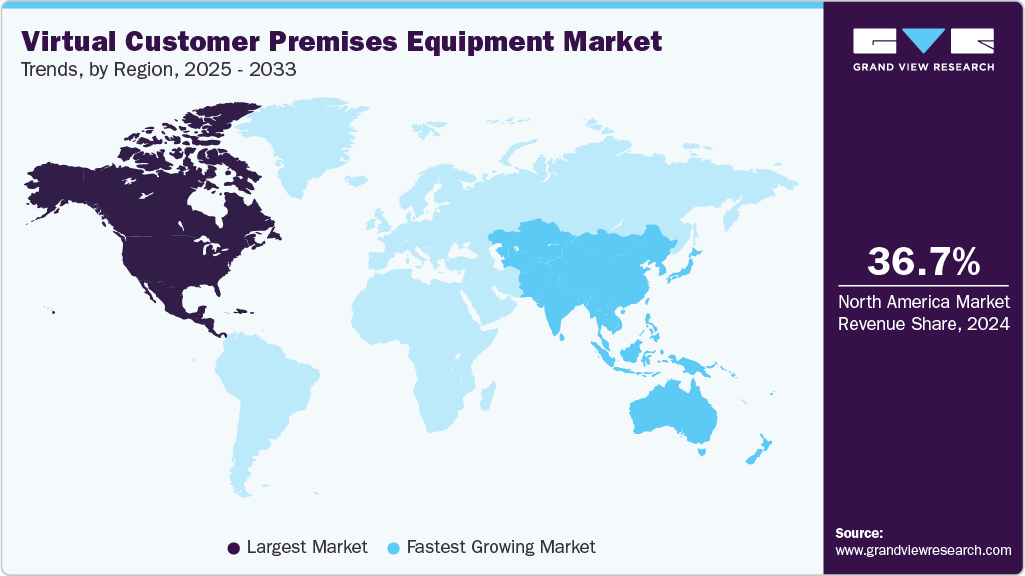

- North America dominated the virtual customer premises equipment industry and accounted for a share of 36.7% in 2024.

- The virtual customer premises equipment industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solutions/tools segment dominated the market in 2024 and accounted for the largest share of 65.9%.

- By deployment type, the cloud-based virtual customer premises equipment segment held the largest market in 2024.

- By enterprise size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.19 Billion

- 2033 Projected Market Size: USD 32.18 Billion

- CAGR (2025-2033): 18.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The need for enhanced IT service mobility and virtual networking infrastructure has been a major driver, as businesses seek to reduce capital expenditure by replacing traditional hardware with software-based solutions. Technological advancements have played a pivotal role in reshaping the vCPE landscape. Key innovations, such as software-defined networking (SDN), edge computing, and AI-driven network orchestration have been increasingly integrated into vCPE platforms to enhance performance and manageability. The shift from proprietary hardware to white-box solutions has been enabled by open standards, thereby fostering vendor interoperability and lowering deployment costs. Furthermore, 5G rollouts have catalyzed the development of more dynamic and responsive vCPE solutions, allowing telecom operators to deliver high-speed and low-latency services at the network edge.

The rise of Software-Defined Wide Area Networking (SD-WAN) is one of the most influential trends driving the vCPE market. Enterprises are increasingly deploying SD-WAN to gain better network agility, centralized control, and cost efficiency, especially for multi-site operations. vCPE enables SD-WAN solutions by virtualizing network functions such as routing, firewalling, and WAN optimization at the edge. This trend is particularly strong among large enterprises and service providers seeking to eliminate the complexity of legacy hardware-based CPE. The ongoing shift from MPLS to internet-based WAN connectivity further boosts this transformation.

The growing demand for network function virtualization (NFV), along with the need for cost-effective and agile network infrastructure, has significantly contributed to the market’s growth. Enterprises and service providers are increasingly shifting towards cloud-based network functions to reduce hardware dependencies and improve scalability. In addition, the rise in remote work and the proliferation of IoT devices have accelerated the adoption of vCPE solutions as businesses seek to enhance network flexibility and streamline service delivery. Thus, the virtual customer premises equipment market is growing rapidly with the adoption of cloud-native network functions and broader NFV frameworks.

Despite strong growth potential, several restraints have hindered the widespread adoption of vCPE solutions. Legacy infrastructure in many enterprises has limited the transition to virtualized environments, while concerns over data security and compliance have slowed down decision-making. The complexity of integrating vCPE with existing network systems, along with the shortage of skilled IT professionals, has posed operational challenges. Moreover, initial deployment costs and the need for robust testing and validation frameworks have deterred smaller organizations from fully embracing virtualized customer-edge solutions.

Component Insights

The solutions/tools segment dominated the market in 2024 and accounted for the largest share of 65.9%. The segment is further bifurcated into virtual routers, virtual switches, security and compliance, infrastructure management and orchestration, and application and controller platforms. These tools replace traditional hardware appliances, allowing network functions to be hosted on standardized servers, reducing hardware dependency, and improving scalability. The growing adoption of Software-Defined Networking (SDN) and NFV technologies is also pushing service providers and enterprises to invest in vCPE solutions that can be easily configured and managed through centralized control planes.

The services segment is expected to witness the fastest CAGR over the forecast period. The service segment is further bifurcated into professional services and managed services. The services segment is experiencing robust growth, driven by the increasing complexity of deploying and managing virtualized network environments. Enterprises transitioning to vCPE typically require professional services, including consulting, implementation, integration, and support, to ensure smooth deployment and optimal performance. Managed services are gaining traction as businesses seek to offload day-to-day network operations to specialized providers. These services ensure reliable performance and security and allow organizations to focus on core business functions.

Deployment Type Insights

The cloud-based virtual customer premises equipment segment held the largest market share in 2024. The cloud-based deployment segment is witnessing rapid growth driven by the global trend of organizations migrating their operations and data to cloud environments. This segment's expansion is primarily attributed to its inherent scalability, flexibility, and cost-effectiveness, which allow enterprises to dynamically adjust network resources in line with evolving business demands. Cloud-based vCPE solutions facilitate rapid service provisioning and remote management, aligning with the increasing adoption of cloud-first policies and digital transformation initiatives.

The on-premise segment is expected to register a moderate CAGR of 14.6% during the forecast period. The segment’s growth is driven by organizations requiring enhanced control, security, and compliance over their network infrastructure. On-premises deployment type is widely used by enterprises operating in highly regulated industries such as healthcare, finance, and government sectors, where data sovereignty and stringent privacy regulations necessitate local control of network functions. On-premise vCPE deployments enable businesses to maintain critical network services within their facilities, thereby reducing latency and ensuring greater reliability for mission-critical applications. Despite the growing preference for cloud solutions, on-premise models are still essential for organizations with legacy infrastructure or those facing connectivity limitations.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. The segment’s growth is due to the increasing complexity and scale of its network infrastructure requirements. The segment’s growth is further driven by the need for advanced, scalable, and secure networking solutions that support digital transformation initiatives, including the adoption of 5G and cloud technologies. Large enterprises benefit from vCPE by enabling centralized management, rapid service provisioning, and enhanced network agility, which are critical for maintaining competitiveness in dynamic markets.

The small and medium enterprises segment is expected to witness the fastest CAGR over the forecast period. The segment’s growth is driven by the demand for cost-effective, flexible, and easy-to-manage network infrastructure. SMEs are leveraging vCPE to overcome the limitations of traditional hardware-based networking, which often involves high upfront costs and complex maintenance. The availability of tailored vCPE offerings that cater to the specific needs of SMEs, such as simplified deployment and remote management capabilities, has facilitated wider acceptance.

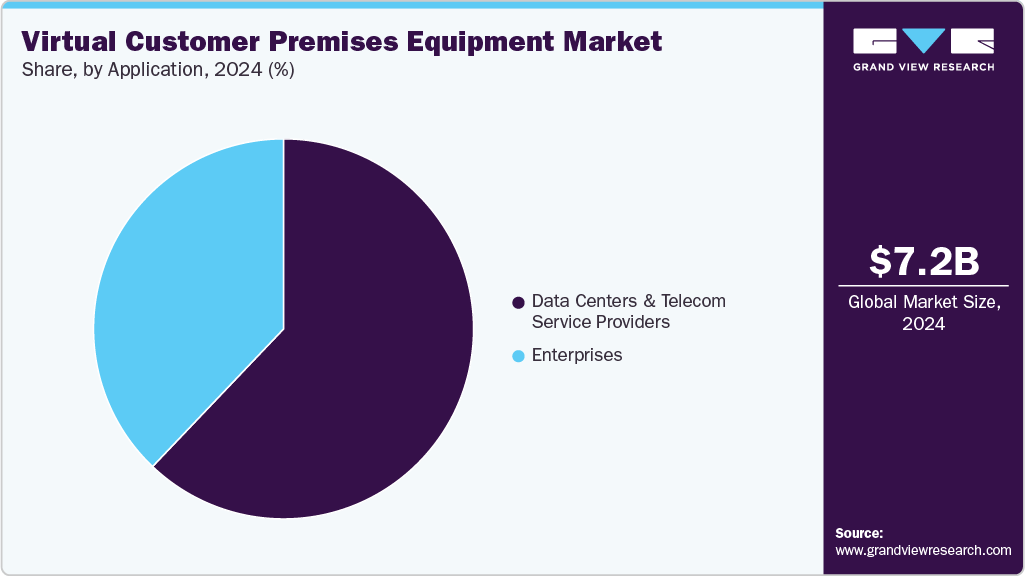

Application Insights

The data centers and telecom service provider segment dominated the market in 2024. The segment’s growth is driven by the increasing need for virtualized network infrastructure that supports rapid service deployment and enhanced network agility. This segment benefits from the ability of vCPE to virtualize network functions such as routing, firewall, and VPN, which reduces hardware dependency and operational complexity. Telecom operators and data centers leverage vCPE to deliver scalable, flexible, and cost-efficient networking services to their enterprise customers, enabling faster provisioning and remote management. The ongoing rollout of 5G networks and the rising demand for cloud and edge computing further accelerate adoption in this segment.

The enterprise segment is expected to witness the fastest CAGR over the forecast period. The enterprise segment is further segmented into BFSI, IT, healthcare, government and public sector, manufacturing, and others. The growth is driven by the need for enhanced branch connectivity, security, and operational flexibility. Enterprises adopt vCPE to streamline network management across multiple locations, reduce hardware costs, and enable rapid deployment of new services. The growing emphasis on digital transformation and cloud-first strategies has increased demand for virtualized networking solutions that can support remote workforces and hybrid IT environments.

Regional Insights

North America virtual customer premises equipment market dominated the global industry and accounted for a share of 36.7% in 2024. The region’s growth is driven by mature telecom infrastructure, widespread cloud adoption, and strong demand for network virtualization technologies. The region is home to major vCPE vendors and technology providers who are actively investing in R&D and expanding managed network service portfolios. Furthermore, the region’s increasing rollout of 5G and edge computing enhances the relevance of vCPE in both urban and remote deployments.

U.S. Virtual Customer Premises Equipment Market Trends

The U.S. virtual customer premises equipment market held a dominant position in the region in 2024, driven by a high concentration of telecom operators, cloud service providers, and large enterprises. The U.S. market benefits from early adoption of SD-WAN, NFV, and SDN technologies, which form the foundation of vCPE deployments. Enterprises across industries such as healthcare, BFSI, and retail are leveraging vCPE for secure and scalable branch connectivity.

Europe Virtual Customer Premises Equipment Market Trends

Europe virtual customer premises equipment market is expected to register a notable CAGR from 2025 to 2033. The region’s strong focus on data privacy, digital infrastructure modernization, and cross-border enterprise connectivity is driving the growth of the market. Telecom operators and managed service providers are adopting vCPE to optimize service delivery while complying with strict regulatory standards, thereby driving the region’s growth.

The UK virtual customer premises equipment market is expected to grow at a significant CAGR from 2025 to 2033. The UK is emerging as a key adopter of vCPE solutions in Europe, driven by the country’s dynamic telecom sector and strong enterprise demand for agile network services. The ongoing rollout of full-fiber broadband and 5G networks is further accelerating vCPE deployment in both urban and rural areas.

The virtual customer premises equipment market in Germany held a substantial market share in 2024. The country’s strong manufacturing base and industrial digitization strategies (such as Industry 4.0) are driving demand for secure, software-defined network architectures. German telecom operators and cloud service providers are increasingly offering customized vCPE solutions to support multi-site enterprise connectivity, thereby driving country’s growth.

Asia Pacific Virtual Customer Premises Equipment Market Trends

The Asia Pacific virtual customer premises equipment market is expected to grow at a CAGR of 20.5% during the forecast period. The region’s growth is fueled by expanding digital infrastructure, rising cloud adoption, and the proliferation of software-defined networking and network function virtualization. Enterprises and telecom providers across the region are investing in vCPE solutions to enhance network agility and reduce operational expenses.

India virtual customer premises equipment market is expected to grow at the fastest growth rate during the forecast period. The country’s growth is driven by the rapid expansion of broadband infrastructure, increasing enterprise digitization, and the roll-out of 5G networks. Telecom operators and managed service providers are actively adopting vCPE to deliver agile network services to enterprises and small businesses.

The virtual customer premises equipment market in China held a substantial market share in 2024, driven by significant investment in 5G, cloud computing, and edge infrastructure. Large telecom providers and hyperscale data center operators are deploying vCPE to virtualize network services and improve customer experience across industries.

Key Virtual Customer Premises Equipment Market Company Insights

Some of the key companies in the virtual customer premises equipment industry include Cisco Systems, Inc., Juniper Networks, Inc., and NEC Corporation, among others. These players dominate the market through comprehensive product portfolios, strategic partnerships, and strong global reach. Competition is driven by innovation in software-defined networking, cloud integration, and scalable service delivery models.

-

Cisco Systems, Inc. is a prominent company in networking and IT infrastructure, offering a comprehensive portfolio of virtualized solutions tailored to service providers and enterprises. The company’s vCPE solutions often integrate with their broader networking and cloud platform to provide a comprehensive suite of services.

-

Juniper Networks is a prominent company in providing networking hardware and software solutions, including those related to virtualized Customer Premises Equipment (vCPE). Their offerings, such as the vMX and vSRX VNFs (Virtual Network Functions), are used to build NFV solutions that enable organizations to create more agile and flexible virtualized network environments.

Key Virtual Customer Premises Equipment Market Companies:

The following are the leading companies in the virtual customer premises equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Arista Networks

- Broadcom

- Cisco System, Inc.

- Dell

- Juniper Networks

- NEC Corporation

- Versa Networks

- Advantech

- Anuta Networks

- Lanner

Recent Developments

-

In January 2021, Enea and NEXCOM collaborated to develop an open-source software kit for secure SD-WAN, aimed at simplifying the evaluation and deployment of enterprise networks using universal customer premises equipment (uCPE) for system integrators and communication service providers. The kit features virtualized versions of pfSense, an open-source firewall and flexiWAN, an open-source SD-WAN application, both optimized to run on uCPE platforms.

-

In January 2021, Cisco Systems, Inc. introduced four new devices under its Catalyst 8000 Edge series, comprising two Virtual CPE Edge units, a 5G cellular gateway, and a high-performance aggregation router-all engineered to enhance SD-WAN networking capabilities.

Virtual Customer Premises Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.35 billion

Revenue forecast in 2033

USD 32.18 billion

Growth rate

CAGR of 18.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Arista Networks; Broadcom; Cisco System; Dell; Juniper Networks; NEC Corporation; Versa Networks; Advantech; Anuta Networks; Lanner

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Customer Premises Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global virtual customer premises equipment market report based on component, deployment type, enterprise size, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solutions/tools

-

Virtual Routers

-

Virtual Switches

-

Security & Compliance

-

Infrastructure Management and Orchestration

-

Application & Controller Platform

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Centers & Telecom Service Providers

-

Enterprises

-

BFSI

-

IT

-

Healthcare

-

Government and Public Sector

-

Manufacturing

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual customer premises equipment market size was estimated at USD 7.19 billion in 2024 and is expected to reach USD 8.35 billion in 2025.

b. The global virtual customer premises equipment market is expected to grow at a compound annual growth rate of 18.4% from 2025 to 2033 to reach USD 32.18 million by 2033.

b. The solutions/tools segment dominated the market in 2024 and accounted for the largest share of 65.9%.

b. Some key players operating in the virtual customer premises equipment market include Arista Networks, Broadcom, Cisco Systems, Inc., Dell, Juniper Networks, NEC Corporation, Versa Networks, Advantech, Anuta Networks, and Lanner.

b. The virtual customer premises equipment (vCPE) market is being driven by the growing demand for flexible, scalable, and cost-efficient network solutions across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.