- Home

- »

- Next Generation Technologies

- »

-

Vertical Farming Market Size & Share, Industry Report, 2033GVR Report cover

![Vertical Farming Market Size, Share, & Trends Report]()

Vertical Farming Market (2026 - 2033) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Services), By Growing Mechanism (Aeroponics, Hydroponics, Aquaponics), By Crop Category, By Structure, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-797-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vertical Farming Market Summary

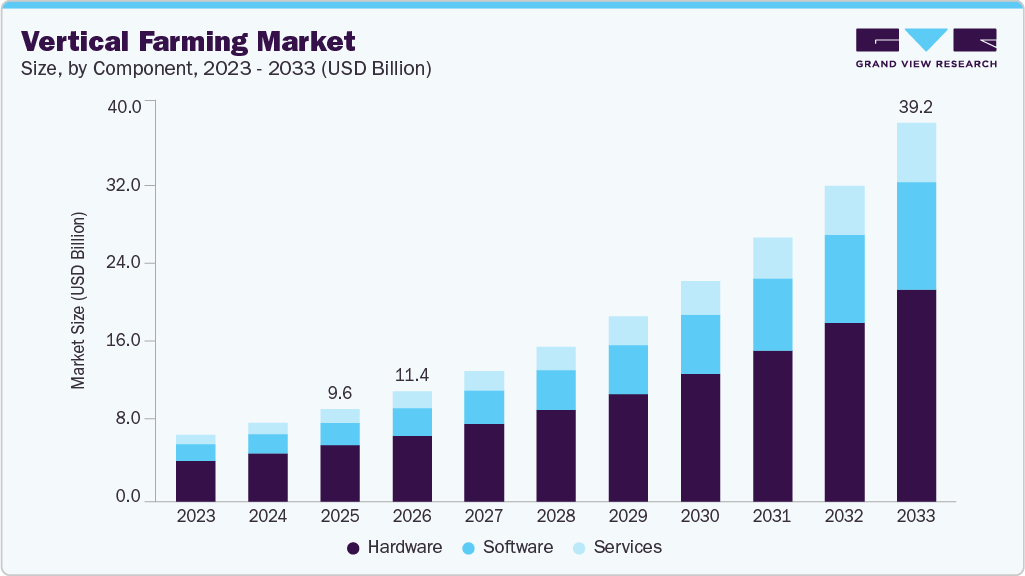

The global vertical farming market size was valued at USD 9.62 billion in 2025 and is anticipated to reach USD 39.20 billion by 2033, growing at a CAGR of 19.3% from 2026 to 2033. The growth of the vertical farming market is attributed to increasing consumer demand for organic food is positively impacting the growth of the vertical farming market, creating favorable business opportunities.

Key Market Trends & Insights

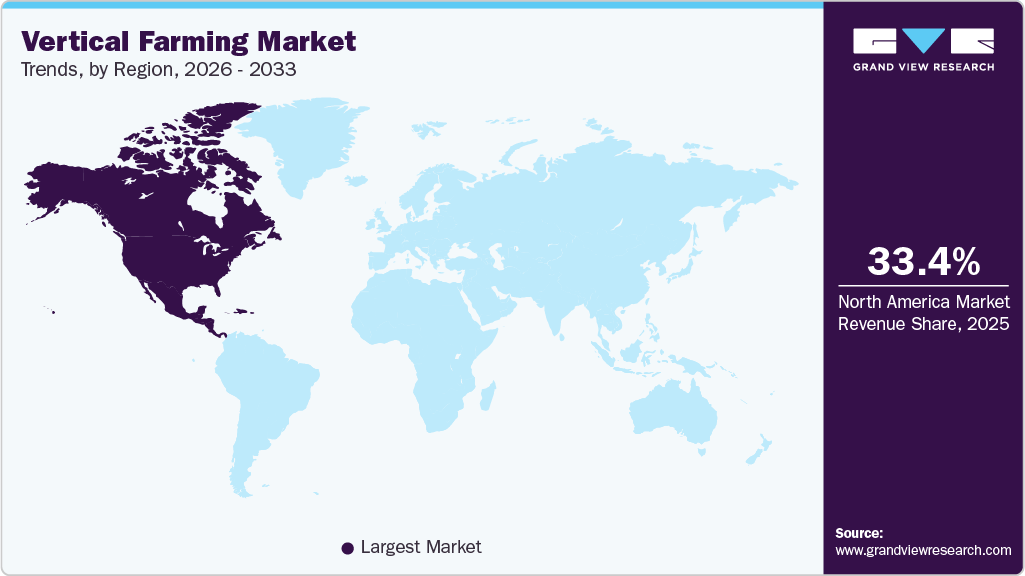

- North America held 33.4% revenue share of the global vertical farming market in 2025.

- In the U.S., the increasing digital maturity of U.S. farms is accelerating market growth.

- By component, the hardware segment held the largest revenue share of 60.6% in 2025.

- By growing mechanism, the hydroponics segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9.62 Billion

- 2033 Projected Market Size: USD 39.20 Billion

- CAGR (2026-2033): 19.3%

- North America: Largest market in 2025

Vertical farming is the practice of producing food in vertically stacked layers, such as in a used warehouse, skyscraper, or shipping container. Organic foods are perceived as healthier, more nutritious, safer, and more environmentally friendly. A critical factor influencing demand for organic food is the purchasing behavior of consumers, which is essential for producers, policymakers, and suppliers to implement successful marketing strategies.Obesity and heart disease are prevalent health-related issues among consumers. Furthermore, the growing depletion of groundwater and changing climatic conditions have urged traditional growers to adopt alternative farming methods. Increasing consumer concerns about health and the abovementioned factors are likely to elevate industry demand.

Unlike traditional farming, indoor farming can produce crops throughout the year, which results in increased productivity. Furthermore, indoor farming can protect crops from extreme weather conditions through the usage of techniques such as controlled environment agriculture technology, where facilities use artificial environmental control, control of light, and fertigation.

Increasing demand for high-quality food, independent agricultural techniques, and growing urbanization are some of the key factors driving market growth. These factors have increased the requirement for food. The demand for food is expected to experience significant growth due to a growing population by 2030. The adoption of vertical cultivation techniques allows consumers to grow crops in a warehouse or a multi-story building.

Vertical farms are becoming technologically advanced, with the use of LED lights and automated control systems to tailor to the growing environment. Several vertical farm service providers are locating their facilities near urban hubs to capitalize on the increasing demand for local food. Therefore, as the industry becomes increasingly capital-intensive, utilizing venture funding and other sources to build infrastructure is necessary to compete in the current market. Various industries, particularly the food & beverage sector, were negatively impacted by the labor shortage and supply chain disruptions. However, the COVID-19 outbreak created several opportunities for the vertical farming sector. Urban agriculture has become more popular because of the pandemic. For instance, the East Japan Railway Company and Infarm joined forces in February 2020 to supply fresh food cultivated and harvested in retail outlets. These new developments are expected to provide future growth opportunities in these countries.

Component Insights

The hardware segment accounted for the largest market share of over 61.0% in 2025 in the vertical farming market. Hardware plays a significant role in maintaining an environment in vertical farming. The segment is further categorized into lighting, hydroponic components, climate control, and sensors. The lighting segment led the market revenue in 2025. A large share of the lighting segment can be attributed to the dependence of vertical farms on artificial lighting. Artificial lights provide sufficient light intensities required for crop growth. The climate control segment is expected to register the highest CAGR over the forecast period. Increasing adoption of hydroponic components by farmers to minimize weight load and infrastructure needed to support equipment is anticipated to drive demand for hydroponic components.

Climate control is a kind of agriculture where plants are grown inside a greenhouse under a controlled environment that allows growers to maintain and monitor the proper supply of light, carbon dioxide, water, humidity, pH levels, and nutrients for crop growth. The main aim of climate control farming is to facilitate protection and maintain optimum growth conditions throughout the development period of the crop. In many cases, climate-controlled farming is used to ensure that plants receive optimal nutrients for their growth.

Farming with the help of lighting technology ensures consistent plant growth by reducing heat stress on the root zone and providing uniform lighting. The use of LED lighting technology acts as a supplementary light source to the sun and ensures increased productivity with minimum power usage. Sensors enable comprehensive monitoring of the external environment and crop conditions. Various sensors, such as nutrient sensors, humidity sensors, and light sensors, are used to monitor crop growth. Monitoring also enables notification of changes and alerts.

Automation in vertical farming aims at minimizing time to market, reducing distribution, production, and environmental costs, and standardizing high quality. IoT has become a mainstream technology that drives several industries, such as transportation, manufacturing, and agriculture. The proliferation of IoT has revolutionized the agriculture industry.

The software segment is expected to grow significantly during the forecast period due to emerging trends in technology and farming practices. Software may identify growers, crop batch, land or field, and supplier information for fruits and vegetables. Since cloud-based software gathers millions of data points in real-time that can be analyzed with machine learning techniques to ascertain how changes in specific environmental parameters affect the yield and flavor of finished products, it is anticipated that the market will grow significantly in years to come.

Growing Mechanism Insights

The hydroponics segment accounted for the largest market share in 2025 in the vertical farming market. Hydroponics is a popular growth mechanism due to low installation costs and ease of operation. It is a method of growing plants without soil, where soil is replaced by a mineral solution inserted around plant roots. Additionally, the hydroponics method removes the risk of soil organisms causing diseases. Growing awareness among consumers regarding the effects of pesticides is expected to boost demand for hydroponics. Hydroponically grown plants produce greater yields than similar plants grown in soil because of proper control over nutrients. In addition, plant roots are submerged under a chemical solution and checked periodically to ensure appropriate chemical composition is maintained for growth.

The aquaponics segment is anticipated to expand significantly during the forecast period. Aquaponics is an integration of hydroponics and aquaculture, which eliminates the need for harmful chemicals for cultivation. Plants such as lettuce, chives, peppers, kale, mint, cucumbers, and peas are grown through aquaponics. Water used in aquaponics systems contains fish waste that becomes nutrient-rich and increases crop production time. This creates a sustainable natural system, which eliminates the need for chemicals to produce food.

Crop Category Insights

The fruits, vegetables, & herbs segment accounted for the largest market share in 2025 in the vertical farming industry. Increasing cultivation of commonly grown fruits and vegetables in vertical farming is driving segment growth. Crops grown in vertical farming provide maximum profit to companies involved in their cultivation. At the same time, vertical farming improves biodiversity as it does not cause land disturbances. As such, vertical farming is in high demand for growing different types of crops. Further, fruits, vegetables, & herbs are segmented into tomato, lettuce, bell peppers, chili peppers, strawberry, cucumber, leafy greens (excluding lettuce), herbs, and others. The tomatoes segment led the market and accounted for more than 24.4% of global fruits, vegetables, & herbs revenue in 2025. This large share is attributed to the high average demand for tomatoes in all regions, compared to other crops such as lettuce, leafy greens, peppers, cucumbers, and herbs. Some of the most commonly grown vegetables, herbs, and fruits across different regions include strawberries, lettuce, bell, chili peppers, tomato, cucumber, and leafy greens, among others. One of the important factors behind growing any crop in vertical farming is to validate the economic viability of that crop, which ensures that the company is making a large amount of money from its cultivation.

Similarly, the time taken for crops to grow fully is one of the criteria because some vegetables like lettuce and mint grow fast, whereas herbs and some fruiting crops take more time to grow but can have higher margins than many other plants. As a farmer, it is imperative to make sure that we can sell what we grow, and production costs should not be too high. In order to make this decision, the kind of crops also plays a very vital role in the feasibility study of vertical farming. Lettuces have shown consistent demand globally that has enhanced its cultivation.

The flowers and ornamentals segment is anticipated to grow significantly during the forecast period. Increasing usage of flowers and ornamentals for decorative and aesthetic purposes is anticipated to boost market growth. Also, vertical farming has gained popularity in growing edible flowers, which include marigolds, matthiol, cloves, and snapdragons. The segment has been further segregated into perennials, annuals, and ornamentals. Ornamentals flowers held the largest market share in 2025, owing to increasing sales.

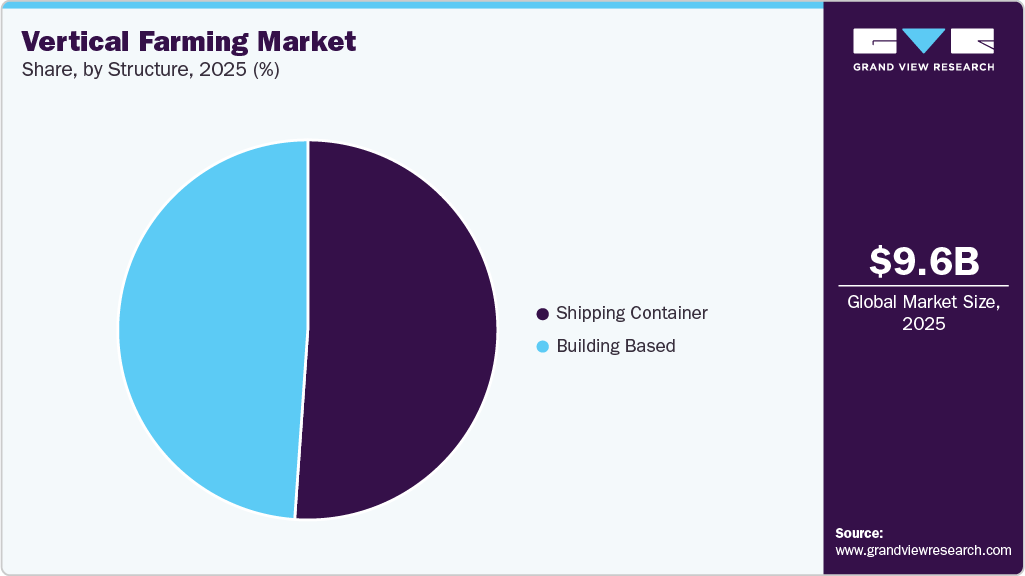

Structure Insights

The shipping container segment dominated the market in 2025. This growth is attributed to the ability of structure to help grow crops irrespective of geographic location. One of the primary benefits of container-based farming is that container farms are easy to transport, and one doesn't require a large piece of land or dedicated building to start cultivating. Moreover, the price of shipping containers decreases with increased competition because the cost of acquiring used containers is relatively less, which gives other companies an opportunity to enter the market space. However, low comparative output and antagonism between light, heat, and layout are some of the drawbacks of such a kind of agriculture.

Factors such as growing technological advancements and increasing penetration of precision farming are anticipated to drive the shipping container segment over the forecast period. A building-based segment is widely accepted in Japan, China, and other Asian countries, and it is the fastest-growing segment in terms of revenue owing to its growing acceptance in the region. Building-based farming helps minimize cultivation costs and requires larger farming areas than single farming land, hence ensuring food security. Shipping container-based farming uses 95% less water than traditional cultivation with drip irrigation. Shipping containers are easy to modify, stackable, durable, and can be recycled and refurbished at lower cost. Additionally, the surplus availability of unused shipping containers across the globe is likely to influence segment growth over the forecast period.

The building based segment is anticipated to grow significantly during the forecast period. The rising demand for hyper-local and fresh produce among urban consumers who prioritize sustainability, food traceability, and reduced carbon footprints is driving segment growth. By producing food closer to the point of consumption, building-based vertical farms eliminate the long supply chains and transportation emissions associated with traditional agriculture. This farm-to-fork proximity also reduces food spoilage and enhances the freshness and nutritional value of produce, making it highly attractive to health-conscious consumers and premium retail markets.

Regional Insights

North America held the major share of over 33.4% of the vertical farming industry in 2025. Advancements in hydroponic and aeroponic farming techniques are also contributing to the growth of the vertical farming market in North America. These soil-less farming methods use nutrient-rich water or air to nourish plants, allowing them to grow faster and more efficiently than traditional farming methods. Hydroponics and aeroponics can be used in vertical farming systems to maximize space utilization and minimize water and resource waste. These technologies are highly compatible with urban environments and are increasingly being adopted in vertical farming operations.

U.S. vertical farming industry is anticipated to witness significant growth from 2026 to 2033. The advancements in renewable energy integration are contributing significantly to the growth of the vertical farming market in the U.S. As renewable energy sources such as solar and wind power become more affordable and widely available, vertical farming operations are increasingly utilizing these sources to power their facilities. Since vertical farms require significant amounts of electricity for lighting, climate control, and irrigation systems, transitioning to renewable energy sources allows farms to reduce their carbon footprint and operational costs. This integration of sustainable energy sources aligns with the overall goals of vertical farming to minimize environmental impact and make agriculture more energy-efficient.

Europe Vertical Farming Market Trends

The vertical farming market in Europe is growing significantly from 2026 to 2033. Over the forecast period, the market is expected to witness consistent growth. The European vertical farming market is experiencing robust growth, driven by the region's increasing focus on sustainable agriculture and food security. With a rising population and limited availability of arable land, European countries are turning to vertical farming as a way to produce food efficiently within urban environments. Vertical farming allows crops to be grown in stacked layers, often using hydroponic or aeroponic systems that consume significantly less water and land compared to traditional farming methods. This method of cultivation aligns closely with the European Union's Green Deal and Farm to Fork strategies, both of which emphasize reducing the environmental footprint of agriculture and increasing the resilience of food systems. As urban centers grow and climate change continues to disrupt conventional farming, vertical farming presents a reliable alternative for fresh food production close to consumer bases.

The vertical farming market in UK is projected to grow significantly from 2026 to 2033. The UK vertical farming market is gaining momentum due to a combination of food security concerns, post-Brexit agricultural policy shifts, and climate challenges. With increasing pressure on domestic food production and an unstable import landscape, vertical farming offers a resilient and controlled method of agriculture that is less susceptible to weather disruptions or supply chain delays. The UK’s unpredictable climate, coupled with more frequent extreme weather events, has made traditional farming riskier and less reliable. Vertical farms, often established in urban or peri-urban areas, provide year-round crop production in controlled environments.

The vertical farming market in Germany is projected to grow significantly from 2026 to 2033. Germany’s growth in engineering and automation is fueling innovations in vertical farming technologies. With a strong base of manufacturers, robotics companies, and AI developers, German firms are advancing automation in vertical farming facilities, from climate control systems to harvesting robots and nutrient delivery mechanisms. These innovations enhance efficiency and reduce operational costs, making vertical farming more scalable and economically viable. Government-funded research institutions and public-private partnerships are also investing in agri-tech R&D, further strengthening the technological backbone of the country’s vertical farming sector.

Asia Pacific Vertical Farming Market Trends

The vertical farming market in Asia Pacific is growing significantly from 2026 to 2033. The increasing demand for fresh, pesticide-free, and locally-grown produce is driving market growth. Asia Pacific has witnessed several food safety scandals in recent years, particularly in countries like China, which has heightened consumer sensitivity towards the origin and safety of their food. Vertical farming ensures a controlled and contamination-free environment, minimizing the use of chemical inputs and providing consistent produce quality. This has led to a rise in consumer trust in vertically farmed foods, particularly in high-income and health-conscious populations.

The vertical farming market in the China is growing significantly from 2026 to 2033. The increasing adoption of smart technologies and automation is propelling the vertical farming sector forward in China. The integration of artificial intelligence (AI), the Internet of Things (IoT), and robotics has enabled data-driven farming operations that improve resource efficiency, crop yields, and scalability. Chinese tech companies and agri-tech startups are collaborating to develop sophisticated indoor farming modules that can be easily deployed in urban settings, further enhancing accessibility and efficiency. These smart farms not only address labor shortages in agriculture but also ensure consistent production of high-quality crops throughout the year.

The vertical farming industry in India is growing significantly from 2026 to 2033. The growing interest in urban farming solutions is a powerful driver of vertical farming in India. With urban populations soaring and available agricultural land shrinking, cities are increasingly looking for innovative ways to grow food locally. Vertical farming, with its ability to be established in small spaces such as rooftops, warehouses, and vacant buildings, offers a solution to food production within city limits. Urban farming reduces the need for long supply chains, limits food spoilage, and offers fresher produce. The rise of urban farming communities and government initiatives promoting urban agriculture is accelerating the adoption of vertical farming in India’s metropolitan areas, further boosting the market.

Key Vertical Farming Company Insights

Some of the key players operating in the market include Signify Holding and EVERLIGHT ELECTRONICS CO., LTD.

-

Signify Holding is a global provider in the lighting market. The company focuses on providing advanced LED lighting solutions specifically designed for high-tech horticulture and vertical agriculture. Their lighting products are tailored to support the growth of a wide range of crops, offering the right spectrum and intensity to optimize plant yields and quality. Signify also provides business advice and product support to help growers build viable vertical farming business models.

-

EVERLIGHT ELECTRONICS CO., LTD. is a leading manufacturer and supplier of high-power LEDs and infrared components. The company offers products such as high-power LEDs, Surface-Mount Device (SMD) LEDs, lamps, LED lighting modules, lighting components, optocouplers, digital displays, and infrared components for several applications, including agriculture, appliances, automotive, consumer products, and industrial. The company has marked its presence in countries such as China, India, Germany, the U.S., Canada, Japan, Hong Kong, and Korea.

iFarm and LOGIQS B.V. are some of the emerging market participants in the target market.

-

iFarm is an ag-tech company specializing in developing advanced software and hardware solutions for vertical farming and hydroponics. iFarm provides turnkey modular vertical farming systems designed for the automated, pesticide-free cultivation of a wide range of crops, including leafy greens, microgreens, berries, and vegetables. Their technology integrates hydroponic irrigation methods such as Nutrient Film Technique (NFT), Deep Flow Technique (DFT), Flood & Drain, and drip irrigation, coupled with proprietary automation for climate control, lighting, and farm management.

-

LOGIQS B.V. is engaged in producing and designing vertical farm systems. In addition, the company designs and produces automatic plant benching mechanisms for greenhouse horticulture. It operates through three business segments, namely vertical farming, greenhouse automation, and warehouse automation. It has marked its regional presence across North America, South America, South Korea, Europe, and the Asia Pacific.

Key Vertical Farming Companies:

The following are the leading companies in the vertical farming market. These companies collectively hold the largest market share and dictate industry trends.

- AGEYE Technologies

- American Hydroponics

- Argus Control Systems Limited

- CubicFarm Systems Corp.

- EVERLIGHT ELECTRONICS CO., LTD.

- FOSHAN REINFA AGTECH CO., LTD.

- iFarm

- Intelligent Growth Solutions Limited

- LOGIQS B.V.

- OnePointOne

- Signify Holding

- Vertical Farm Systems

Recent Developments

-

In August 2025, Intelligent Growth Solutions partnered with Aberdeen-based EPC contractor Modutec to support its expansion into the UAE. The collaboration will focus on building 20 vertical farming growth towers as part of a larger 200-tower GigaFarm in Dubai’s Food Tech Valley. The towers will operate within a self-contained, closed-loop system designed to maximize resource efficiency and minimize waste, underscoring the partnership’s commitment to advanced, sustainable agriculture solutions.

-

In May 2025, OnePointOne launched Opollo Farm, a fully robotic vertical farm integrating AutoStore’s advanced cubic storage technology to revolutionize food production. The modular and highly efficient system uses intelligent robotics to nurture and transport crops within a grid-based environment, enabling harvest-ready leafy greens in as little as 15 days while consuming up to 95% less water than conventional farming.

-

In June 2025, Signify Holding launched new 4-channel LED models in its Philips GreenPower toplighting force (TLF) series. These advanced 800W and 1040W lights offer precise control over the red, blue, white, and far-red spectrums through the Philips GrowWise system, enabling growers to fine-tune light intensity, energy usage, and crop development in real-time.

-

In June 2025, Signify Holding launched an updated Philips GrowWise control, a cloud-based solution that allows growers to remotely monitor and manage lighting systems across single or multiple greenhouses. The platform provides real-time insights, centralized control, and an intuitive recipe editor for quick adjustments, enhancing operational efficiency and ensuring consistent lighting strategies.

Vertical Farming Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.39 billion

Revenue forecast in 2033

USD 39.20 billion

Growth rate

CAGR of 19.3% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, growing mechanism, crop category, structure, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Singapore; South Korea; Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

AGEYE Technologies; American Hydroponics; Argus Control Systems Limited; CubicFarm Systems Corp.; EVERLIGHT ELECTRONICS CO., LTD.; FOSHAN REINFA AGTECH CO.,LTD.; iFarm; Intelligent Growth Solutions Limited; LOGIQS B.V.; OnePointOne; Signify Holding; Vertical Farm Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vertical Farming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the vertical farming market report based on component, growing mechanism, crop category, structure, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Lighting

-

Hydroponic Components

-

Climate Control

-

Sensors

-

-

Software

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Growing Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Aeroponics

-

Hydroponics

-

Aquaponics

-

-

Crop Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruits Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others

-

-

Structure Outlook (Revenue, USD Million, 2021 - 2033)

-

Shipping Container

-

Building Based

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the vertical farming market growth include the growing adoption of environment-friendly production of fruits and vegetables. The unprecedented growth of the global population has also increased the demand for urban agriculture.

b. The global vertical farming market size was estimated at USD 9.62 billion in 2025 and is expected to reach USD 11.39 billion in 2026.

b. The global vertical farming market is expected to grow at a compound annual growth rate of 19.3% from 2026 to 2033 to reach USD 39.20 billion by 2033.

b. North America dominated the vertical farming market with a share of 33.4% in 2025, driven by rising food security concerns such as frequent extreme weather events, supply chain disruptions, and increasing demand for locally grown produce.

b. Some key players operating in the vertical farming market include AGEYE Technologies, American Hydroponics, Argus Control Systems Limited, CubicFarm Systems Corp., EVERLIGHT ELECTRONICS CO., LTD., FOSHAN REINFA AGTECH CO.,LTD., Freight Farms, Inc., iFarm, Intelligent Growth Solutions Limited, LOGIQS B.V., OnePointOne, Vertical Farm Systems

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.