- Home

- »

- Next Generation Technologies

- »

-

Vietnam Digital Identity Solutions Market Size Report, 2030GVR Report cover

![Vietnam Digital Identity Solutions Market Size, Share & Trends Report]()

Vietnam Digital Identity Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Authentication (Biometric, Non-Biometric), By Deployment, By Organization Size, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-515-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

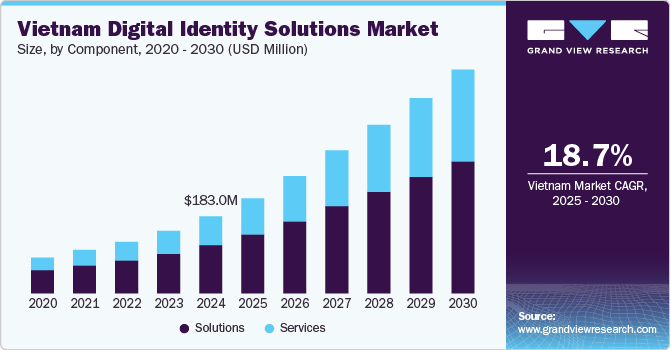

The Vietnam digital identity solutions market size was estimated at USD 183.01 million in 2024 and is projected to grow at a CAGR of 18.7% from 2025 to 2030. Vietnam’s transition from paper-based to digital documentation is a major step forward in its digital journey. For a long time, the country used slow, manual processes for identification, which were not that efficient or secure. Looking at modernization, the government launched the Digital Transformation Plan with the goal of creating a centralized, digital national biometric identity system.

Vietnam’s move has brought the Ministry of Public Security (MOPS) to team up with international tech companies like NEC and VNPT. With NEC’s automated Biometric identification system (ABIS), they are now using fingerprint and facial recognition to boost security during identity checks for more than 50 thousand people.

Moreover, NEC Asia Pacific has played a big role in upgrading Vietnam’s national ID system as part of the country’s push toward a digital economy. Through the Digital Transformation Plan, the Ministry of Public Security (MOPS) chose NEC’s Automated Biometric Identification System (ABIS) to modernize its ID system with advanced Biometric tech. This system, which uses fingerprint and facial recognition, has made identity verification much more reliable for 50 thousand people in Vietnam.

Government initiatives are playing a major role in driving market growth. For instance, in November 2024, Vietnam implemented strict new regulations that require social media users to verify their accounts with local phone numbers or personal identification numbers. These regulations, which take effect on December 25, 2024, will ensure that only verified accounts can post and share information, representing a major step forward in digital identity verification across the country.

Component Insights

The solutions segment led the market and accounted for 62.7% of the revenue in 2024. The solutions segment has been a dominant feature in the Vietnamese government, which is actively expanding its digital government ecosystem, integrating more services into its national digital ID Authentication, VNeID. Vietnam is integrating digital IDs with public services to streamline access and reduce costs for citizens. The VNeID app allows access to administrative documents, procedures, social welfare, and government grants. Plans include digital payments, wallet integration, utility bill payments, stock market transactions, and pension/unemployment payments.

In Vietnam, the services component of digital identity solutions is growing rapidly as part of the country’s broader push toward digital transformation. International tech companies, such as NEC, are partnering with the government and private enterprises to provide services for biometric identification and authentication, further accelerating the growth of digital identity services in the country. Moreover, the financial sector, especially in digital banking and mobile payments, has been another major area where digital identity services are growing. Secure identification and fraud prevention are crucial in these industries, leading to an increase in biometric and multi-factor authentication services.

Authentication Insights

The biometric segment led the market in terms of revenue share in 2024. The major initiatives to be undertaken in the country, for instance, in December 2024, Vietnam will require Biometric authentications for all online banking transactions, building upon its initial rollout in July 2024. This initiative, spearheaded by the Ministry of Public Security, State Bank of Vietnam, and Ministry of Information and Communications, aims to bolster security in the banking sector and combat fraudulent activities. Banks must complete customer identification processes, and online transactions will be suspended for customers who have not updated their biometric data and identification documents.

In Vietnam, non-biometric authentication methods are growing quickly alongside biometric solutions, driven by the need for secure and easy-to-use identity verification. OTPs, Two-Factor Authentication (2FA), and SMS/email-based verification are widely used, especially in banking and e-commerce, offering a simple and cost-effective way to secure online transactions. With the government pushing for digital identity, smartcards are becoming a more common way to securely access services. Risk-based authentication, which looks at user behavior to assess security, is also catching on in areas like banking. As digital payments and mobile wallets continue to grow, methods like PINs and QR codes are becoming more popular.

Deployment Insights

The cloud segment held a significant share of the market in 2024. Cloud deployment for digital identity solutions is growing fast in Vietnam as more businesses and government agencies move towards flexible and scalable systems. Cloud-based platforms offer better security, lower costs, and easier integration, which makes them appealing to sectors like banking, e-commerce, and healthcare. With the government's push for digital transformation, cloud solutions are becoming a key part of secure access to services and smooth identity verification. As companies continue to adapt to the digital age, using the cloud helps them meet the rising demand for secure and scalable identity solutions.

On-premises deployment of digital identity solutions is still growing in Vietnam, particularly in industries where security and control are a top priority, like government, finance, and healthcare. Many organizations prefer on-premises systems for the ability to fully manage and secure sensitive data. While cloud solutions are popular, the demand for on-premises setups continues due to concerns over data privacy and compliance with local regulations. As businesses seek more tailored, secure options, on-premises deployment remains a strong choice for many looking to maintain full control over their digital identity infrastructure.

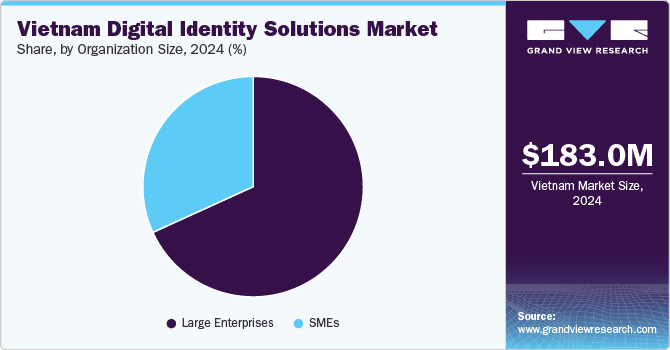

Organization Size Insights

The large enterprises segment held a significant share of the market in 2024. Large enterprises in Vietnam are increasingly adopting digital identity solutions to secure their complex systems, manage vast customer bases, and comply with regulatory standards. These organizations prioritize scalable solutions for high data volume management, driven by rising data breaches and the need for secure network access. The growing use of cloud and hybrid cloud technologies further fuels this adoption. As Vietnam's digital transformation accelerates, large enterprises will continue to invest in next-generation identity solutions to enhance security, improve user experience, and meet regulatory compliance requirements.

SMEs in Vietnam are significantly adopting the technology as they look to secure online transactions and improve customer trust. As more businesses go digital, the need for secure and efficient identity verification has become essential, especially in sectors like e-commerce and online services. Many SMEs are turning to affordable, scalable solutions that offer strong security without the need for large investments. With the government pushing digital transformation, SMEs are also encouraged to implement secure digital identity systems to meet compliance requirements and stay competitive in the growing digital economy.

Industry Insights

The BFSI segment held a significant share of the market in 2024. Recent data breaches and the rise in transactional fraud highlight the importance of a multi-layered security approach in the country. Developments in open finance frameworks have increased the urgency around creating digital identities to prevent unauthorized access to personal data, spurring the development of digital identity frameworks. EU and UK initiatives like eIDAS 2.0 and the Digital Identity and Attributes Trust Framework are spearheading the development of secure digital identity systems.

This expansion is propelled by increasing consumer demand and rapid digital adoption, positioning Vietnam as a leading e-commerce hub in Southeast Asia. The rise in online services, including e-commerce, necessitates robust identity verification solutions to authenticate users and prevent fraudulent activities, driving market growth. A young, tech-savvy population and the increasing popularity of online shopping diminish the role of traditional retail. The Vietnamese government's proactive policies in promoting digital transformation also play a significant role, encouraging businesses to invest in e-commerce platforms and enhance customer experiences.

Key Vietnam Digital Identity Solutions Company Insights

Some of the key companies in the Vietnam digital identity solutions industry include NEC Corporation; Thales; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc. and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

NEC Corporation, headquartered in Tokyo, is in digital identity solutions, utilizing advanced technology to meet the demands of the digital era. Specializing in digital identity, NEC offers a range of solutions, including biometrics, identity verification, access management, and authentication technologies. These solutions aim to enhance security, streamline operations, and improve user experiences1. NEC's expertise in biometric authentication, such as facial and fingerprint recognition, distinguishes it in the digital identity sector. Through ongoing research and development, NEC ensures its solutions stay at the forefront of technology, empowering organizations to thrive in the digital landscape

-

Thales is a global player in advanced technologies, playing a key role in various sectors, including aerospace, defense, digital identity, and security. The company is actively involved in ambitious space exploration projects, such as building the Emirates Airlock for the Gateway cislunar station. Thales excels in cybersecurity and data protection, offering a wide range of cyber solutions tailored to meet diverse business needs, data privacy levels, and regulatory requirements. Their expertise in digital identity and security enables them to provide cutting-edge solutions that ensure secure and reliable digital interactions for individuals, businesses, and governments worldwide.

Key Vietnam Digital Identity Solutions Companies:

The following are the leading companies in the Vietnam digital identity solutions market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- Thales

- GB Group plc (‘GBG’)

- TELUS

- Tessi

- Daon, Inc.

- IDEMIA

- EY Vietnam

- Eviden

Recent Developments

-

In February 2024, IDEMIA Public Security North America and CertiPath joined forces to integrate IDEMIA's digital identity solutions with CertiPath's TrustVisitor, bolstering identity verification and fraud prevention. This collaboration enables TrustVisitor users to verify individuals accessing high-assurance environments, such as federal buildings and military bases, with next-generation technology, improving security and user experience.

-

In November 2024, Vietnam implemented strict new regulations that require social media users to verify their accounts with local phone numbers or personal identification numbers. These regulations, which take effect on December 25, 2024, will ensure that only verified accounts can post and share information, representing a major step forward in digital identity verification across the country.

Vietnam Digital Identity Solutions Market Report Scope

Report Attribute

Details

Market Size value in 2025

USD 225.7 million

Revenue forecast in 2030

USD 531.7 million

Growth rate

CAGR of 18.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Thousand and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, authentication, deployment, organization size, industry, country

Country scope

Vietnam

Section scope

Northern Vietnam; Southern Vietnam; Central Vietnam

Key companies profiled

NEC Corporation; Thales; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc.; IDEMIA; EY Vietnam; Eviden

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Vietnam Digital Identity Solutions Market Report Segmentation

This report forecasts revenue growth in Vietnam and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Vietnam digital identity solutions market report in terms of component, Authentication, deployment, organization size, industry, and country:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Authentication Outlook (Revenue, USD Million, 2018 - 2030)

-

Biometric

-

Non- Biometric

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking, Financial Services, & Insurance

-

Education

-

Retail & E-commerce

-

Manufacturing

-

Agriculture, Forestry, & Fishery

-

Construction

-

Automotive

-

Travel & Hospitality

-

Government & Defense

-

Healthcare

-

IT & Telecommunication

-

Energy & Utilities

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Vietnam

-

Northern Vietnam

-

Southern Vietnam

-

Central Vietnam

-

-

Frequently Asked Questions About This Report

b. The global Vietnam digital identity solutions market size was estimated at USD 183.01 billion in 2024 and is expected to reach USD 225.78 billion in 2025.

b. The global Vietnam digital identity solutions market is expected to grow at a compound annual growth rate of 18.7% from 2025 to 2030 to reach USD 531.66 billion by 2030.

b. The solutions segment dominated the Vietnam digital identity solutions market with a share of 62.7% in 2024. Solutions has been the dominant feature in the Vietnamese government is actively expanding its digital government ecosystem, integrating more services into its national digital ID Authentication Type, VNeID. Vietnam is integrating digital IDs with public services to streamline access and reduce costs for citizens.

b. Some key players operating in the Vietnam digital identity solutions market include NEC Corporation; Thales; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc.; IDEMIA; EY Vietnam; Eviden

b. Vietnam’s transition from paper-based to digital documentation is a major step forward in its digital journey. Government initiatives are playing a major role in driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.