- Home

- »

- Animal Health

- »

-

Veterinary Software Market Size And Share Report, 2030GVR Report cover

![Veterinary Software Market Size, Share & Trends Report]()

Veterinary Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Imaging, Telehealth), By Delivery Mode (Cloud/Web-based, On-premise), By Practice Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-621-9

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Software Market Summary

The global veterinary software market size was estimated at USD 1.43 billion in 2024 and is projected to reach USD 3.01 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030. The market is primarily driven by the growing adoption of veterinary software integrators, artificial intelligence (AI), and telehealth software, and the rising prevalence of animal diseases, leading to increased veterinary patient volume.

Key Market Trends & Insights

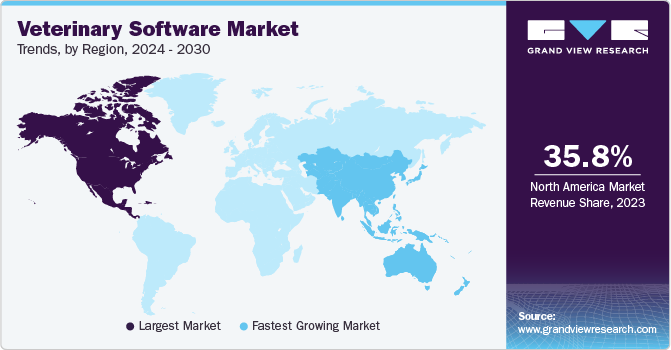

- North America veterinary software market held largest share of 42.97% of the global market in 2024.

- The veterinary software market in Asia Pacific held the highest CAGR over forecast period of 2025-2030.

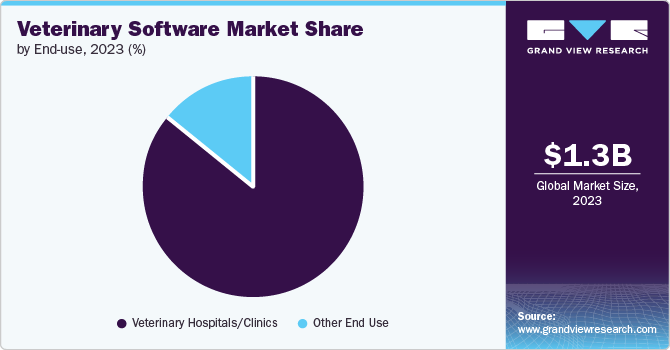

- By end use, veterinary hospitals/ clinics segment held highest market share of over 85.97% in 2024.

- By delivery mode, cloud/web-based segment held highest market share of over 80.45% in 2024.

- By practice type, small animals held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.43 Billion

- 2030 Projected Market Size: USD 3.01 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The digital transformation continues to unfold in the veterinary industry. To foster efficiency, streamline workflow, and improve patient care, practices are gradually transitioning from recording documentation on paper to employing software.Veterinary clinics are seeking veterinary software with which they can effortlessly integrate with external databases and other platforms, such as imaging software, telehealth software, etc. This connection facilitates healthcare administration and data exchange. Veterinary software frequently includes data analysis technologies that offer insightful data on patient demographics, treatment outcomes, and clinic performance. Clinics can optimize their operations and make data-driven decisions using the assistance of these findings.

The market is influenced by various technological advancements that drive innovation, improve software integration, and enhance the overall performance of these veterinary software. Ongoing efforts are in progress to integrate healthcare and IT to develop technologies that are beneficial for the management, diagnosis, and treatment of diseases in humans as well as animals. This software offers robust analytical capabilities that enable insightful data on patient demographics, treatment outcomes, and clinic performance. Healthcare facilities can enhance their operations and make data-driven decisions with the assistance of these insights.

Existing veterinary software is offering integration with multiple other software’s in the market. Software integrations connect programs to one another to streamline data entry, retrieval, and several other tasks. Software integration enables users to combine applications and streamline processes within Practice Management Systems (PMS). Standalone software frequently has functionalities that are replicated across several systems. This multiple integration allows users to combine multiple features of multiple other software’s to ensure that all necessary features are available for use.

For example, ezyVet Veterinary Software by Idexx Laboratories has multiple integrations with an array of other veterinary software for categories like finance & analytics, insurance, controlled drugs management, diagnostics, telemedicine, online pharmacy, patient care, reference labs, etc. When it comes to veterinary diagnostics, this software integrates with other software by Gribbles Veterinary Pathology, Heska (Antech Diagnostics), Ellie Diagnostics, Vetnostics, etc. Also, for telehealth, this software can integrate with other software like Otto, VetChip, etc.

Another such software, Hippo Manager, has been designed to integrate with multiple others, such as Covetrus, Idexx, PetDesk, GreenLine, mCLub, etc., for functionalities such as medical records, client communication tools, payment, etc. Through an amalgamation of features from multiple software providers, these integrations elevate user experience and assure seamless integration within Practice Management Systems (PMS). The market is steadily expanding because these software solutions are appealing to veterinarians, considering their versatility and ease of compatibility with other prominent platforms in the sector.

The veterinary community globally has seen a rise in veterinary patient volume over the years. According to data published by the American Veterinary Medical Association (AVMA), between 2019 and 2020, the average number of veterinary appointments booked grew by 4.5%. Between January and June 2021, there was a 6.5% rise in appointments as compared to the same period in 2020. This rise in veterinary appointments points towards a rise in the volume of patients. Furthermore, calling for an increase in demand for better practice management systems in hospitals and clinics. These factors are expected to continue to drive demand for the installation of veterinary software into veterinary healthcare facilities to ensure efficient handling of the increasing patient volume.

Another crucial factor driving this software market is the growing application and integration of AI into veterinary software. The veterinary sector is undergoing a significant transformation with the implementation of AI in veterinary software. The growing utilization of AI-powered tools has led to speeding up as well as increasing the accuracy of the daily processes in industry, thereby enabling veterinary professionals to make informed decisions. Furthermore, technologies like AI-driven chatbots improve client communication, liberating the staff to focus on more critical tasks. The analysis of diagnostic medical images, such as Magnetic Resonance Imaging (MRI) and X-rays, is also facilitated by AI, allowing for early and timely diagnosis. In addition, growing influence of AI-powered predictive analytics is said to aid veterinarians in identifying at-risk patients and preventing diseases. The integration of AI has also streamlined administrative tasks, reduced paperwork, and optimized practice management. Ultimately, the incorporation of AI in veterinary software is revolutionizing the sector by enhancing productivity, precision, and patient care. Taking into consideration these advantages, software companies are increasingly investing their resources into integrating AI into veterinary software solutions.

For instance, in May 2024, Modern Animal announced a roadmap for AI-assisted tools to revolutionize the veterinary industry. Over the next few years, the company aims to develop AI-powered diagnostic tools, predictive analytics, and personalized treatment plans to improve patient outcomes and enhance the overall veterinary care experience. Ultimately increasing efficiency, accuracy, and patient care in the sector.

Furthermore, in August 2024, Digitail, one of the leading veterinary software solution providers, upgraded their AI-powered veterinary assistant, Tails AI, to enhance the functionality and user experience. The software has been upgraded to now support veterinary teams with tasks such as automated task assignments, customizable workflows, and improved integration with practice management systems.

Among smaller or more limited in resources veterinary clinics, particularly in developing nations, initial expenditures associated with obtaining and deploying veterinary software can be a major obstacle. Hardware prerequisites, licensing costs, and training costs can be high. The substantial upfront costs associated with software purchase and installation can additionally divert funds away from other vital areas of a veterinary practice, such staffing expansions, equipment purchases, or facility expansions. This could discourage practitioners from choosing software-based solutions.

For instance, as of 2024 price per month for a single user of IDEXX's cloud-based Practice Management software, ezyVet, is USD 230. For more than 190 users, this cost can reach USD 3,100 per month. 24/7 support, product upgrades, and anywhere accessibility have been incorporated into the price. Further setup requirements could result in higher initial expenses. Moreover, there are extra fees for specific products like texted texts, faxed emails, and postcards. Particularly smaller veterinarian practices might not have as much money as they would want. High initial expenses may prevent many practices from implementing cutting-edge veterinary software.

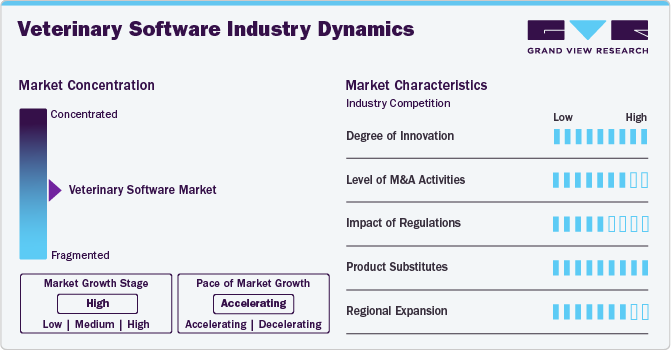

Market Concentration & Characteristics

Vet software offering an outstanding degree of innovation and cutting-edge features like integrated diagnostics and telehealth is expected to propel market expansion by satisfying changing industry demands and optimizing user experience. Growing market concentration might arise from additional mergers and acquisitions in the veterinary software industry, resulting in better, more holistic solutions. This has potential to improve the competitive environment and offer a wider selection of features to users.

Players in the industry are leveraging merger and acquisition strategies to promote the reach of their offerings and increase their product capabilities globally. For example, in February 2024, Agriculturetech (Agtech) software specialist Herdwatch acquired ComTag in Ireland and Lilac Technology in the UK. With this acquisition, the company aims to accelerate veterinary software in these countries, enhancing its existing portfolio.

Strict regulatory compliance will leave an impact on market by influencing development of functionalities essential to patient confidentiality, data security, and market regulations compliance. Solutions that emphasize conformity may get more widely used in response to regulatory requirements.The presence of viable alternatives to software will impact market dynamics, increasing competition and driving software developers to continue upgrading their offerings. Veterinary software companies that are expanding into new areas will see a growth in market share. Adapting solutions to comply with local demands and legal constraints will help businesses succeed in a variety of industries, which will further fuel market expansion.

In addition, players are developing new and innovative products that will ensure that end users' efficiency is boosted while collaborating with other industry players to improve the advantages of both software. These kinds of initiatives are frequently utilized to broaden a worldwide footprint or regional penetration with an objective to reach a wider audience. For example, in March 2024,Covetrus launched vRxPro, an advanced online prescription management solution within VetSuite to streamline veterinary practices' operations, enhance client engagement, and boost revenue. Furthermore, in February 2024,IDEXX introduced Vello, a pet owner engagement software for veterinary practices, to reduce no-show rates by 19% and to improve client communication, streamline workflows, and improve care outcomes. Vello integrates with IDEXX’s practice management software, offering more advanced features such as automated reminders, online scheduling, and mobile access to pet health records.

Market players are executing consolidation operations such as mergers and acquisitions (M&A) and improving their existing capacities and abilities to strengthen their industry dominance and meet expanding demand. Incorporation of elements of the acquired company's software allows market participants to guarantee that their own software becomes formidable and gains a competitive share in the industry. For instance, in February 2024,DaySmart Software acquired Time To Pet, integrating pet sitting and dog walking features into its business management software for pet care providers, expanding its offerings beyond grooming and daycare. The acquisition improved pet business operations while improving customer experience by merging Time To Pet's cutting-edge solutions with DaySmart's industry expertise.

Product Insights

Practice Management Software (PMS) held the highest market share of over 59.60% in 2024, owing to wide usage in hospitals and clinics both in established and developing economies. Several standard-of-care practices and health guidelines are supported and documented by this system. In addition to helping with billing and invoicing, resource management, inventory control, and treatment procedure management, it also maintains track of health conditions of the patients. Consequently, PMS raises profitability and operational efficacy. Over the course of the forecasted period, these factors are anticipated to fuel market growth.

Moreover, during the forecast period, a rise in strategic initiatives by important players is anticipated to propel segment expansion. For example, in May 2023, MWI Animal Health launched an improved version of PetPage Patient Portal, a web and mobile application platform for pet wellness. This software is delivered via MWI's cloud-based AllyDVM veterinary software suite. This program makes it easier for veterinary offices and their clients to communicate by giving pet owners smartphone access from a distance.

The veterinary telehealth software segment emerged as the fastest-growing segment with a CAGR of 15.67% due to increasing demand for remote healthcare services and the adoption of telemedicine in veterinary practices. Telehealth software enables veterinarians to provide consultations, diagnose cases, and offer follow-up care virtually.Moreover, advancements in telehealth technology, coupled with a growing acceptance of virtual consultations among both veterinarians and animal owners, are driving rapid growth of this segment.

Delivery Mode Insights

By delivery mode, cloud/web-based segment held highest market share of over 80.45% in 2024 and is also estimated to grow with highest CAGR over the forecast period. Cloud-based solutions are easily scalable, accomplishing specifications of veterinary clinics of every kind. This makes it available to significant, multilocation veterinary hospitals as well as tiny, independent clinics. Veterinarians can examine patient data, identify trends, and make better decisions regarding patient care and practice management with help of this software, which frequently has sophisticated analytics and reporting capabilities. By enabling online appointment booking, email or SMS reminders, and patient portals where clients can view their pet's records and contact the practice, they can enhance client experience.

Furthermore, cloud-based software providers update their products often to resolve vulnerabilities and enhance functionality. Veterinarians no longer need to spend their resources and energy updating and maintaining software by hand. Together, these elements fuel need for cloud-based veterinary software, which helps clinics increase productivity, improve patient care, cut expenses, and maintain their competitiveness in a market that is changing quickly.

Practice Type Insights

By practice type, small animals held the highest market share in 2024. The segment includes software revenue from veterinarian practices that treat small companion animals (dogs and cats) as their primary source of care. Veterinarians and veterinary clinics can more efficiently manage their daily activities and deliver high-quality animal care with aid of small animal PMS, a specialized tool. The primary factors propelling this segment’s growth are an increasing number of product developments, software integration, and practice management opportunities in small animal practices.

For instance, according to data from November 2023 from the U.S. Bureau of Labor Statistics, the amount spent on pets in 2013 was $57.8 million. This amount increased to $102.8 million by end of 2021, a 77.9% increase in just 8 years. This demonstrates how the need for more advanced equipment, protocols, and-above all-systems and software has grown along with demand for pet care. Veterinarians have approved and acknowledged use of more advanced and integrated software to manage pet animal practices professionally, according to VHMA. Thanks to veterinarians' growing interest in software administration in small animal practices, leading companies are bringing innovative products to market.

Other practice types segment is anticipated to grow at the fastest CAGR over the forecast period. The segment includes software revenue from other companion animals (e.g., small mammals, reptiles, birds, and aquatics). As the exotic pet ownership trend rises and veterinary clinics diversify their services, the necessity for advanced software to support specialized care for these animals is becoming increasingly apparent, driving the market. According to American Veterinary Medical Association (AVMA) and internal GVR estimates, pet bird and reptile population in the U.S. was estimated at 8.1 million and 6.1 million, respectively, in 2018. These numbers are projected to reach 11.7 million and 6.9 million, respectively, by December 2024

End Use Insights

By end use, veterinary hospitals/ clinics segment held highest market share of over 85.97% in 2024 and is expected to grow rapidly during forecast period. The accelerating digitization of veterinary practices and growing awareness of advantages that software provides to both patient care and business operations are what are driving overall growth of hospitals/clinics segment. A wider variety of services, such as surgery, imaging, emergency care, and specialized treatments, are generally provided by veterinary hospitals and clinics. Software that can easily handle multiple facets of patient care is required due to this complexity.

Furthermore, compared to smaller practices or individual veterinarians, veterinary hospitals and clinics frequently manage a higher patient volume. More sophisticated software must be installed to effectively manage appointments, patient records, billing, and inventory in light of increased patient load. Veterinary clinics and hospitals can gain a competitive advantage by implementing technology to provide better services, increase customer satisfaction, and draw in new customers who value efficiency and convenience of digital tools. The need for veterinary software used in clinics and hospitals is anticipated to rise in upcoming years as a result of these factors.

Over the forecast period, other end use segment is expected to grow profitably. Other end users such as Other End Use are adopting more veterinary software, including imaging and telehealth software, in order to stay current with technological advancements in veterinary medicine, improve workflow efficiency, boost collaboration, and offer high-quality diagnostic services. The use of imaging software in veterinary laboratories is expected to grow steadily as technology develops.

Regional Insights

North America veterinary software market held largest share of 42.97% of the global market in 2024. The existence of well-established competitors and rising need for maintenance from veterinary clinics to support daily operations are what are driving the market. It makes it possible to keep track of patient demographics, appointments, and routine tasks that accompany running a veterinary clinic. Because so many of the top animal healthcare companies are based there, the U.S. is the largest market in the region for veterinary software. It is anticipated that rising innovation in veterinary software will aid in market expansion. For example, in April 2023, DaySmart Software acquired ReCPro Software, a veteran provider of recreation management software, expanding its portfolio to support recreation vertical. The acquisition aimed to offer ReCPro customers access to DaySmart's cloud-based solution and customer service, reinforcing DaySmart's commitment to serving parks and recreation departments with integrated solutions.

U.S. Veterinary Software Market Trends

The veterinary software market in the U.S. held the largest share of 2024 among all countries in the global market. The U.S. has an all-time high number of veterinary clinics and veterinarians due to rising pet adoption and pet ownership. The veterinary field has also changed as a result of introduction of innovative ways to manage patient data, such as veterinary software. Veterinarians, clinics, and hospitals obtain superior assistance with veterinary practice management when veterinary software is integrated. Its adoption is anticipated to soar as it meets clinical and managerial needs of veterinary practitioners.

Europe Veterinary Software Market Trends

The Europe veterinary software market held the second largest share in 2024. Due to extensive local veterinary markets, rising zoonotic disease prevalence, and increased consumption of livestock products, Europe holds second-largest share in global market. Furthermore, driving market expansion are existence of well-established competitors and recent advancements in software, such as real-time veterinarian engagement software that offers high accuracy and data accessibility. The changing trend in this area toward new technology-based practice management and imaging software might serve as a factor in rising demand for veterinary software.

Germany veterinary software market held second-largest share in Europe in 2024. In order to increase productivity in clinical practices for pets and livestock, major players in the market in Germany are offering their software for a variety of applications, including appointment scheduling, medical record management, billing, and other clinical practices. The best patient care provided by evidence-based veterinary services, scientific methods to enhance animal welfare, rise in zoonotic illnesses, and the growing use of acquisition strategies by major players are some of the factors propelling the market's expansion. In addition, there is a need for appropriate services and software because a large number of hospitals and veterinary clinics offer emergency care for animals. Furthermore, the General Administrative Regulation for Zoonoses in the Food Production Chain establishes the legal framework for monitoring zoonotic agents, while the European Council and European Parliament's Directive on the monitoring of zoonoses and zoonotic agents presents significant guidance.

The veterinary software market in the UK is expected to grow significantly over the forecast period.One of the world's most concentrated veterinary markets is believed to be in the UK. The country's growth can be attributed to rising incidence of diseases as well as healthcare and control initiatives for pets and farm animals. Approximately 60% of UK households have pets that need to be seen by a veterinarian, which has driven up demand for veterinary software. The revenue of major players has increased due to the increasing use of veterinary software for standard services in hospitals and clinics.

France veterinary software market will show significant growth as France is widely recognized for its animal health services. There are two primary categories of healthcare services in nation: companion animals and animals raised for food. In France, veterinary care is essential for preserving health and welfare of domestic animals as well as livestock, particularly when it comes to detection, management, and treatment of animal illnesses. Furthermore, the nation has stringent guidelines for high-quality medical care, with a focus on routine health examinations and preventive veterinary care.

Asia Pacific Veterinary Software Market Trends

The veterinary software market in Asia Pacific held the highest CAGR over forecast period of 2025-2030. The market is expanding at fastest rate in Asia Pacific, which can be attributed to growing number of pets, rising livestock product demand, and rising incidence of zoonotic diseases. Furthermore, in order to save time and concentrate on patient care, veterinary practices in developing nations like China and India are progressively implementing veterinary software. The market's expansion has been significantly aided by the existence of well-established competitors and cutting-edge software solutions. For example, FUJIFILM Healthcare Asia Pacific Pte. Ltd. expanded its healthcare operations in Thailand in February 2023. As part of its One-stop Total Healthcare Solution, the company unveiled a comprehensive portfolio of diagnostic imaging and informatics solutions backed by cutting-edge medical image analysis & Artificial Intelligence (AI).

India veterinary software market held the highest CAGR over the forecast period of 2025-2030. Over the course of the forecast period, the market in India is expected to grow at a profitable rate. Growth is attributable to the rising need from hospitals and veterinary clinics for software to meet their expanding needs. Furthermore, to promote better resilience against disease control and potentially boost market growth, Indian veterinary care organizations are pushing for use of cutting-edge technologies like imaging software and veterinary practice management.

The veterinary software market in China held the largest share in 2024. During past ten years, pet adoption has dramatically increased in several major countries, including China. China's market is expanding quickly as a result of higher disposable income and a surge in pet ownership. Companies have developed creative software products, including practice management and imaging software, as a result of nation's increasing growth potential and its position as a global leader in industry. The nation's requirements for timely appointment scheduling, quality veterinary care, and daily operations have also increased demand for veterinary software. Moreover, emergence of well-known major players and fresh, creative software solutions are supporting expansion of the market in China.

Latin America Veterinary Software Market Trends

The veterinary software market in Latin America holds a significant share of global market. The increasing number of household pets, high demand for livestock products, and an increasing number of clinics in region are likely to boost the market over forecast period. Furthermore, increased government funding has contributed to market growth in countries like Brazil. Factors such as untapped opportunities, economic development, and rising awareness levels can contribute to the region’s rapid market growth. Advantages associated with veterinary software products-on-premises & cloud-based-and their uses in hospitals and clinics are anticipated to drive the market.

Brazil veterinary software market is dynamic and unique, with lucrative opportunities for veterinarians and industry. The number of household pets in country is rising. Furthermore, there has been substantial market growth in recent years due to rising sales of veterinary software and an increasing number of clinics. Furthermore, over 150,000 veterinarians work in over 30,000 veterinary facilities in Brazil, offering top-notch services to their clients. Furthermore, numerous companies are expanding their presence in Brazil to support the development of vets with new software and services.

MEA Veterinary Software Market Trends

The veterinary software market in MEA includes South Africa, Saudi Arabia, Israel, Iran, Turkey, and the United Arab Emirates (UAE). Several countries in the MEA have developed livestock and animal healthcare industries. The region’s market is driven by integration of advanced technologies, enabling a diverse array of software solutions. In addition, rapid urbanization and the growing adoption of pets are expected to attract global veterinary software companies to region. The entry of major market players in region can boost animal healthcare industry and the economy.

South Africa veterinary software market growth can be attributed to rising animal health concerns, consumption of animal-derived products, and increased livestock production. In terms of cattle resources and vegetation, South Africa occupies a unique position in Africa. The livestock industry has been distinguished by a dual system that puts an advanced commercial sector using modern technologies against a developing sector that comprises new & small-scale farmers. As a result, adoption of veterinary services & solutions is rising in South Africa, boosting this market. On the other hand, there has been a considerable increase in number of zoonotic diseases in animals in recent years. Consequently, the need to treat diseases has increased significantly, promoting market growth.

Key Veterinary Software Company Insights

Some of the key players operating in market include Idexx Laboratories, Covetrus Inc. (Henry Schein), Hippo Manager, Shepherd Veterinary Software, DaySmart Software, Digitail, ProVet (NordHealth), OnwardVet, Asteris, Carestream Health, Heska Corporation (Mars Inc.), Oehm und Rehbein GmbH, VetStoria, Instinct Science, LLC, Planmeca. There is severe competition in the veterinary services market because there are both well-established and newly started companies. These organizations are actively carrying out strategic initiatives meant to increase their market share and market presence. Both large and small businesses are implementing a variety of tactics in an effort to obtain a competitive advantage. In addition, an enhanced and holistic strategy for veterinary care services can be facilitated by strategic alliances and collaborations in the form of software integrations with other players in the industry.

Key Veterinary Software Companies:

The following are the leading companies in the veterinary software market. These companies collectively hold the largest market share and dictate industry trends.

- Idexx Laboratories

- Covetrus Inc. (Henry Schein)

- Hippo Manager

- Shepherd Veterinary Software

- DaySmart Software

- Digitail

- ProVet (NordHealth)

- OnwardVet

- Asteris

- Carestream Health

- Heska Corporation (Mars Inc.)

- Oehm und Rehbein GmbH

- VetStoria

- Instinct Science, LLC

- Planmeca OY

Recent Developments

-

In August 2024, Digitail announced sponsorship for The Veterinary Hospital Managers Association’s (VHMA) mission to advance veterinary management and provide resources to veterinary hospital managers.

-

In June 2024, Pawlicy Advisor announced integration with EzyVet practice management software (PMS) with an aim to streamline the insurance process, improve client engagement, and increase revenue for veterinary clinics.

-

In May 2024, Evette, a leading company that addresses staff shortages in veterinary settings, partnered with Shepherd Software with an aim to create a platform to streamline veterinary clinic operations, improve staff efficiency, and enhance the overall work environment.

-

In April 2024, Wag! launched a software solution named as Furscription which is designed to assist veterinary clinics manage pet care and improve customer engagement. By streamlining clinic operations, reducing administrative tasks, and enhancing the overall pet care experience.

-

In April 2024, Weave integrated with Shepherd, enhancing its capabilities in client communication and engagement for businesses. This integration streamlined communication processes and improved customer service, benefiting businesses using Weave's platform.

-

In February 2024, IDEXX launched a novel pet parent engagement software known as Vello. Its features include; automated appointment reminders, health service reminders, online scheduling, and two-way texting, all integrated with IDEXX's practice management software.

-

In January 2024, Covetrus showcased its VetSuite solution at VMX 2024, offering integrated technology and services to improve veterinary practice efficiency and pet care. The company entered into partnership with Zoetis Diagnostics for seamless data exchange, enhancing diagnostic capabilities for veterinarians and improving patient care.

-

In November 2023, a brand-new reference lab for Antech Diagnostics opened in Warwick. With its debut, Antech's first comprehensive and adaptable portfolio-which comprises software solutions, in-house diagnostics, imaging, and reference lab-arrived in the UK.

Veterinary Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.62 billion

Revenue forecast in 2030

USD 3.01 billion

Growth rate

CAGR of 13.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, practice type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Russia; Netherlands; Switzerland; Poland; Ireland; Japan; China; India; Australia; South Korea; Thailand; Indonesia; Philippines; Malaysia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Iran; Turke; Israel

Key companies profiled

Idexx Laboratories; Covetrus Inc. (Henry Schein); Hippo Manager; Shepherd Veterinary Software; DaySmart Software; Digitail; ProVet (NordHealth); OnwardVet; Asteris; Carestream Health; Heska Corporation (Mars Inc.); Oehm und Rehbein GmbH; VetStoria; Instinct Science, LLC; Planmeca OY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary software market report based on product, delivery mode, practice type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Practice Management Software

-

Imaging Software

-

Telehealth Software

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud/Web-Based

-

On-premise

-

-

Practice Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Mixed Animals

-

Equine

-

Food-producing Animals

-

Other Practice Types

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Sweden

-

Switzerland

-

Ireland

-

Poland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Iran

-

Turkey

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global veterinary software market size was estimated at USD 1.44 billion in 2024 and is expected to reach USD 1.62 billion in 2025.

b. The global veterinary software market is expected to grow at a compound annual growth rate of 13.21% from 2025 to 2030 to reach USD 3.01 billion by 2030.

b. North America veterinary software market held largest share of 42.97% of the global market in 2024. The existence of well-established competitors and the rising need for maintenance from veterinary clinics to support daily operations are what are driving the market. It makes it possible to keep track of patient demographics, appointments, and the routine tasks that go along with running a veterinary clinic.

b. Some key players operating in the veterinary software market include IDEXX Laboratories, Inc., Covetrus Inc. (Henry Schein), Hippo Manager Software, Inc., Shepherd Veterinary Software, DaySmart Software, Digitail, Nordhealth AS, OnwardVet, Patterson Companies, Inc., Carestream Health, Antech Diagnostics, Inc. (Mars), Oehm und Rehbein GmbH, Vetstoria, Instinct Science, LLC, and Planmeca OY

b. Key factors that are driving the veterinary software market growth include growing adoption of veterinary software integrators, increasing adoption of Artificial Intelligence (AI), increase in adoption of telehealth software, and rising prevalence of animal diseases leading to increase in veterinary patient volume.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.