- Home

- »

- Automotive & Transportation

- »

-

Vessel Traffic Management System Market Size Report, 2030GVR Report cover

![Vessel Traffic Management System Market Size, Share & Trends Report]()

Vessel Traffic Management System Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Service), By Type, By End-use (Commercial, Defense), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-370-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

VTMS Market Summary

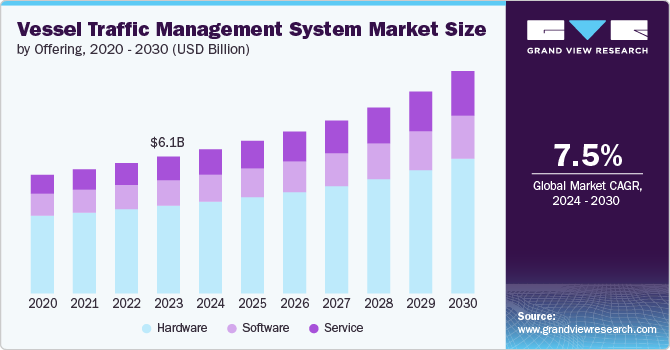

The global vessel traffic management system market size was valued at USD 6.12 billion in 2023, and is expected to reach USD 9.95 billion by 2030, growing at a CAGR of 7.5% from 2024 to 2030. Vessel traffic management systems (VTMS) are a cornerstone of modern port operations, playing a vital role in ensuring safe and efficient maritime traffic flow.

Key Market Trends & Insights

- The Asia Pacific region dominated the vessel traffic management systemmarket in 2023 and accounted for a 40.2% share of the global revenue.

- The vessel traffic management system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- By offering, the hardware segment dominated the market in 2023 and accounted for a 64.1% share of global revenue.

- By type, the A to N management & health monitoring systems segment dominated the market in 2023.

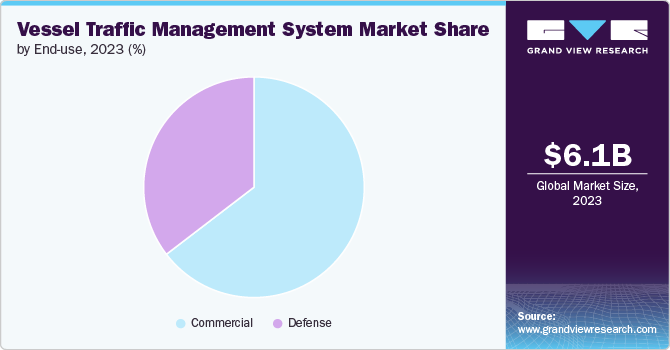

- By end-use, the commercial segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.12 Billion

- 2030 Projected Market Size: USD 9.95 Billion

- CAGR (2024-2030): 7.5%

- Asia Pacific: Largest market in 2023

These systems use real-time data from radars and Automatic Identification Systems (AIS) to provide comprehensive situational awareness of vessel movements within designated areas like ports and waterways. This data allows port authorities to proactively monitor and manage traffic congestion, prevent collisions, and optimize movement for improved efficiency. The VTMS market is a comprehensive solution for monitoring and managing maritime traffic in busy areas like ports, waterways, and shipping lanes. It encompasses three key components - onboard systems like radars, Automatic Identification System (AIS), and communication equipment that collect vessel data; shore-based systems including traffic monitoring software, data analysis tools, communication infrastructure, and control centers that process and visualize the information; and services such as data analysis, route planning, incident management, and training to ensure smooth and safe maritime operations.

The VTMS market is poised for a surge driven by a confluence of factors. The ever-expanding volume of global maritime trade demands efficient traffic management to ensure smooth flow and prevent accidents. Furthermore, stricter regulations from the International Maritime Organization (IMO) mandate VTMS implementation in critical areas, further propelling market adoption. Technology plays a crucial role as well. Integration of 5G, IoT, and AI promises to enhance data collection, analysis, and decision-making capabilities. The growing focus on sustainability adds another layer of opportunity. VTMS can optimize routes and improve fuel efficiency, aligning perfectly with the shipping industry's push for a greener future. These combined forces paint a promising picture for the VTMS market's continued growth.

While the VTMS market boasts significant potential, some hurdles could impede its growth trajectory. Implementing a robust VTMS can be a costly endeavor, especially for smaller ports and developing countries, presenting a financial barrier to entry. Additionally, the market faces heightened cybersecurity risks. As reliance on digital systems increases, concerns about cyberattacks and data breaches become more prominent. However, seamlessly integrating various technologies and systems from different vendors is still a challenge, requiring innovative solutions to ensure smooth information flow within the VTMS architecture. Addressing these roadblocks will be crucial for the market to capitalize on its full potential.

The VTMS market boasts exciting avenues for expansion. As developing economies ramp up their maritime infrastructure, the demand for VTMS solutions is poised to skyrocket. This presents a significant opportunity for market players to cater to this growing segment. Additionally, the rise of autonomous vessels creates a compelling need for advanced VTMS capabilities. These next-generation systems will be crucial for ensuring the safe integration of autonomous vessels with traditional maritime traffic. Finally, data analytics and advanced visualization tools offered as value-added services can unlock valuable insights into traffic patterns, leading to significant operational efficiency gains for ports and shipping companies. By capitalizing on these emerging trends, the VTMS market can solidify its position as a critical driver of safe and efficient maritime operations.

Offering Insights

The hardware segment dominated the market in 2023 and accounted for a 64.1% share of global revenue. Hardware includes radars, AIS transponders, communication equipment, and onboard sensors. The dominance is driven by the need for robust data collection infrastructure as the foundation of any VTMS system. Additionally, stricter regulations mandating specific hardware installations on vessels further fuel this segment's growth. However, with the increasing focus on data analysis and optimization, the service segment is expected to gain significant traction in the coming years.

The service segment is projected to witness significant growth from 2024 to 2030. The segment encompasses data analysis, route planning, incident management, and training. This growth is attributed to the increasing complexity of maritime traffic and the need for advanced tools to optimize operations and ensure safety. As VTMS systems generate vast amounts of data, advanced analytics services are becoming critical for extracting meaningful insights and optimizing traffic flow. Additionally, the rise of autonomous vessels will further propel the service segment, as these vessels will require specialized training and sophisticated route planning tools for safe integration into existing maritime traffic.

Type Insights

The A to N management & health monitoring systems segment dominated the market in 2023. These systems provide real-time information on vessel positions, identification, and status, which is crucial for traffic monitoring and collision avoidance. Regulatory mandates requiring AIS compliance significantly contribute to the dominance of this segment. Additionally, health monitoring systems integrated into VTMS offer valuable insights into vessel performance and can be used for preventative maintenance, reducing downtime and ensuring operational efficiency.

The port management information systems segment is projected to witness significant growth from 2024 to 2030. This growth is fueled by the increasing traffic congestion in major ports worldwide. PMIS integrates VTMS data with other port operations data, such as cargo handling schedules and berth availability. This allows for better resource allocation, optimized vessel turnaround times, and improved overall port efficiency. As maritime trade continues to expand, the demand for PMIS solutions is expected to rise significantly.

End-use Insights

The commercial segment dominated the market in 2023. This segment encompasses merchant ships, container vessels, tankers, and other vessels involved in global trade. The increasing volume of global maritime trade necessitates robust VTMS solutions to ensure smooth traffic flow and prevent accidents. Additionally, rising insurance costs and stricter environmental regulations are driving the adoption of VTMS within the commercial shipping sector.

The defense segment is projected to witness significant growth from 2024 to 2030. This growth is driven by the growing need for maritime security and border control. VTMS can be used to monitor and track vessels in territorial waters, identify potential threats, and enhance overall maritime awareness for defense agencies. Additionally, the rise of piracy and other maritime security threats further fuels the adoption of VTMS solutions in the defense sector.

Regional Insights

The vessel traffic management system market in North America is expected to witness steady growth from 2024 to 2030. Aging infrastructure in many ports necessitates upgrades to meet modern traffic management demands. The U.S. Coast Guard's implementation of stricter regulations mandating VTMS adoption in key waterways further pushes market expansion. Additionally, North American companies are at the forefront of developing next-generation VTMS solutions, incorporating cutting-edge technologies like Artificial Intelligence (AI) and Internet of Things (IoT) to enhance capabilities. However, budget constraints faced by smaller ports and the potential for trade disputes impacting maritime traffic volume pose a challenge to market growth. Despite these hurdles, North America's focus on innovation and infrastructure upgrades positions it as a major player in the evolving vessel traffic management system market.

U.S. Vessel Traffic Management System Market Trends

The vessel traffic management system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The extensive network of busy ports and waterways necessitates robust VTMS solutions to ensure smooth traffic flow and prevent accidents. The region’s position as a major player in global trade contributes significantly to maritime traffic volume, further driving the need for advanced VTMS systems. Government funding initiatives allocated for upgrading port infrastructure, including VTMS systems, provide a crucial boost to market growth. However, the saturation of the market in some mature U.S. ports might limit growth potential in specific segments. Moving forward, the U.S. market is expected to focus on optimizing existing solutions and integrating advanced technologies to maintain its leadership position.

Asia Pacific Vessel Traffic Management System Market Trends

The Asia Pacific region dominated the vessel traffic management systemmarket in 2023 and accounted for a 40.2% share of the global revenue. The region's booming economies are leading to increased maritime trade and port traffic, creating a strong demand for efficient traffic management solutions. Governments in the Asia Pacific are strategically investing heavily in developing and upgrading their maritime infrastructure, including VTMS systems, to support economic growth and enhance overall maritime efficiency. Emerging markets like India and China represent significant growth opportunities for VTMS vendors, offering vast potential for market expansion. However, fragmentation in the regional market due to the presence of numerous local players and varying regulatory landscapes can pose challenges for market entry and expansion. Overcoming these challenges by developing strategic partnerships and adapting solutions to local regulations will be crucial for companies seeking to capitalize on the immense potential of the Asia Pacific VTMS market.

The vessel traffic management system market in Japan is expected to grow at a significant CAGR from 2024 to 2030.Japan boasts a long and rich history of maritime trade, resulting in sophisticated port infrastructure equipped with well-established and advanced VTMS systems. The country enforces stringent regulations regarding maritime safety, necessitating the adoption of advanced VTMS solutions that provide real-time data and robust traffic monitoring capabilities. Furthermore, Japanese companies are at the forefront of technological innovation in the marine traffic management industry, continuously developing and deploying next-generation solutions to further enhance maritime safety and efficiency. However, reaching market saturation in mature markets like Japan might limit future growth potential within the country. Moving forward, the focus may shift towards optimizing existing systems and exploring opportunities for collaboration with emerging markets within the region.

Europe Vessel Traffic Management System Market Trends

The vessel traffic management system market in Europe is expected to grow at a significant CAGR from 2024 to 2030. The European Union plays a crucial role by enforcing strict regulations on maritime safety, effectively mandating the adoption of VTMS across the region. This regulatory push, coupled with ongoing modernization initiatives by European ports to upgrade their infrastructure, create a consistent demand for advanced VTMS solutions. Additionally, a growing focus on sustainability within the European maritime sector adds another layer of opportunity.

VTMS offers valuable tools for optimizing traffic flow, leading to reduced fuel consumption and, ultimately, lower maritime emissions. This aligns perfectly with the European Union's environmental goals. However, the market is not without its challenges. Economic fluctuations within the Eurozone can create uncertainties and potentially slow down investment in new VTMS solutions. Furthermore, the recent political and economic separation of the U.K. from the European Union (Brexit) poses a potential risk of trade disruptions, impacting maritime traffic volume and consequently, the demand for VTMS systems. Navigating these challenges and capitalizing on the strong regulatory framework and focus on sustainability will be key for the continued growth of the European VTMS market.

The vessel traffic management system market in France is expected to grow at a significant CAGR from 2024 to 2030.As home to some of Europe's busiest ports, France need for advanced VTMS solutions to ensure efficient and safe traffic management. This necessity has fostered a robust ecosystem of French companies at the forefront of developing and deploying cutting-edge VTMS technologies. French technological expertise combined with active government support for developing and adopting next-generation VTMS solutions further propels France's position as a leader in the European VTMS market. However, France faces competition from other European countries with strong maritime sectors. These competitors also possess advanced technologies and are vying for market share. To maintain its leadership position, France may need to focus on strategic partnerships, continuous innovation, and offering cost-competitive solutions that cater to the specific needs of a diverse European market.

Key Vessel Traffic Management System Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, the U.S. and Canadian authorities signed an agreement to improve safety and efficiency of maritime traffic across the Great LakesMarine Transportation System. The agreement focuses on information sharing to reduce human error and improve situational awareness.

-

In March 2020, Wärtsilä has upgraded the Vessel Traffic Management System (VTMS) at the Cochin port in India. This upgrade will improve safety and efficiency by providing seamless coverage of the port's radar and automatic identification system. The existing system, installed in 2008, has helped manage increased traffic from major projects at the port. Upgrading the VTMS will ensure it meets future requirements and technological advancements.

Key Vessel Traffic Management System Companies:

The following are the leading companies in the vessel traffic management system market. These companies collectively hold the largest market share and dictate industry trends.

- Hanwha Systems Co., Ltd.

- HENSOLDT AG

- Japan Radio Co.

- Kongsberg Gruppen

- Leonardo S.p.A.

- Rohde & Schwarz

- Saab AB

- ST Engineering

- Thales Group

- Wärtsilä.

Vessel Traffic Management System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.45 billion

Revenue forecast in 2030

USD 9.95 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Hanwha Systems Co., Ltd.; HENSOLDT AG; Japan Radio Co.; Kongsberg Gruppen; Leonardo S.p.A.; Rohde & Schwarz; Saab AB; ST Engineering; Thales Group; Wärtsilä

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vessel Traffic Management System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vessel traffic management system market report based on offering, type, end-use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Communication

-

Surveillance & Monitoring

-

Navigation

-

-

Software

-

Service

-

Maintenance Service

-

Operation Service

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

A to N Management & Health Monitoring Systems

-

Global Maritime Distress Safety System

-

Port Management Information Systems

-

River Information Systems

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vessel traffic management system market size was estimated at USD 6.12 billion in 2023 and is expected to reach USD 6.45 billion in 2024.

b. The global vessel traffic management system market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030, reaching USD 9.95 billion by 2030.

b. Asia Pacific dominated the vessel traffic management system market, with a share of 40.2% in 2023. The region's booming economies are leading to increased maritime trade and port traffic, creating a strong demand for efficient traffic management solutions. Emerging markets like India and China represent significant growth opportunities for VTMS vendors, offering vast potential for market expansion.

b. Some key players operating in the vessel traffic management system market include Hanwha Systems Co., Ltd., HENSOLDT AG, Japan Radio Co., Kongsberg Gruppen, Leonardo S.p.A., Rohde & Schwarz, Saab AB, ST Engineering, Thales Group, and Wärtsilä

b. The vessel traffic management system market is expected to grow significantly, driven by the ever-expanding volume of global maritime trade demands for efficient traffic management to ensure smooth flow and prevent accidents. Furthermore, stricter regulations from the International Maritime Organization (IMO) mandate VTMS implementation in critical areas, further propelling market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.