- Home

- »

- Animal Health

- »

-

Veterinary Regenerative Medicine Market Size Report, 2033GVR Report cover

![Veterinary Regenerative Medicine Market Size, Share & Trends Report]()

Veterinary Regenerative Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Small Animals, Large Animals), By Product (Stem Cells, Others), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-043-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Regenerative Medicine Market Summary

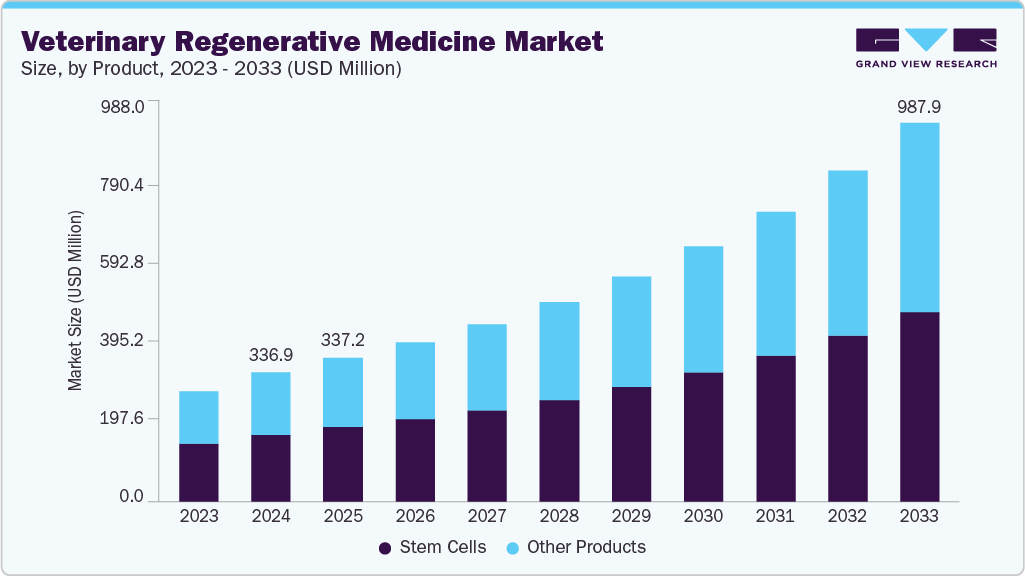

The global veterinary regenerative medicine market size was estimated at USD 336.86 million in 2024 and is projected to reach USD 987.85 million by 2033, growing at a CAGR of 12.94% from 2025 to 2033. The market is advancing, driven by the rising prevalence of chronic and degenerative diseases in animals, advancements in stem cell and gene therapy technologies, growing humanization of pets, and the willingness to spend on advanced care.

Key Market Trends & Insights

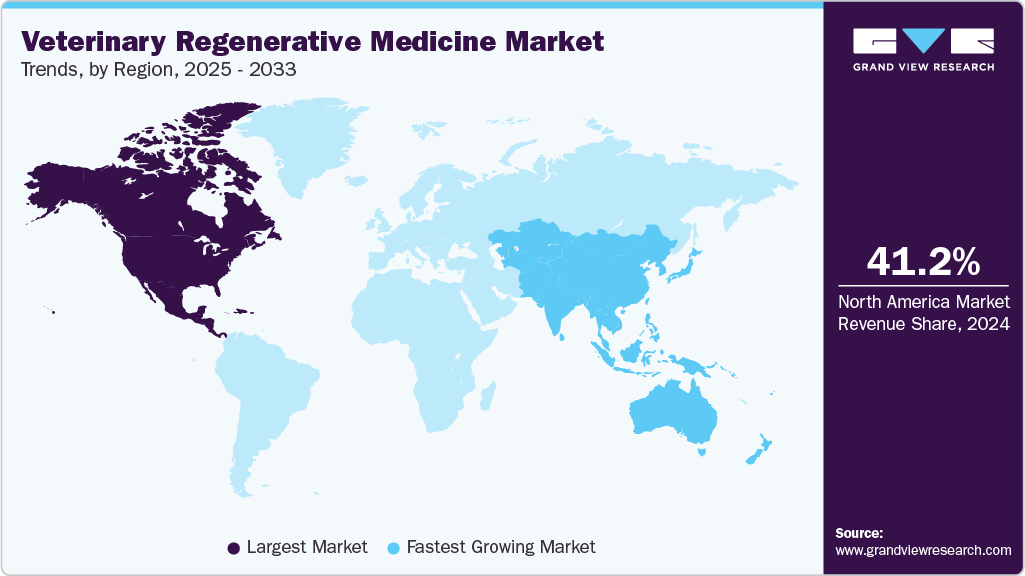

- North America veterinary regenerative medicine market held the largest share of 41.17% of the global market in 2024.

- By application, orthopedics segment held the largest share of 41.98% of the market in 2024.

- By animal, small animals comprising cats and dogs segment dominated the global market in 2024.

- Based on product, the stem cells segment held the highest market share of 51.89% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 336.86 Million

- 2033 Projected Market Size: USD 987.85 Million

- CAGR (2025-2033): 12.94%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing incidence of chronic, degenerative, and age-related conditions such as osteoarthritis, hip dysplasia, tendon injuries, and spinal disorders in companion and livestock animals is driving demand for veterinary regenerative medicine.Osteoarthritis (OA) causes 80% of lameness and joint disease in companion animals, with rising cases due to obesity and longer lifespans. In young dogs, 39.8% show radiographic OA and 23.6% clinical signs, emphasizing the underreported prevalence and the need for early detection to optimize treatment outcomes. Pet owners and veterinarians are seeking advanced treatment options beyond symptom management to address the root cause of disease. Stem cell therapy, platelet-rich plasma (PRP), and tissue engineering techniques offer the potential to restore function, reduce pain, and improve quality of life. As awareness of these benefits spreads among pet owners, adoption accelerates, creating strong growth potential in regenerative veterinary healthcare.

An increasing number of innovations in stem cell isolation, culture, and delivery methods, alongside breakthroughs in gene therapy and biomaterials, is significantly enhancing the efficacy and safety of veterinary regenerative medicine. For instance, the European Commission approved Arti-Cell Forte, the first stem cell-based veterinary product, offering a ready-to-use, long-term solution for equine lameness, developed by Boehringer Ingelheim and GST to address the underlying joint inflammation causes. Improvements in cell viability, targeted delivery, and minimally invasive application techniques are expanding the range of treatable conditions in small and large animals. These advancements also lower costs, making treatments more accessible to a wider population of pet owners. In addition, increasing veterinary clinical trials and peer-reviewed evidence are strengthening veterinarians' confidence in regenerative approaches, leading to higher recommendation rates and fostering long-term market adoption.

The current state of veterinary regenerative medicine

Species / Category

Key Focus Areas

Applications & Findings

Limitations / Notes

Small Animals - Dogs (PRP)

Platelet-Rich Plasma (PRP)

Used for wounds, periodontitis, joint disease, soft tissue injuries, fractures; improves wound healing; reduces pain & lameness in OA; aids tendon & ligament healing.

Product variability in platelet/WBC concentrations & growth factors affects efficacy.

Cats (MSCs)

Mesenchymal Stem/Stromal Cells (MSCs)

Applied to chronic kidney disease, refractory gingivostomatitis, chronic enteropathy, IBD, spinal cord injury; some use in acute kidney injury, asthma, cardiomyopathy.

Variability in source, dose, administration; lack of controls; limited studies but few adverse effects.

Extracellular Vesicles (EVs) from MSCs

EVs from adipose & placenta MSCs show concentrated immunomodulatory RNA; potential in tissue regeneration; differential miRNA profiles affect anti-inflammatory/immunometabolic roles.

Still experimental; mechanism understanding ongoing.

Dogs (Immunotherapy)

Genetically engineered T-cells

CAR-T cell therapy potential for autoimmune, fibrotic, senescent diseases; aligns with One Health & translational medicine.

Early-stage research; nonmalignant disease focus is new.

Equine - MSCs & PRP

Systematic review/meta-analysis

MSCs or MSC+PRP reduce reinjury rates in tendon/ligament injuries; no increase in return-to-performance.

High study heterogeneity & bias risk.

Equine MSC Preconditioning

Dual-licensed MSCs (IL-1β + TGF-β2)

Enhanced tenocyte migration, metabolism, anabolic gene expression; lower MHC-I for immune evasion.

In vitro study; needs in vivo validation.

Equine MSCs for Septic Arthritis

Immune-activated MSCs

Reduced bacteria & improved lameness vs antibiotics; altered immune gene expression in synovium.

Mechanisms still being mapped.

Equine EV Biomarkers

EV miRNA profiling

PTOA horses have altered plasma & synovial fluid EV miRNA; potential for biomarker development.

Exploratory stage.

Equine EV Therapeutics

EV production from MSCs

3-D culture increases EV yield per cell; informs scalable production methods.

No direct therapeutic testing yet.

Equine Gene Therapy

IL-1 receptor antagonist vector

Improved lameness, cartilage, subchondral bone in PTOA model; supports disease-modifying potential.

Equine model; needs clinical rollout.

Neurologic Diseases (Equine & Canine)

Cellular therapy

Investigated neuroinflammatory & neurodegenerative diseases; early but promising.

Underreported; requires more research.

Exotics - MSC Therapy

Novel cell-based treatments

Potential for joint, soft tissue, autoimmune, inflammatory, infectious diseases in exotic species; useful when repeated treatments not feasible.

Limited case studies; species-specific adaptation needed.

Source: American Veterinary Medical Association, AVMA

The trend of pet humanization has heightened owners’ willingness to invest in sophisticated medical solutions, including regenerative therapies. Pets are increasingly viewed as family members, prompting demand for treatments that extend lifespan and enhance comfort. Higher disposable incomes, expanding pet insurance coverage, and financing options for costly procedures further boost market accessibility. Owners are increasingly open to novel, science-backed therapies if they offer improved recovery outcomes and reduced reliance on pharmaceuticals or invasive surgeries. This cultural shift, coupled with the emotional value placed on animal well-being, is a powerful driver shaping the growth trajectory of veterinary regenerative medicine.

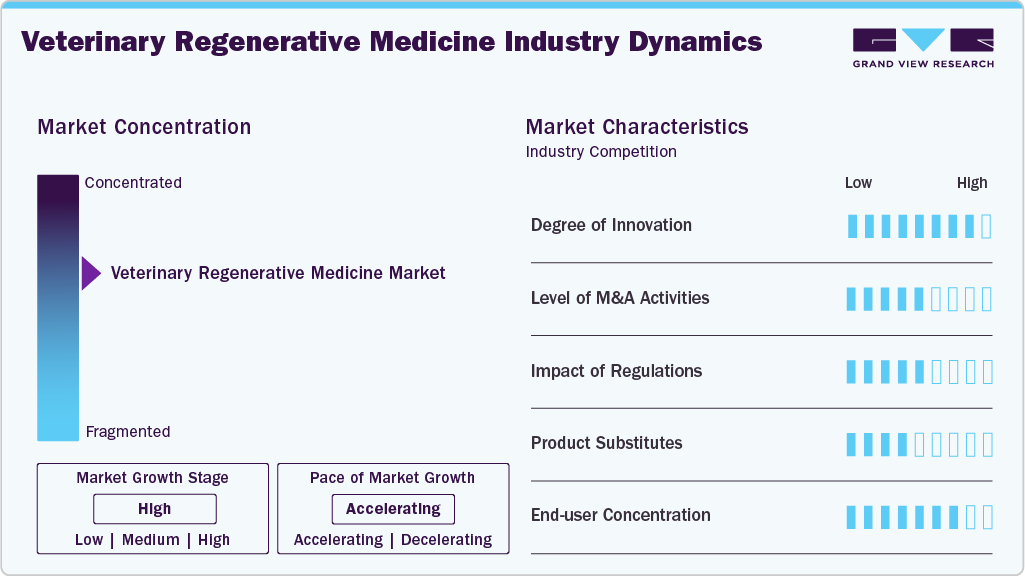

Market Concentration & Characteristics

The veterinary regenerative medicine industry exhibits a high concentration in the market, and the pace of growth is accelerating. The market is dominated by global players such as Zoetis, Boehringer Ingelheim, Dechra, and VetStem, Inc. These companies leverage strong R&D, broad portfolios, and global distribution networks to maintain competitiveness.

The veterinary regenerative medicine industry exhibits high innovation, driven by advances in stem cell therapies, PRP applications, gene therapy, and extracellular vesicle research. Companies are focusing on disease-modifying approaches, moving beyond symptomatic relief. Novel delivery methods, preconditioned cells, and One Health translational research are accelerating breakthroughs, enhancing treatment efficacy across companion, equine, and exotic species. In April 2025, Transcend Biologics launched TropoVet PRP, an advanced one-step platelet therapy enhancing pet healing and recovery, delivering innovative, effective, and accessible regenerative solutions to the growing veterinary medicine market.

M&A activity is moderate but growing, with strategic collaborations between biotech firms, veterinary pharmaceutical companies, and research institutions. For instance, in December 2021. DSM Biomedical and Dechra partner to distribute ProVet regenerative systems, delivering portable, rapid cell and platelet therapies for horses and companion animals. Such deals aim to combine innovation pipelines, regulatory expertise, and distribution networks to accelerate commercialization and gain competitive advantages in emerging therapeutic segments.

Regulations in veterinary regenerative medicine are evolving, with stringent guidelines on product safety, cell sourcing, and clinical evidence. Variations across regions affect market entry timelines and costs. While rigorous approval processes ensure quality, they can delay innovation. Harmonization efforts in the EU and North America foster clarity, aiding long-term investment and global product rollout.

Conventional veterinary treatments like NSAIDs, corticosteroids, surgical interventions, and physiotherapy serve as substitutes, offering more established, lower-cost options. However, they often focus on symptom relief rather than regeneration. As awareness grows around the limitations of traditional care, regenerative medicine’s disease-modifying potential is increasingly favored, reducing the competitive threat from substitutes over the long term.

End users are primarily concentrated among veterinary clinics, specialty hospitals, and equine rehabilitation centers. High-value treatments target companion animal owners willing to invest in advanced care and performance-driven equine sectors. Growing adoption by referral veterinarians and specialist practices drives market penetration, though broader uptake will require cost reductions and wider practitioner training.

Product Insights

Stem cells dominated the market with a revenue share of 51.89% in 2024, driven by their ability to repair, regenerate, and restore damaged tissues in companion and large animals. Widely used for treating osteoarthritis, tendon injuries, and ligament damage, stem cell therapies offer long-term benefits by targeting the root cause of conditions rather than symptoms. Growing clinical evidence, supportive regulatory pathways, and cryopreservation advancements and ready-to-use formulations fuel adoption. For example, in April 2025, VetStem, Inc. secured funding to advance FDA conditional approval of StemStat Ortho, an allogeneic stem cell therapy for canine osteoarthritis, aiming to be the first FDA-approved product in a USD 1 billion market. Strategic collaborations between biotech firms and veterinary providers are enhancing accessibility and innovation.

Platelet-rich plasma (PRP) and other emerging regenerative therapies are the fastest-growing segment in the market, driven by rising adoption for treating musculoskeletal injuries, osteoarthritis, and wound healing in animals. PRP offers a minimally invasive, cost-effective, and natural treatment option that utilizes the animal’s platelets to stimulate tissue repair and reduce inflammation. Increasing awareness among veterinarians and pet owners about its efficacy and advancements in portable PRP systems is boosting market penetration.

Animal Insights

Small animals, particularly cats and dogs, represent the largest segment with a revenue share of 53.41% in 2024 and are among the fastest-growing segments in the market. Rising pet ownership, increased spending on advanced treatments, and growing awareness of regenerative therapies drive demand. Conditions such as osteoarthritis, ligament injuries, and chronic wounds in small animals are increasingly treated with platelet-rich plasma (PRP), mesenchymal stem cells (MSCs), and other biologics. Pet owners’ willingness to invest in high-quality, minimally invasive solutions boosts adoption. Veterinary clinics are expanding regenerative offerings for small animals, supported by ongoing clinical research and technological advancements, positioning this segment as the primary growth engine of the market.

Large animals, including horses and livestock, are emerging as a significant segment in the market. Increasing adoption of stem cell and platelet-based therapies for conditions like lameness, tendon injuries, and joint disorders is driving interest. Advancements in portable treatment systems and rising awareness among breeders, trainers, and farmers are accelerating demand for regenerative solutions in large animal care.

Application Insights

Orthopedics held the largest revenue share of 41.98% in 2024, segment in the market, driven by the high prevalence of musculoskeletal disorders such as osteoarthritis, ligament injuries, and joint degeneration in companion and performance animals. Regenerative therapies like stem cells, Platelet-Rich Plasma (PRP), and bone marrow concentrates are increasingly used to repair damaged cartilage, promote healing, and reduce inflammation. Rising pet life expectancy, obesity-related orthopedic issues, and demand for minimally invasive, long-lasting treatments fuel segment growth. Advancements in product innovation, such as allogeneic “off-the-shelf” solutions, are further expanding accessibility. This dominance is reinforced by strong clinical adoption and increasing investment in orthopedic-focused veterinary research.

Other applications are the fastest-growing segment in the market, encompassing dermatology, wound healing, neurology, dentistry, and ophthalmology. Growth is driven by expanding use of regenerative therapies beyond orthopedics, addressing chronic skin disorders, nerve injuries, oral diseases, and corneal damage in animals. Innovations like PRP, stem cell treatments, and tissue scaffolds are improving recovery outcomes. Rising awareness among veterinarians, coupled with increasing pet owner willingness to explore advanced, minimally invasive solutions, is accelerating adoption and expanding the market’s reach across diverse therapeutic areas.

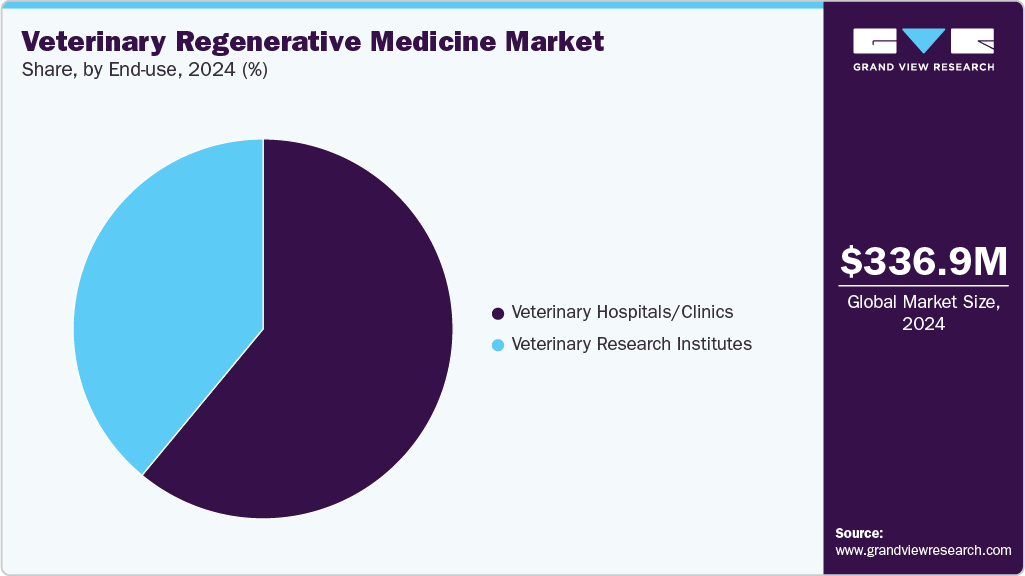

End Use Insights

Veterinary hospitals and clinics represented the largest segment in the market with a share of 61.42% in 2024, serving as primary hubs for administering advanced therapies such as stem cell treatments, PRP, and tissue engineering solutions. Their dominance stems from widespread accessibility, specialized equipment, and trained veterinary professionals capable of delivering complex regenerative procedures. These facilities cater to companion and large animals, driving adoption through integrated diagnostics, treatment, and follow-up care. Increasing partnerships with biotech firms and rising demand for minimally invasive and long-term solutions for conditions like osteoarthritis, injuries, and chronic diseases further solidify their central role in market growth.

The others segment, which includes ocular and intranasal routes of administration, is the fastest growing over the forecast period. These non-invasive delivery methods offer significant advantages such as ease of administration, reduced stress for birds, and improved compliance. Ocular and intranasal vaccines and treatments allow rapid absorption and localized immune response, enhancing disease prevention and control. In addition, these routes minimize the need for injections, lowering labor costs and risk of injury. Growing awareness of animal welfare and advancements in formulation technology are driving the adoption of ocular and intranasal products, making this segment a key growth area in veterinary regenerative healthcare.

Regional Insights

The North America veterinary regenerative medicine market held the largest revenue share of 41.17% in 2024 driven by rising pet ownership, increasing prevalence of osteoarthritis, and demand for minimally invasive treatments. Some companies include VetStem, Boehringer Ingelheim, Dechra, and Transcend Biologics. In June 2025, Gallant secured USD 18 million Series B funding, led by Digitalis Ventures, to advance FDA conditional approval of its first ready-to-use allogeneic stem cell therapy for pets, targeting refractory Feline Chronic Gingivostomatitis by 2026.

U.S. Veterinary Regenerative Medicine Market Trends

The veterinary regenerative medicine market in the U.S. is expanding rapidly, driven by rising pet healthcare spending, increasing osteoarthritis prevalence, and demand for minimally invasive treatments. Advancements in allogeneic stem cell therapies, PRP systems, and FDA-regulated products fuel innovation and strengthen market competitiveness. In April 2025, Vetirus Pharmaceuticals acquired Enso Discoveries, enhancing its regenerative medicine portfolio with patented products like Rebound PRP and Rebound PRF, strengthening global capabilities in delivering innovative, cost-effective healing solutions for veterinary and human health.

Europe Veterinary Regenerative Medicine Market Trends

The veterinary regenerative medicine market in Europe is growing, driven by rising companion animal ownership, equine sports industry demand, and early adoption of advanced therapies. Some players include Boehringer Ingelheim, Dechra, and MSD Animal Health. Innovations such as Arti-Cell Forte, portable PRP/BMC systems, and expanding stem cell applications enhance treatment outcomes and boost regional competitiveness.

The UK veterinary regenerative medicine market is expanding, fueled by increasing pet healthcare spending, strong equine sports demand, and awareness of stem cell and PRP therapies. The Roslin Institute and iC-biosolutions have partnered to develop ready-to-use stem cell preparations, aiming to deliver more effective, affordable regenerative therapies for horses, enhance tissue repair, and advance veterinary medicine efficiency. Advancements like portable ProVet systems and novel stem cell applications are enhancing accessibility, driving innovation, and positioning the UK as a leader in regenerative veterinary care.

Asia Pacific Veterinary Regenerative Medicine Market Trends

The veterinary regenerative medicine market in Asia is the fastest-growing over the forecast period, driven by rising pet ownership, increasing livestock care investments, and growing awareness of advanced treatments. Some of the players include VetStem, Medrego, and VETBIO. Advancements in stem cell therapy, PRP, and portable regenerative systems enhance accessibility, while supportive regulations and collaborations with research institutes foster innovation and market penetration.

India veterinary regenerative medicine market is expanding, driven by rising companion animal care, advances in stem cell research, and government-backed biotech initiatives. Key players include NIAB, StemRx, and Vetbiotech. Innovations like India’s first Animal Stem Cell Biobank in August 2025 and growing collaborations enhance therapeutic options, positioning India as a regional hub for advanced, cost-effective regenerative veterinary solutions.

Latin America Veterinary Regenerative Medicine Market Trends

The veterinary regenerative medicine market in Latin America is growing, fueled by increasing pet ownership, demand for advanced treatments, and rising awareness of regenerative therapies. Some of the companies include VetBR, BioCell, and Regenvet. Advancements in stem cell and PRP therapies and expanding veterinary hospital capabilities are driving adoption, offering cost-effective solutions for orthopedic, wound healing, and chronic disease management in companion animals.

Brazil veterinary regenerative medicine market is expanding, driven by rising pet healthcare spending, advanced therapies for chronic conditions, and growing awareness. Key players like Ourofino Saúde Animal led innovations by launching a stem cell treatment for dogs in August 2022. Technological advancements, supportive regulations, and increasing adoption of regenerative solutions position Brazil as a key growth hub in Latin America.

Middle East & Africa Veterinary Regenerative Medicine Market Trends

The veterinary regenerative medicine market in MEA is gaining momentum, driven by rising pet ownership, equine sports demand, and advancing biotech infrastructure. Key innovators like Pet Pavilion (UAE) are offering stem cell and PRP therapies, while regional markets such as Saudi Arabia and the UAE are leading adoption. In March 2022, Qatar Foundation’s EVMC launched Inara, a biobank for preserving horse DNA, stem cells, and tissues, enabling rapid regenerative treatments for injuries by ensuring timely access to stored genetic and cellular materials. Collaboration with international biotech firms and regulatory support is accelerating accessibility and innovation.

South Africa veterinary regenerative medicine market is fast emerging, driven by growing pet ownership and demand for advanced orthopedic care. Stem cell therapies represent the largest segment, while other products are the fastest growing. Key providers such as Valley Farm Animal Hospital (in partnership with VetRenew) and Blue Hills Veterinary Hospital are advancing accessibility, signaling a strengthening and innovation-driven regional market.

The Saudi market is gaining traction, propelled by rising pet ownership, expanding veterinary infrastructure, and government investment in biotech research. Biologics and regenerative therapies are the fastest-growing segments, backed by collaborations with global firms. Institutions such as VetStem, Arti-Cell Forte, and emerging regional biotech innovators are advancing stem cell and PRP applications in companion and livestock care.

Key Veterinary Regenerative Medicine Company Insights

Major players, including Zoetis, Dechra, Boehringer Ingelheim, and VetStem, Inc., command significant market share, leveraging broad product portfolios, global distribution, and strong regulatory compliance. They are advancing through innovations in recombinant and vector-based vaccines, expansion into emerging regions, and strategic M&A activities. Nonetheless, regulatory hurdles, high R&D costs, and tighter antibiotic restrictions are influencing competition; while emerging and regional companies gain momentum with cost-effective, targeted solutions tailored to local disease challenges and resource constraints.

Key Veterinary Regenerative Medicine Companies:

The following are the leading companies in the veterinary regenerative medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Dechra

- Integra Lifesciences

- Vetherapy

- Vetstem, Inc.

- Ardent

- Enso Discoveries

- Animal Cell Therapies, Inc.

- Vetbiologics

- Medrego

- Celavet Inc.

Recent Developments

-

In July 2025, Gallant raised USD 18 million in Series B funding to advance off-the-shelf stem cell therapies, including treatment for refractory feline chronic gingivostomatitis, using mesenchymal stem cells from the uterus.

-

In April 2025, Vetirus Pharmaceuticals acquired Kansas-based Enso Discoveries, enhancing its regenerative medicine portfolio and expanding capabilities to deliver innovative, cost-effective biologic therapies for animals and humans globally.

-

In April 2025, Transcend Biologics launched TropoVet PRP, a one-step veterinary platelet purification system that enables on-site extraction of concentrated PRP to accelerate healing, reduce pain, and enhance recovery in animals.

-

In March 2025, VetStem secured funding to complete regulatory submissions for StemStat Ortho, aiming for FDA conditional approval as the first allogeneic stem cell therapy for canine osteoarthritis.

Veterinary Regenerative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 373.20 million

Revenue forecast in 2033

USD 987.85 million

Growth rate

CAGR of 12.94% from 2025 to 2033

Historical Period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Dechra; Integra Lifesciences; Vetherapy; Vetstem, Inc.; Ardent, Enso Discoveries; Animal Cell Therapies, Inc.; Vetbiologics; Medrego; Celavet Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Regenerative Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary regenerative medicine market report based on animal, product, application, end use and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Stem Cells

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Trauma/Wound Care

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals/Clinics

-

Veterinary Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary regenerative medicine market size was estimated at USD 336.86 million in 2024 and is expected to reach USD 373.20 million in 2025.

b. The global veterinary regenerative medicine market is expected to grow at a compound annual growth rate of 12.94% from 2025 to 2033 to reach USD 987.85 million by 2033.

b. North America dominated the veterinary regenerative medicine market with a share of 41.17% in 2024. This is attributable to the greater awareness of the therapy and presence of huge number of facilities that provide stem cell therapy services.

b. Some key players operating in the veterinary regenerative medicine market include VetStem, Inc.; Vetherapy; Boehringer Ingelheim International GmbH; Vetbiologics; Animal Cell Therapies, Inc.; Ardent; Zoetis; Dechra; ACell Inc. (Integra LifeSciences); Enso Discoveries.

b. Key factors that are driving the veterinary regenerative medicine market growth include increasing pet industry spending, greater access to veterinary care, increasing prevalence of soft tissue injuries and osteoarthritis in animals, as well as various benefits of animal stem cell therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.